Sticking to a Budget

In It to Win It

Budgeting can be a lot like dieting. You start out with big hopes for dramatic changes in your life. But, ultimately, sticking to a budget (like sticking to a diet) can take serious sacrifices and major changes in your day-to-day choices.

Many people find it’s hard to stick with their original plan over the long haul. But following a few tips and tricks—and making sure that your budget is a good fit for you—can make it easier to stay the course. Let’s take a look at how.

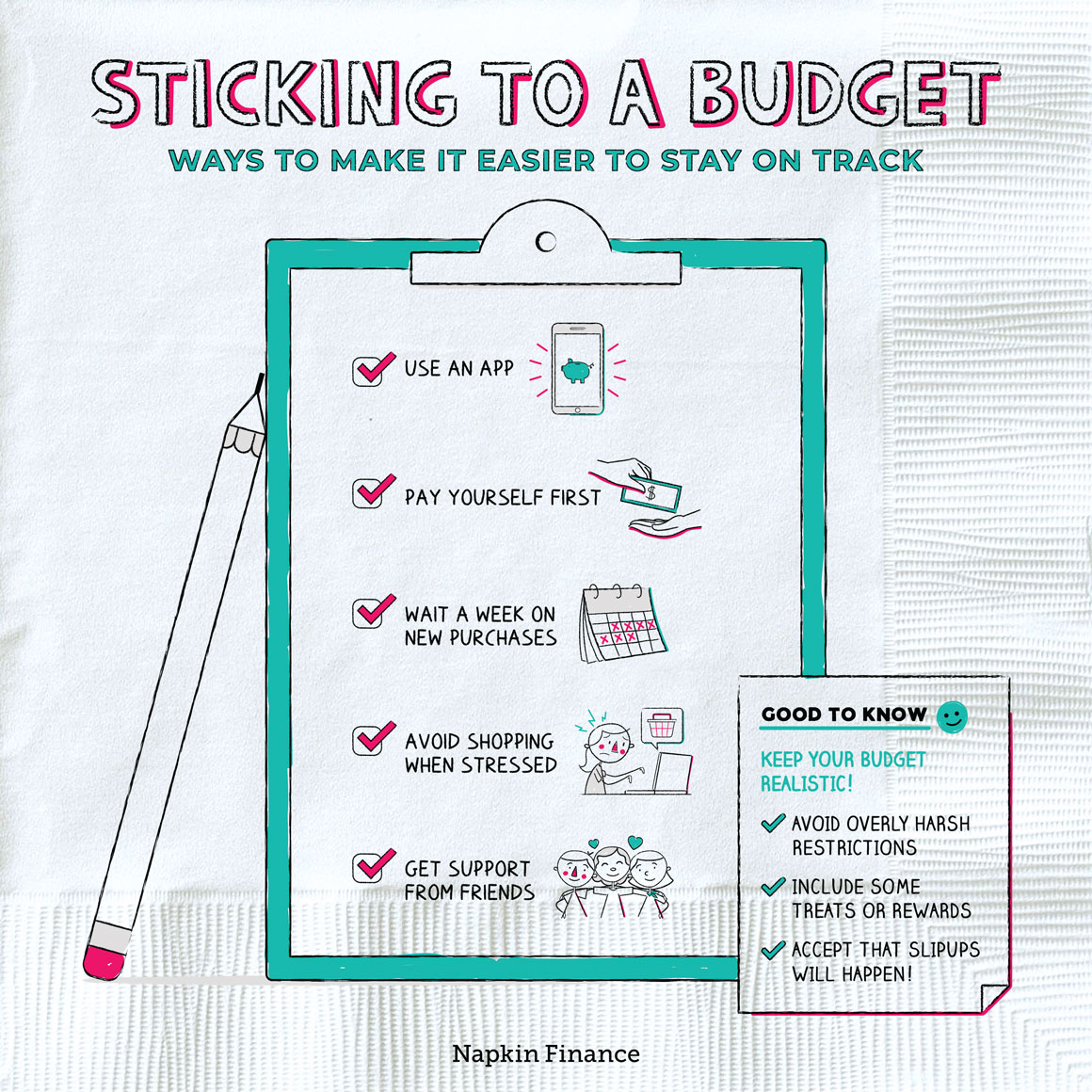

Here are some simple and easy tricks that can help you stick within the spending limits you’ve set:

Tip #1: Use an app.

- Whether it’s a dedicated budgeting app or your bank or credit card‘s own app, use something that syncs with your spending automatically.

- Some apps will ping you when you’re getting close to your spending limits to give you a warning.

- If your app doesn’t have that capability, make sure to check it at the end of the day so that you know where you stand.

Tip #2: Pay yourself first.

- If following your spending limits just isn’t working, try flipping your budget on its head.

- As soon as your paycheck is deposited, first put money into savings, toward debt payments, or toward any other goals you’re working on.

- Then, what’s left in your checking account is yours to spend until your next payday.

Tip #3: Wait a week on new purchases.

- Sometimes, you do actually need to buy something you haven’t budgeted for.

- When that happens, force yourself to take a one week cooling off period before you click “buy.”

- Chances are many items won’t feel so urgent a week later. But if something still does, you can feel good that you’re making the purchase with a cool head.

Tip #4: Avoid shopping when you’re emotional.

- Just like you shouldn’t grocery shop when you’re hungry, avoid any tempting stores (both in the real world and online) when you’re feeling stressed.

- If you tend to use retail therapy to blow off steam, come up with a few free alternate activities you can turn to instead, like getting outside or calling a friend.

Tip #5: Make it social

- Budgeting can be extra hard if you’re going it alone—particularly if it means missing out on expensive (but fun!) plans with friends.

- Tell some friends about your new cost-conscious lifestyle, and make regular plans together for free or low-cost activities.

- Even better, challenge a friend to a competition to see who can spend the least and save the most over a month.

Although you want to do everything you can to stick to the goals you’ve set, being too strict with yourself won’t set you up for success either. Here’s how to keep your budget realistic:

- Avoid overly restrictive limits

- Although you’d definitely save more money if you only ever ate lentils and rice, you’d probably be miserable too (and more likely to quit your budget).

- Come up with a budget that will meet your goals but also that you can honestly picture yourself sticking with for, say, six months to a year.

- Build in some treats or rewards

- Maybe you’ll decide that buying a morning latte is still important, maybe you want to give yourself a little extra spending money for a favorite hobby, or maybe you want to plan for one small splurge whenever you meet a savings goal.

- Whatever it is—build the occasional treat for yourself into your budget.

- Accept that slipups will happen

- Sometimes, you may still end up breaking your spending rules. If that happens, the most important thing is not to abandon your budget entirely.

- Instead, forgive yourself and focus on what you could do differently next time.

And give yourself a pat on the back now and again—even if your budgeting isn’t perfect. Changing habits is hard, but even small changes can add up over time.

Sticking to a budget is hard because it requires you to change your day-to-day habits. Some tricks that can help you stick to your chosen budget include using apps, waiting before making new large purchases, getting support from friends, and making sure the budget you’re using isn’t overly restrictive.

- If you feel like you don’t have a great handle on your spending, at least you’re not alone. Some 65% of Americans say they don’t know what they spent last month.

- Those who do know aren’t faring much better—with 31% saying they regret how much they spent.

- When life changes, your budget may need to change too. During the coronavirus shutdowns, people spent about 23% more on their pets and 23% less on entertainment.

- Following a budget can take real work and sacrifices, which is why many people find it so hard to stick with one.

- To make it easier, consider tracking your spending with an app, putting money toward savings and goals before you spend anything, and avoiding stores when you’re feeling stressed.

- It’s also important to keep realistic expectations by avoiding extreme budgeting goals and building a few treats or rewards for yourself into your budget.

- Try to keep at your budget over time even if you don’t always follow it perfectly.