Credit Report

Good Marks

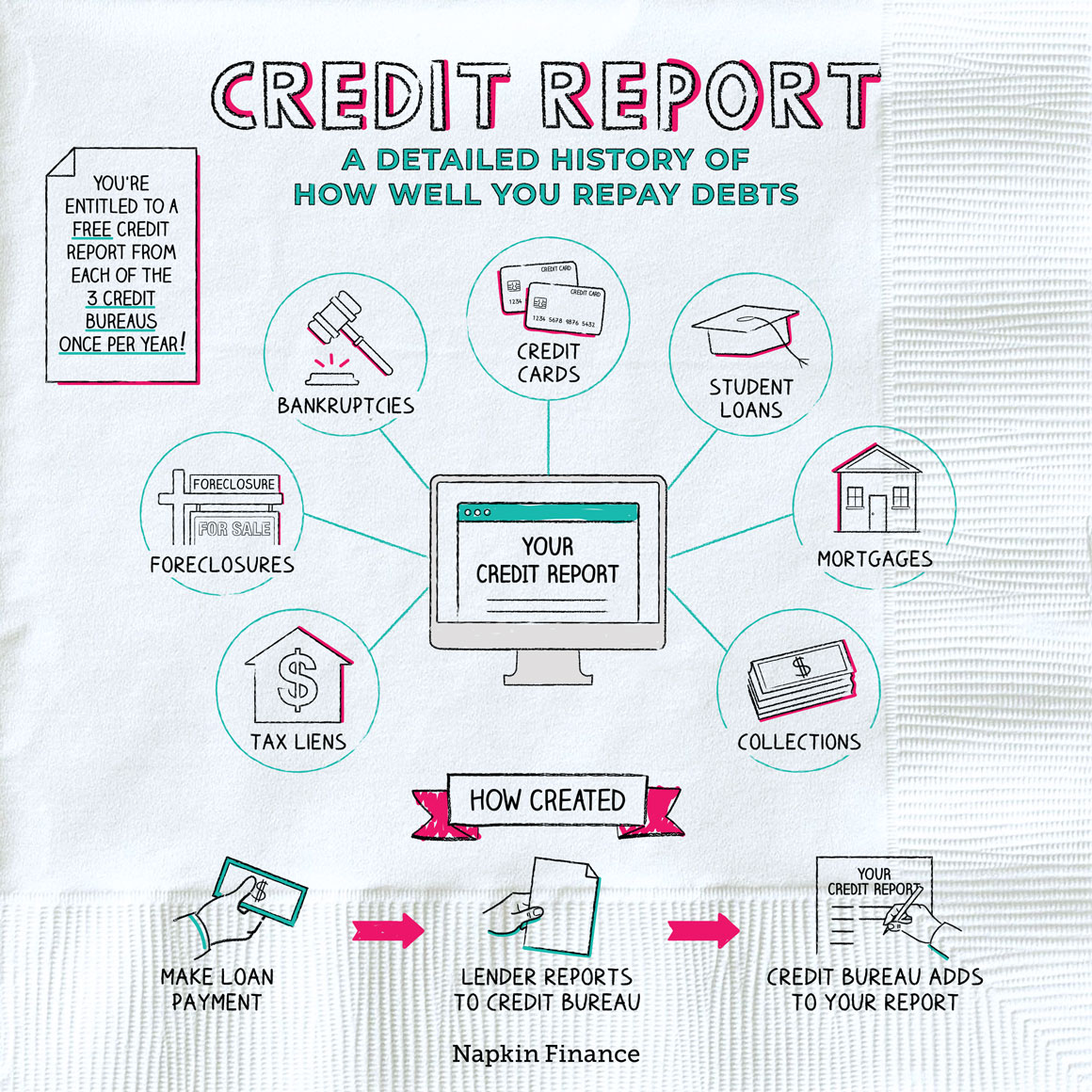

Your credit report is a detailed history of your past use of credit.

It’s a bit like a financial report card and can tell lenders (or banks, insurance companies, or others) how reliable you are when it comes to repaying your debts.

A credit report is a summary of your borrowing and repayment history. It lists each time you’ve taken out a loan, opened a credit card, or made or missed a payment.

Credit reports tend to follow a fairly consistent format and include four basic types of information:

| What | What it includes |

| Personal data |

|

| Credit accounts |

|

| Credit inquiries |

|

| Public records |

|

Information can stay on your credit report for seven years or more.

Credit reports are produced by credit bureaus. You might have heard of the three big ones—Experian, TransUnion, and Equifax—but there are some smaller bureaus too.

These companies receive information from your creditors and public records and add it to your credit file. They then use the information in this file to create your credit report.

The process looks something like this:

You make a mortgage payment

↓

Your lender tells the credit bureaus about your payment

↓

The credit bureaus add a note about

that payment to your file

↓

The payment shows up on your report

(usually within 30 days)

The process is the same whether you make or miss a payment.

Banks, credit card companies, and others may look at your credit report when deciding whether to approve you for a loan or credit card or work with you in another way. What they find on your credit report tells them whether you’re likely to make your bill payments on time or not.

A company might look at your credit report when you apply for:

- Loans and credit cards

- Insurance

- An apartment

- A job

In addition to helping them decide whether or not to approve your application, companies may use the information in your report when deciding what to charge you—like when setting the interest rate on your loan or premium on your insurance.

While your credit report gives the detailed backstory on all your past payments, your credit score is a single number that grades your reliability as a borrower. It’s a quick snapshot that gives someone an idea of your creditworthiness without reading your report.

Depending on the scoring model used, your credit score will typically fall anywhere between 300 (the worst possible score) and 850 (perfect).

Here are some other points to keep in mind about credit reports:

- Not everyone has one. If you’ve never had a loan or credit card, you probably won’t have a credit report.

- Each credit bureau keeps a separate file on you, so your report could look a little different depending on which bureau produced it.

- Potential employers need your permission to look at your credit report.

You’re entitled to a free copy of your credit report every year from each of those three main credit bureaus. Experts recommend that you try to check your report regularly (like every four months, which you can do if you rotate which bureau you request a report from) to keep an eye out for errors and signs of fraud.

If you do see something wrong, there’s a formal process you can follow to dispute the information with the bureaus.

Your credit report is a summary of your borrowing and repayment history (the good, the bad, and the ugly). Banks, credit card companies, landlords, employers, and other lenders may use it when deciding whether to do business with you. Your report includes your personal information, accounts, payment history, credit limits, any bankruptcies, and more.

- About 20 percent of people have an error on at least one of their credit reports, yet only one-third check their reports annually.

- Until the 1950s, there was no such thing as credit scores. Bankers often made lending decisions based simply on whether or not they liked you.

- A credit report is a detailed summary of your past and current loans, credit cards, and lines of credit, and of all the payments you’ve made (or missed) on those accounts.

- It tells lenders whether you’ve done a good job repaying loans and credit card bills on time or if your record is spotty.

- A lender, landlord, or company might use your credit report when deciding whether to give you a loan, rent you an apartment, or give you a good rate on a credit card.

- Credit reports are created by credit bureaus. Lenders report what you borrow and pay to the credit bureaus, and the credit bureaus compile all that information into your report.

- The information in your credit report is used to calculate your credit score, which can range from 300 to 850 and gives a quick take on your creditworthiness.