Deductibles

Cut Rate

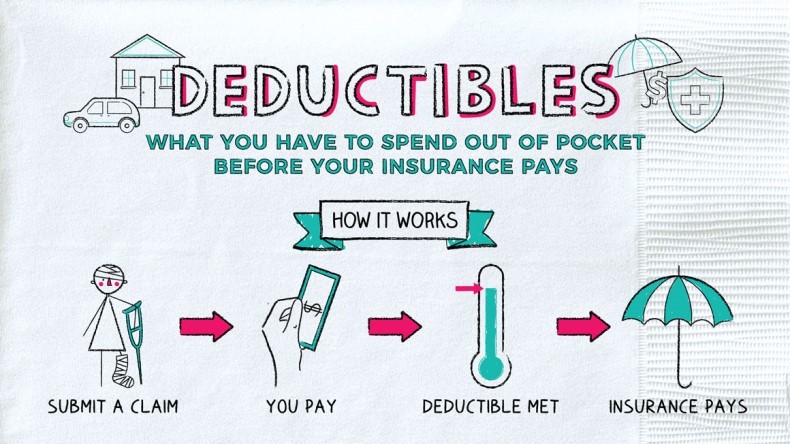

A deductible is the amount of money you must spend out of pocket before your insurance company will pick up the tab.

Many different types of insurance—including home, auto, and health insurance—typically come with deductibles. Here’s a closer look at how deductibles work with each of these types of insurance.

Health insurance deductibles are based on a calendar year.

Each time you spend on healthcare out of pocket, you get closer to meeting your deductible for the year. So, if your deductible is $500 and by March you’ve already paid $500 in doctor bills, you don’t have to worry about it for the rest of the year.

Here’s how this works in practice:

You visit the doctor

↓

Your doctor’s office submits your bill

to your insurance company

↓

If you haven’t met your deductible, the insurer

tells the doctor’s office that it’s your responsibility to pay the bill

↓

What you pay reduces

your remaining deductible

↓

Once you’ve met your deductible,

your insurer pays some or all of your costs

But when the clock strikes midnight on New Year’s Eve, the slate gets wiped clean, and you have to meet your deductible all over again.

Unlike health insurance, auto insurance policies usually have a per-claim deductible. This means that each claim you submit (such as damage from a single specific accident) is reduced by the full deductible amount.

If you have a $1,000 deductible and get in a car accident that results in $5,000 in damage, you’re responsible for paying $1,000 before your insurance kicks in. If you get into a fender bender two months later and the bill is $2,000 this time, the same deductible applies. You pay the first $1,000, and then insurance starts paying.

Similar to auto insurance, with homeowners insurance, you often have a per-claim deductible.

You might also have a disaster deductible depending on where you live. This applies specifically to damage from a natural disaster, such as a hurricane, an earthquake, or a windstorm. These are often based on a percentage of your home’s insured value. If a hurricane rips off your roof and you have a 10% deductible on a $100,000 policy, you’ll owe the first $10,000 before insurance comes into play.

Your deductible tends to drive another insurance cost: your premium. This is the periodic amount you pay to your insurance company in exchange for your coverage.

Typically, if you have a high deductible, you pay lower premiums and vice versa. Both play a role in helping you pick the right insurance at the right price.

Let’s say you have two health insurance policies with identical benefits.

| Coverage | Policy A | Policy B |

| Deductible | $2,000 | $500 |

| Premium | $100/month | $250/month |

You can see the trade-off here. For the low deductible in Policy B (which you can probably hit with a few lab tests), you’re going to pay more each month.

Similar trade-offs apply to other types of insurance, such as home and auto.

Your insurance deductible is how much you have to pay out of pocket before your insurance company starts paying some or all of your bill. Health insurance deductibles are normally based on a calendar year, while auto and home policies can be based on each claim. Deductibles typically vary from plan to plan or provider to provider. Generally, the higher your deductible, the less you’ll pay in a monthly premium and vice versa.

- The word deductible is derived from the Latin word deductus, which means “to lead down or bring away.” Its modern root, deduct, means “to reduce”; your deductible reduces the amount of your coverage by requiring you to pay.

- If you have very high deductibles on your health insurance, you can also likely contribute to a health savings account, which can save you money on taxes.

- Your deductible is the amount you must pay out of pocket before your insurance provider will cover all or some of your costs.

- Deductibles typically apply to health, auto, and homeowners insurance.

- Deductibles vary from policy to policy, but generally the lower it is, the higher your premiums and vice versa.

- Health insurance deductibles are usually based on the calendar year, but home and auto policies might have deductibles for each claim.