Balance Transfers

Shell Game

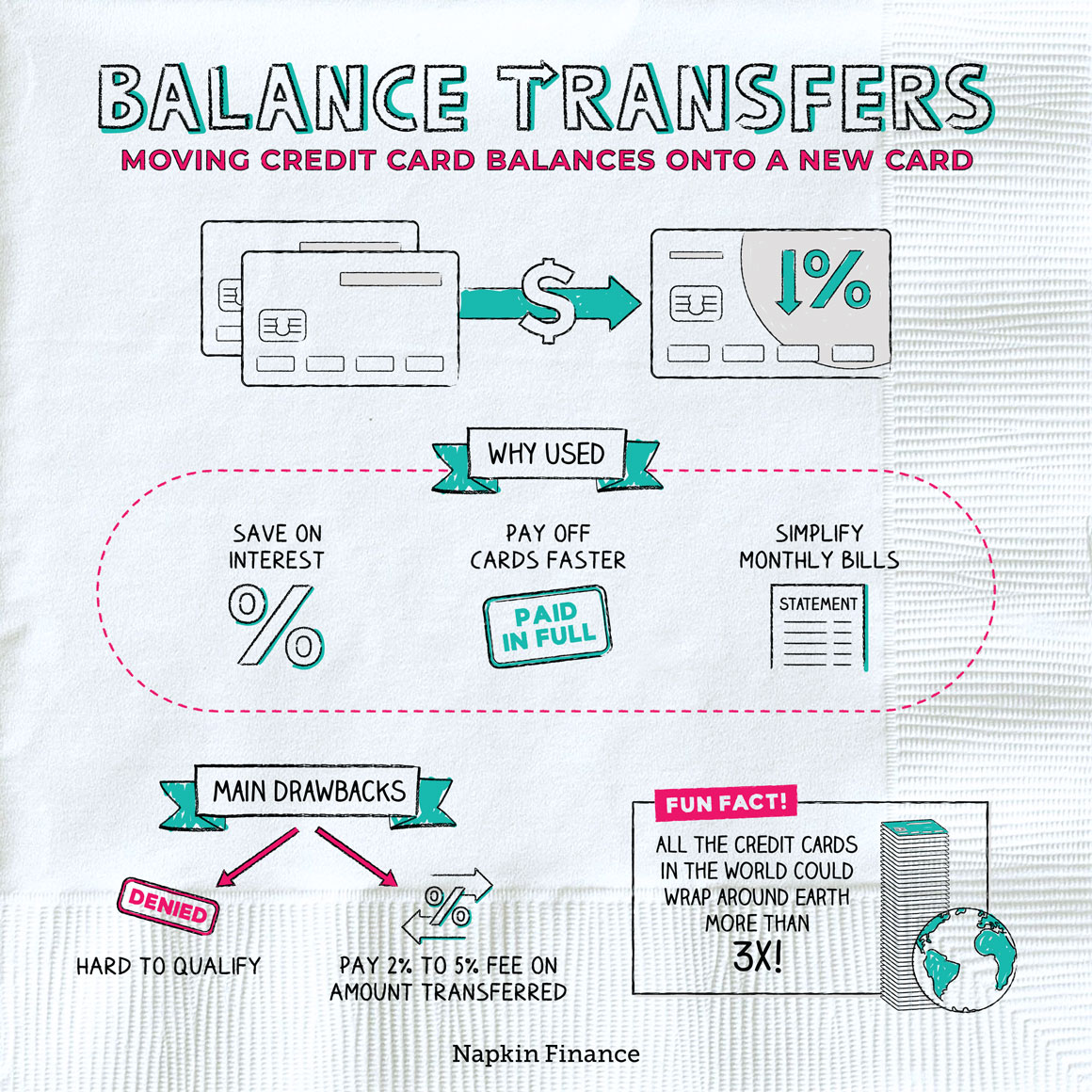

Balance transfers are a way to move what you owe on one (or more) credit cards and loans onto another credit card.

It’s a strategy people usually use to take advantage of a low interest rate on a new card—typically so that they can save on interest and pay off their balances faster.

Balance transfers let you move credit card balances from one account to another—often to a brand-new card. (Sometimes, you can also move some types of loans.)

Here’s how the process works:

Step 1

Find a balance transfer card;

Apply and get approved

↓

Step 2

Give the new card issuer

the details for the accounts you’re transferring

↓

Step 3

New card issuer pays off the old cards;

Old cards now have a $0 balance

↓

Step 4

New card now has the combined balances

of all the accounts you transferred

↓

Step 5

Start making payments on the new card

Even after you’re approved, it might take the card issuer a few weeks to complete the balance transfer. Until you’re sure the transfer is finished, you need to keep making payments on your old cards, or you’ll risk wrecking your credit score (and racking up late fees).

Even after the transfer is complete, it doesn’t hurt to check old accounts on occasion to make sure there aren’t any fees or balances still hanging around.

People typically use balance transfers for two main reasons:

- To save on interest

- Balance transfer cards may offer promotional interest rates (of as low as 0%) for a set introductory period.

- If you have high interest rate credit cards or loans, shifting them could help you save money while you pay them off or even pay them off faster.

- To consolidate accounts

- It’s complicated to keep track of multiple accounts, multiple bills and multiple due dates.

- By moving the balances of multiple credit cards or loans to a single account, you only have to deal with one monthly payment.

You might be considering a balance transfer if you’re trying to dig out of high-rate credit card debt. While it can be a helpful strategy in many situations, it’s not always the right move. Here are some questions to ask yourself as you’re trying to decide:

- Can you qualify?

- What you don’t want to do is apply for one card, get rejected, then apply for another and another. That’s because each hard inquiry hurts your credit.

- You typically need great credit to get approved. If you have any doubts, try other debt repayment strategies first and focus on improving your credit.

- How fast can you pay off your balances?

- A card’s low introductory rate will jump after a certain period of time.

- A transfer might be a good move if you can eliminate the full balance before that time period is up.

- Can you resist temptation?

- Once the transfer is complete, all your other cards will have $0 balances.

- Only consider a transfer if you’re sure you’ll be able to avoid racking up new balances on them.

And remember that although a balance transfer might sound like a no-brainer (who wants to pay 20% if you can pay 0%?), they’re not free. The new card typically charges 2% and 5% of the total amount you transfer. Do your best to weigh the hard numbers of the situation before you commit.

- Here are some other details to keep in mind about the strategy:

- There’s often a dollar limit on how much you can transfer.

- Many credit card issuers won’t let you transfer a balance from one of their cards to another one of their cards.

- You don’t necessarily have to open up a new card for a balance transfer. You might be able to transfer all your balances onto one card you already have.

And while you might be tempted to Marie Kondo your wallet by closing all your old cards after the transfer, think twice before you do so. Experts generally recommend keeping them open because it’s good for your credit.

A balance transfer lets you shift existing balances from one or more credit cards onto a new credit card—usually one with a low introductory interest rate. Many people use it as a strategy to save on interest while they’re paying off their cards. Although it can sound like a great deal, it can be hard to qualify for a balance transfer card, and doing a transfer typically comes with fees.

- If you put all the credit cards in the world end to end, it would wrap around the earth more than three times.

- In the U.K. your credit score gets an automatic boost when you register to vote.

- China has for years been developing a new “social credit” system. In addition to affecting your ability to borrow, bad marks could affect your ability to travel or access education.

- A balance transfer lets you move one or more credit card or loan balances to another account.

- People usually use balance transfers as a strategy for saving on interest or in order to slim down the number of bills they have to pay each month.

- While many people open a new card with a low (or even 0%) introductory interest rate, it’s sometimes possible instead to simply transfer your balances onto an existing card.

- If you’re considering doing a transfer, it’s important to think carefully about whether you could realistically qualify for a balance transfer card and whether the strategy still makes sense after paying transfer fees.

- Balance transfers can take a few weeks to complete, and it’s important to keep making payments on your old cards until you’re sure all your balances have been moved.