How to Save More Money

Keep the Change

Like many good habits, saving more money is easier said than done. Once you’ve gotten into a spending routine, you may find yourself running on autopilot when it comes to monthly expenses (and splurges).

But just like changing other habits, changing your saving patterns is in fact possible. With a sense of commitment, a few lifestyle tweaks, and a little creativity, you’ll find yourself kick-starting your savings and making progress to your money goals in no time.

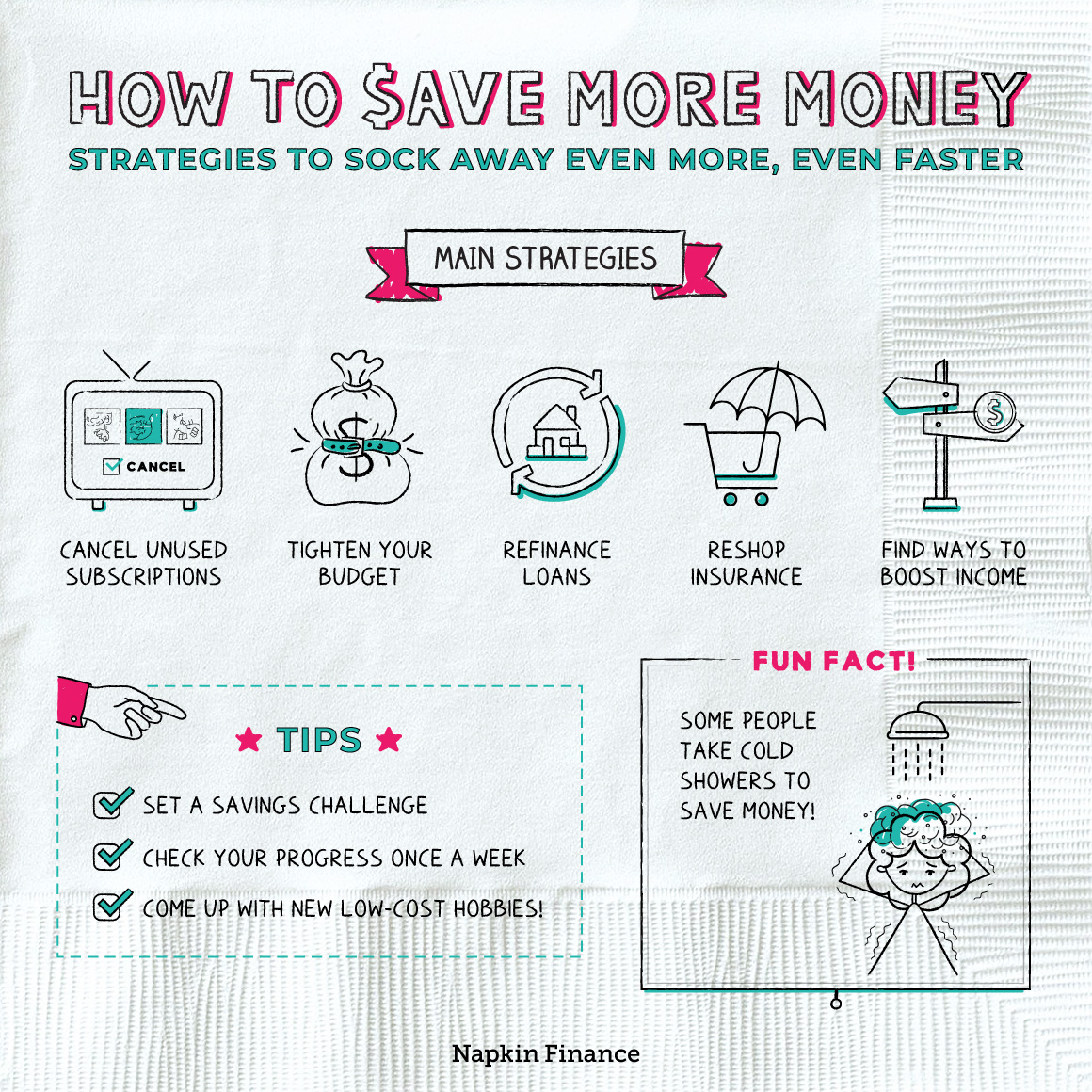

The first step in changing any habit is to set your intention. Once you’re mentally committed to increasing your savings, consider whether some (or all) of these strategies are a good fit for you:

Strategy #1: Plug any leaks.

- Comb through your last few months of spending and look for any easy expenses that you could cut out without even missing.

- In particular, check for recurring subscriptions that you rarely use and anything set to “auto-renew” that you think you could live without.

Strategy #2: Tighten your budget.

- If you don’t already have a budget, there’s no better time than now to start.

- If you already follow one, check in on how well you’re sticking to it.

- Look for any routine expense categories where you could realistically cut back or for areas where you’re prone to splurging.

Strategy #3: Reduce what you pay in interest.

- Get all your debt payments organized. Figure out what you’re paying each month, and check the interest rates on all your debts.

- Consider whether you could obtain a lower interest rate by refinancing any of your loans (like your mortgage), especially if your credit has improved since you took out the loan.

- If you’ve got credit card debt, look into whether a 0% balance transfer card could help you dig out faster and save on interest.

Strategy #4: Reshop your insurance.

- Spend an afternoon getting new quotes for your insurance policies.

- You might qualify for better rates if you haven’t made any claims or if you bundle your coverage. Or, companies might offer you savings just to win your business.

- You can also consider whether you still need the same amount of coverage you’ve been carrying. If you’ve recently paid off a mortgage or car loan, for example, you may be able to reduce your level of coverage (though that means you’ll have less protection too).

Strategy #5: Boost your income.

- If you’re still struggling to save, perhaps you need to focus on your income more than your expenses.

- Consider whether you can take on a side gig, turn a hobby into a source of income, ask for a raise, or even consider a new career path.

Once you’ve picked your strategies, give them some time before you decide on whether or not they’re working. Try not to abandon your new choices until you’ve had at least a few months to settle into any changes.

A big part of getting into a new savings routine is keeping your mental commitment on track. Here are some tips and hacks to help you stay dedicated to your new savings goals:

- Set yourself a short-term challenge.

- Committing to a lifetime of low spending can feel heavy. Lighten the task with a short-term goal, like going a week without any nonessential spending or saving an extra $1,000 just this month.

- Keep it fresh by coming up with a different challenge next time. Even better—enlist a friend so that you can set challenges together and keep each other on track.

- Create a dedicated check-in time.

- It’s easy to lose momentum on new habits when you get busy, so carving out time is key.

- Choose a half hour slot once a week when you can check in on your recent spending and savings activity, and renew your focus on your goal.

- Try to choose a time when you’re likely to be calm, focused, and in a good mood.

- Consider new habits.

- Cutting out old spending habits can leave your free time feeling dull.

- Brainstorm new lower-cost ways to spice up your week—whether new hobbies, outings, exercise routines, or gatherings with friends.

And of course, celebrate your progress anytime you hit a savings goal or reach a milestone with a new routine.

Saving more money can mean making real changes to your spending habits, but with a sense of commitment and purpose, it is possible to make progress. In addition to identifying ways to simply spend less, consider whether boosting your income or refinancing loans is right for you, and try setting yourself some short-term savings challenges.

- Your spare change could be a hot commodity, with some coin hobbyists earning more than $100,000 selling rare vintage coin finds.

- Some savers get creative with their budget-trimming tactics: potty-training their cats, washing their hair only once a week, or only taking cold showers to trim their bills.

- Most Americans have less than $5,000 in savings but an average of $5,102 in monthly expenses.

- Once you’ve set an intention to start saving more, look through your expenses for any easy areas to trim, like by canceling subscriptions you don’t use.

- Consider what you pay for insurance and how much you spend each month on debt. Look into whether you could save more by reshopping your policies or refinancing any loans.

- Sometimes, in order to save more money, you simply need higher income. Think about what you could do to boost what you’re bringing in whether over the short or long term.

- Setting yourself periodic savings challenges or going on a short-term spending diet can help you try out new habits without getting bogged down by a heavy long-term commitment.

- Consider creating a weekly dedicated check-in time to evaluate your progress and renew your dedication to your new savings routines.