Savings

One Penny at a Time

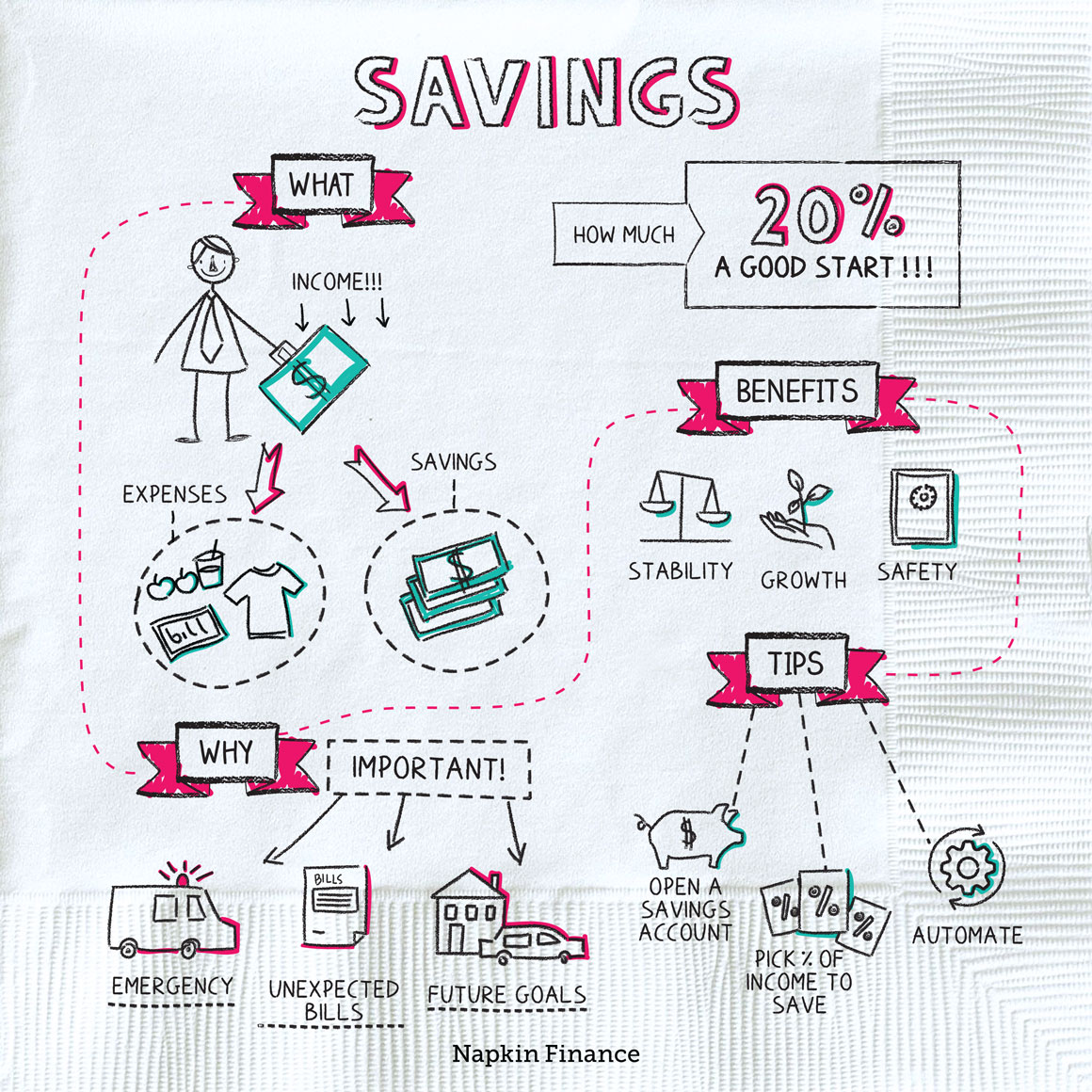

Savings are funds that you put aside and don’t spend.

Life can be full of surprises, both good and bad. Building savings is a great way to make sure you have cash available for emergencies, unexpected bills, medical expenses, and future goals.

Most importantly, savings are key to building a lifetime of financial security.

- General

- Often kept in a savings account, which you can access for any reason. A savings account typically limits you to a maximum of six withdrawals per month, so it’s not a replacement for your checking account.

- Emergency

- Savings that are to be used only for emergencies, such as for unexpected medical bills or to cover expenses if you lose your job. Experts recommend that you try to save three to six months of living expenses in your emergency fund.

- Note: Paying for last-minute Coachella tickets does not count as a financial emergency!

- Retirement

- Typically kept in a dedicated tax-deferred investment account, such as an IRA or 401(k), to provide income after you retire. These accounts typically place restrictions on when you can withdraw funds.

- Dedicated

- Savings fund built up for a specific long-term goal, such as to put toward a down payment on a home, buy a new car, or fund your wedding.

Savings give you a cushion when life happens. Saving is also a crucial habit to develop if you want to build a foundation of financial security—because you’ll never get rich if you spend more than you earn. Some of the additional benefits of saving include:

- Peace of mind

- Having savings means that you always have a little extra money in the bank should you need it. Just knowing that you have something to fall back on can relieve the stress of living paycheck to paycheck.

- Safety net

- Having an emergency fund means that you won’t be financially ruined if your car breaks down, you have an unexpected medical issue, or you lose your job.

- Planning for the future

- Buying a house, having a family, and retiring are all significant life events that come with large price tags. The earlier you can start saving, the better your chance at having a financially secure future.

Saving money is a great habit to get into. Keeping your hard-earned stash in a dedicated savings account also comes with certain benefits, including:

- Stability

- Unlike investments, which may offer higher returns, savings accounts don’t bounce around in value and won’t lose money. They’re for preserving what you have.

- Growth

- Your money grows in a savings account as you earn interest. Over time, that growth compounds as you earn interest on the interest you’ve already earned, and you can boost that growth by depositing more.

- Safety

- The U.S. government, through the FDIC, guarantees your balance at most banks for up to $250,000. That means that even if something horrible happens—like the U.S. economy crashes or there’s an “It’s a Wonderful Life” type run on your bank—your money is safe.

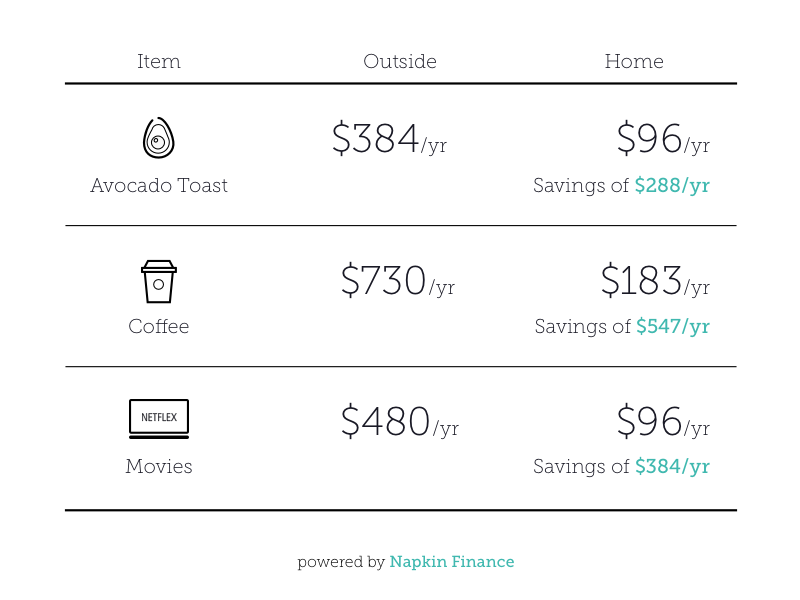

In order to save, you have to spend less than you earn. Trimming back on treats is hard, but over time it can really add up.

“Do not save what is left after spending, but spend what is left after saving.“

—Warren Buffett

Here are some hacks to help turbocharge your savings:

- Document your spending

- Figure out how much you currently spend each month. There are loads of great free apps that can help you track your expenses.

- Open a savings account

- A dedicated savings account can help you keep your savings separate from spending money, so you’re not as tempted to dip into it. Choose an account with low or no fees and a high interest rate.

- Cut costs

- Separate spending on “needs” from spending on “wants,” and try to come up with some wants that you could live without. (Avocado toast you make at home is almost as tasty as the artisanal restaurant stuff, we promise.)

- Pick a percent

- Decide on a specific percentage of each paycheck that you will devote to savings based on your budget. Any amount helps, but experts suggest you ultimately want to get to a 20% saving rate.

- Automate

- Set up a recurring automatic transfer from your checking account to your savings account. Try to make sure that as soon as your paycheck is deposited a portion of it goes straight into savings so that you don’t have a chance to spend it.

- Forget about it

- Keep your savings account out of mind and let it grow.

Savings are funds that you don’t spend and instead keep safe in a bank or other account. Building up savings helps you create a foundation of financial security, and learning to spend less than you earn is a vital habit to build if you want to raise your financial fortunes. That said, give yourself a pat on the back every time you meet a savings goal. Saving is hard!

- Retail therapy is real. About half of Americans say emotions can drive them to overspend. Try not to take your stress out on your bank account.

- Paying with cash instead of with a card can help you spend less. Apparently, counting out bills makes you feel the pain of spending more than swiping does.

- Most Americans have less than $1,000 in savings.

- Saving money for the future is a vital way of building up financial security and preparing for the future.

- Keeping your money in a savings account can let it earn interest, keep it safe, and help you avoid spending it.

- Finding ways to trim spending on “wants” is a crucial way of boosting your savings and an important habit to build in order to make sure you spend less than you earn.

- Using apps to track your spending, setting up automatic transfers to your savings account, and saving a dedicated percentage of your paycheck can all help get you on track with a sustainable savings plan.