Featured Napkin

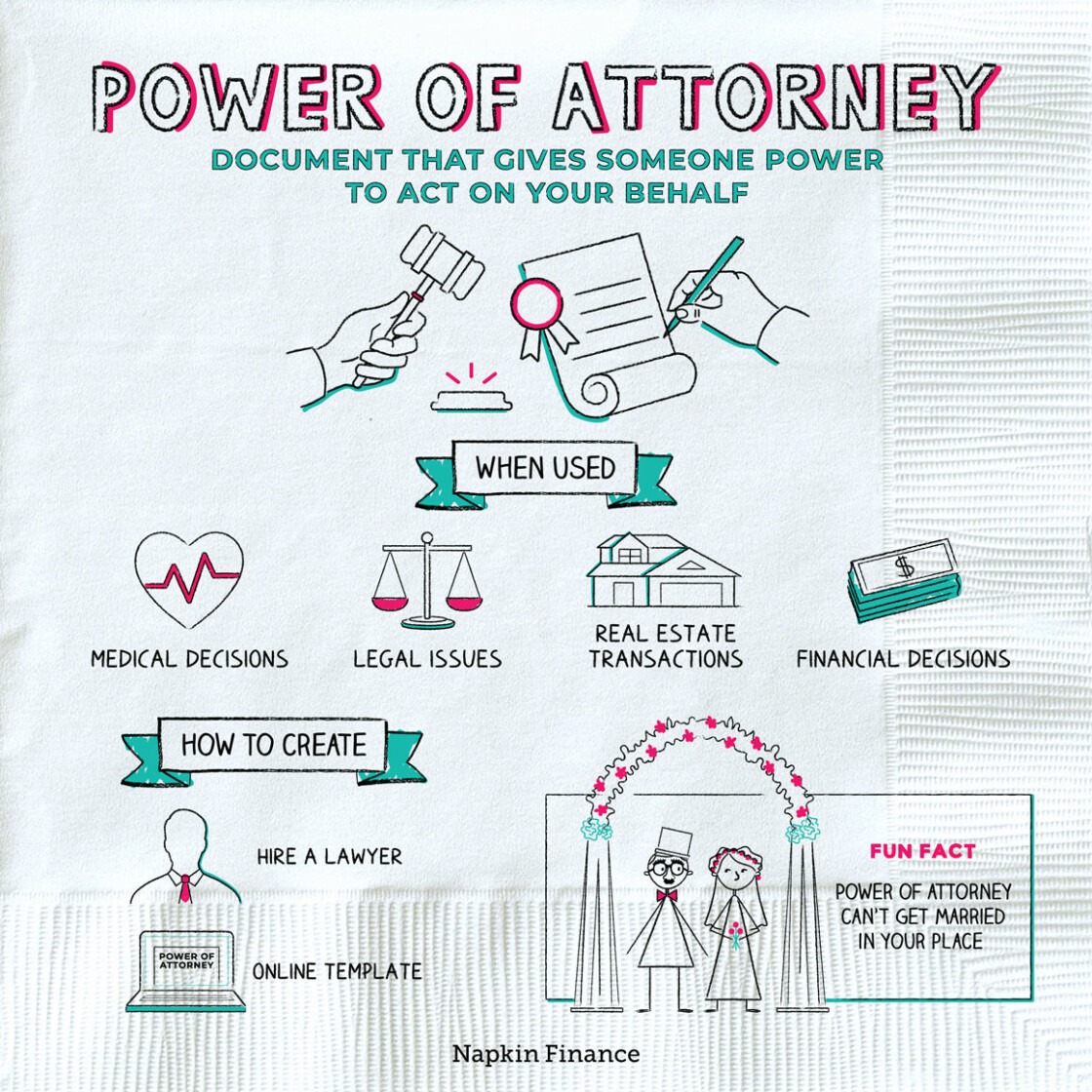

Power of Attorney

More Power to You

A power of attorney is a document you can create if you want to give someone else the authority to act or make decisions on your behalf. It’s a tool people can use to make sure that someone they trust will handle their decisions if there’s ever a situation (usually...

Learn moreMore reaching retirement Napkins...

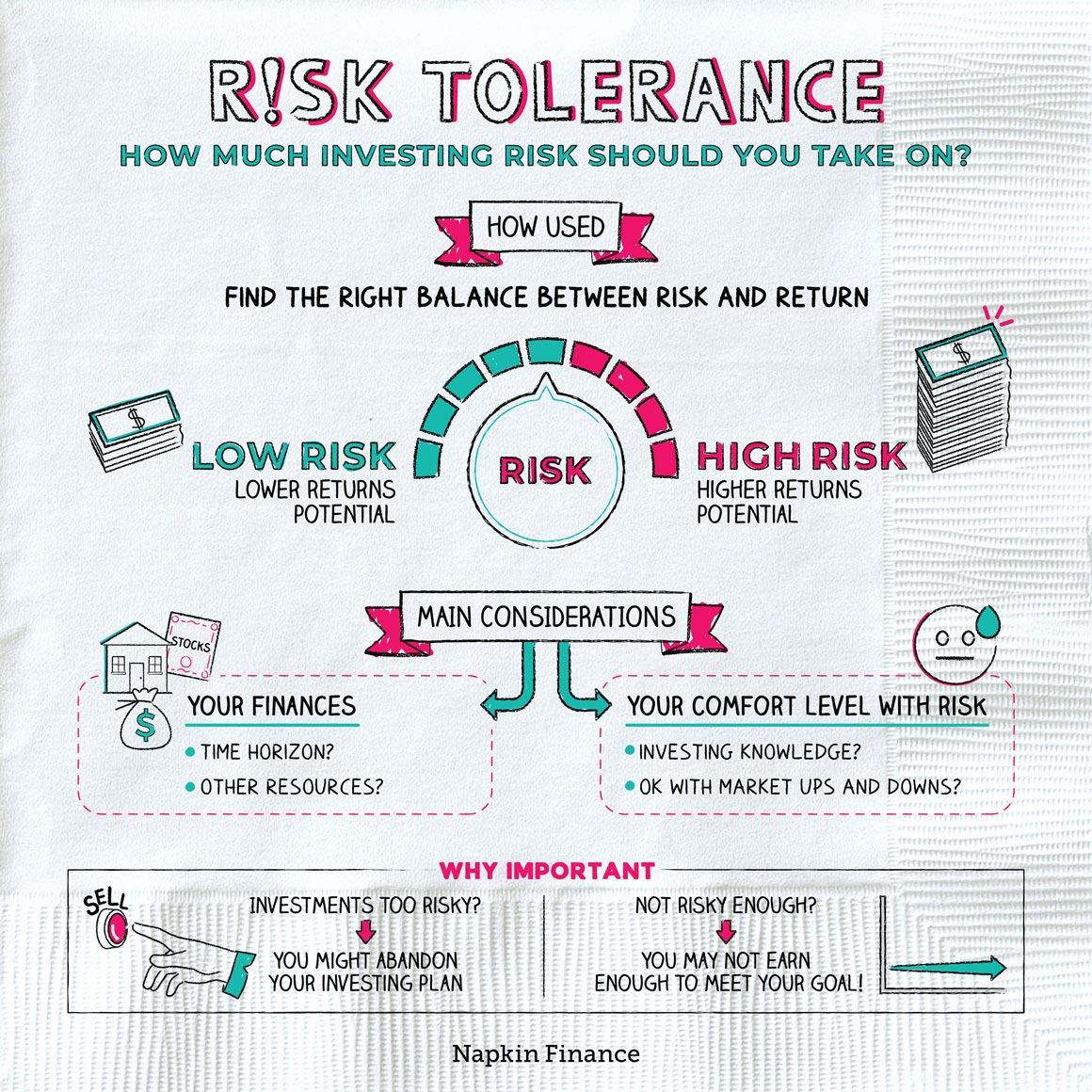

Risk Tolerance

Appetite for Destruction

Risk tolerance describes how much risk you can (or should) be taking on with your investments. Investing...

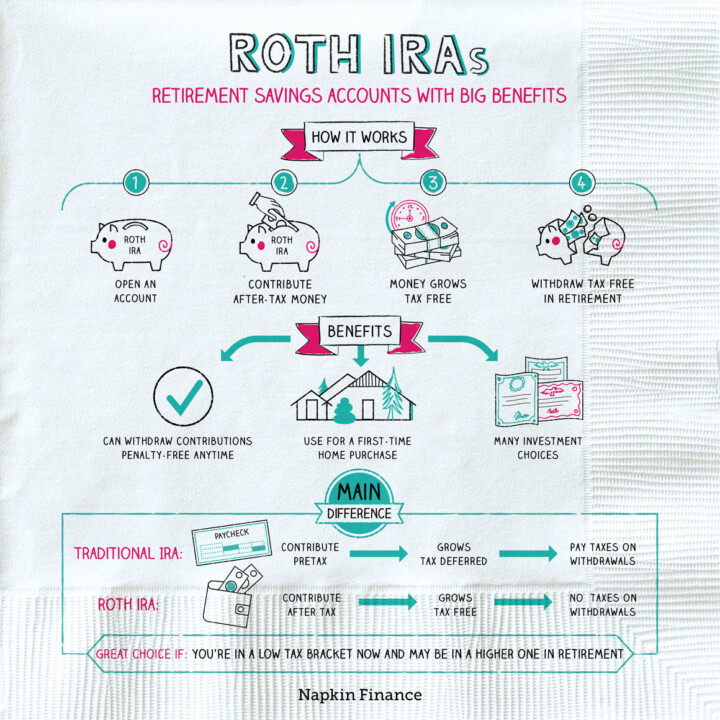

Learn moreRoth IRAs

Road to Retirement

A Roth IRA, or Individual Retirement Account, is one of the most common types of retirement savings...

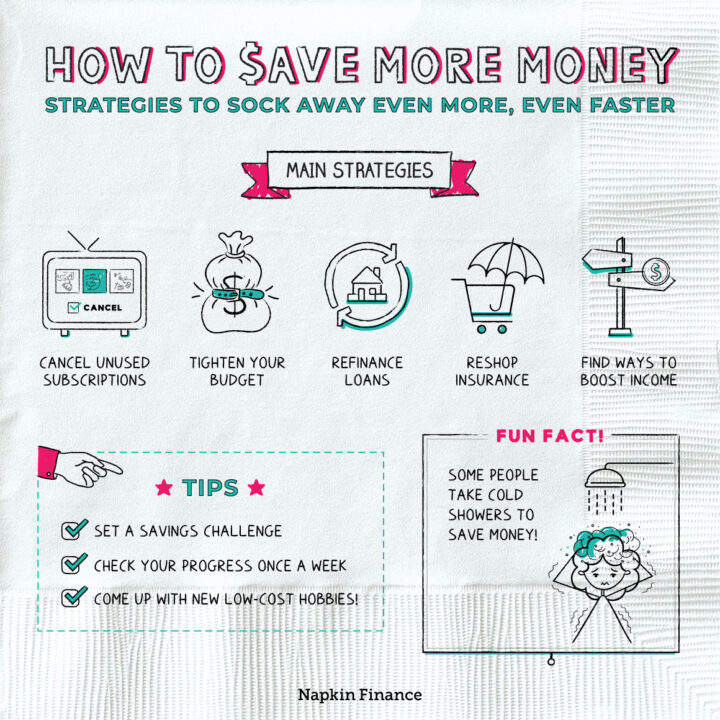

Learn moreHow to Save More Money

Keep the Change

Like many good habits, saving more money is easier said than done. Once you’ve gotten into a...

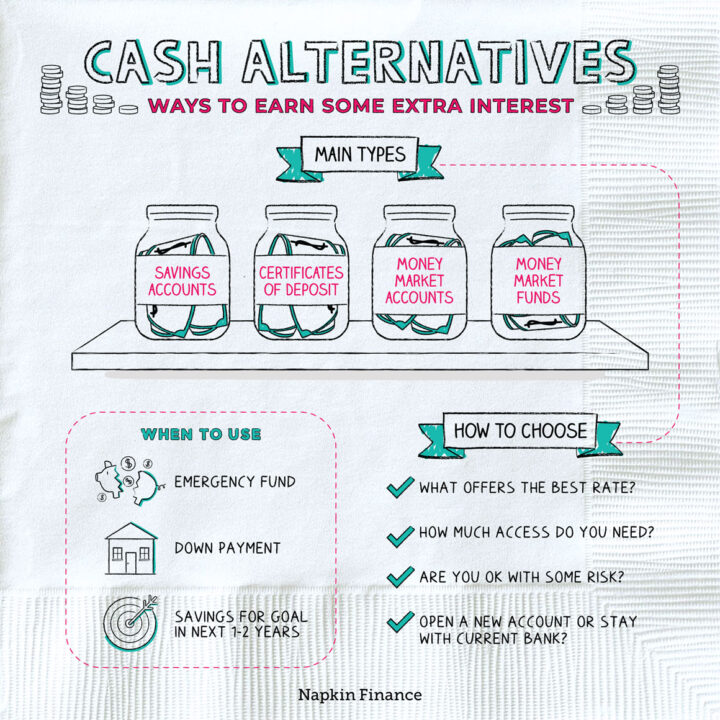

Learn moreCash Alternatives

Cash In

Cash alternatives are investment types that you can consider as alternatives to simply holding money in your...

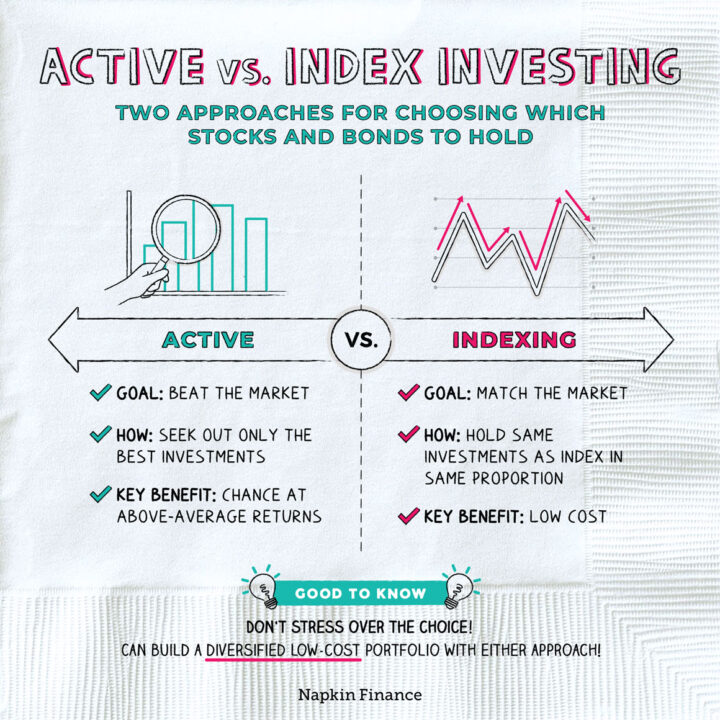

Learn moreActive vs. Index Investing

Pick Sides

Active and index investing are two different ways of choosing individual investments. With active investing, investors try...

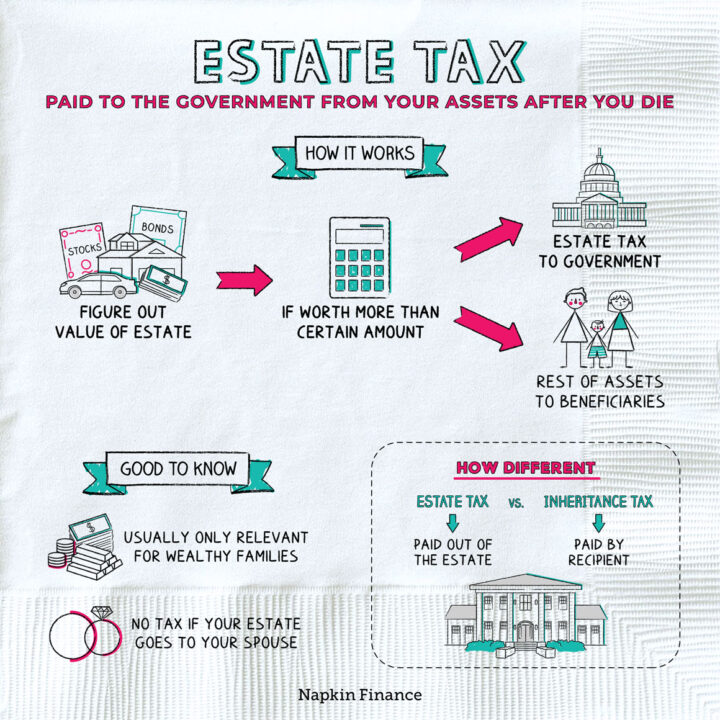

Learn moreEstate Tax

Death and Taxes

An estate tax is an amount that may be paid from your assets to the government after...

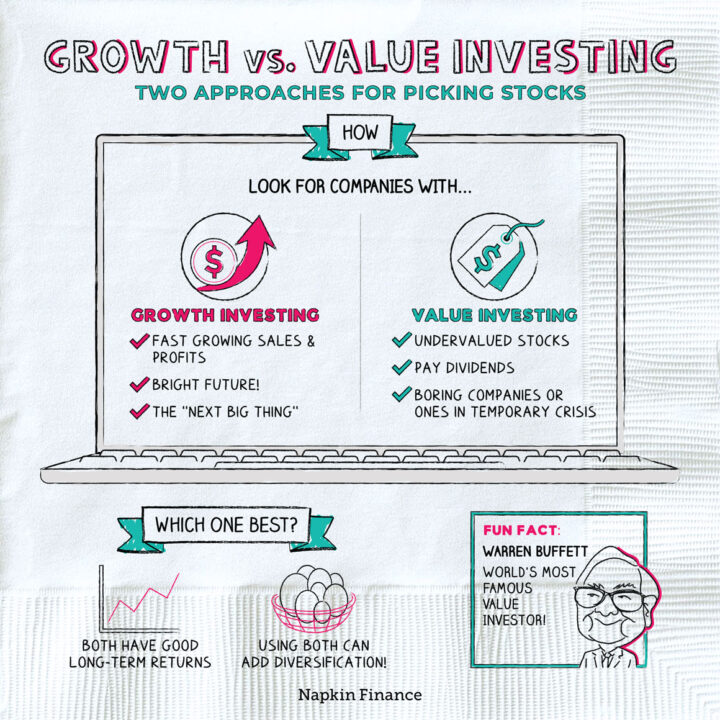

Learn moreGrowth vs. Value Investing

Moves Like Buffett

Growth and value investing are two different approaches to investing in stocks. Growth investors aim to invest...

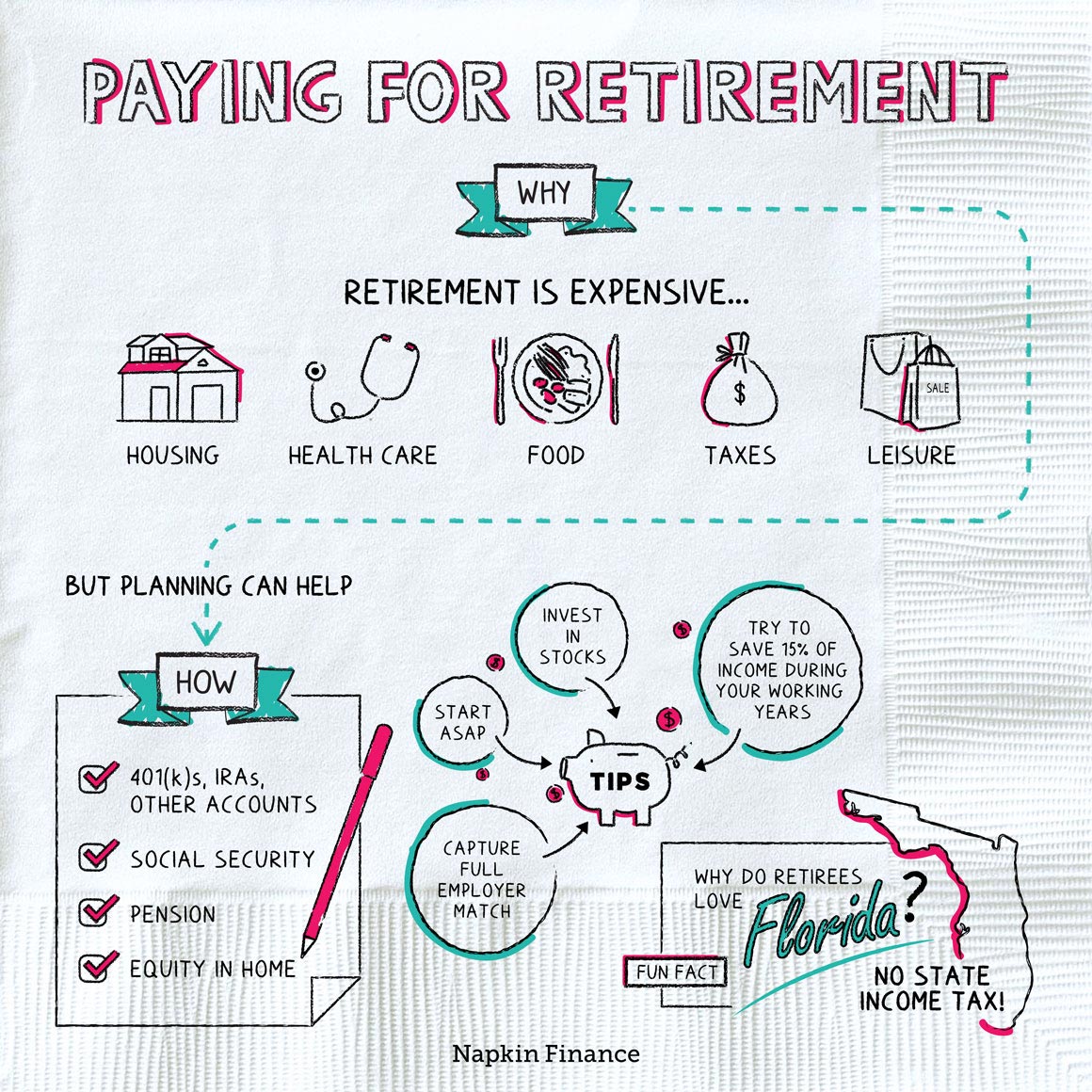

Learn morePaying For Retirement

Into the Sunset

Retirement may seem like an abstract, far-off goal (unless you’re already independently wealthy or a 401(k) ninja,...

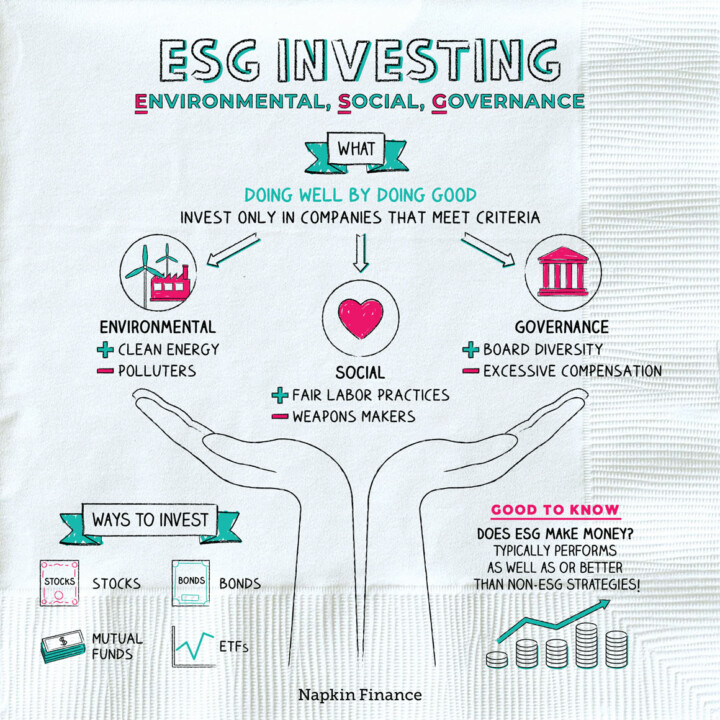

Learn moreESG Investing

Do the Right Thing

ESG investing means investing in companies that do good (or at least don’t actively do harm). With...

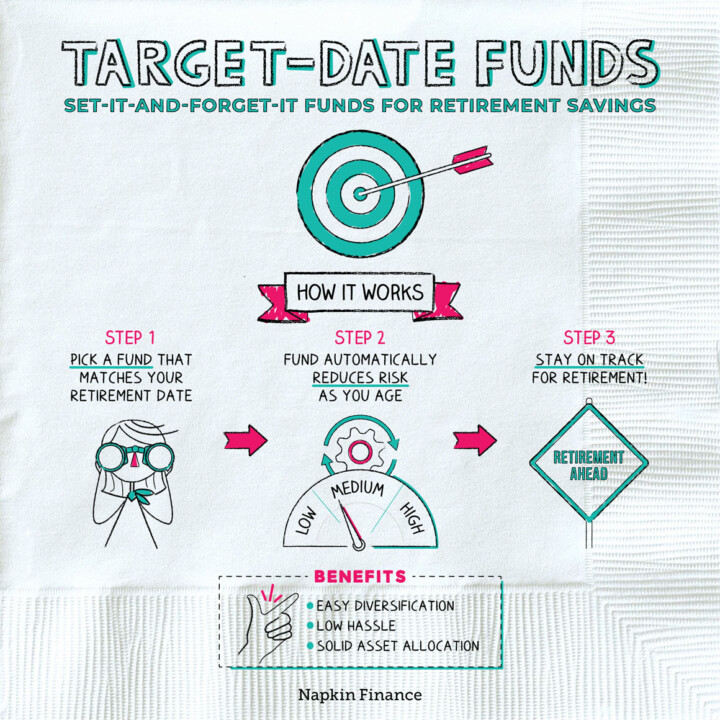

Learn moreTarget-Date Funds

Bullseye on Retirement

A target-date fund is an investment fund that’s based on your expected retirement date. These mutual funds...

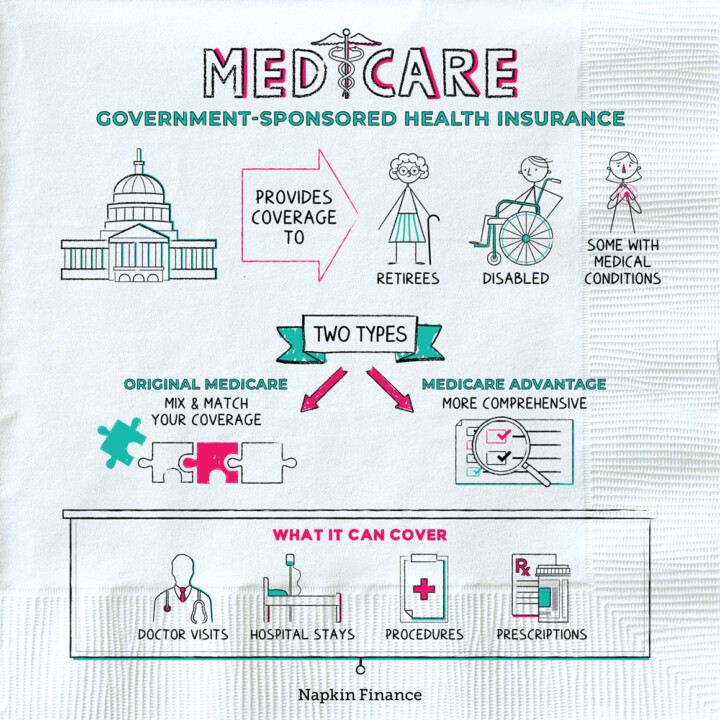

Learn moreMedicare

Free for All

Medicare is a health insurance program for retirees that is sponsored by the federal government. It is...

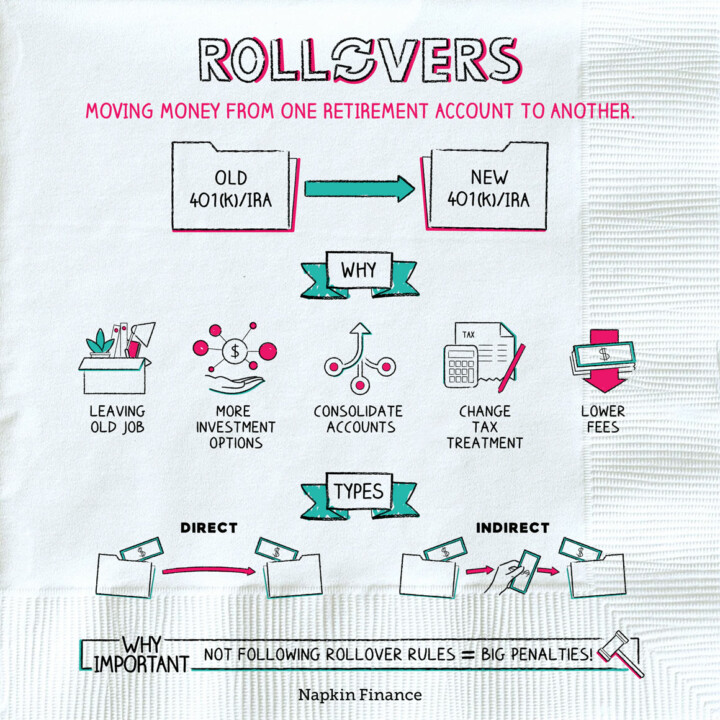

Learn moreRollovers

Roll With It

A rollover is when you move funds from one retirement account into another, such as from a...

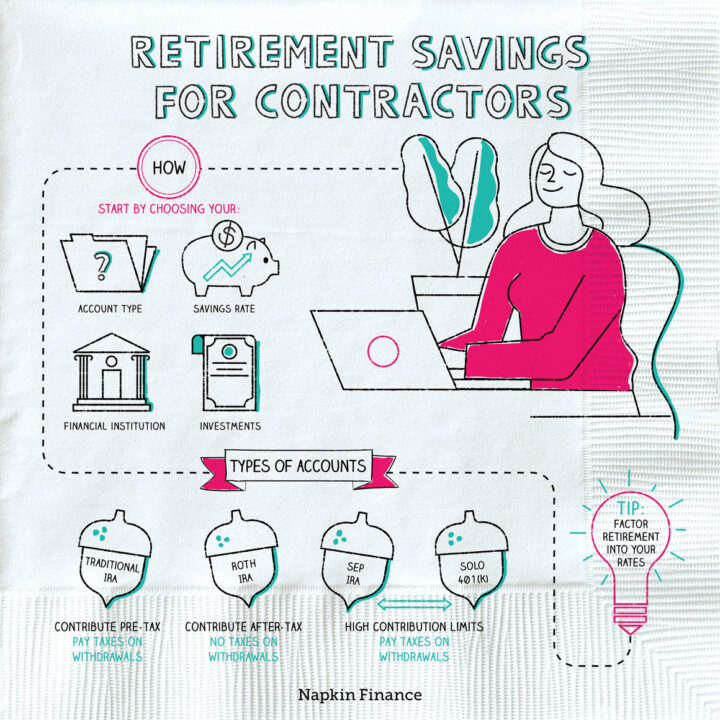

Learn moreRetirement Savings for Contractors

Squirrel Away

If you’re a contractor, saving for retirement can be much more complicated than it is for employees....

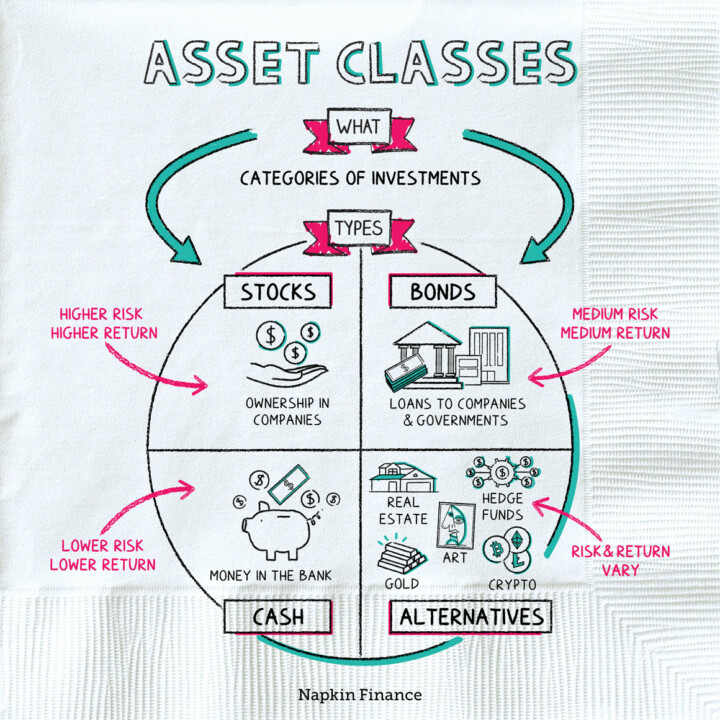

Learn moreAsset Classes

Building Blocks

An asset class is a group of similar kinds of investments. It’s a generalization, not a detailed...

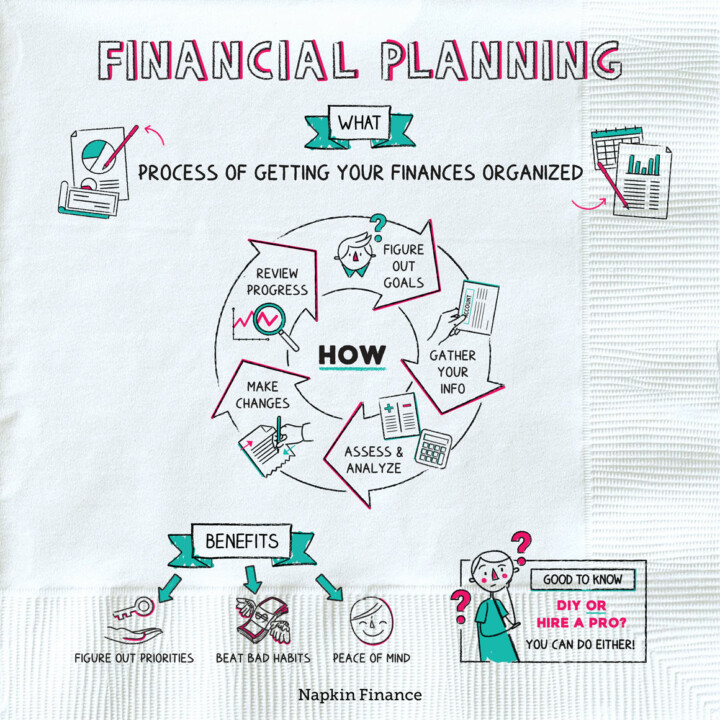

Learn moreFinancial Planning

Ducks in a Row

Financial planning describes the process of mastering your money. It means figuring out where you actually are...

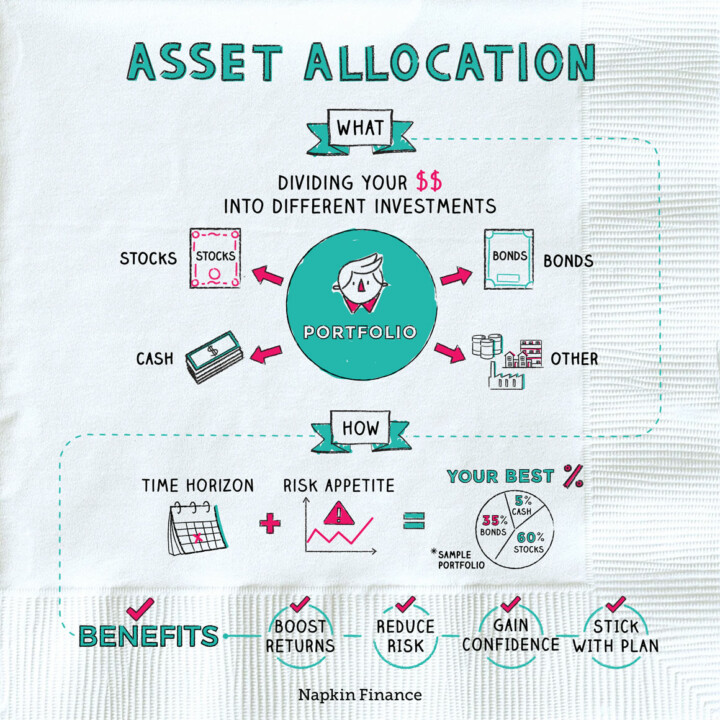

Learn moreAsset Allocation

Divide and Conquer

“Asset allocation” is a way of describing what you own in percentage terms. If you’ve got $1,000...

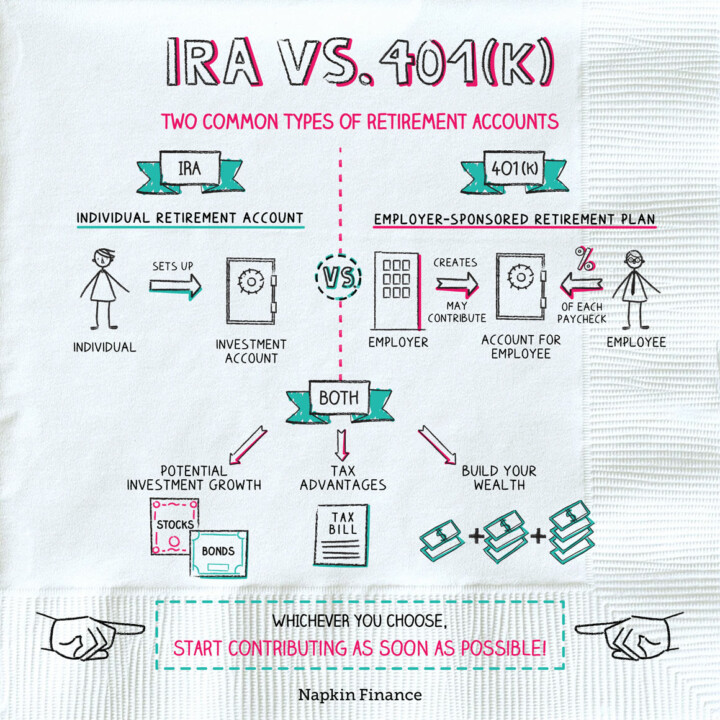

Learn moreIRA vs. 401(k)

Nest Eggs

IRAs and 401(k)s are two popular types of retirement savings accounts. Most people who work in the...

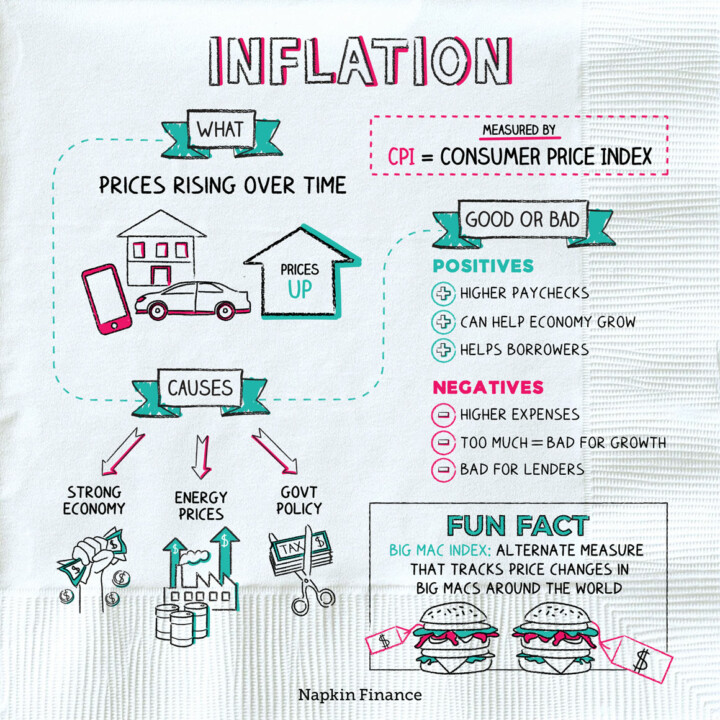

Learn moreInflation

On the Up and Up

Inflation is when prices of things rise over time. For example, in 1980 you could buy a...

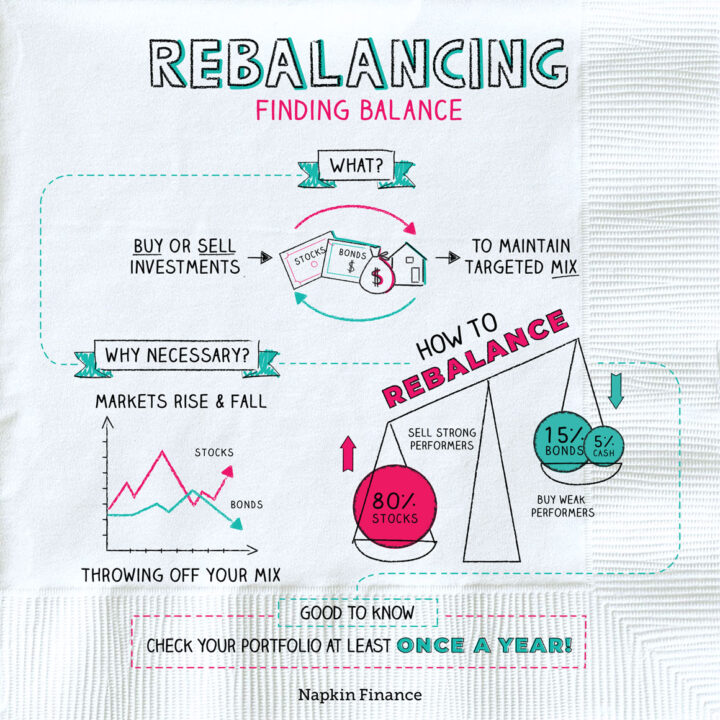

Learn moreRebalancing

Move Your Assets

Know how self-help gurus are always talking about “finding the balance” in your personal life? That same...

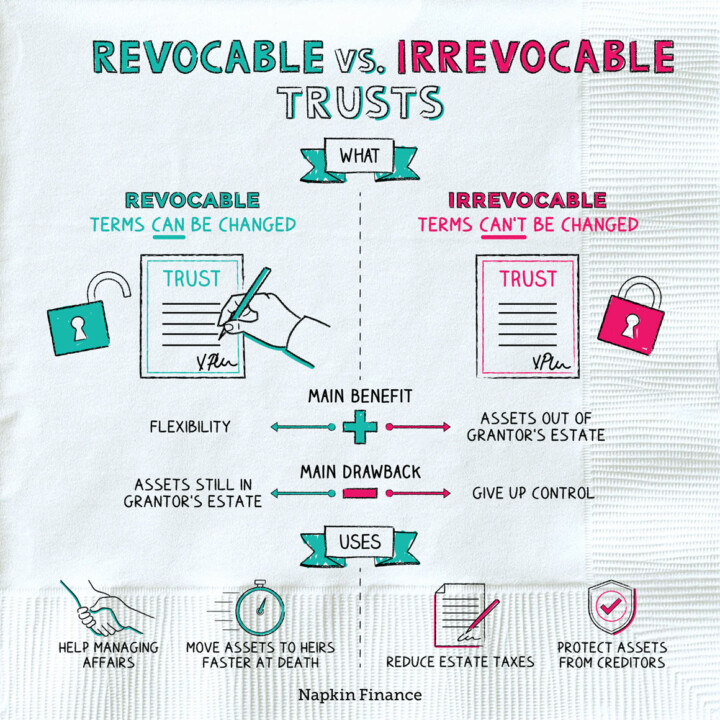

Learn moreRevocable vs. Irrevocable Trusts

In Good Hands

A trust is a legal agreement allowing one person to transfer their assets to someone else via...

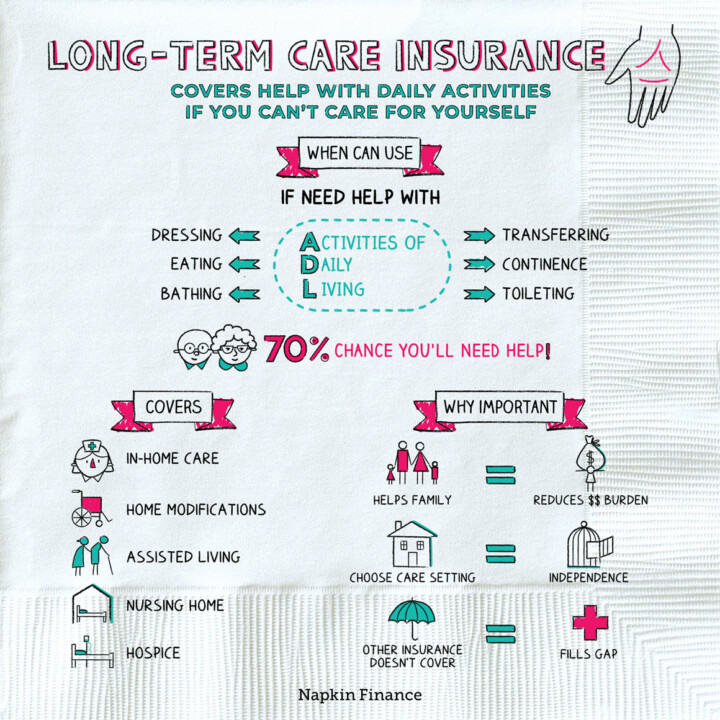

Learn moreLong Term Care Insurance

Senior Moment

Long-term care insurance is a policy that helps cover the cost of assistance with daily activities if...

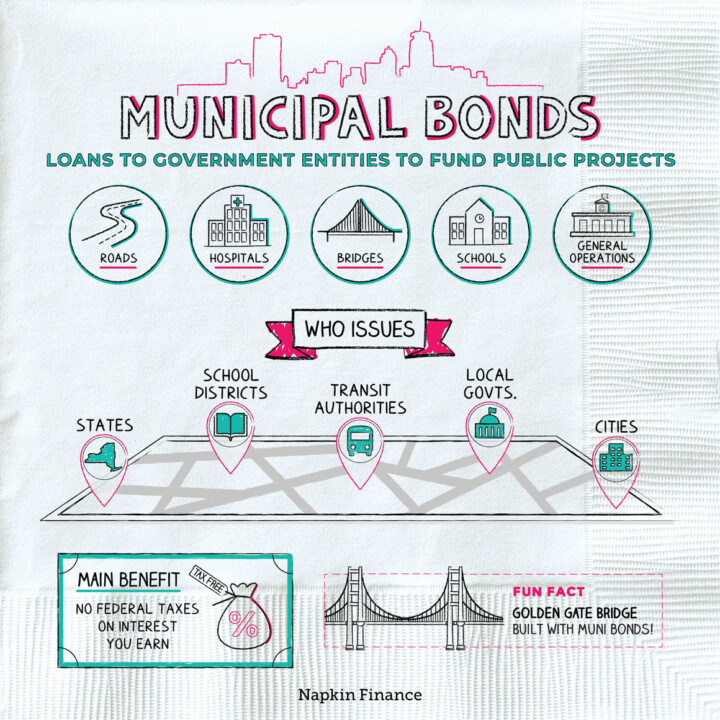

Learn moreMunicipal Bonds

One for the Road

A municipal bond, or muni bond, is a type of bond issued by a state or local...

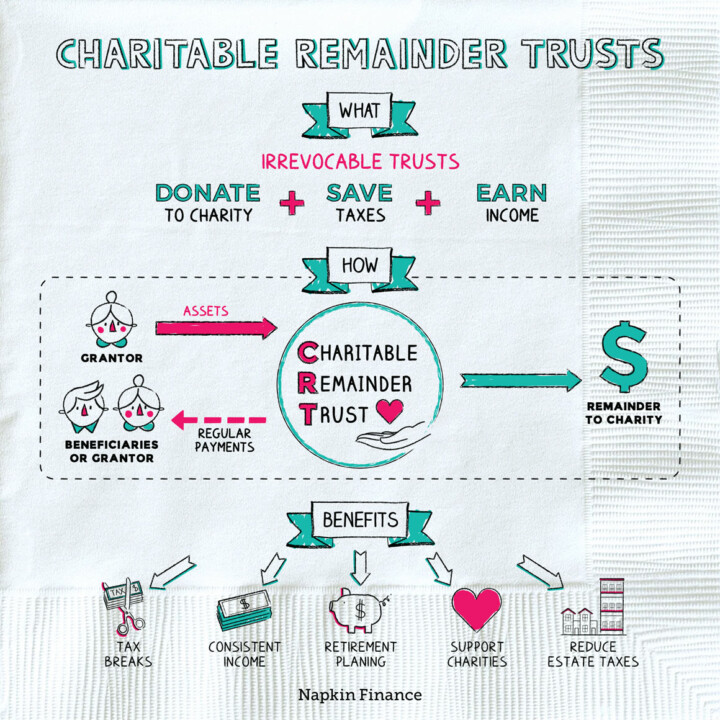

Learn moreCharitable Remainder Trusts

Big Love

A charitable remainder trust is a financial tool that can provide a steady source of income while...

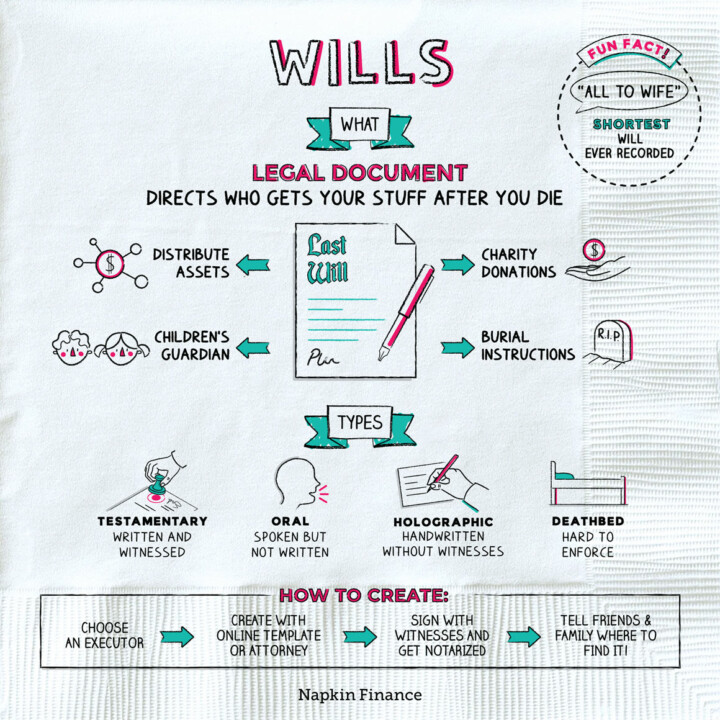

Learn moreWills

For Love or Money

A Last Will and Testament, or “will” for short, is a legal document that lets you transfer...

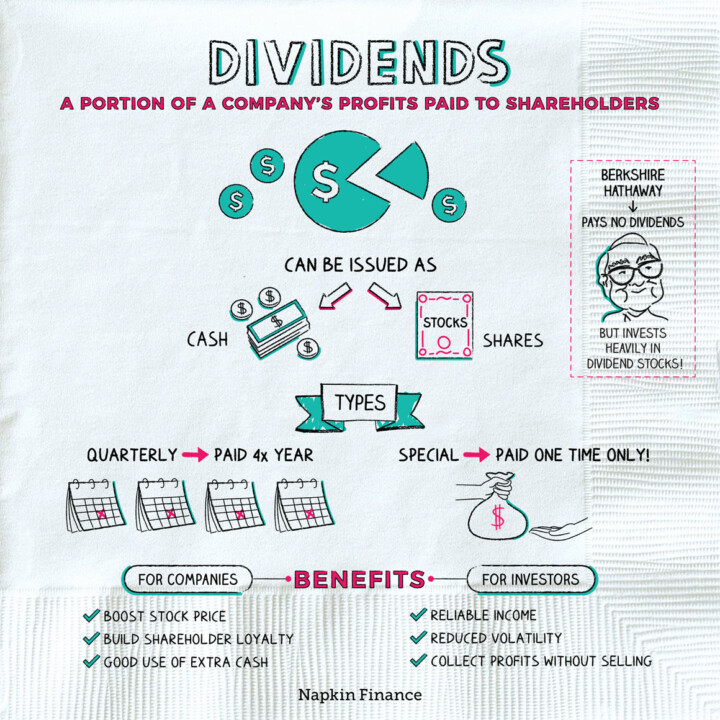

Learn moreDividends

Show Me the Money

A dividend is a portion of a company’s profits that is paid to its shareholders in the...

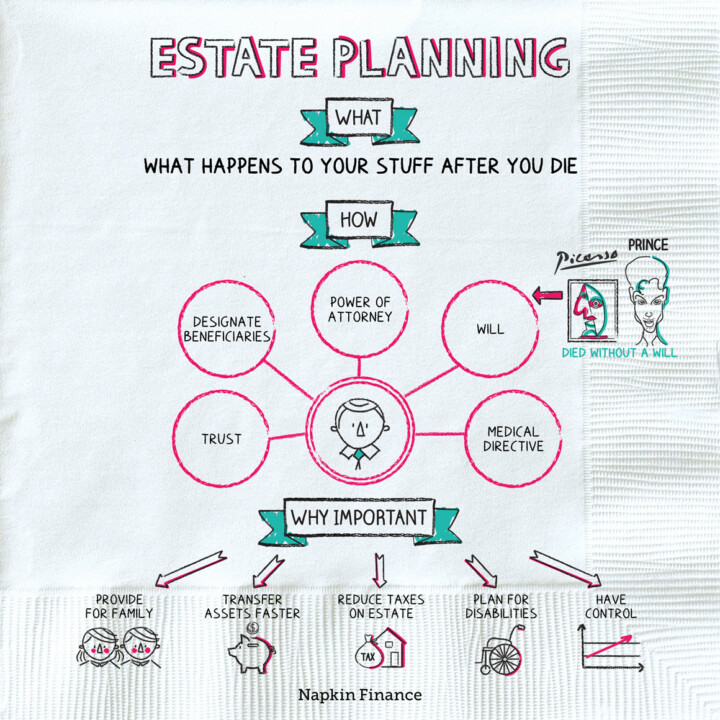

Learn moreEstate Planning

Bite the Dust

Estate planning is the process of figuring out what will happen to your stuff after you die....

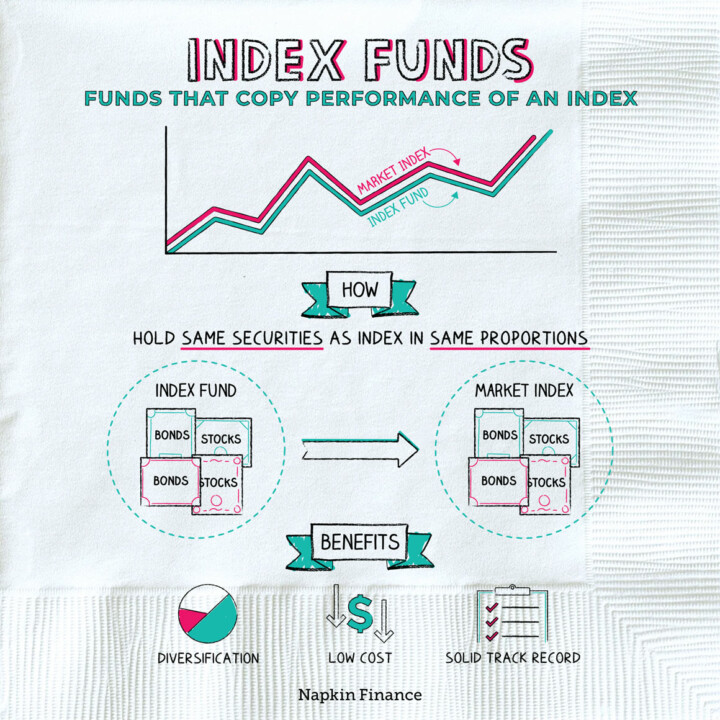

Learn moreIndex Funds

Copy That

An index fund is a professionally managed collection of stocks, bonds, or other investments that tries to...

Learn moreReverse Mortgage

Can’t Take it With You

A reverse mortgage is exactly what it sounds like: instead of paying down a mortgage balance every...

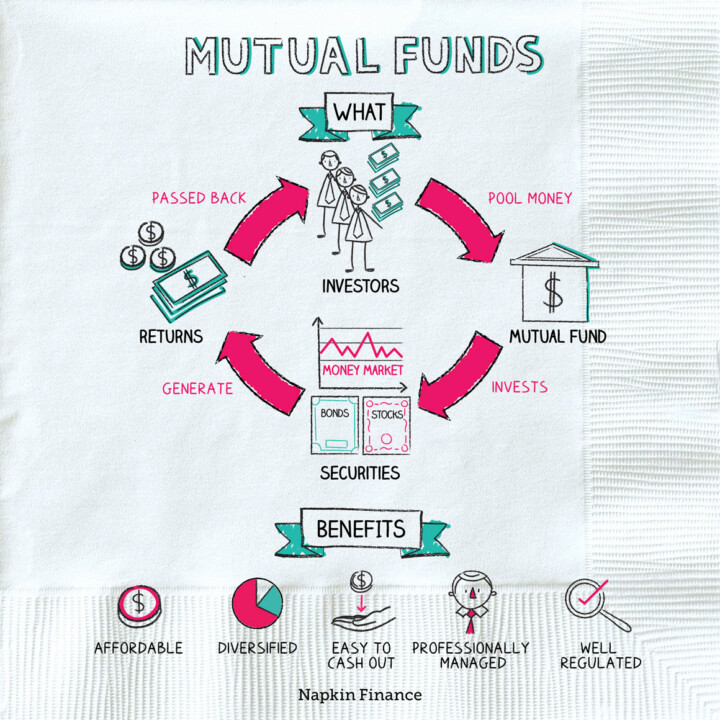

Learn moreMutual Funds

Join Forces

A mutual fund is a professionally managed fund that pools lots of investors’ money in order to...

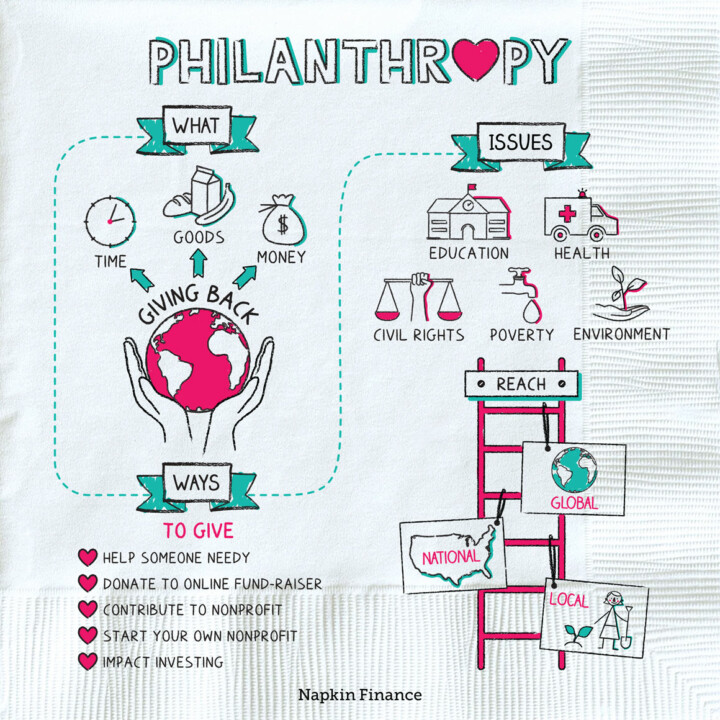

Learn morePhilanthropy

Greater Good

Philanthropy is giving back. It’s paying forward the resources you have—whether your money, or physical goods, or...

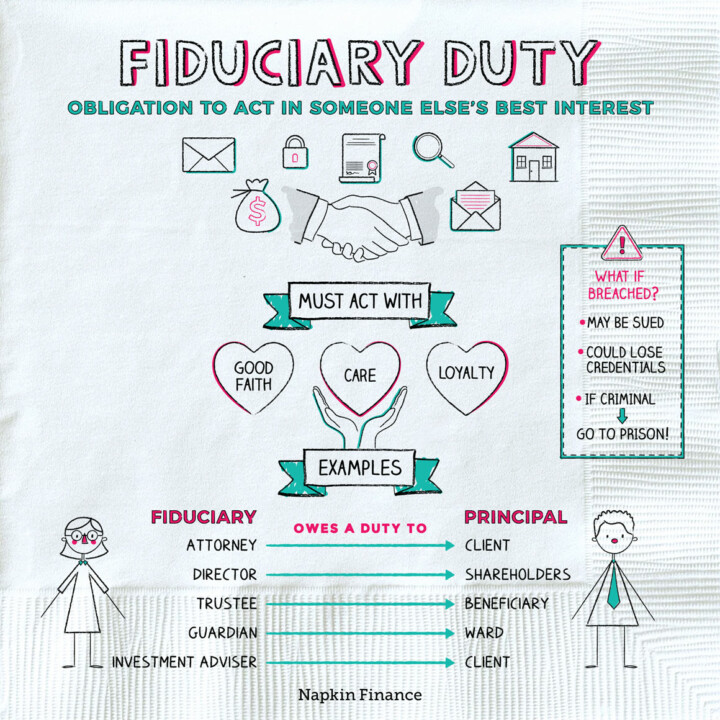

Learn moreFiduciary Duty

Your Best Interest

A fiduciary duty is a legal obligation to act in another person’s best interest.

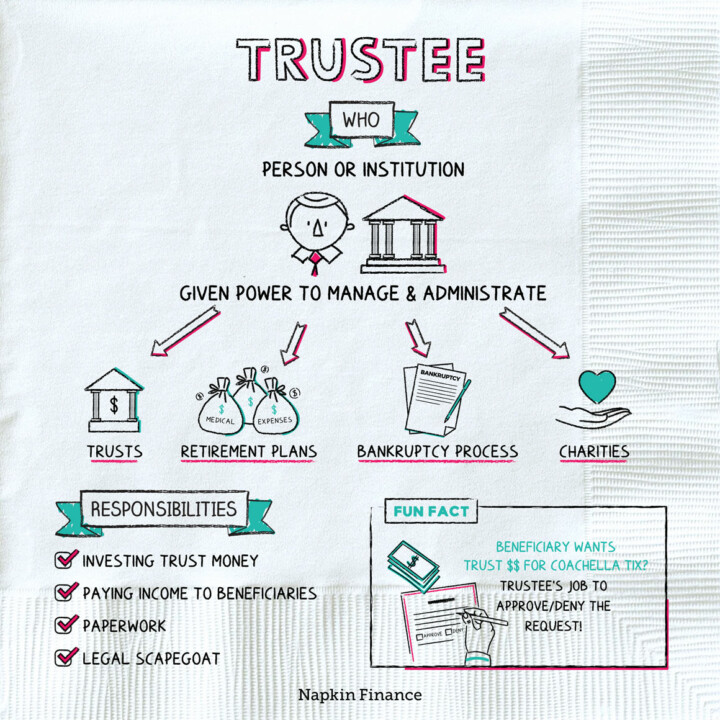

Learn moreTrustee

Handle With Care

A trustee can be an institution or an individual that is given the power to manage and...

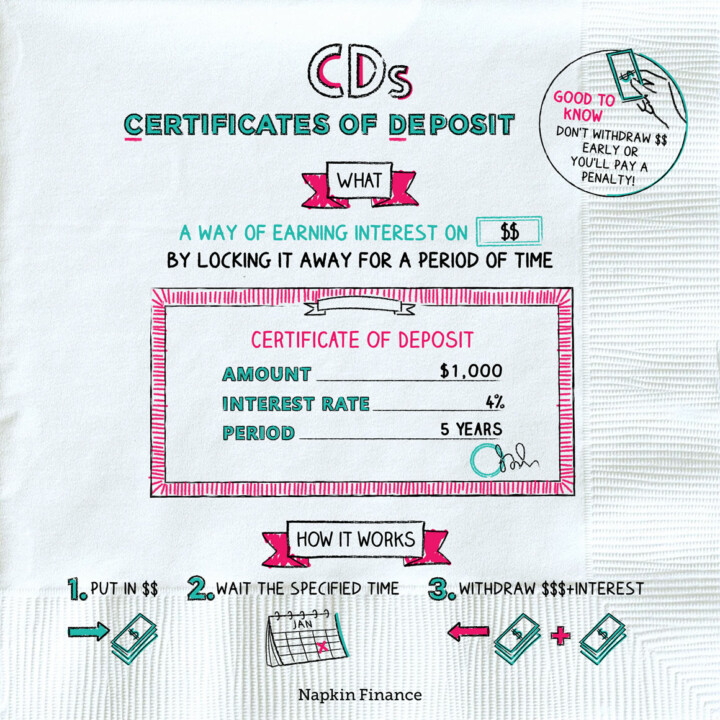

Learn moreCDs

On Principal

Certificates of Deposit, or CDs, are low-risk investments that pay interest. You can think of them as...

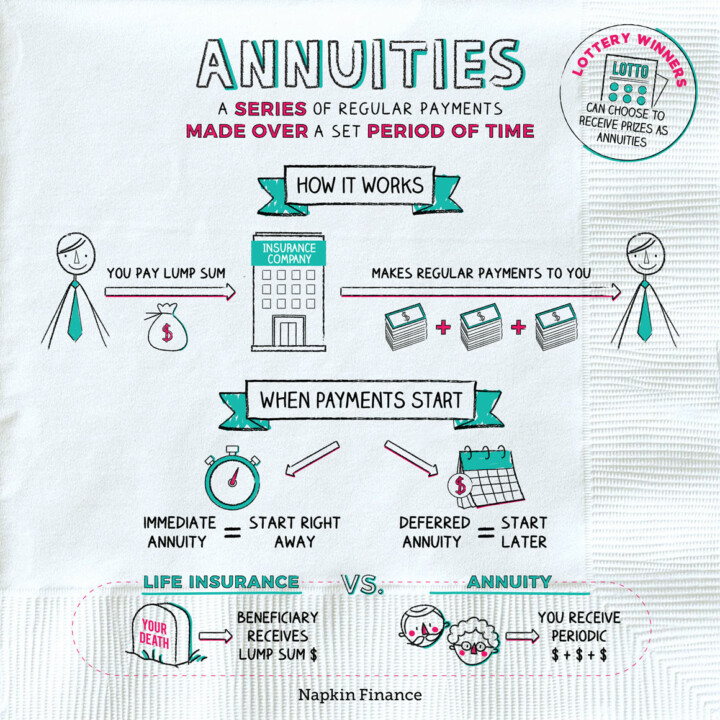

Learn moreAnnuities

Nest Egg

An annuity is a series of regular payments made over a set period of time. Annuities can...

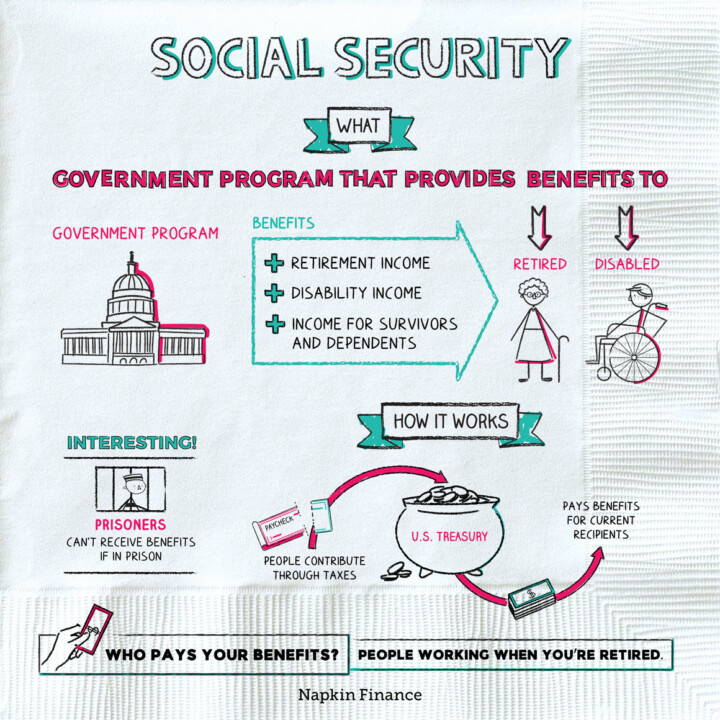

Learn moreSocial Security

Safety Net

Social Security is a government program that takes in taxpayer dollars and pays out benefits to older...

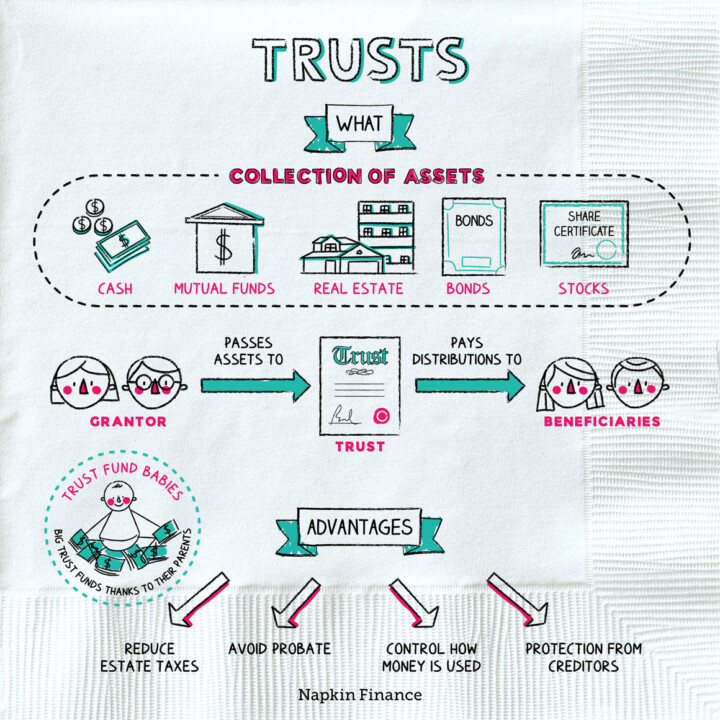

Learn moreTrusts

Pennies From Heaven

A trust is a legal document that allows a person (the trustee) to hold the assets of...

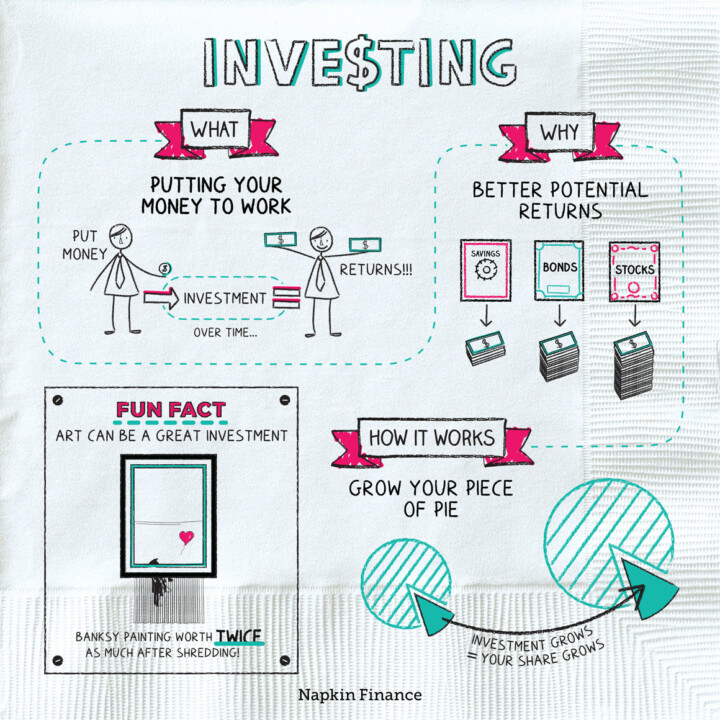

Learn moreInvesting

Piece of the Pie

Investing is putting your money to work in the hopes of earning a return. You probably already...

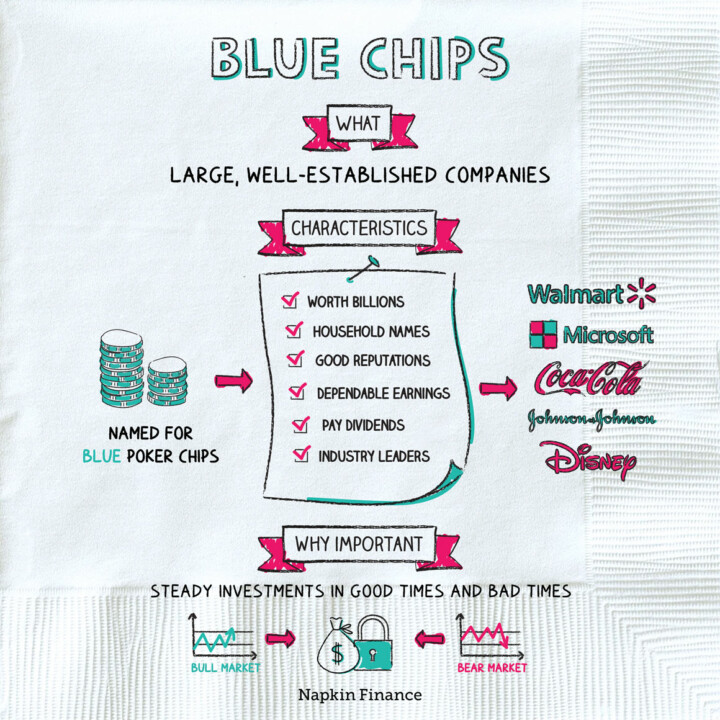

Learn moreBlue Chips

Steady Eddy

A blue chip is a company that is financially sound and well established. These companies usually sell...

Learn more