Tax Refunds

Check’s in the Mail

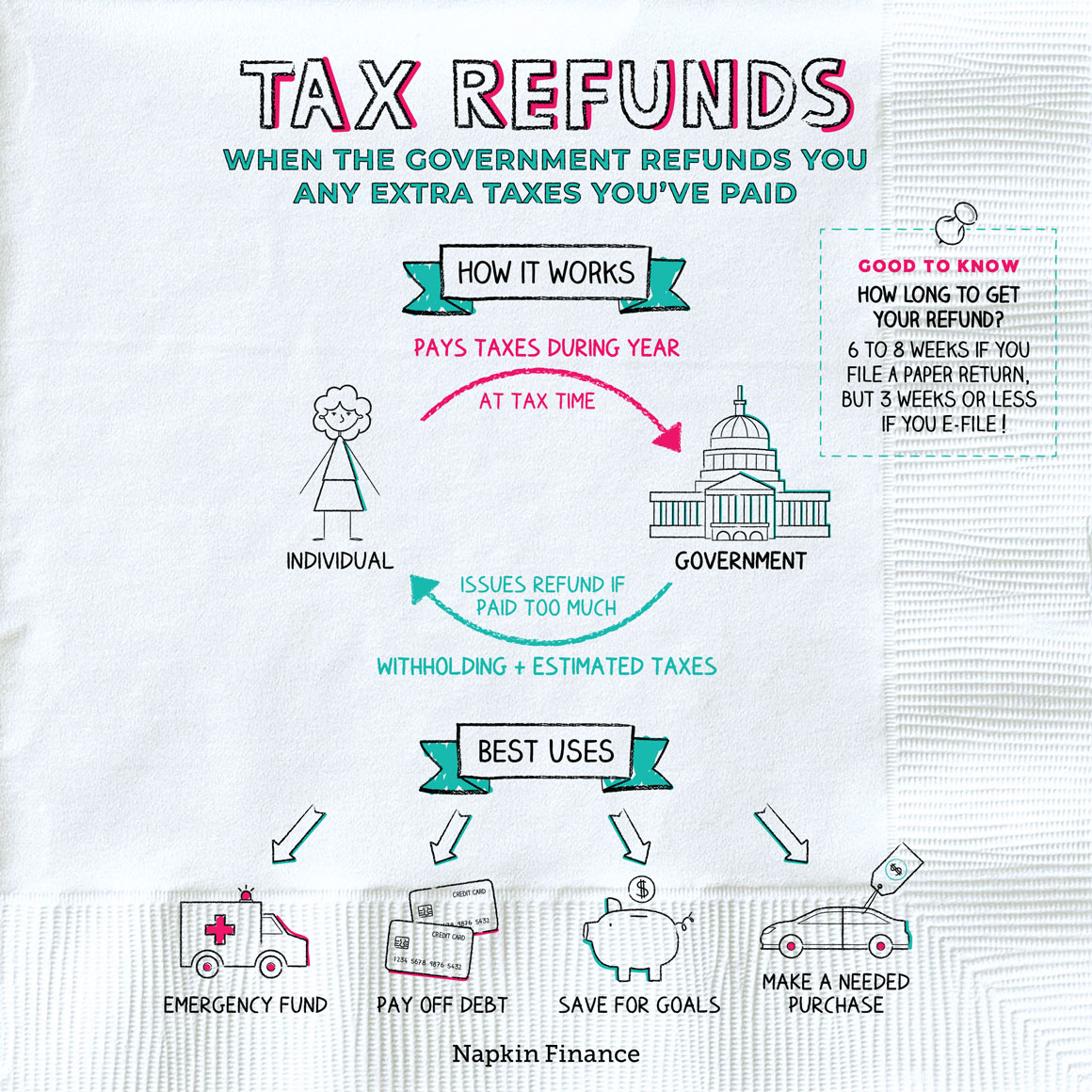

If you pay more than your fair share in taxes over the course of a year, you’re entitled to get that extra cash back in the form of a tax refund.

Think of it as a zero-interest CD you’ve been paying into all year, which you finally get to cash out when you file your taxes.

The IRS wants you to pay taxes as you earn money throughout the year. Your employer might do this via payroll withholding, or you might make estimated tax payments.

But what you pay during the year is only an educated guess at what you’ll end up actually owing. You won’t know the exact amount you owed for the year until you add up all your income and deductions on your tax return.

If it turns out that you’ve paid more than you owe (which is often the case), then you’re due a refund.

Claiming a refund that you’re due is pretty easy (once you get through the pain of the actual filing part). Here’s how:

Do your taxes to find out if you’re due a refund

↓

Decide if you want to receive a check or direct deposit

(direct deposit is usually faster)

↓

File your taxes on time; include your bank account information

if you’re opting for direct deposit

↓

Sit back and marvel at your own awesomeness

while you wait for your refund

If you file a paper return, it can take around six to eight weeks to receive your refund. If you e-file, it can take three weeks or less. In either case, you can check the status of your refund on the IRS website while you’re waiting.

“Next to being shot at and missed, nothing is really quite as satisfying as an income tax refund.“

—F. J. Raymond

Although getting a cash windfall is fun, experts usually advise you put your tax refund toward your financial goals instead of splurging. Here are some ideas for how to use yours:

- Jumpstart your emergency fund

- Lots of people find it hard to save up the three to six months of expenses you’re supposed to keep in an emergency fund. But stashing your tax refund in there can give yours a boost.

- Put toward other savings

- If your emergency fund is already in good shape, consider adding it to retirement savings, your down payment stash, or your kid’s college fund. Future you will thank you.

- Pay off debt

- If you owe money (hello, student loans and credit card debt), you can use these funds to put a real dent in your balance.

- Make a major (and necessary) purchase

- Maybe you need a new big-ticket appliance or your car is on its last legs. Your tax refund can help you afford a major purchase without burning a hole in your credit card statement.

Receiving a big check in the mail can feel great, but many financial experts say it’s better to break exactly even on your taxes (or even owe the government a tiny bit of money) instead of receiving a refund. That’s because overpaying your taxes throughout the year is like giving the government an interest-free loan—with money that you could have been earning a return on instead.

That said, overpaying your taxes during the year is much better than underpaying and risking owing a penalty to the government. And if you put your refund into savings (instead of spending that extra income throughout the year), a refund can even boost your financial security. Just keep in mind that it isn’t free—you worked hard for that money.

If you overpay your taxes during the year, you’ll be entitled to a refund when you file your tax return. You don’t need to do anything special to claim a refund—just file your taxes as usual and the government will send you a check (or deposit your refund directly). Although it can be tempting to use your refund to splurge, experts typically recommend you put the funds toward savings or paying down debt.

- More than 70% of taxpayers typically receive a refund when they file their taxes.

- Most people stay sensible when it comes to using their refund, with saving being the number-one way people report using the money (followed by paying down debt).

- If you think filing your own taxes is boring, imagine this: Around 85,000 people volunteer each year to help other people complete their tax returns.

- A tax refund is when the government pays back to you a portion of the taxes you already paid in a year.

- You generally won’t find out if you’re due a tax refund for a given year until you go through the work of putting together your full tax return.

- It’s not necessarily a good thing to get a refund, but it’s better than owing the government money.

- Before you spend your tax refund on purchases, consider putting it toward your emergency fund, using it to save toward your goals, or paying down debt.