Featured Napkin

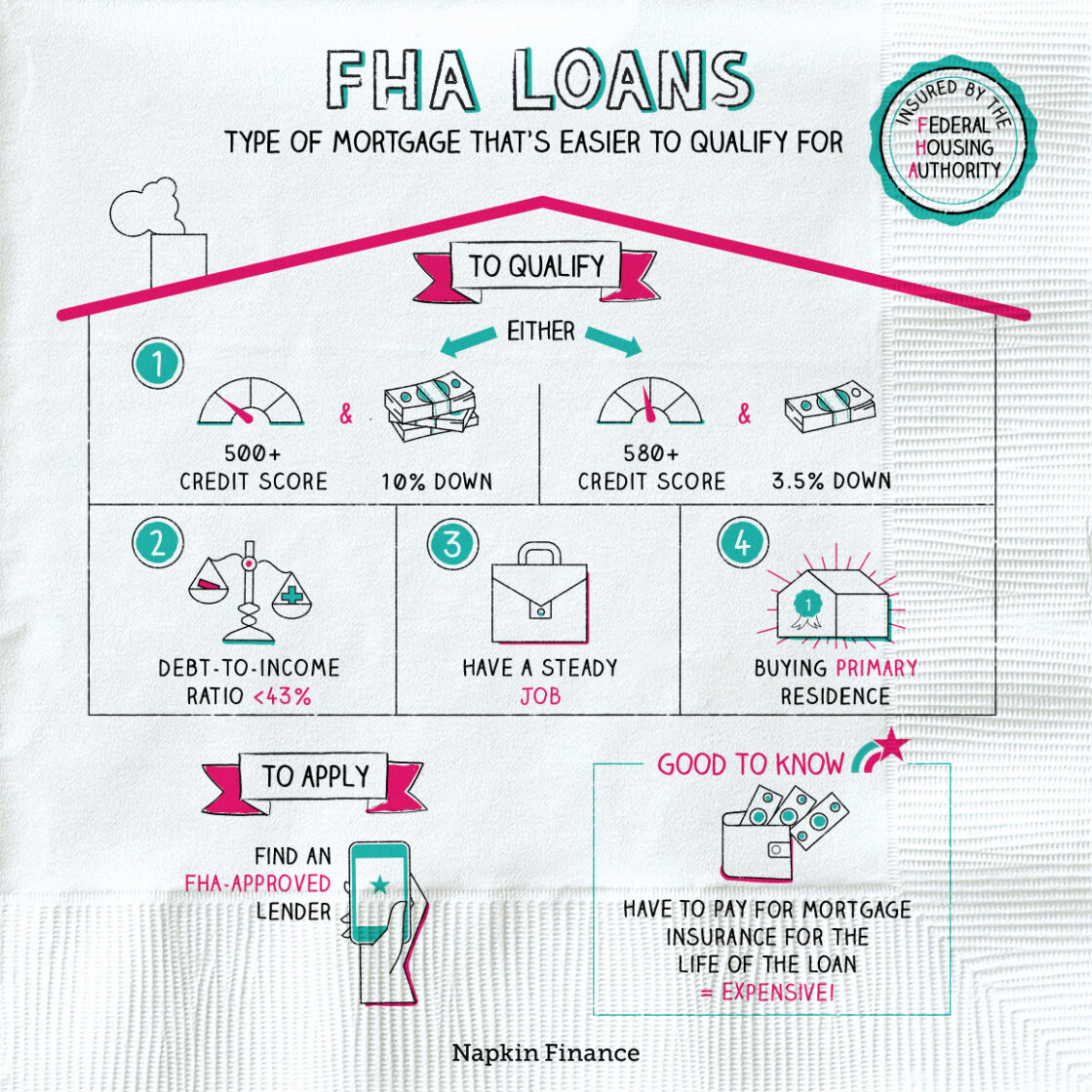

FHA Loans

Helping Hand

FHA loans are a type of mortgage loan that’s available to people who might not qualify for a traditional mortgage. In particular, they can be an option for borrowers with worse credit or smaller down payments than what you usually need to get approved for a mortgage. Although the loans...

Learn moreMore buying a house Napkins...

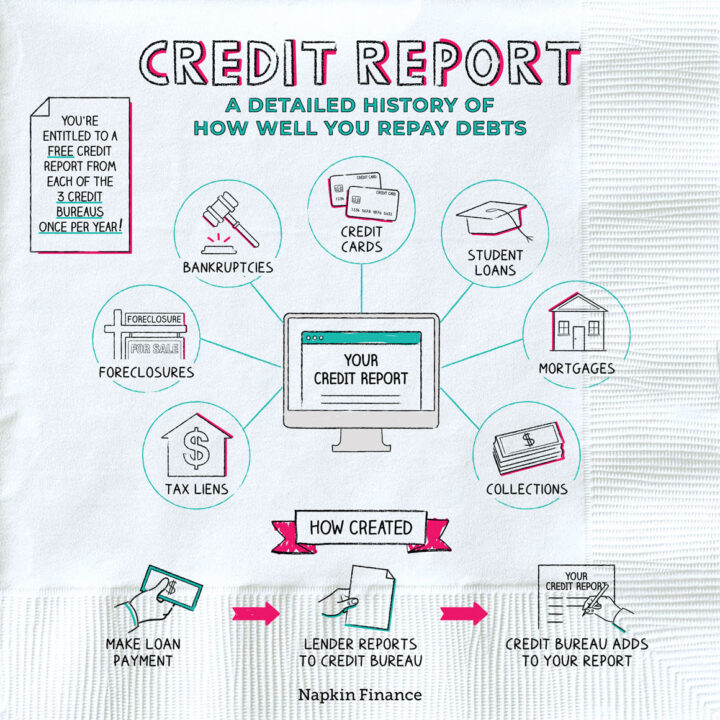

Credit Report

Good Marks

Your credit report is a detailed history of your past use of credit. It’s a bit like...

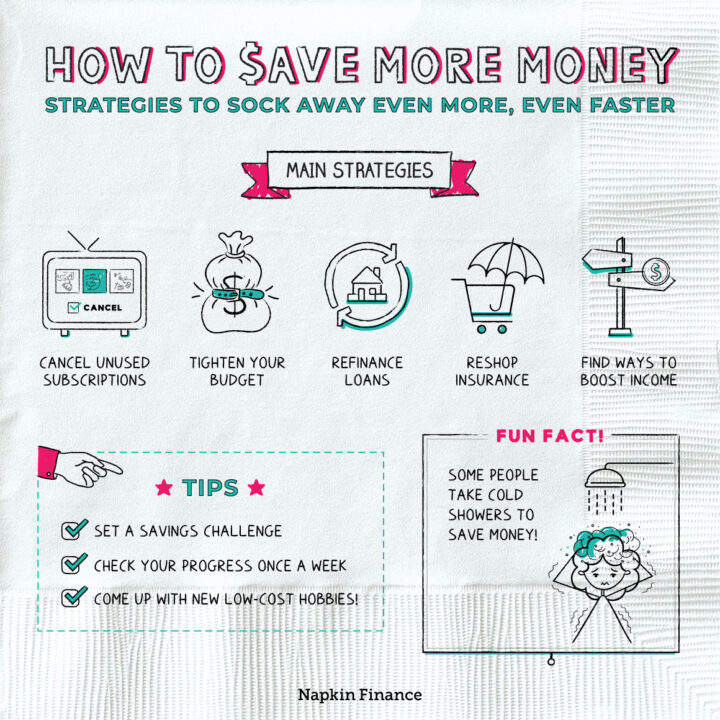

Learn moreHow to Save More Money

Keep the Change

Like many good habits, saving more money is easier said than done. Once you’ve gotten into a...

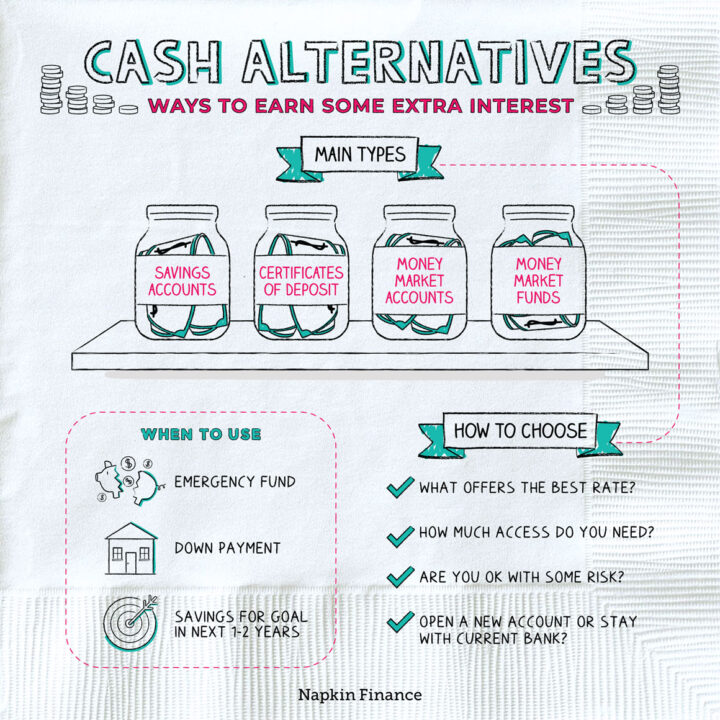

Learn moreCash Alternatives

Cash In

Cash alternatives are investment types that you can consider as alternatives to simply holding money in your...

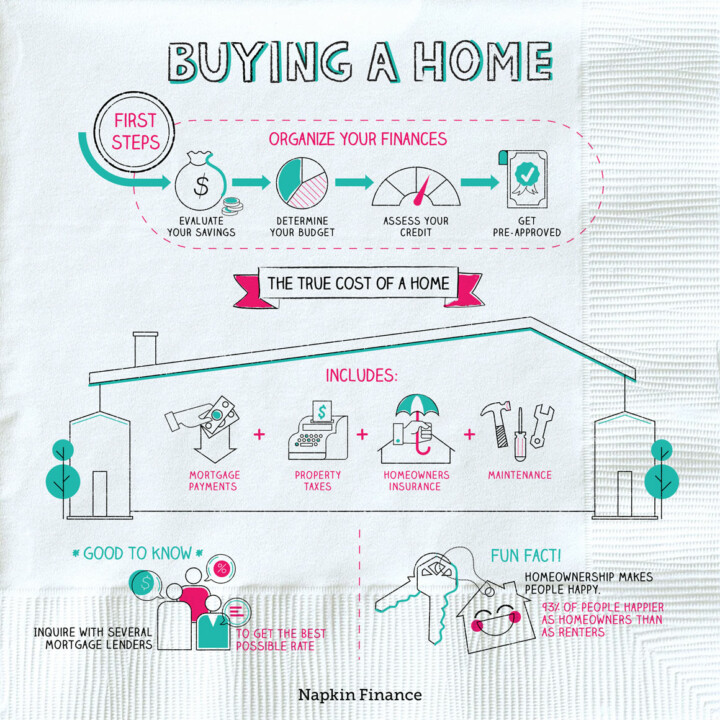

Learn moreBuying a Home

Happy Homeowner, Happy Life

Buying a house is one of the biggest steps you can take in your life. But it’s...

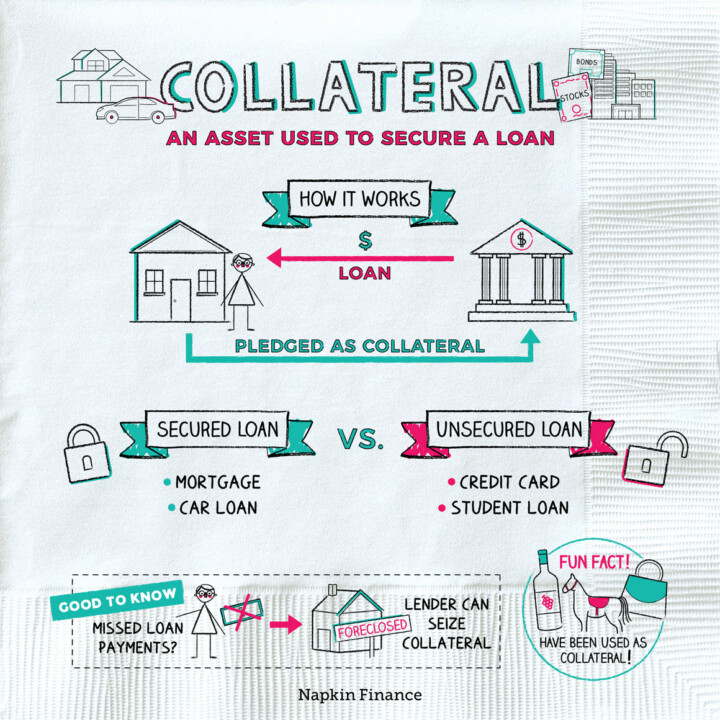

Learn moreCollateral

Give and Take

Collateral is something that a borrower pledges to a lender to secure certain types of loans. If...

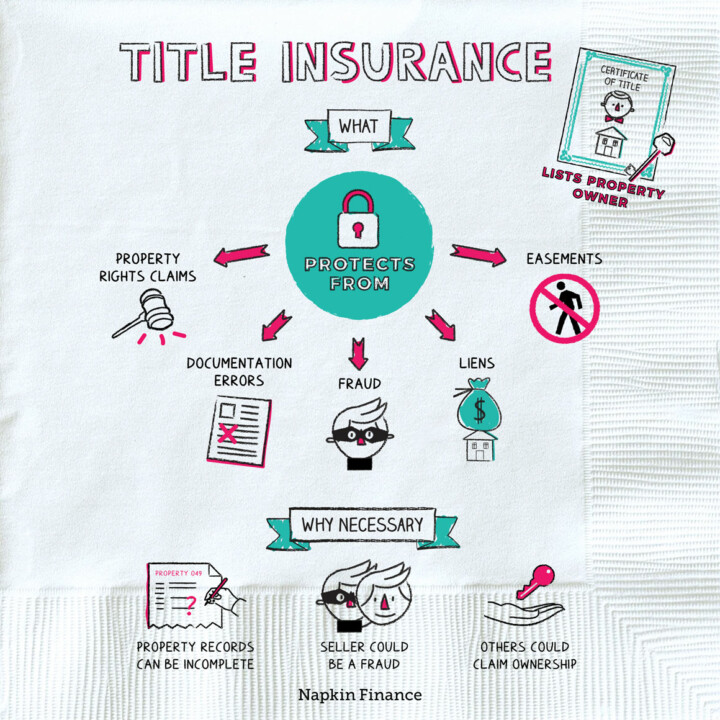

Learn moreTitle Insurance

On the House

A “title” is a document listing the legal owner of a piece of property. Title insurance protects...

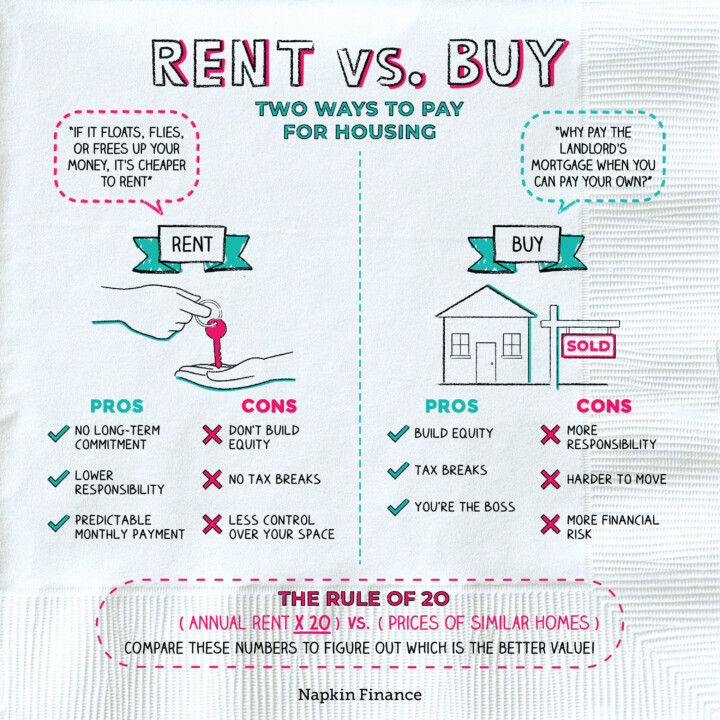

Learn moreRent vs. Buy

Where the Heart Is

The choice between renting or buying a home may be one of the biggest decisions you make...

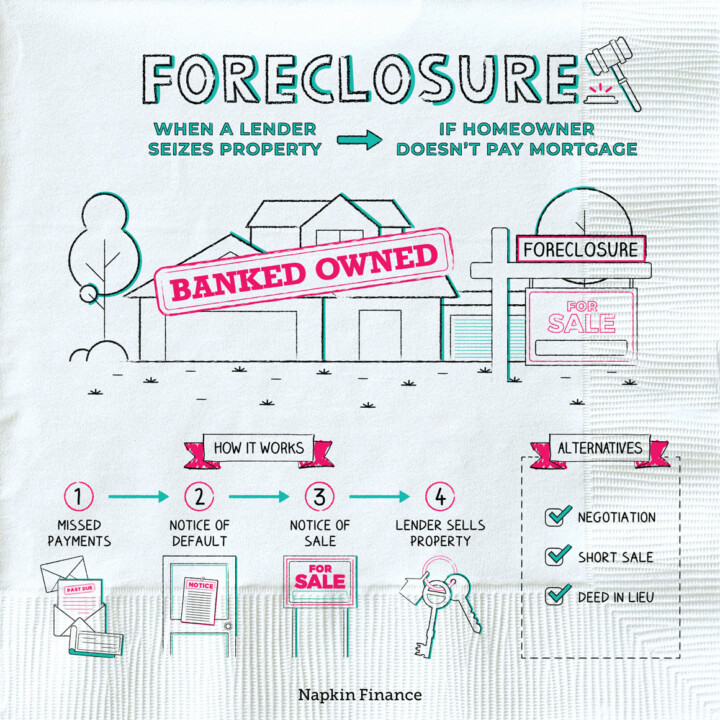

Learn moreForeclosure

Bottom Dollar

Foreclosure is a legal process that lets a lender seize possession of a house or other real...

Learn moreReverse Mortgage

Can’t Take it With You

A reverse mortgage is exactly what it sounds like: instead of paying down a mortgage balance every...

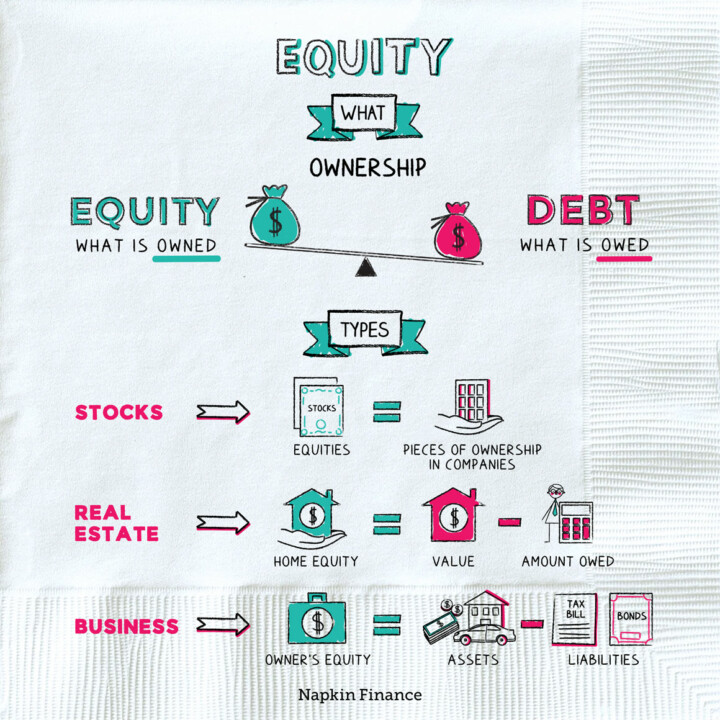

Learn moreEquity

Own It

Equity is ownership. You can have equity—or an ownership stake—in any asset, meaning anything of value.

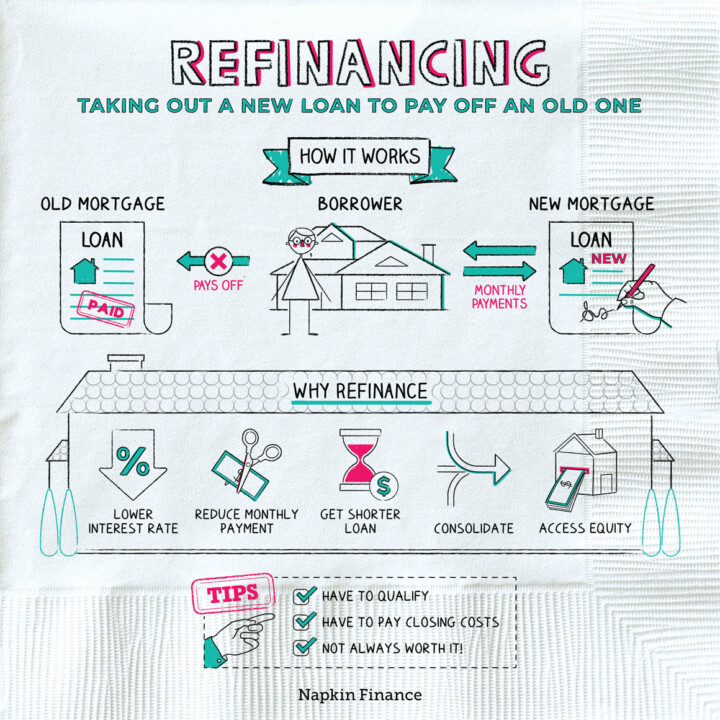

Learn moreRefinancing

Cash in Your Chips

Refinancing is getting a new loan to replace an old one. Borrowers usually refinance in order to...

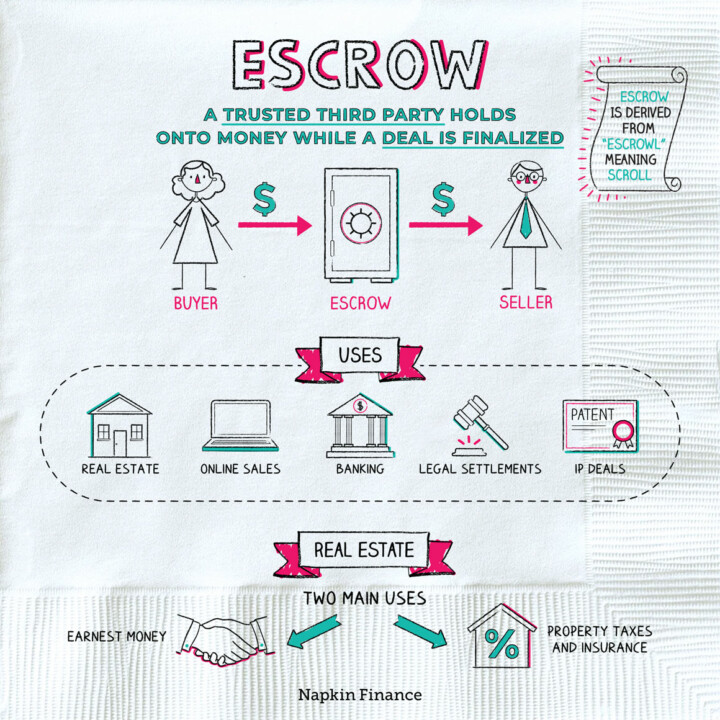

Learn moreEscrow

In Good Hands

Escrow is an arrangement in which a trusted third party temporarily holds onto some kind of asset,...

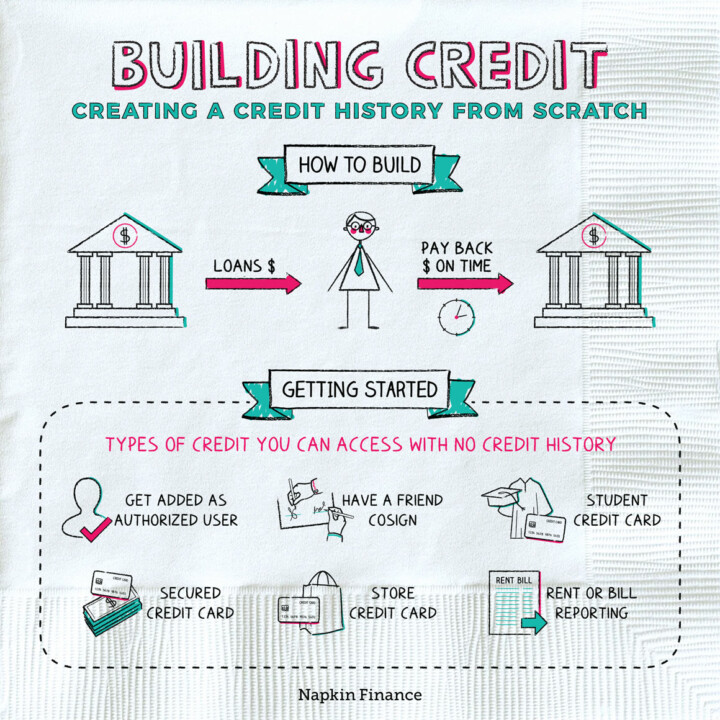

Learn moreBuilding Credit

Bit by Bit

Credit is money that’s available to you to borrow whether through a credit card, mortgage, car loan,...

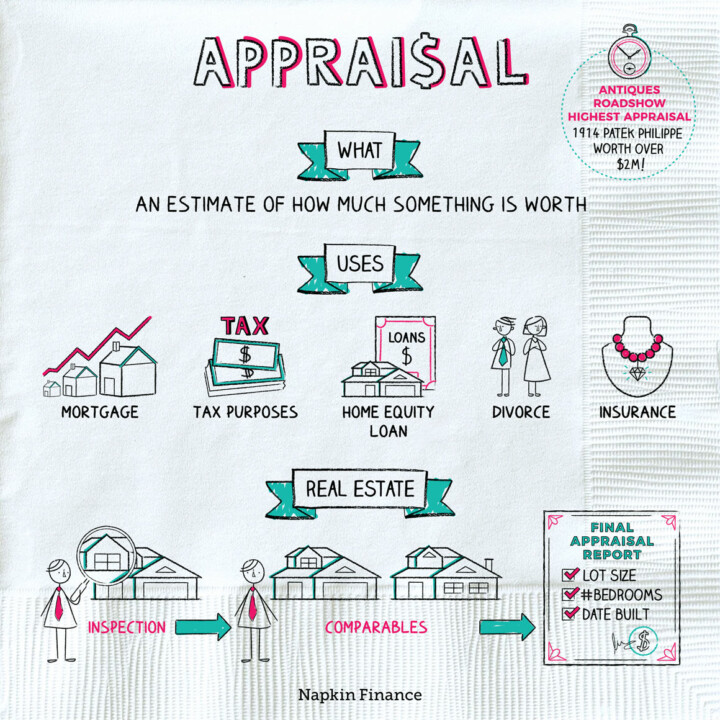

Learn moreAppraisal

For All it’s Worth

An appraisal is an estimate of how much something is worth. People may get appraisals for real...

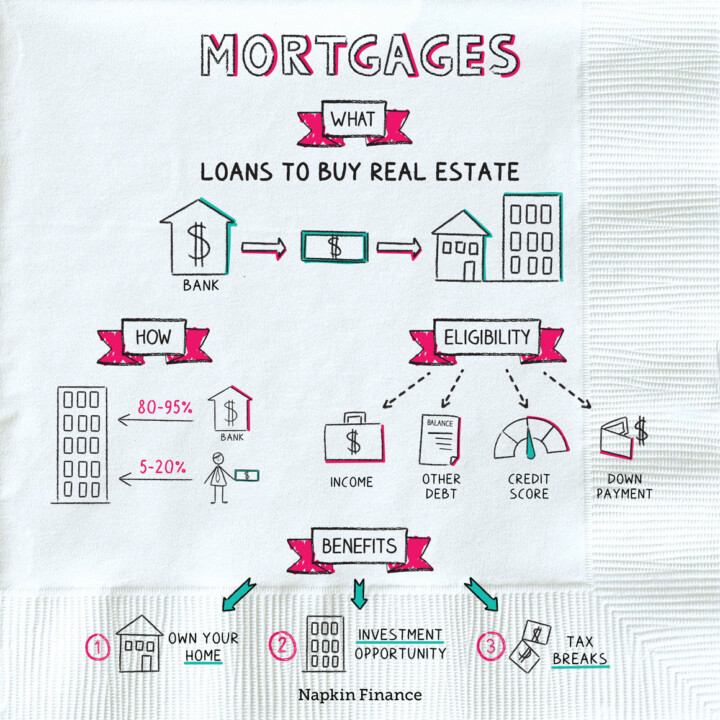

Learn moreMortgages

Home Sweet Home

A mortgage is a type of loan that people use to help them buy a house or...

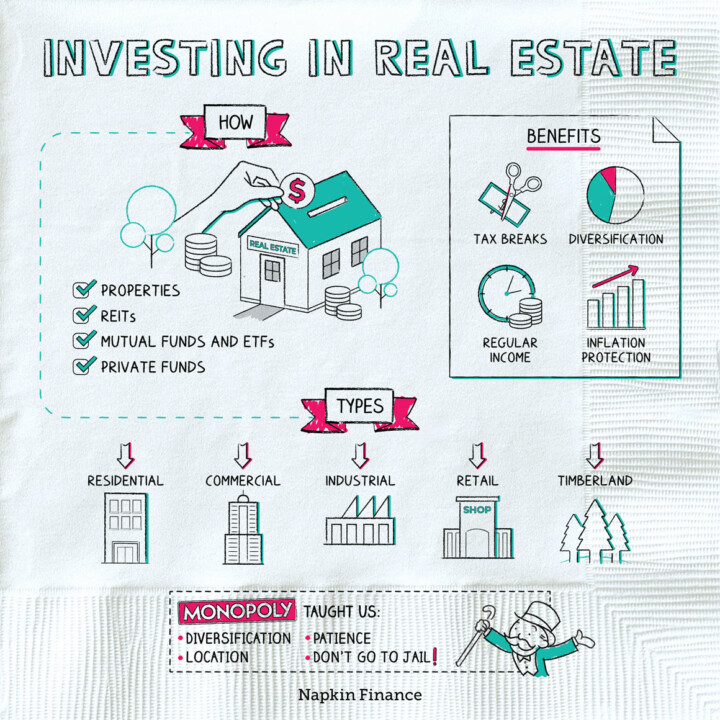

Learn moreReal Estate

Location, Location, Location

Buying real estate—whether on your own or by pooling your resources with other investors—is one possible way...

Learn more