HMO vs. PPO

Bill of Health

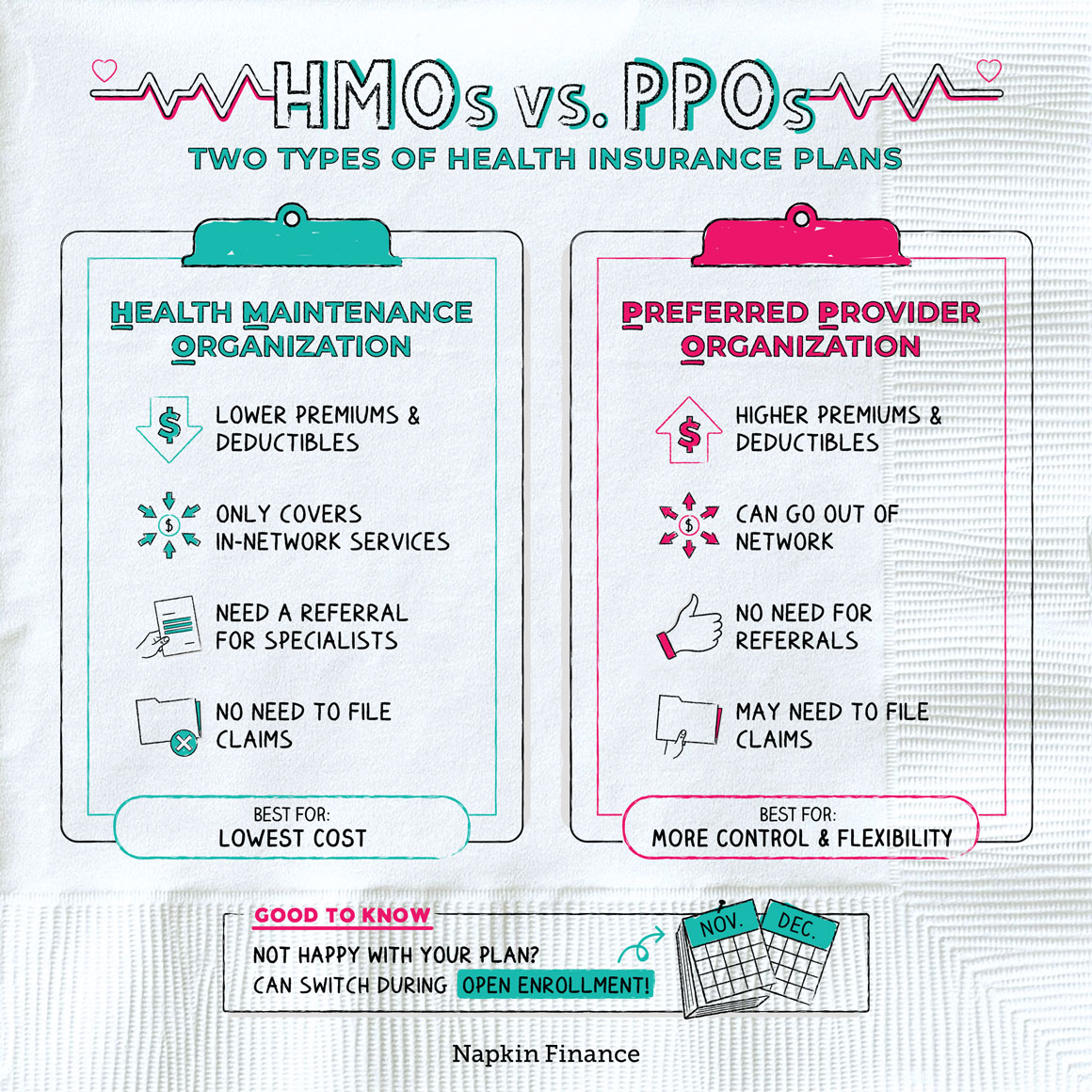

HMOs and PPOs are two different types of health insurance plans.

HMO (or Health Maintenance Organization) plans are typically cheaper but offer less choice and flexibility in which doctors you see and when you can see them. PPO (or Preferred Provider Organization) plans give you more choice and control but are usually higher cost.

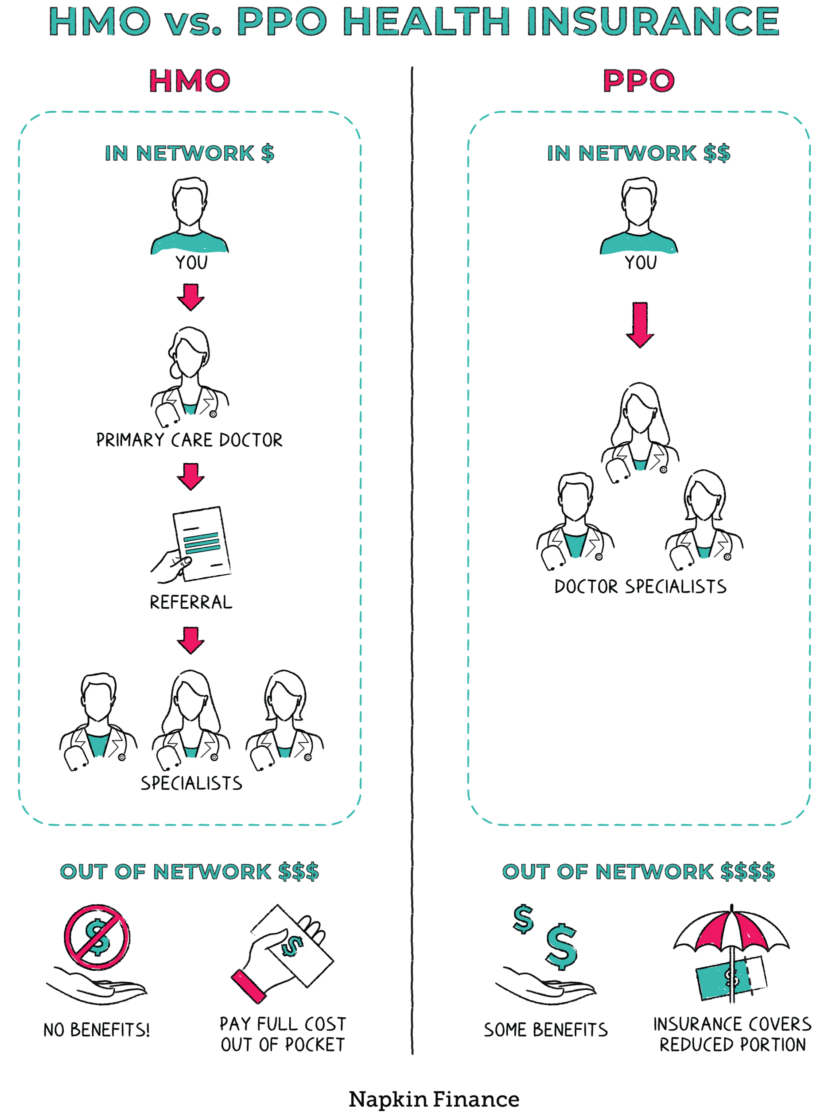

With an HMO plan, you’ll have an in-network primary care doctor who’s the main point person for your healthcare. If you need to see a specialist, you’ll have to get a referral from your primary care doctor first. And if you ever need emergency care, you’ll want to go to an in-network hospital to make sure your stay is covered by your insurance.

With a PPO plan, you can still have a primary care doctor, but you don’t need them to give you a referral if you ever want to see a specialist. And although it’s cheaper to go in network, your insurance will still pay something if you end up seeing an out-of-network provider.

Here’s how those basic features stack up:

Here’s a look at some of the other key differences between the plan types:

| HMO | PPO | |

| Monthly premium | Lower | Higher |

| Must meet a deductible? | Often no | Yes |

| Have to file claims? | No because the plan only pays for in-network services | Yes if you see someone out of network |

| Want to see a specialist? | Book an appointment with your primary care provider and ask for a referral | Pick up the phone and make an appointment with the specialist directly |

| Labs and hospitals? | Must go in network for services to be covered | Insurance should pay something no matter where you go |

| Network of providers | Usually smaller | Usually larger |

If you went to the doctor and you didn’t have health insurance, you’d receive a bill for the full sticker price of your visit (plus any other tests or services you received).

But insurance companies don’t pay that full sticker price. Instead, they negotiate discounts with some doctors—kind of like a discount for buying in bulk. That group of discounted doctors is called the health insurance plan’s “network.”

That’s why no matter what type of insurance you have it’s always cheaper to go with doctors that are in network for your plan.

You may need to choose between an HMO and a PPO plan anytime you’re signing up for new health insurance, like if you’ve just started a new job. To be sure, each type comes with trade-offs. But an HMO might be right for you if:

- You want the lowest-cost option and you’re ok with the plan’s restrictions

- You like the plan’s in-network doctors and hospitals

- You don’t usually see lots of specialists

On the other hand, a PPO could be the better option if:

- You’re ok with paying a little more in exchange for choosing your own doctors

- You want the option to go out of network

- You anticipate seeing lots of specialists

And if you’re not happy with the plan you chose, you don’t have to stick with it forever. You can always switch plans the next time open enrollment comes around—which is usually from November through early December.

HMOs and PPOs are the two main types of health insurance plans. You may need to pick one or the other anytime you’re signing up for new health insurance. HMOs are generally lower cost but come with added restrictions on what doctors you can see and how you can book appointments. PPOs are generally more expensive but come with more flexibility and control over your care.

- HMO and PPO plans may have a lot of differences, but they rank pretty evenly when it comes to customer satisfaction, with 53% of HMO and 57% of PPO policyholders saying they’re satisfied with their health insurance.

- A typical family’s health insurance costs more than $21,000 per year in premiums alone (counting what employers pay toward the premium).

- HMOs and PPOs are the two main types of health insurance plans.

- HMOs are generally lower cost as long as you stick with in-network doctors and hospitals.

- PPOs are generally more expensive but come with more flexibility in which doctors you can see.

- With an HMO, you need a referral from your primary doctor if you want to see a specialist, while with a PPO, you can book appointments with specialists directly.

- You’ll often have to choose between an HMO or a PPO plan when you’re first signing up for new health insurance, but if you’re unhappy with the plan you chose, you can typically change your selection during open enrollment.