Robo-Advisor

Autopilot

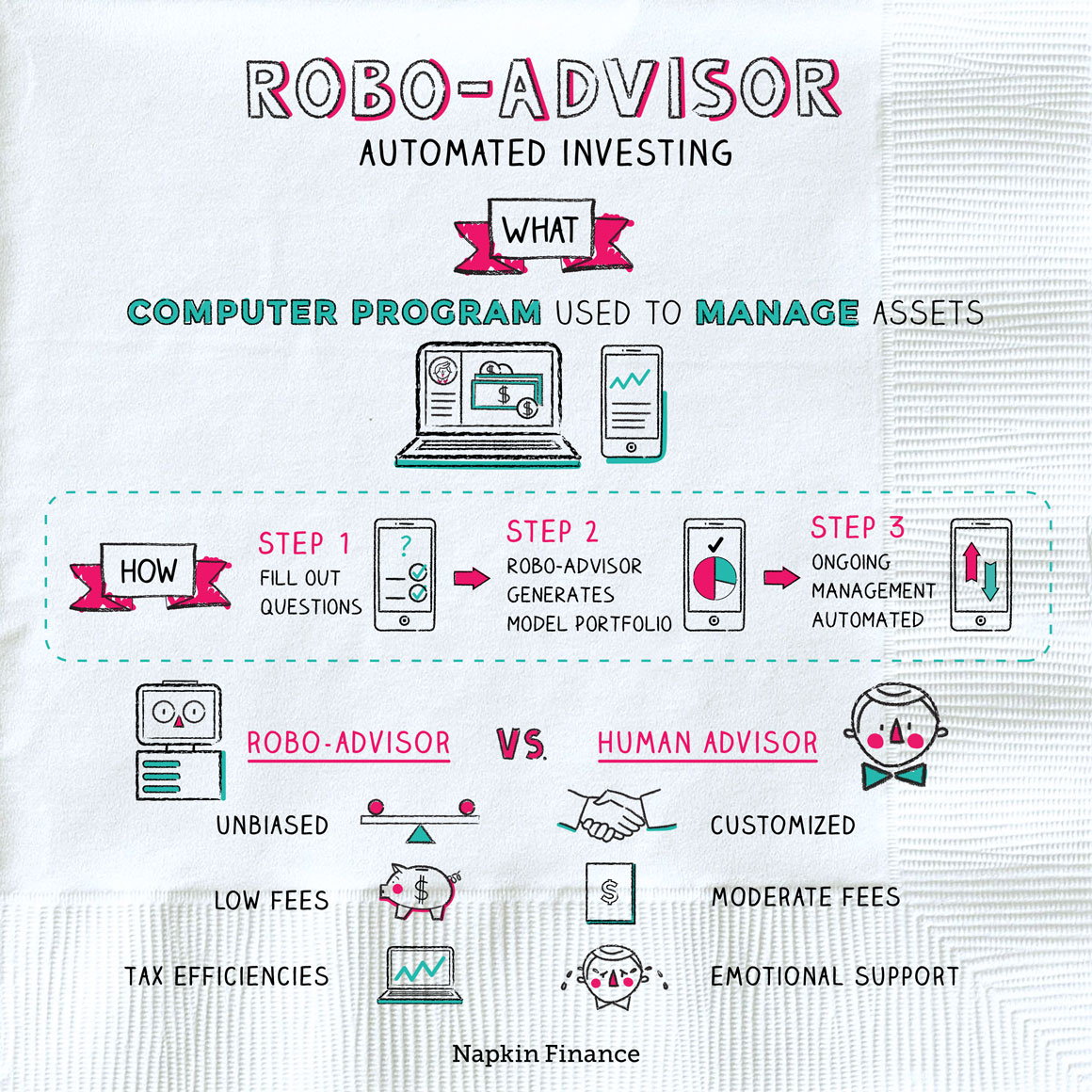

A robo-advisor is an investment management company that uses a computer program instead of a live human to manage assets.

Startups, such as Betterment and Wealthfront, invented the concept of robo-advising. But it’s been so successful that now financial giants, such as Charles Schwab, Fidelity, and Vanguard, have gotten in on the action.

Here’s what investing with a robo-advisor typically looks like:

Step 1

You create an account online with a robo-advisor firm

and fund your account.

↓

Step 2

You answer a few basic questions about your

investment goals, time horizon, and risk tolerance.

↓

Step 3

The robo-advisor decides which of its

preset investment strategies or portfolios is the best fit for you.

↓

Step 4

The robo-advisor invests your funds in the chosen portfolio.

↓

Step 5

The robo-advisor monitors your portfolio and may trade as needed

if the market or your needs change.

Robo-advisors generally rely on algorithms for decisions that a human advisor might rely on judgment for—such as choosing the portfolio that best matches your risk tolerance or deciding when to rebalance.

Many also offer portfolios that cater to environmental or social concerns or that meet religious-based restrictions on certain types of investments.

Compared with using a traditional human financial advisor, using a robo-advisor can come with some important distinctions.

| Robo-advisor | Traditional advisor | |

| Fees | Typically low, such as 0.25% or assets under management per year | Can be moderate to high, typically ranging between 0.5% and 2% of assets (some charge hourly or flat fees instead) |

| Account minimums | Most have account minimums of $500 or less | Many require a large minimum balance (e.g., $25,000+) |

| Quality of advice | Unbiased and objective | Customized and subjective |

| Investment options | Limited—but often limited to solid choices | Range and quality vary based on the advisor |

| Bonus | Many use special trading strategies to minimize the taxes you pay on your investing gains | If you’re anxious about your investments, you have someone you know and trust to talk to |

| May be best if | Your needs are fairly simple, and you feel comfortable with investing | Your needs are more complex, and you’d like a hand to hold |

A note on fees: Keep in mind that the fees you pay to any advisor (whether traditional or robo) are in addition to any fees you pay for specific investments. For example, if your advisor invests your money in ETFs, you’ll pay the advisor’s fees plus the underlying ETF’s fees.

There’s no special tax treatment for money you invest with a robo-advisor. Instead, how your money is taxed depends on your account type. For example:

Brokerage accounts → pay taxes on dividends, interest, and realized capital gains each year

Traditional IRAs → pay no taxes year to year but will owe taxes when you withdraw money

Roth IRAs → pay no taxes year to year or when you withdraw money

Many robo-advisors offer all three of those types of accounts (in addition to other types).

If you want to move an existing retirement account over to a robo-advisor, you can usually do a rollover to make the transfer without triggering taxes. Transferring a nonretirement account, however, may require selling your underlying investments and paying taxes on any gains.

A robo-advisor is a company that manages people’s investments using algorithms and automation. Working with a robo-advisor could be a good option if you have relatively low assets to manage or simple goals. While robo-advisors can’t provide the same human touch as traditional financial advisors, they generally charge lower fees and can offer unique services, such as tax-efficient rebalancing.

- In 2008, Betterment became the first robo-advisor to launch. Today, there are more than 200 robo-advisors operating in the United States.

- Some robo-advisors have started offering clients phone access to financial planners (computers still handle the investing decisions) because even millennials sometimes want to interact with an actual human.

- Every robo-advisor uses different algorithms and investment strategies, but several companies have based their systems on Nobel Prize-winning economic theories.

- A robo-advisor is an investment manager that uses automation to manage funds.

- Robo-advisors may have a number of preset portfolios or strategies that they can choose from to match an investor’s risk profile.

- Using a robo-advisor instead of a traditional advisor doesn’t impact how your investments are taxed.

- Compared with human advisors, robo-advisors are typically cheaper but offer less emotional support. And they may not be able to handle more complex financial planning issues.