Featured Napkin

Interest

Pay Up

Interest is the cost of borrowing money. For a borrower, interest is the price of taking on a loan. For a lender, interest is the return earned on making a loan. Interest is expressed as a rate, such as 5%. How much interest the borrower pays is calculated by multiplying...

Learn moreMore leaving the nest Napkins...

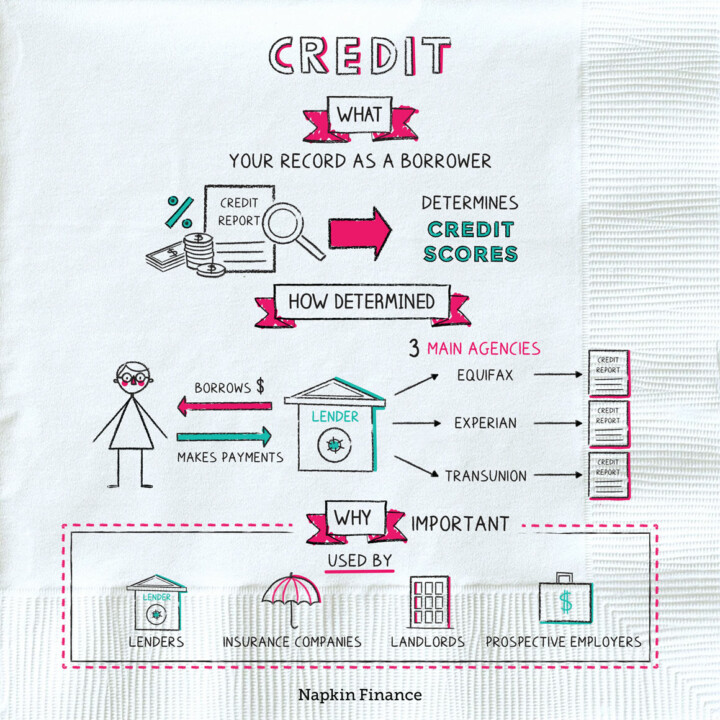

Credit

Permanent Record

Credit is, simply put, your financial reputation. Your credit history describes your record as a borrower, including...

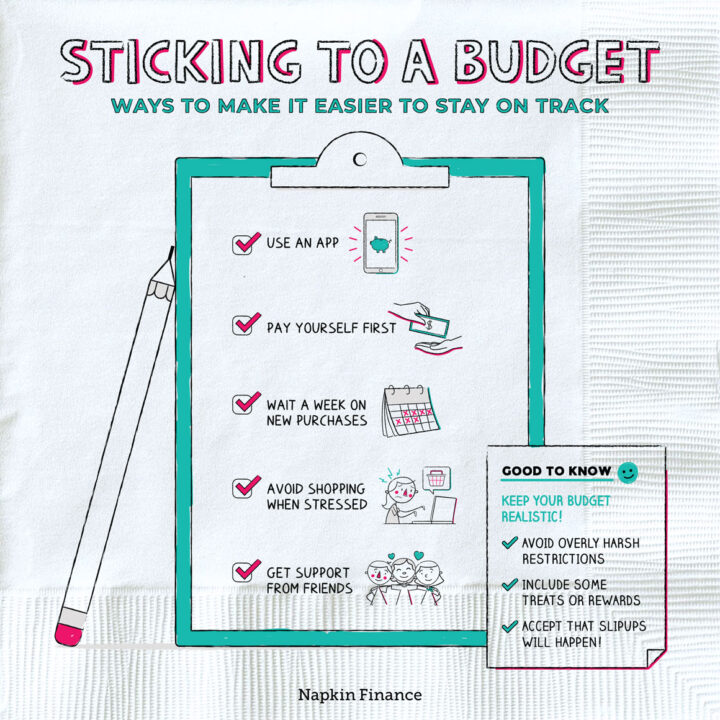

Learn moreSticking to a Budget

In It to Win It

Budgeting can be a lot like dieting. You start out with big hopes for dramatic changes in...

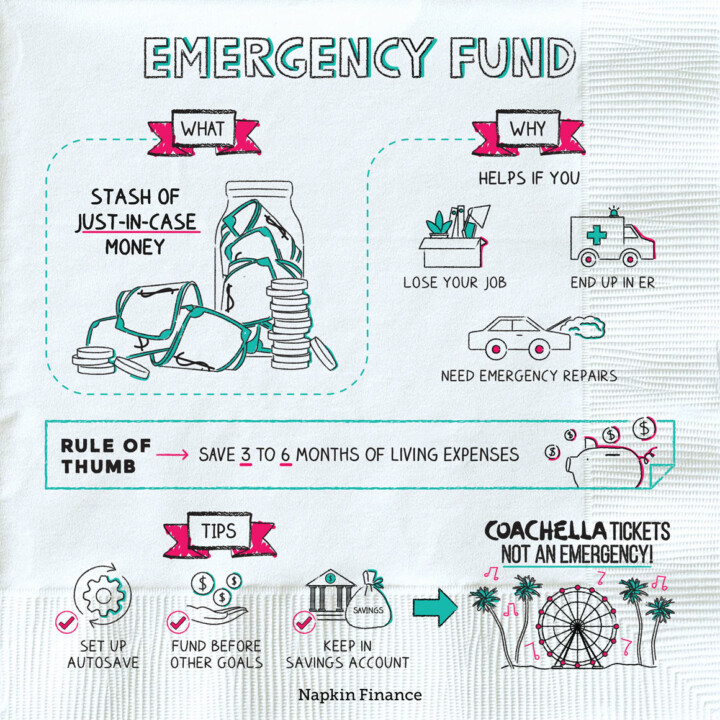

Learn moreEmergency Fund

Cash Cushion

An emergency fund is your stash of just-in-case money. Along with your insurance coverage, it’s a vital...

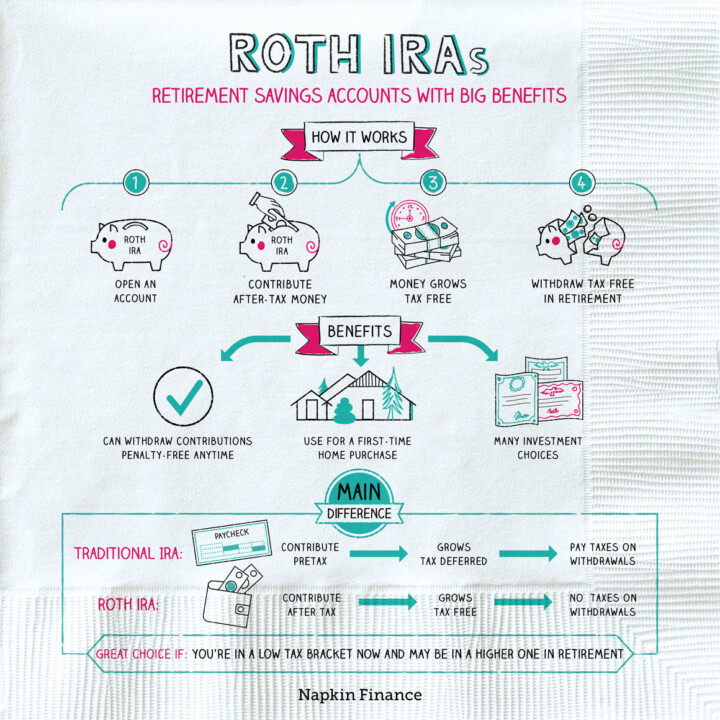

Learn moreRoth IRAs

Road to Retirement

A Roth IRA, or Individual Retirement Account, is one of the most common types of retirement savings...

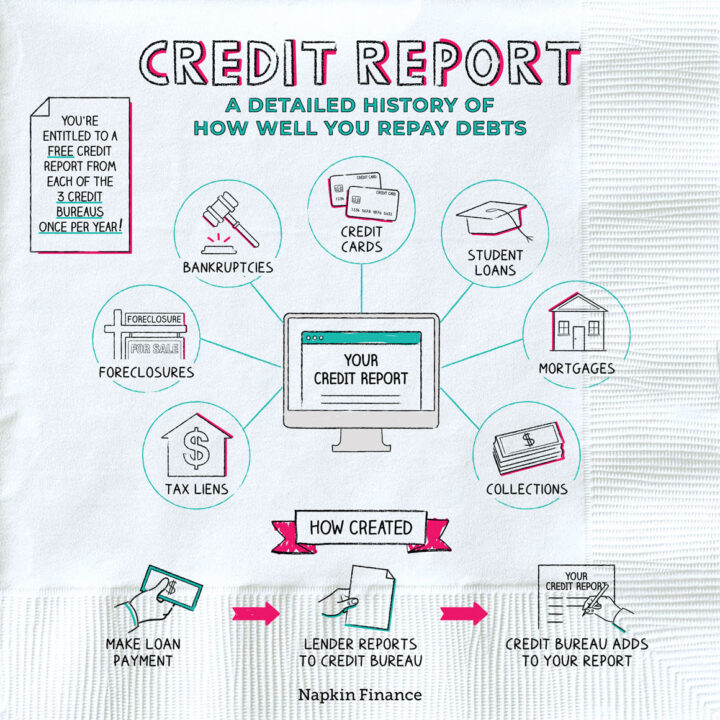

Learn moreCredit Report

Good Marks

Your credit report is a detailed history of your past use of credit. It’s a bit like...

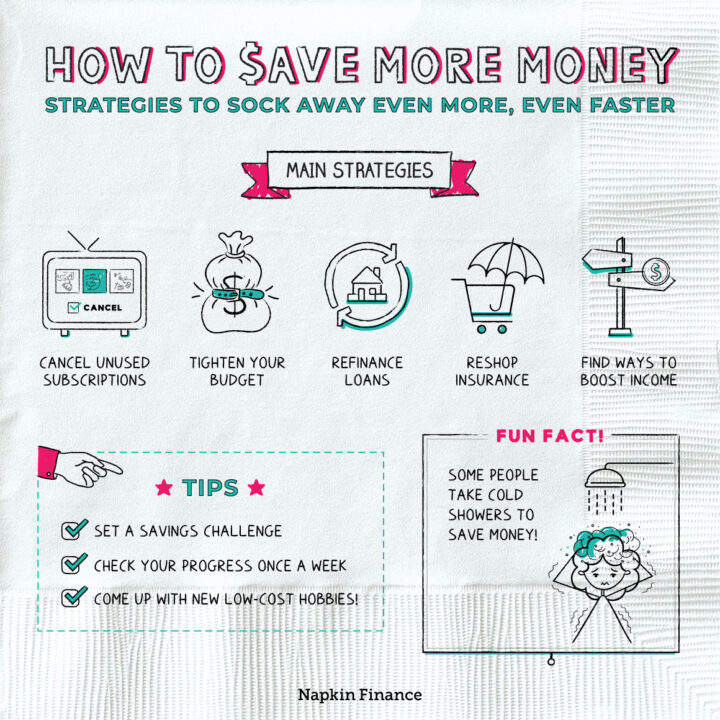

Learn moreHow to Save More Money

Keep the Change

Like many good habits, saving more money is easier said than done. Once you’ve gotten into a...

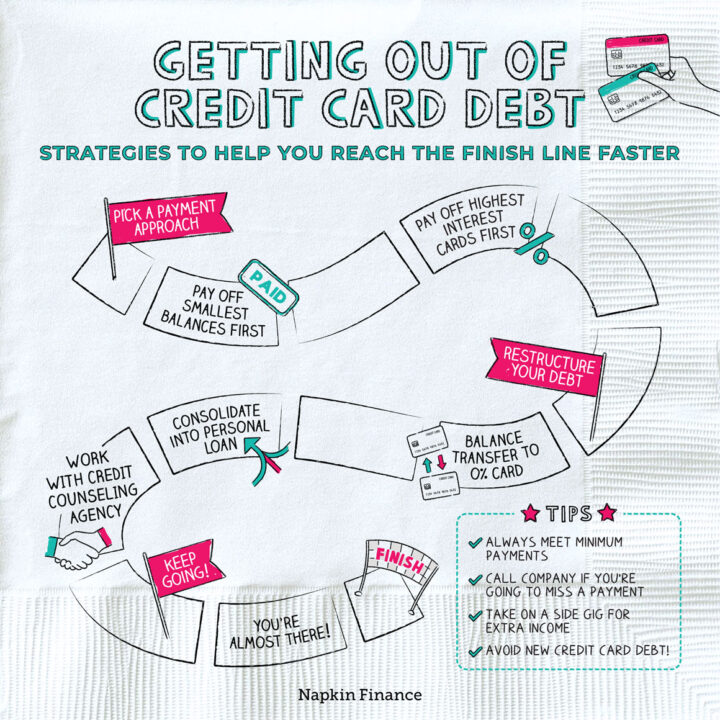

Learn moreGetting Out of Credit Card Debt

Pay the Piper

Credit card debt can be overwhelming. As interest accrues, your balances may keep increasing even if you’re...

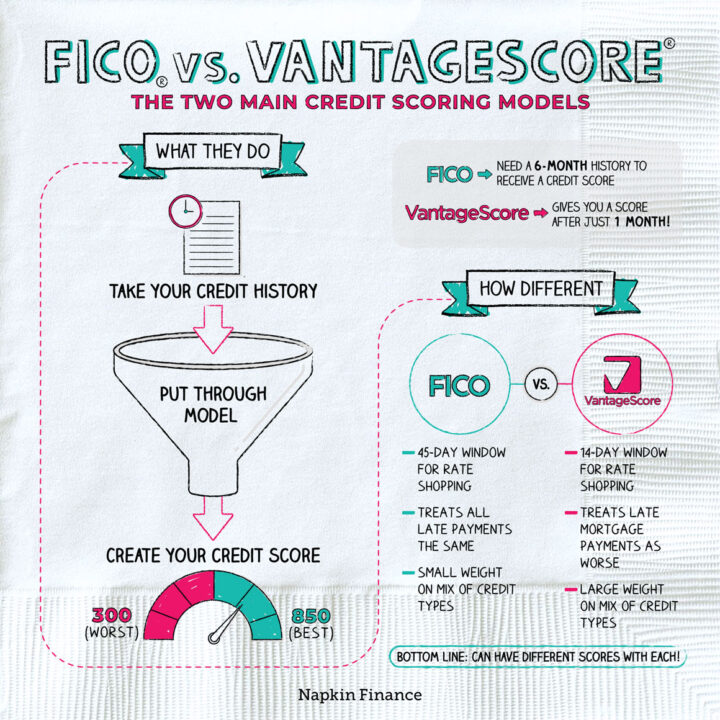

Learn moreFICO vs. VantageScore

Settle the Score

FICO and VantageScore are two of the most common credit scoring models. Contrary to popular belief, you...

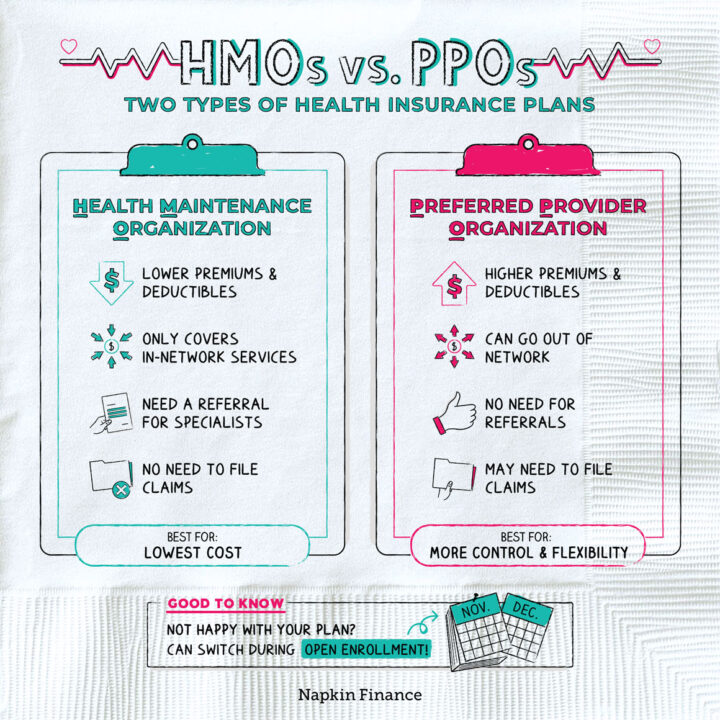

Learn moreHMO vs. PPO

Bill of Health

HMOs and PPOs are two different types of health insurance plans. HMO (or Health Maintenance Organization) plans...

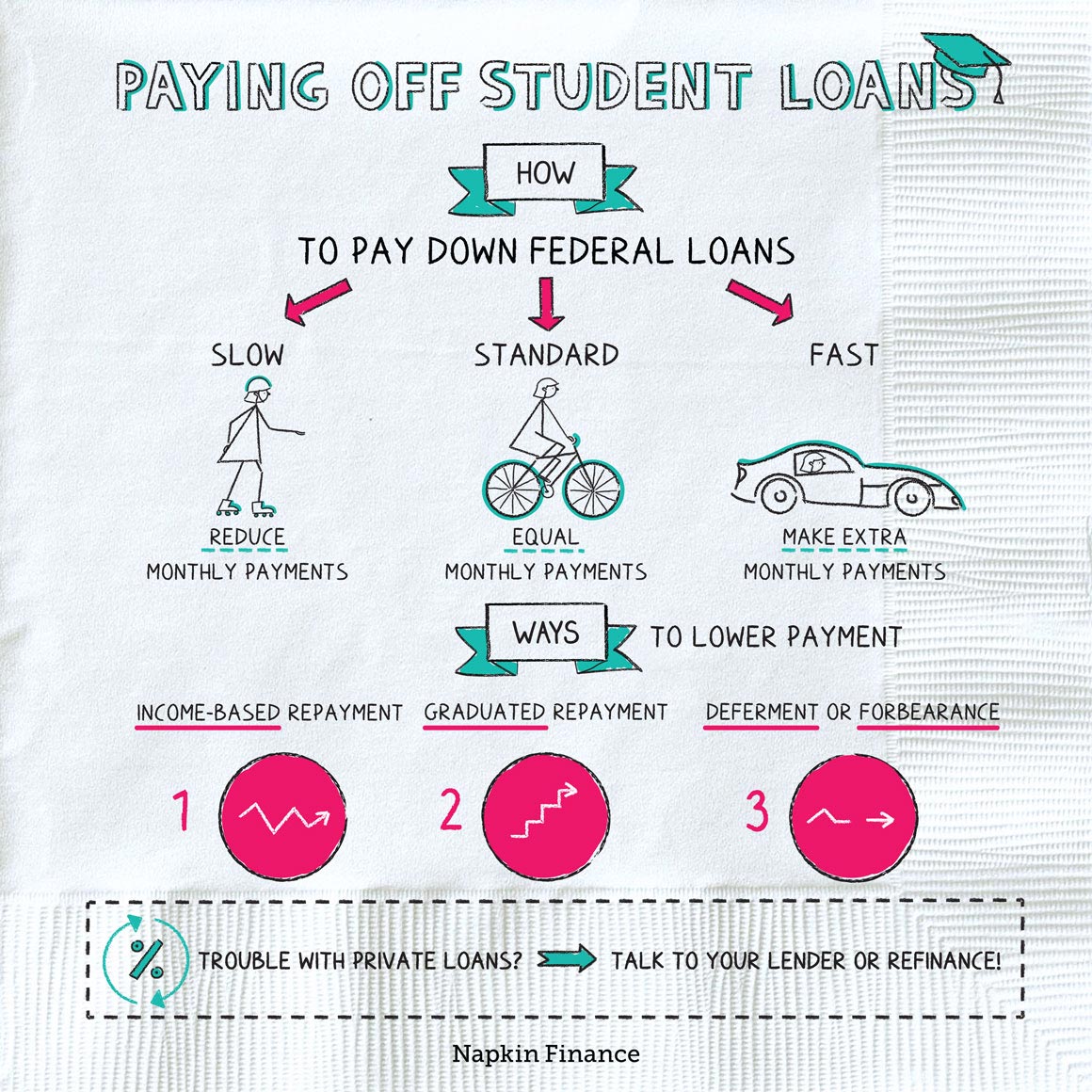

Learn morePaying Off Student Loans

Take a Load Off

It might seem like there’s only one way to pay down your student loans (namely: slowly, painfully,...

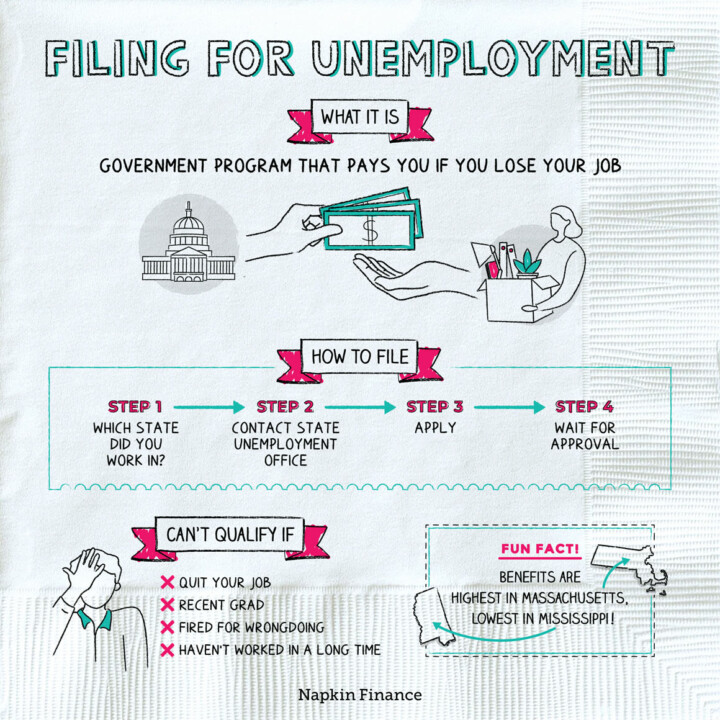

Learn moreFiling for Unemployment

Pink Slip

Unemployment insurance is a government program that gives you money if you lose your job. Sometimes, life...

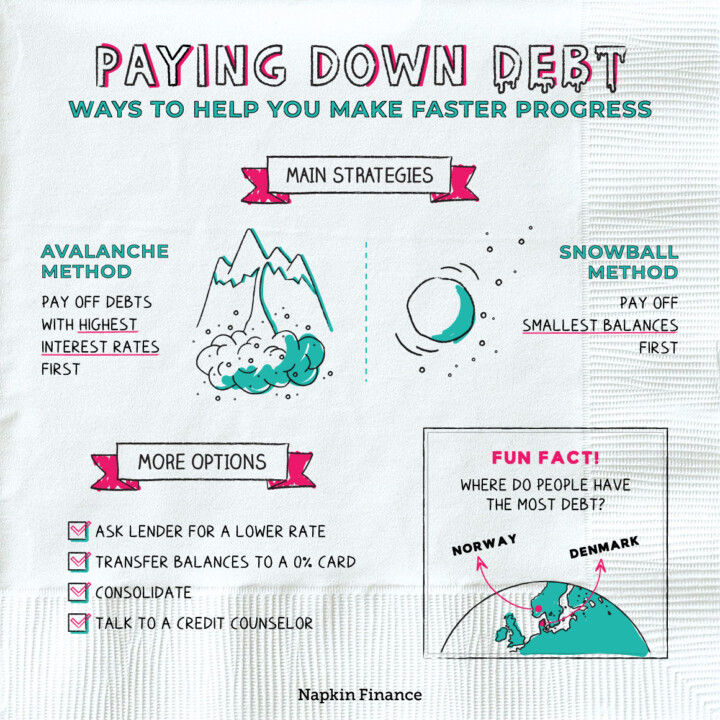

Learn morePaying Down Debt

Get Low

Paying down debt can make you more financially secure and give you more flexibility when deciding what...

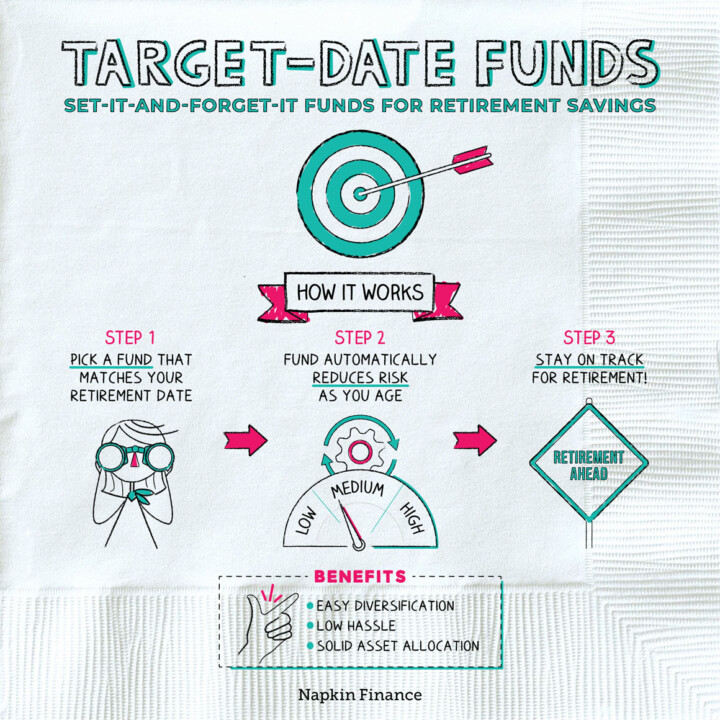

Learn moreTarget-Date Funds

Bullseye on Retirement

A target-date fund is an investment fund that’s based on your expected retirement date. These mutual funds...

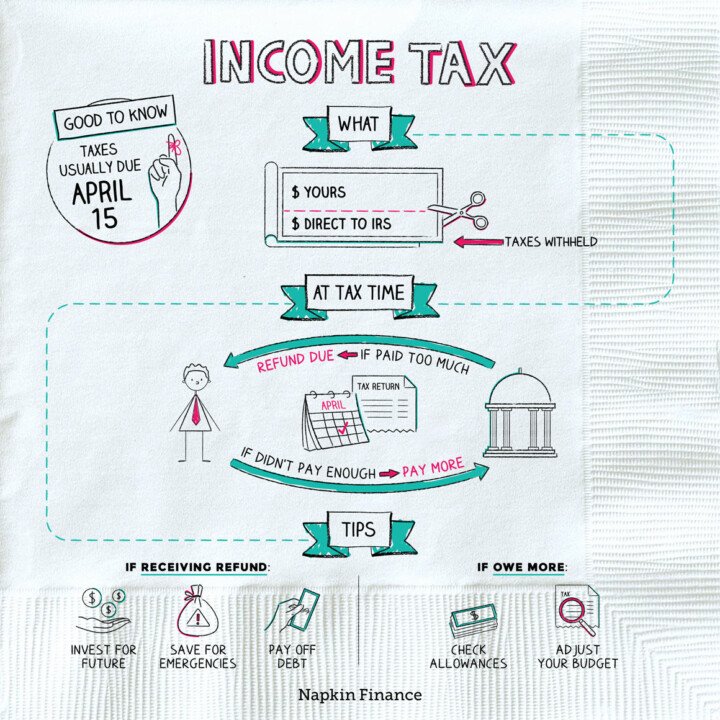

Learn moreIncome Taxes

Pay the Piper

Personal income tax is money the government collects from people based on how much they earned or...

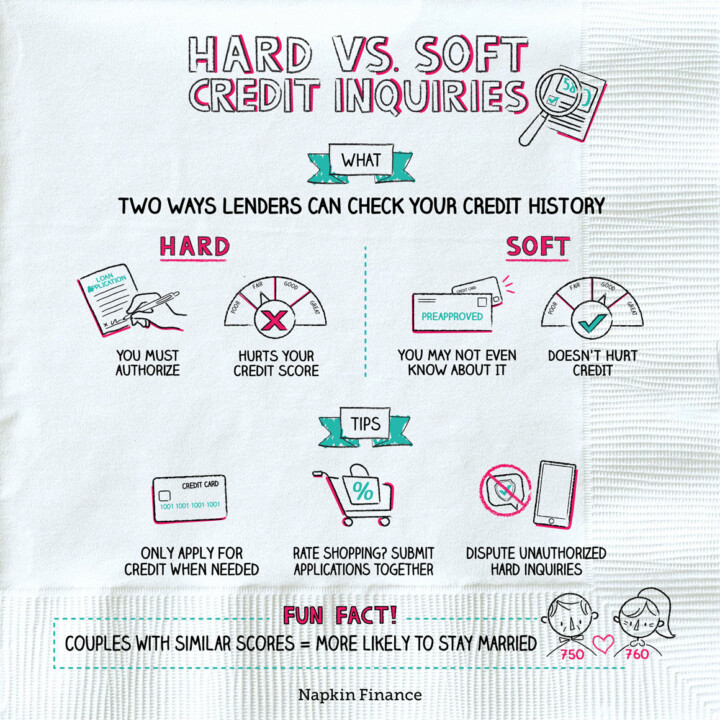

Learn moreHard vs. Soft Credit Inquiries

Extra Credit

Banks, lenders, and others use your credit report and scores to determine your creditworthiness. In other words,...

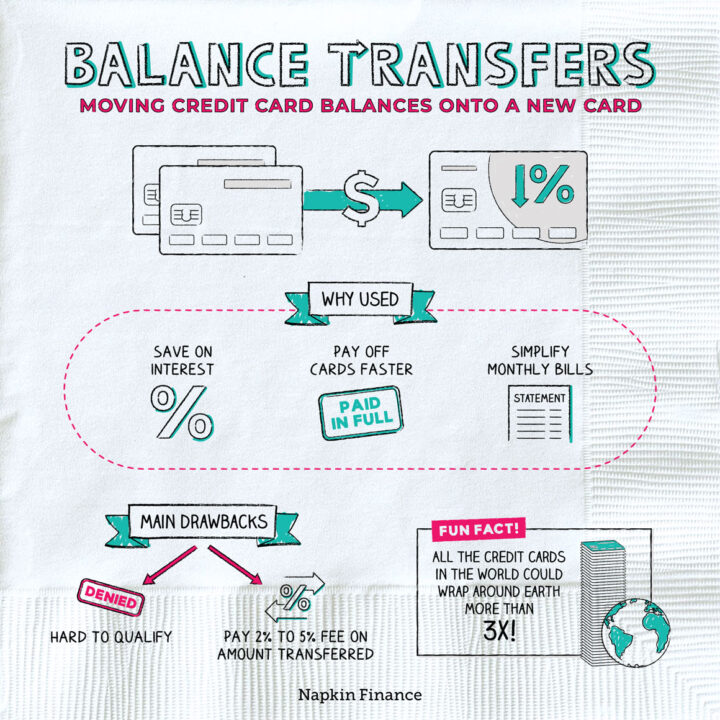

Learn moreBalance Transfers

Shell Game

Balance transfers are a way to move what you owe on one (or more) credit cards and...

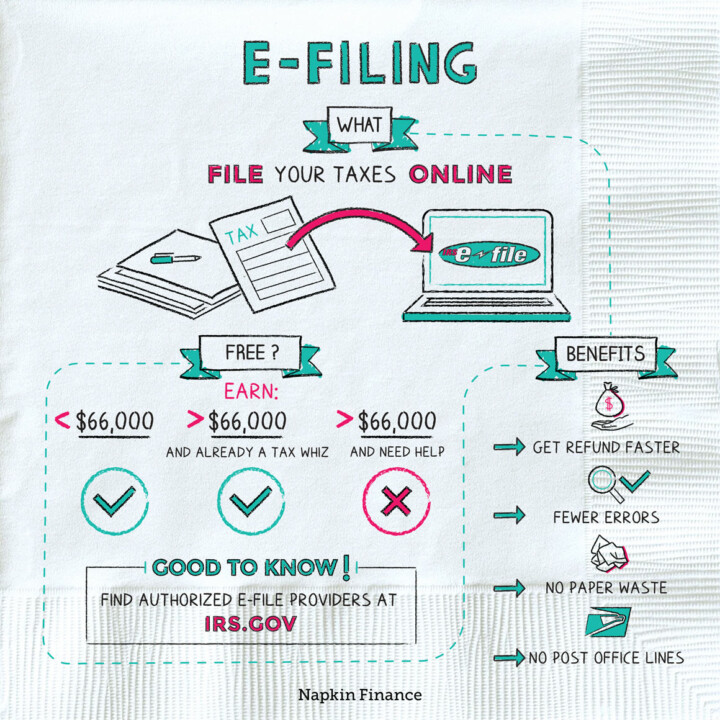

Learn moreE-Filing

Signed, Sealed, Delivered

E-filing means filing your taxes online. You’ll still need all the same documents you’d use to file...

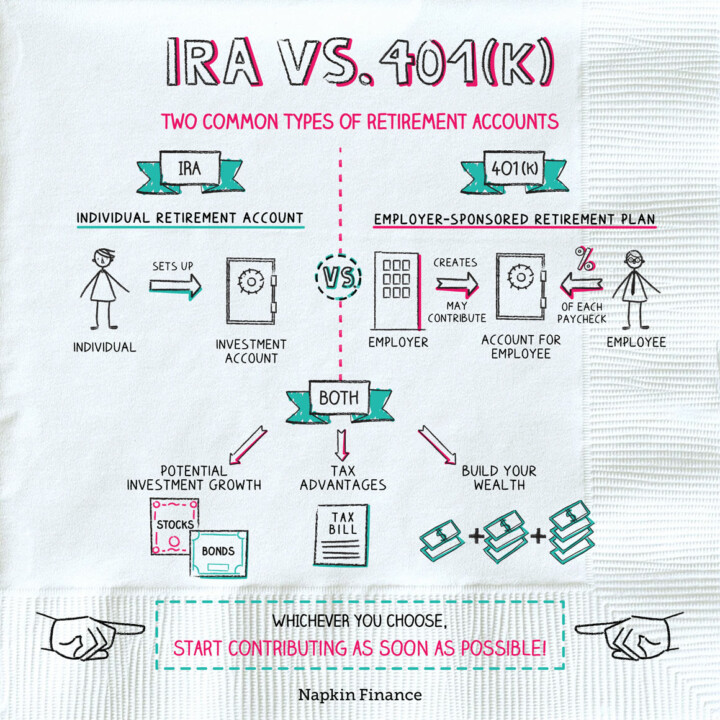

Learn moreIRA vs. 401(k)

Nest Eggs

IRAs and 401(k)s are two popular types of retirement savings accounts. Most people who work in the...

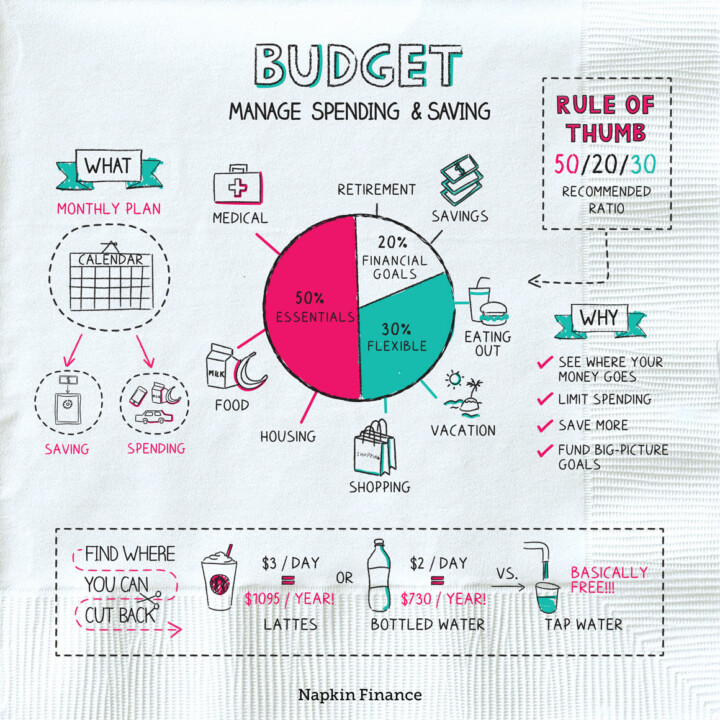

Learn moreBudget

Nickels and Dimes

A budget is a plan you can use to better manage your spending and saving. When you...

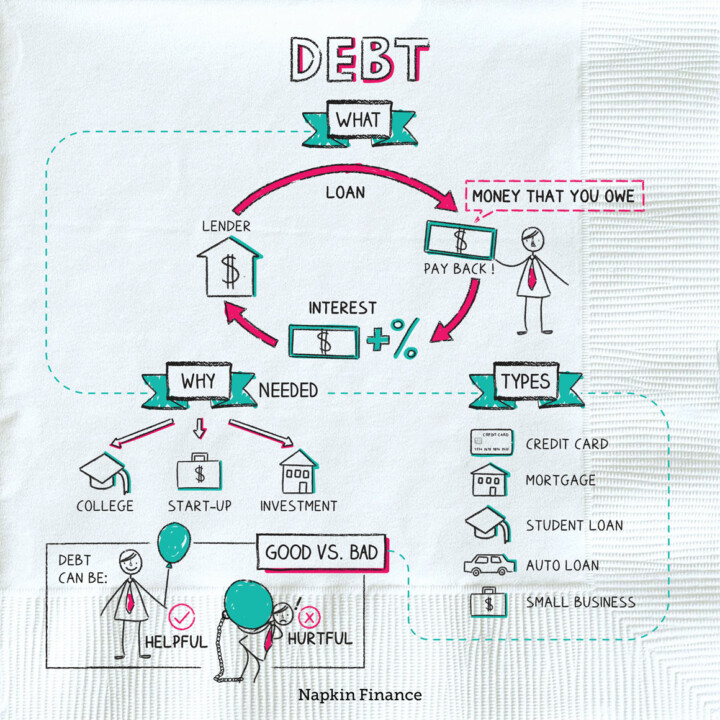

Learn moreDebt

It All Adds Up

Debt is money that you owe to another person or a financial institution. When you borrow money,...

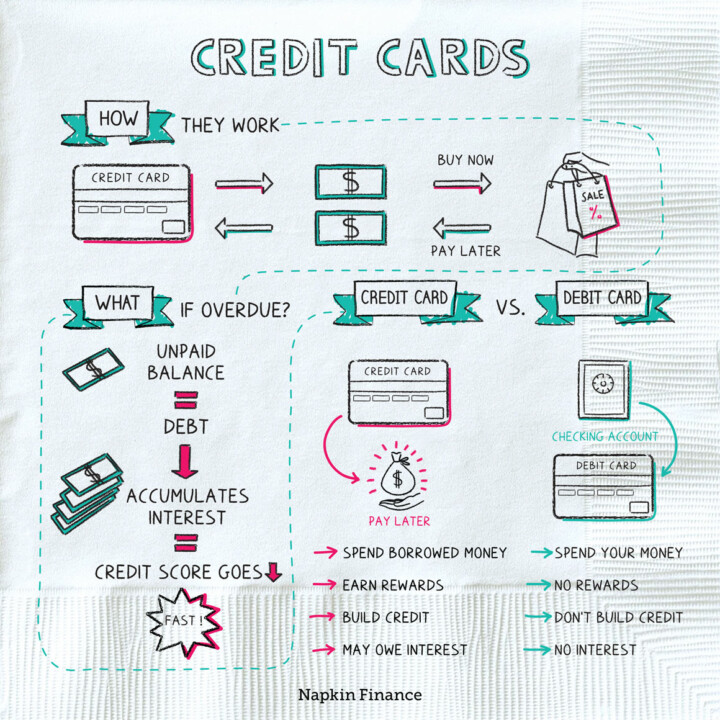

Learn moreCredit Cards

Swipe Right

A credit card lets you buy now and pay later, all without the hassle of counting out...

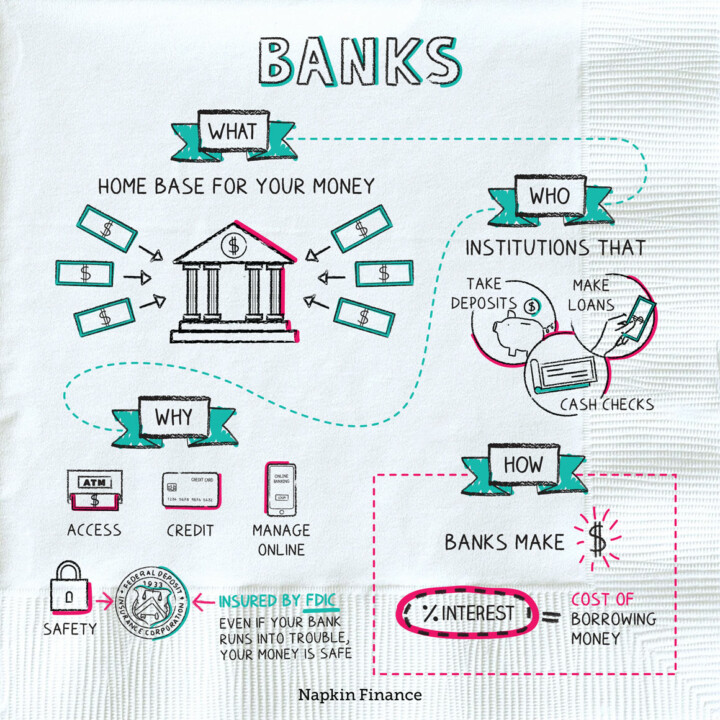

Learn moreBanks

Bank on It

Banks are institutions that take deposits, cash checks, and make loans. They are essentially home bases for...

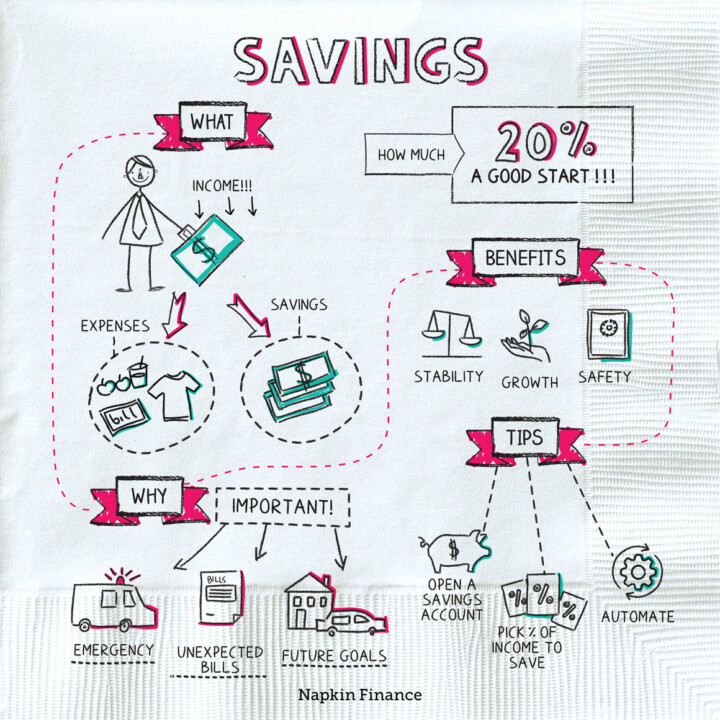

Learn moreSavings

One Penny at a Time

Savings are funds that you put aside and don’t spend. Life can be full of surprises, both...

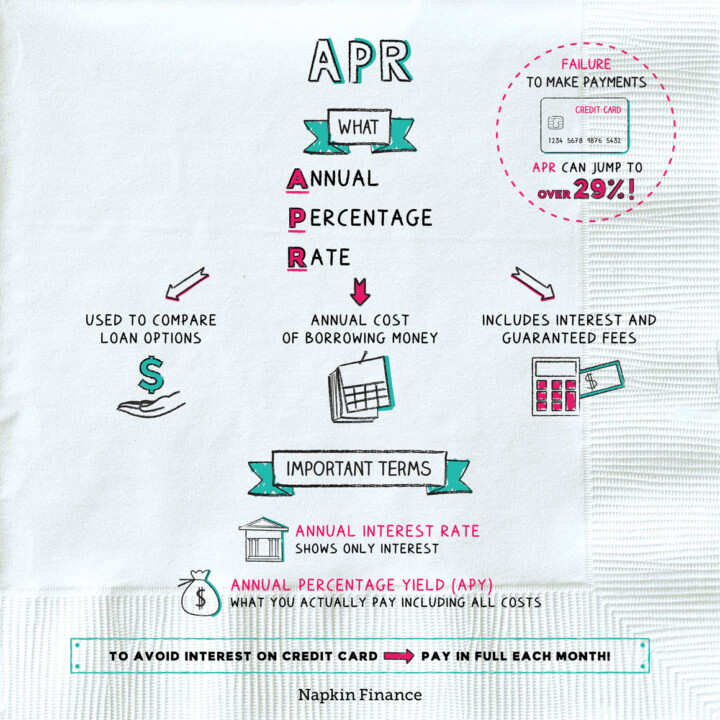

Learn moreAPR

Another Day, Another Dollar

An annual percentage rate (APR) represents the annual cost of borrowing money, including fees. Because the APR...

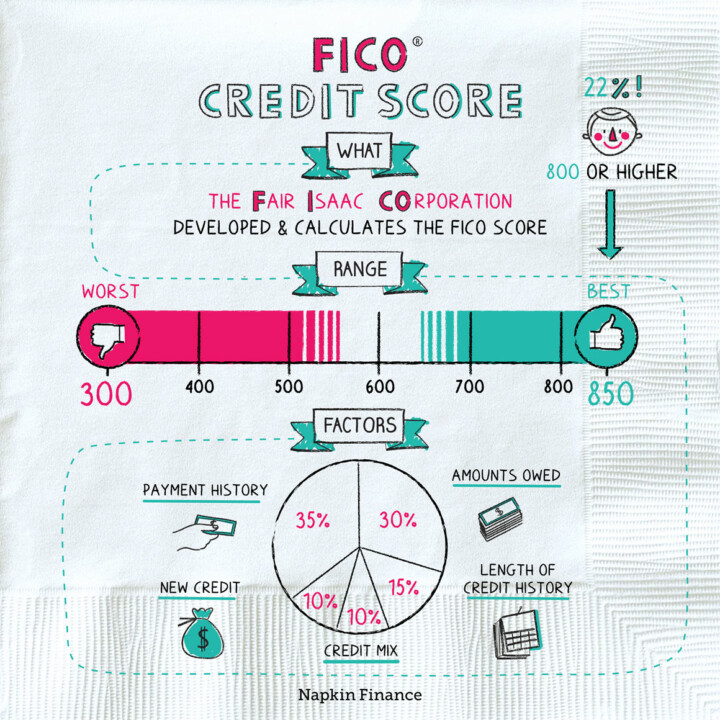

Learn moreFICO

Score Some Points

Although you might hear the phrase “your credit score” tossed around, you actually have multiple credit scores—potentially...

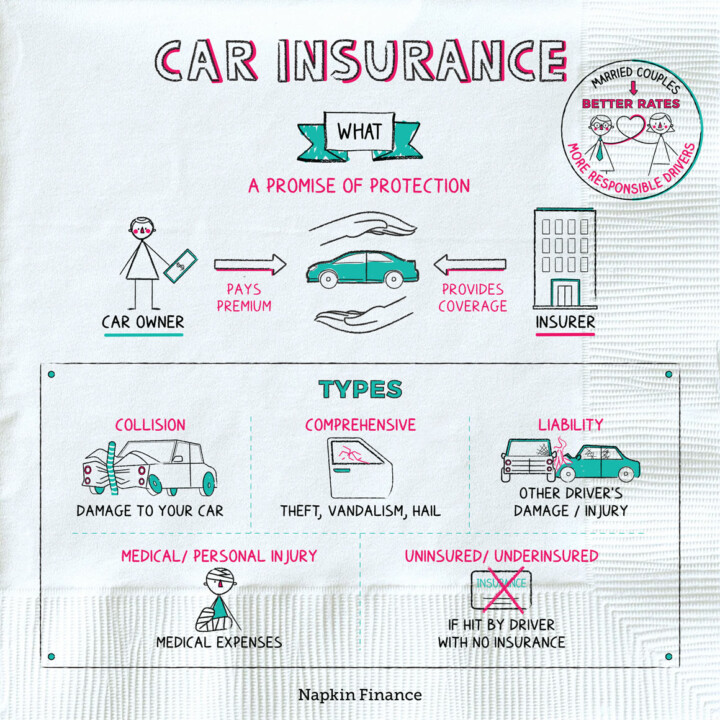

Learn moreCar Insurance

Tighten Your (Seat) Belt

Car insurance is an agreement between you and an insurance provider. In exchange for regular payments from...

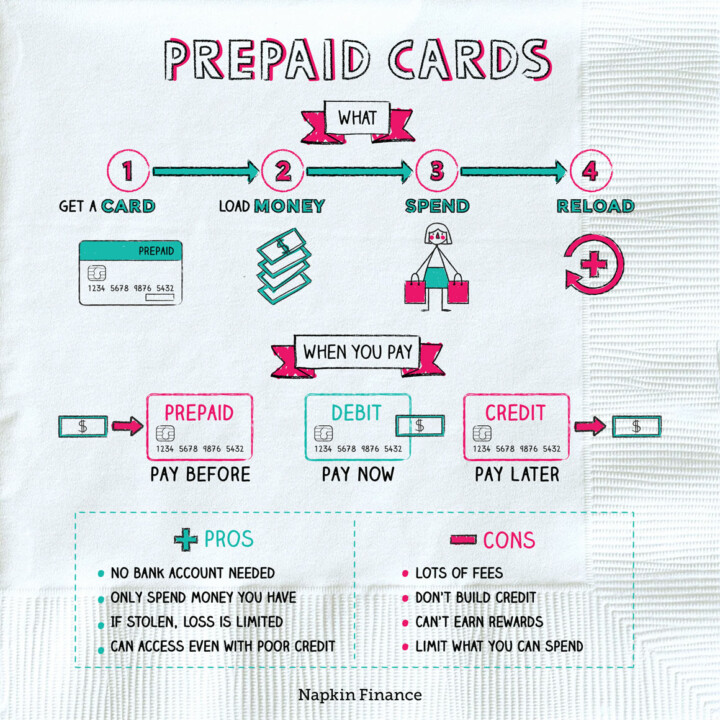

Learn morePrepaid Card

Top Off

A prepaid card lets you spend money that you’ve already added to the card. It’s similar to...

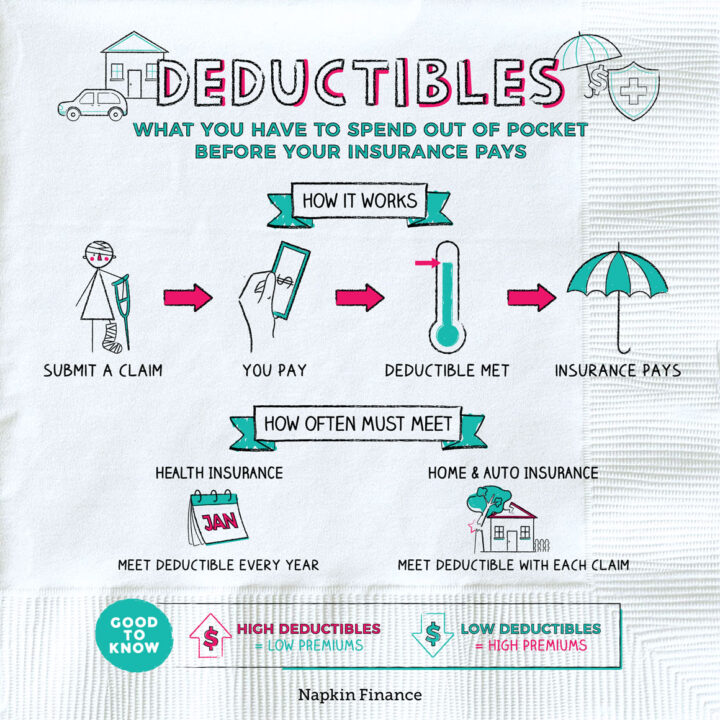

Learn moreDeductibles

Cut Rate

A deductible is the amount of money you must spend out of pocket before your insurance company...

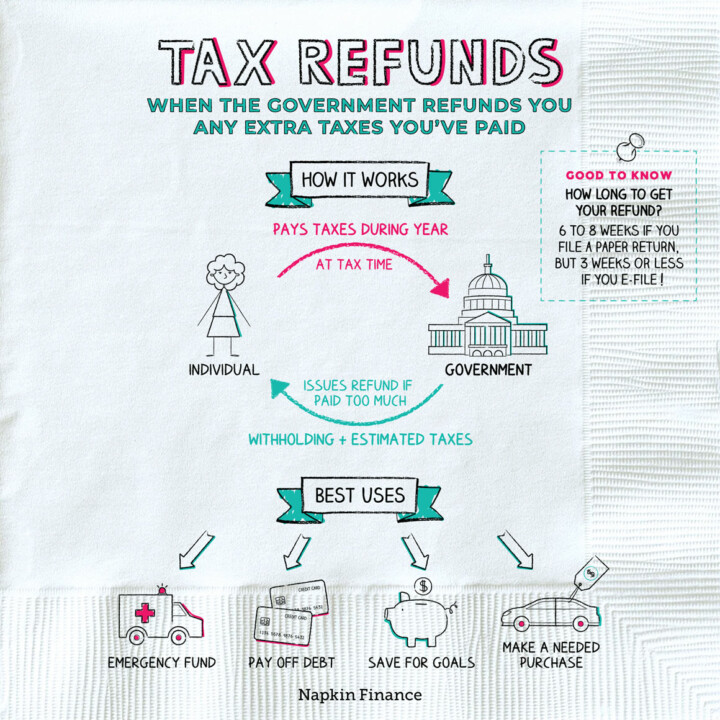

Learn moreTax Refunds

Check’s in the Mail

If you pay more than your fair share in taxes over the course of a year, you’re...

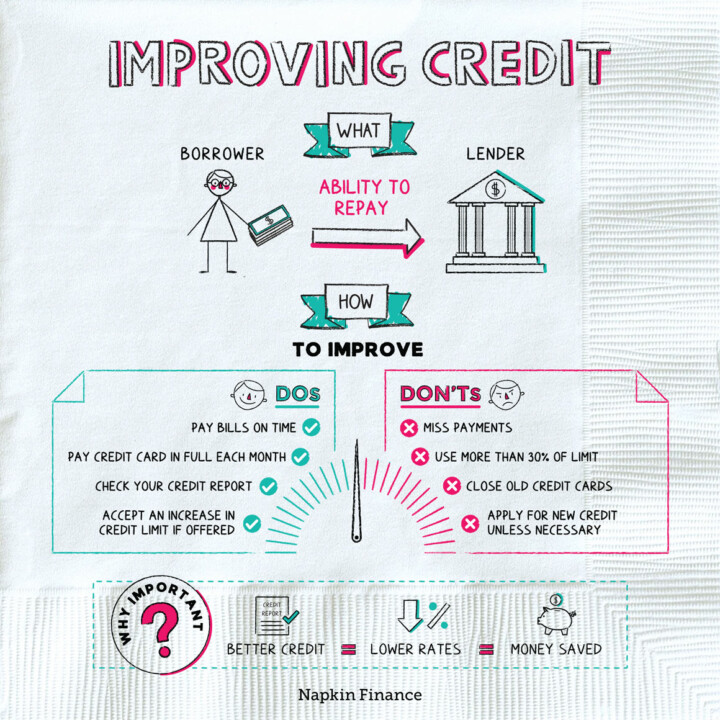

Learn moreImproving Credit

Extra Credit

Your credit report and credit scores describe whether you have a good track record of repaying borrowed...

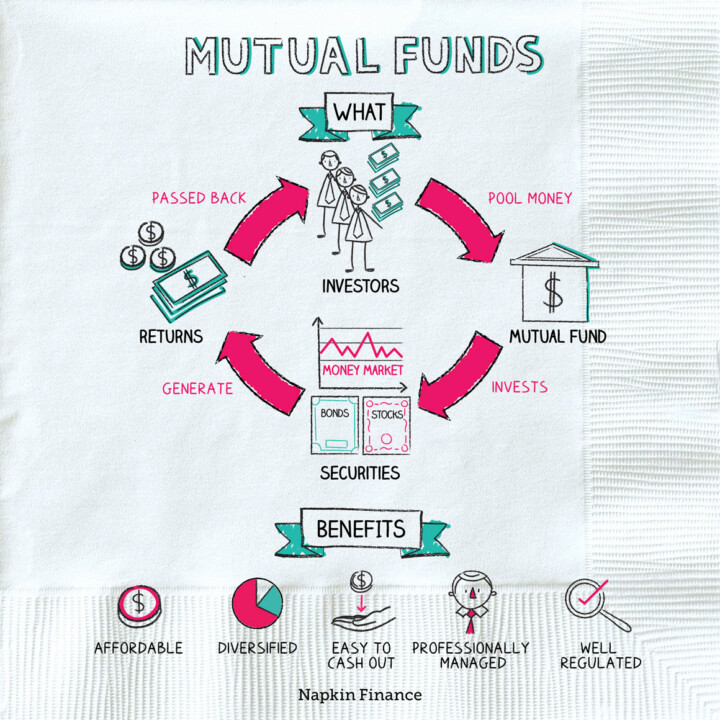

Learn moreMutual Funds

Join Forces

A mutual fund is a professionally managed fund that pools lots of investors’ money in order to...

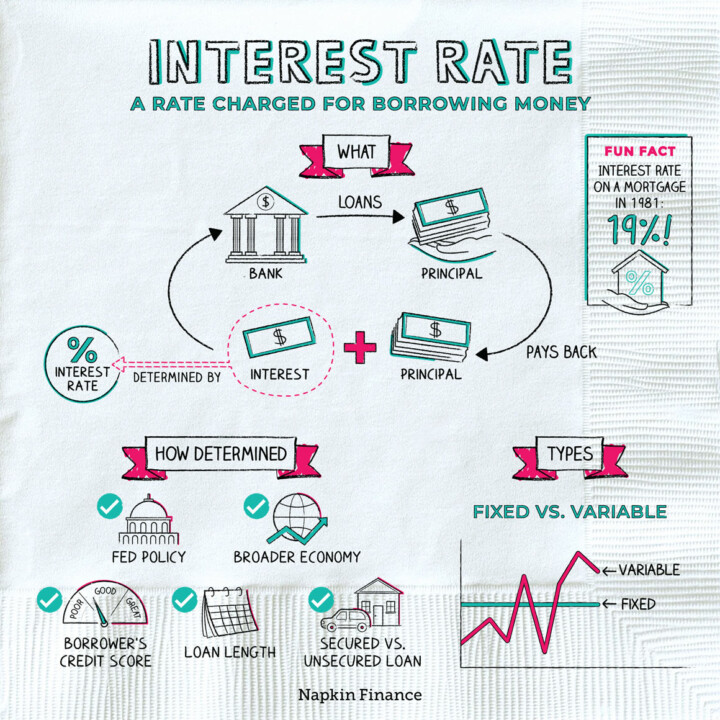

Learn moreInterest Rate

At Any Rate

Interest is what a lender charges you to borrow money. It is usually expressed as a percentage...

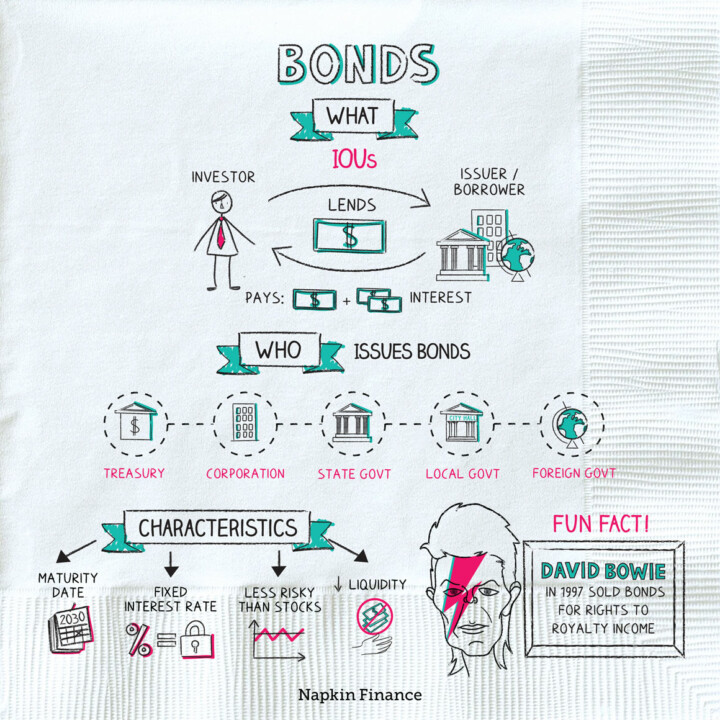

Learn moreBonds

Bonds, James Bonds

Bonds are essentially IOUs. When you buy a bond, you become a lender to whatever entity issued...

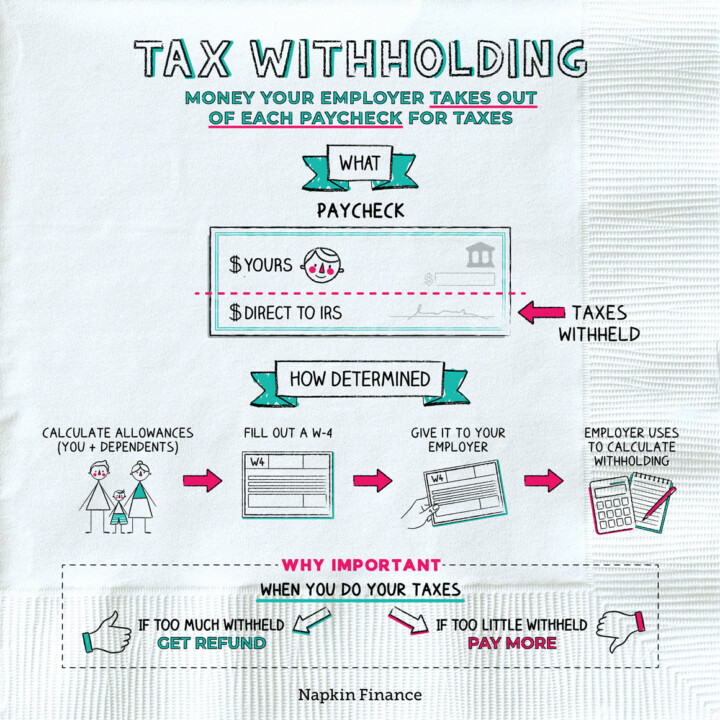

Learn moreTax Withholding

To Have and Withhold

Tax withholding is money your employer takes out of your paycheck each pay period. Your employer then...

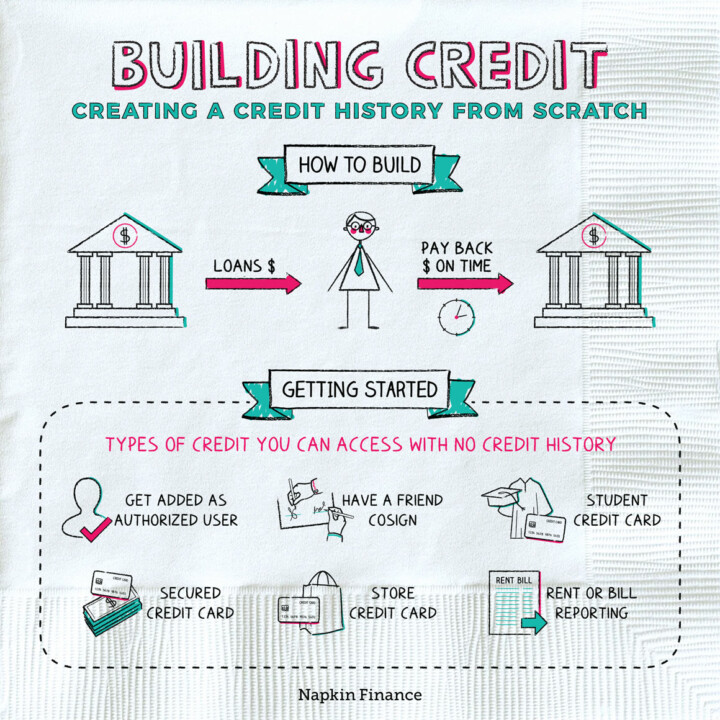

Learn moreBuilding Credit

Bit by Bit

Credit is money that’s available to you to borrow whether through a credit card, mortgage, car loan,...

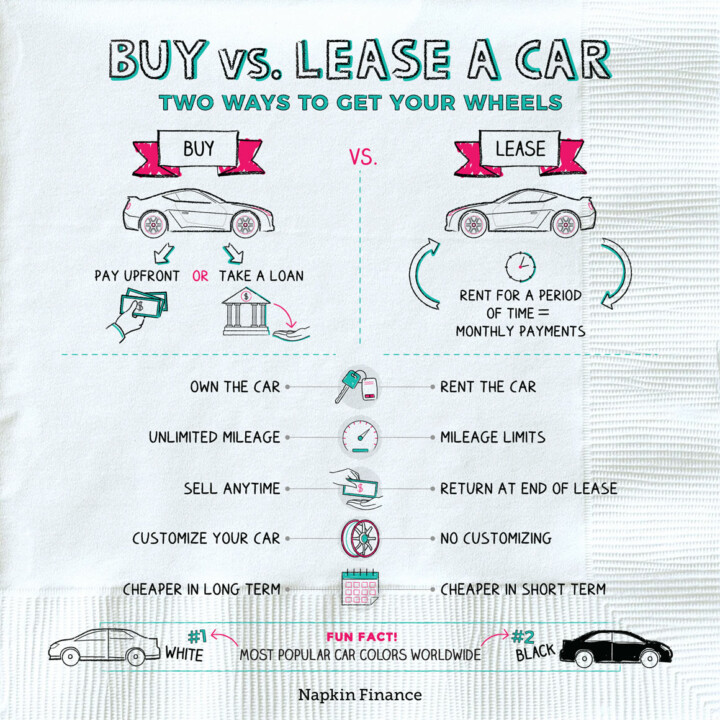

Learn moreBuy vs. Lease a Car

Joy Ride

When you need a car, you have two options: buy or lease. If you buy a car,...

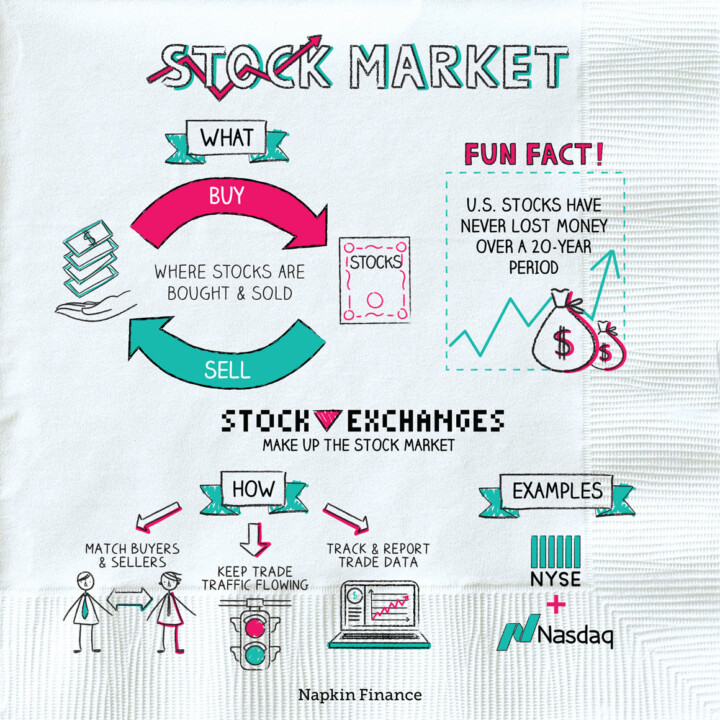

Learn moreThe Stock Market

Greed Is Good

The stock market is the collection of physical and electronic markets where buyers and sellers come together...

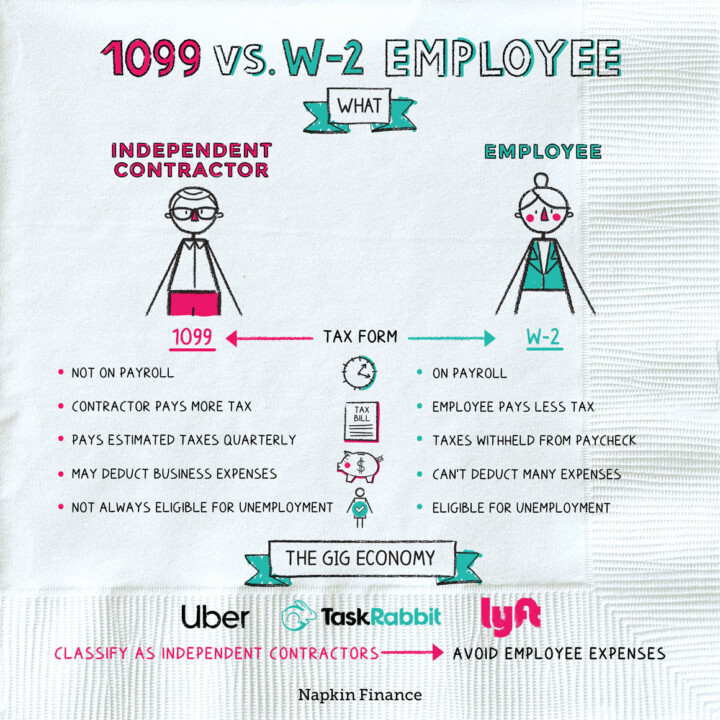

Learn more1099 vs. W-2 Employee

Bring Home the Bacon

1099s and W-2s are both types of tax forms. If you’re a contractor, you should receive one...

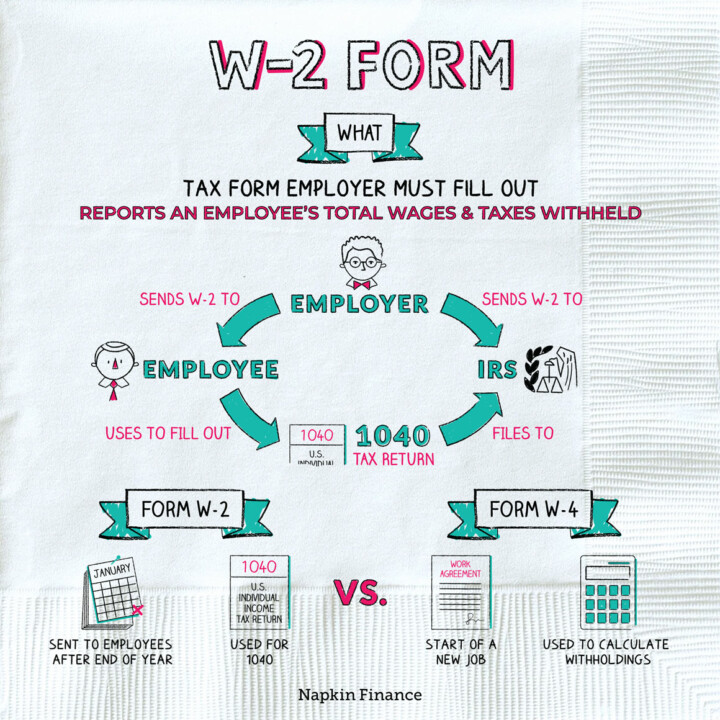

Learn moreForm W-2

Company Man

The W-2 is a tax form your employer must complete at the start of each year to...

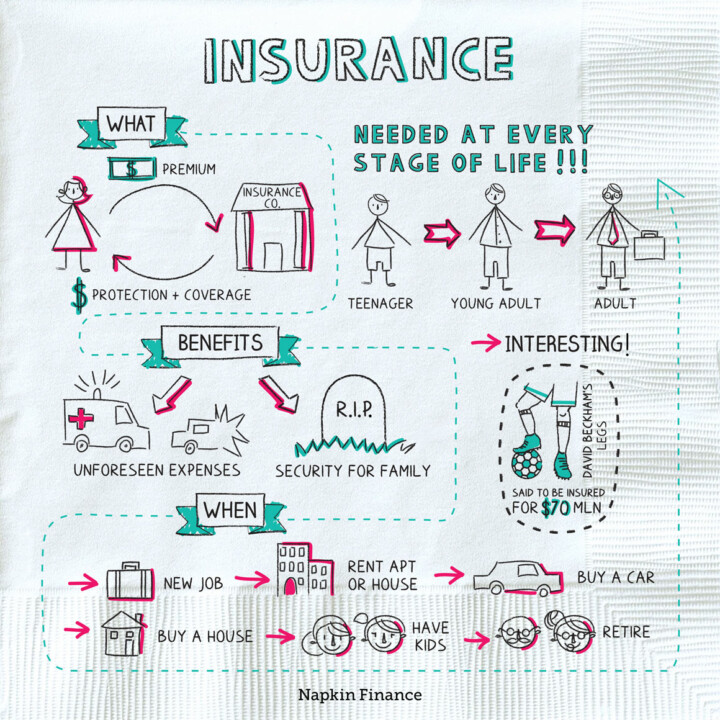

Learn moreInsurance

Cover Your Assets

Insurance is financial protection. Along with your emergency fund, insurance makes up your safety net so that...

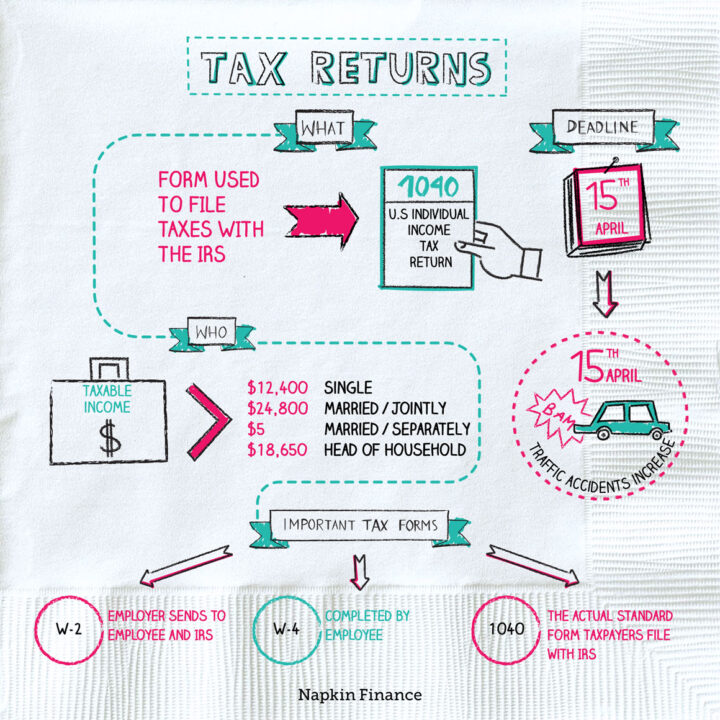

Learn moreTax Returns

Not-So-Happy Returns

Most people pay taxes throughout the year. When you file a tax return, you calculate how much...

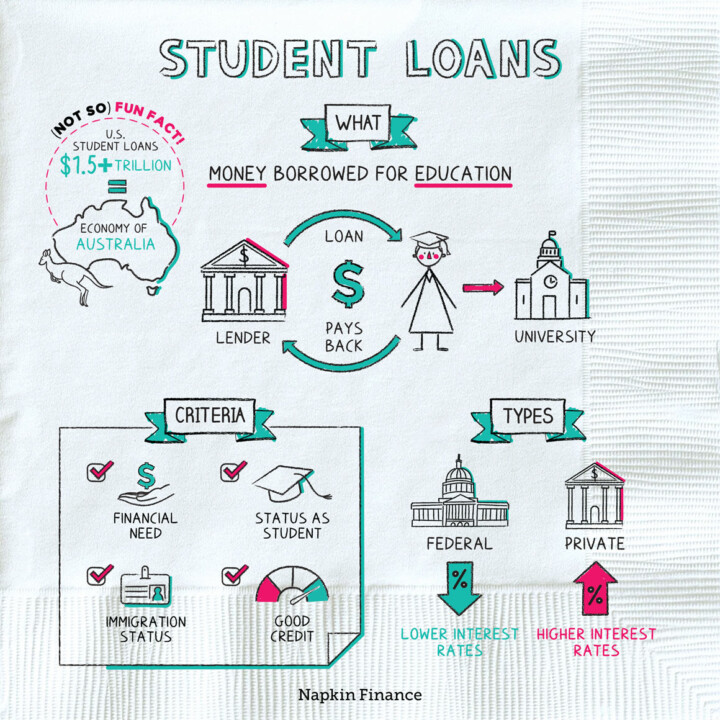

Learn moreStudent Loans

Old College Try

A student loan can be any kind of borrowed money that’s used to pay for education. Although...

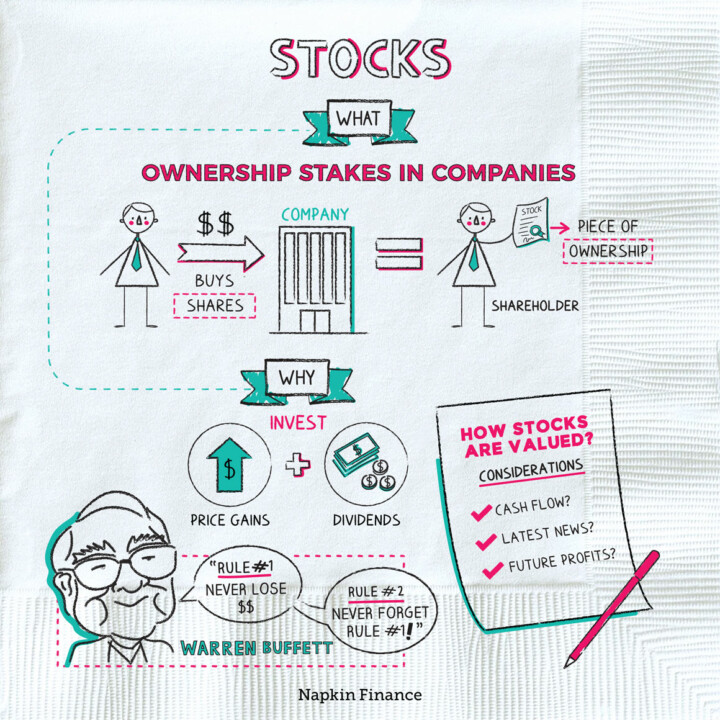

Learn moreStocks

Buy Buy Buy

Stocks are pieces of ownership in companies. If you bought one stock of, say, Amazon, and Amazon...

Learn more