Equity

Own It

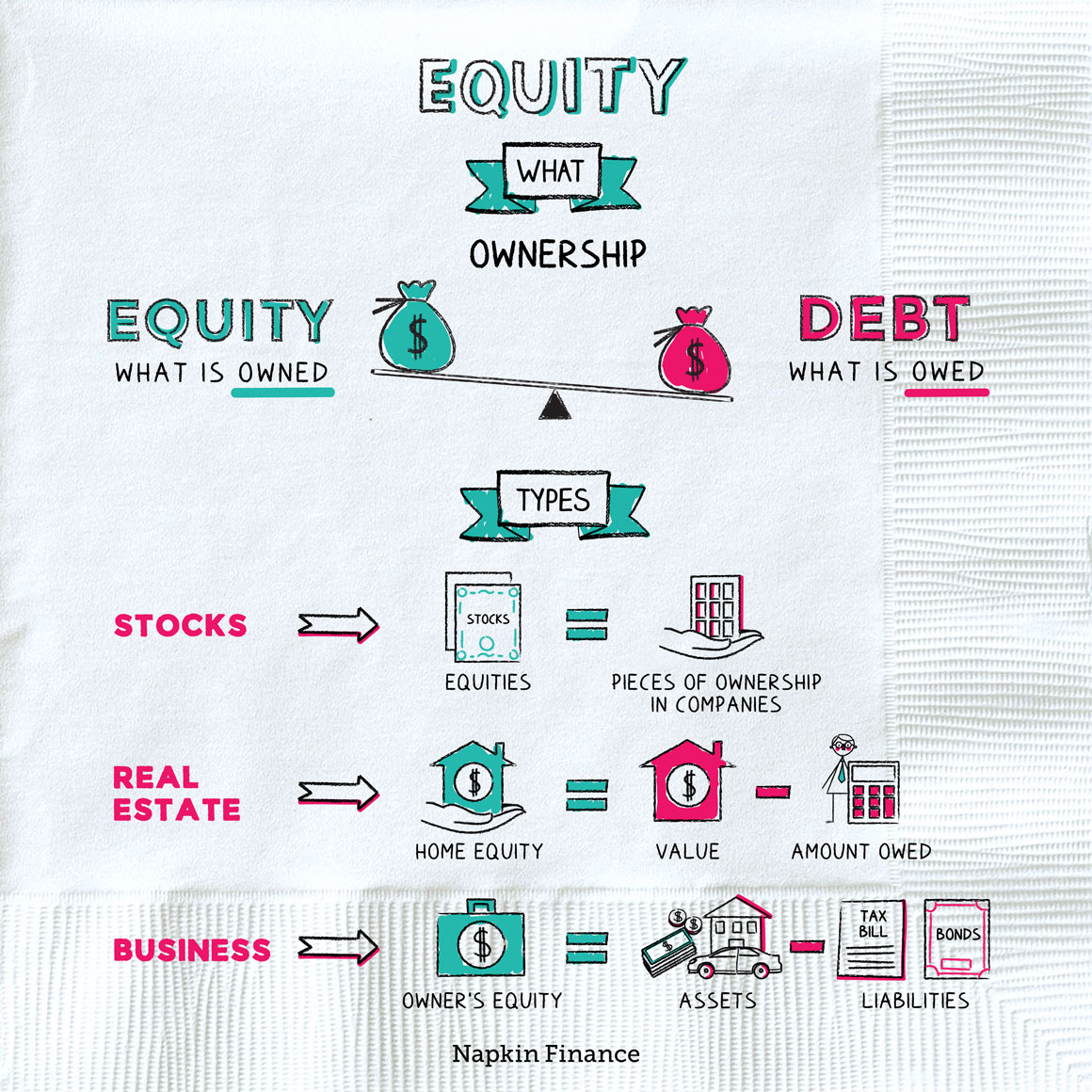

Equity is ownership. You can have equity—or an ownership stake—in any asset, meaning anything of value.

In the financial world, the phrase “equity” or “equities” can be used in a few specific ways:

| In… | You hear… | Which means… |

| Real estate | “Home equity” |

|

| The stock market | “Equities” |

|

| Business | “Owner’s equity” or “Shareholder equity” |

|

Equity is one way of estimating the value of what you own. If, for example, you sold your $500,000 house tomorrow, you’d still have to pay off the $300,000 remaining balance on your mortgage. That would leave you with $200,000—equal to the amount of equity (or ownership) in your home.

Similarly, if a company has $1 million in assets and $700,000 in liabilities, then the company’s owners have:

$1 million – $700,000 = $300,000 in equity

If the company were to shut down tomorrow, in theory it could sell those assets, pay off its liabilities, and hand the remaining $300,000 out to its owners. (In the real world, companies don’t typically decide to suddenly shut down one day, and if they do need to shut down, it can be a pretty messy process.)

Equity is one way of estimating value, but it isn’t the only one.

That company might only be worth $300,000 if it were to shut down today. But when measured by all the future profits it could earn over the next ten or twenty years, it could be worth much more.

That’s why stocks (and entire companies) are typically bought and sold for much more than just the value of their equity.

Equity is a fancy word for ownership. You can have equity in a home, equity in a company, or equity in anything else that has value. Stocks are called “equities” because a stock represents an ownership stake in a company.

- It’s possible to have negative equity. That happened for many homeowners during the housing bubble crash of 2006-12. If you buy a house for $1 million with a $900,000 mortgage but then the value of the home falls to $700,000—you would have $200,000 in negative equity.

- Negative equity usually means you can’t sell your home (because you can’t afford to pay off your current mortgage). It can also mean homeowners are more likely to default on their mortgages (because why pay back a loan for more than your house is worth?).

- At the peak of the crisis, one-third of American homeowners had negative equity.

- Equity means ownership.

- For real estate and businesses, equity refers to what’s left of your assets after you pay off all liabilities (such as debt).

- The word “equities” is also a synonym for stocks—since stocks themselves are pieces of ownership.

- Equity is one important way of measuring the value of what you own, but it’s not the only way.