Car Insurance

Tighten Your (Seat) Belt

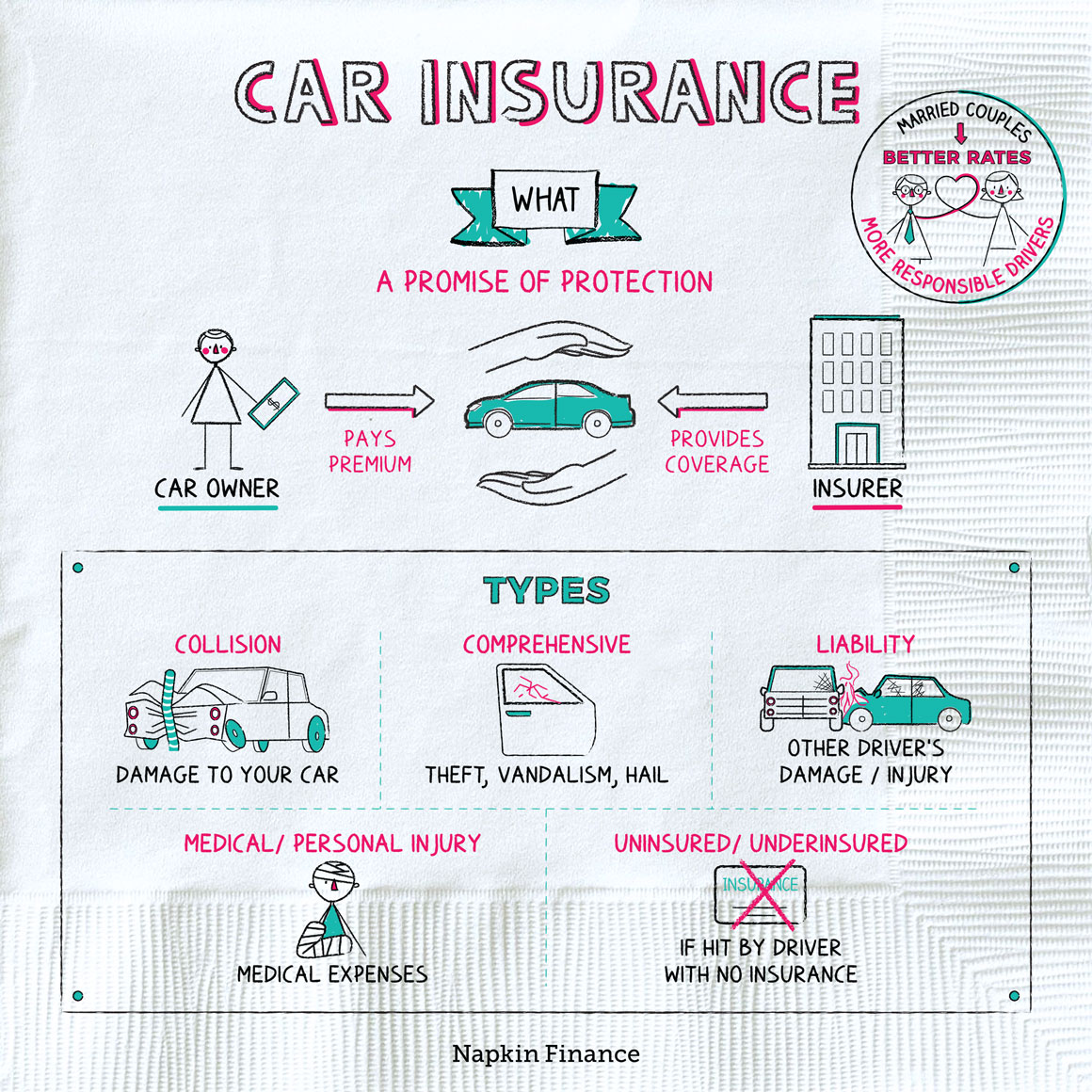

Car insurance is an agreement between you and an insurance provider. In exchange for regular payments from you, the insurer helps pay your bills if someone gets injured or a car is damaged because of an accident or theft.

Most states require that drivers carry at least some auto insurance in order to legally operate a vehicle (though the specific requirements vary).

If you’re in an accident, someone steals your car, or your vehicle is damaged, the resulting repairs or medical bills can be expensive. Auto insurance is there to help you cover your bills and those of anyone else who suffers damage in the accident (if you’re at fault).

You can buy car insurance directly from an insurance company. You have different options for coverage, and the cost of insurance may vary between companies and depending on the type of coverage you choose.

A typical policy covers you and any other licensed drivers in your household whom you list on the policy as a regular driver. Your policy can include multiple vehicles. If you loan your car to someone else, any damage they cause is usually still covered by your insurance.

When you’re shopping for car insurance, you’ll likely come across a few key terms:

- Premium: The amount you pay to keep your policy in force. Many factors influence your premium, including your driving record, how you use the car, your credit score, your age, and where you live.

- Deductible: The amount you must pay out of pocket before your policy kicks in to cover your costs.

- Coverage limit: The most your policy will pay for a given cost. You’ll typically have separate limits for different coverage types—like a $300,000 limit on bodily injury in a given accident but $50,000 for property damage.

There are six common types of auto insurance coverage. Your policy might include some or all of these.

| Coverage type | Might cover |

| Collision | Repairs or replacement of your vehicle after an accident |

| Comprehensive | Damage not caused by an accident (like theft, vandalism, or hail) |

| Liability | Another driver’s medical bills or car repairs if you cause an accident |

| Medical payments | Your or your passengers’ medical expenses after an accident |

| Personal injury protection | Medical expenses, lost wages, and certain other costs, like child care while you visit the doctor |

| Uninsured and underinsured motorist | Your medical expenses or car repairs if you’re hit by someone who doesn’t have insurance (or doesn’t have enough) |

While these are the most common, there are other types of coverage your insurance provider might offer, such as new car replacement, rental car expenses, and business use of your vehicle for things like ridesharing.

Almost all states require you to purchase a certain minimum amount of insurance in order to legally drive, though which types they require (and the minimum amount of dollar protection they require you to have) varies by state.

Here are some tips to keep in mind when you’re evaluating your own car insurance:

- You can save money on your insurance by bundling it with other policies (like your home or renters policy) or increasing the deductible.

- You may also be eligible for a discount if you’re in the military or belong to an organization, such as AARP.

- Your insurance policy might not cover business use of your vehicle.

- Experts recommend that you reevaluate your insurance every couple of years to make sure you’re still getting the best coverage and rates.

- Policy terms are usually for six months to one year, after which you can renew. If you don’t renew on time, your insurance rates could go up.

Car insurance helps you pay for repairs and medical expenses if you’re in an accident or if your vehicle is damaged or stolen. There are different types of coverage at different prices available from insurance providers, some of which your state might require to legally drive.

- New Hampshire and Virginia are the two states that don’t require drivers to carry insurance (though in Virginia you have to pay a $500 annual fee to drive uninsured).

- Black cars are among the most likely to be in an accident, while yellow cars are the least likely.

- Married people tend to pay less for car insurance because studies have shown they’re more responsible drivers.

- Car insurance can cover property damage, medical expenses, and liabilities incurred if you are in an accident or your vehicle is stolen or otherwise damaged.

- Your policy can cover you and any other drivers listed plus people you allow to borrow your car temporarily. It can also cover multiple vehicles.

- Different types of coverage are available, some of which your state might require. Each can help you pay for different repairs or medical bills.