Insurance

Cover Your Assets

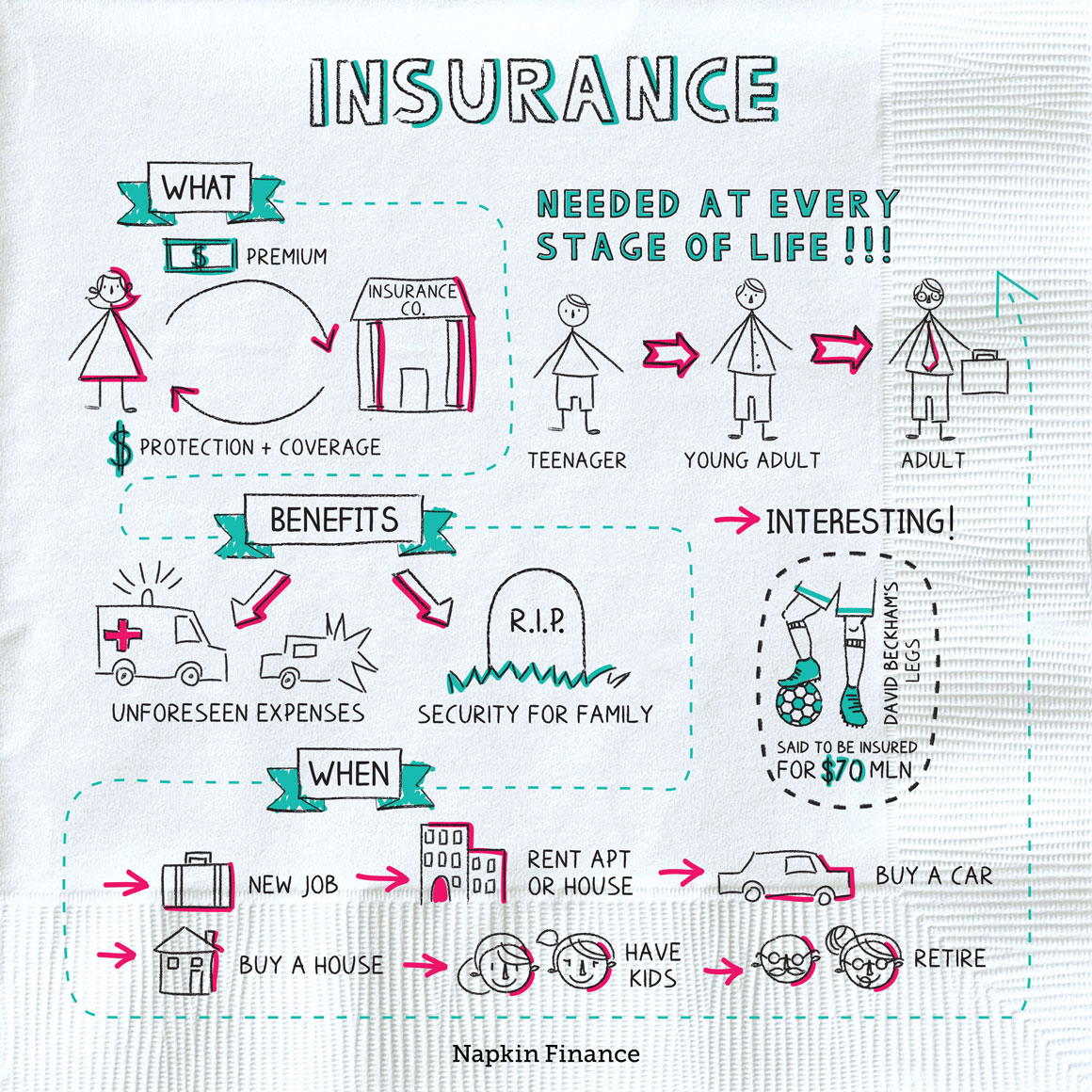

Insurance is financial protection. Along with your emergency fund, insurance makes up your safety net so that any number of potential disasters—such as an accident, illness, fire in your home, or death in your family—don’t wreck your financial security.

When you buy an insurance policy, you usually agree to periodically pay the insurer a certain amount of money—called a premium. In exchange, the insurer promises to pay you back or help cover your costs if you ever need to make a claim or file for reimbursement for covered losses.

You can find insurance to cover almost anything—from weddings to alien abductions to specific parts of your body—but the most common types for people are:

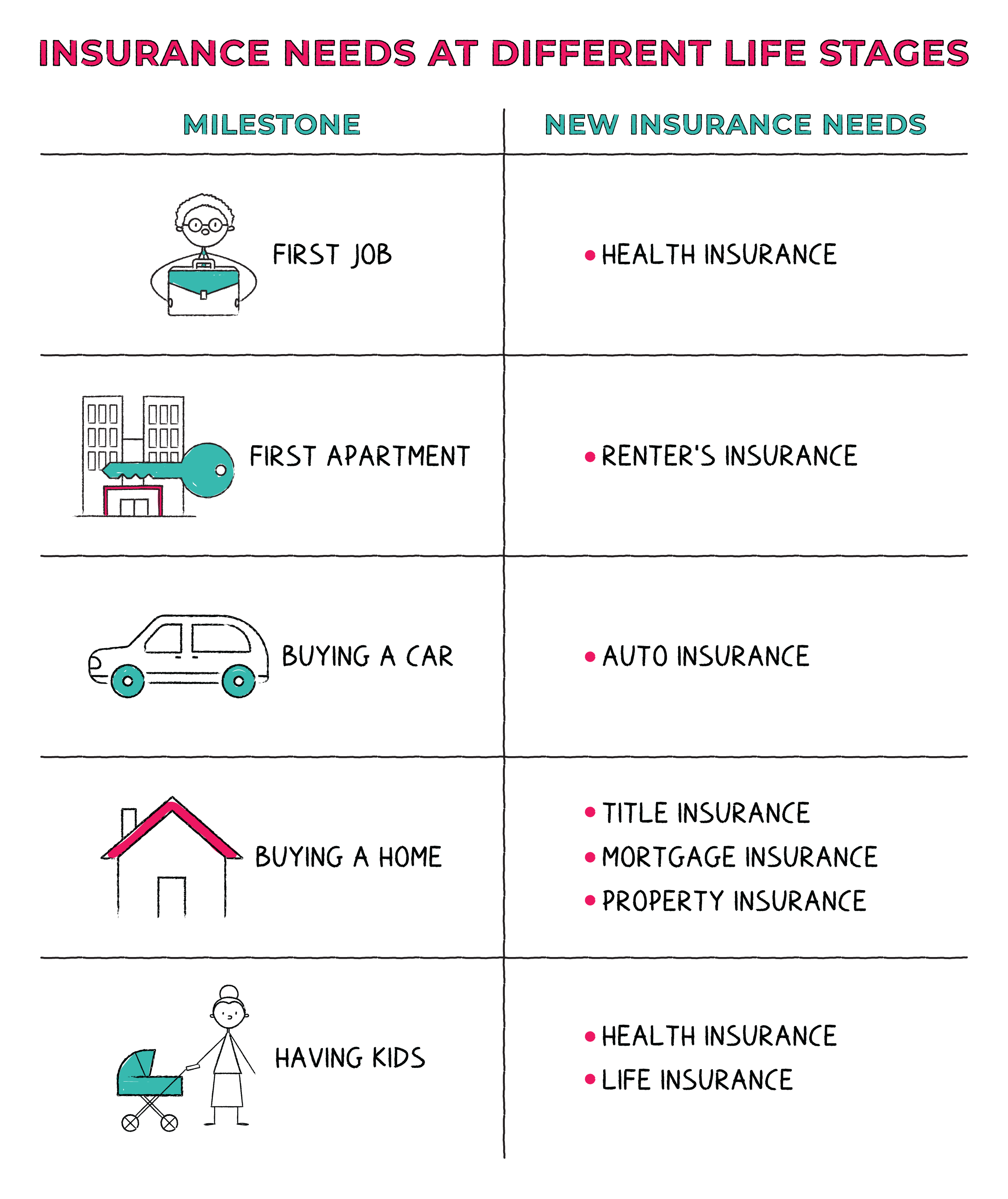

- Health insurance: You might get this through your employer. It can cover doctor visits, hospital expenses, dental work, glasses, and prescriptions.

- Car insurance: Options include coverage for personal injury and car repair after an accident and even damage caused by things such as vandalism or hail.

- Life insurance: If you die, your beneficiaries (like your spouse or kids) receive a set amount of money to make up for what you would have earned.

- Disability insurance: Offered by many employers, it helps cover lost income if you’re temporarily or permanently disabled.

- Homeowners or renters insurance: This can cover your home and the things inside it against damage, theft, and some types of weather-related damage. It can also protect you if a guest or visitor gets hurt while they’re on your property and then sues you.

Your insurance needs typically change with major life events and milestones. Here are some of the different types of insurance you may need at different points in your life.

Sure, it’s an extra bill to pay for something you might never use (fingers crossed), but insurance can provide:

- Coverage of unforeseen expenses: You probably can’t set aside a giant pot of money to cover all the possible bad things that might happen.

- Financial security for your family: People file for bankruptcy every year because they can’t afford unexpected bills (especially medical ones). Insurance gives you peace of mind that the unexpected won’t result in financial ruin.

- Tax benefits: You may be able to deduct your health insurance premiums if you’re self-employed. And life insurance policies may help you reduce taxes on your investments or your estate.

- A way to meet your obligations: Your state might legally require you to have a certain amount of auto insurance. And your mortgage company probably requires you to carry a certain amount of property insurance.

As you get used to navigating the world of insurance, keep in mind that:

- Lower risk equals lower premiums. If you don’t smoke, your chances of dying from smoking-related diseases are lower, so you can typically obtain a cheaper life insurance policy.

- Even with insurance, you’ll still owe deductibles. These are amounts that you often must pay out of pocket before your insurance pays anything. Make sure you know what they are for each of your policies.

- If you make a lot of claims, your premiums may go up. That’s why people in fender benders often don’t tell their car insurance company.

Insurance is complicated and can vary a lot from policy to policy. Read your contracts closely so that you understand your coverage.

Insurance offers financial protection in case the unexpected happens. There are many types of insurance, the most common being health insurance, car insurance, life insurance, and homeowners insurance. Your insurance needs usually evolve as your life changes.

- At the height of his soccer career, David Beckham’s legs were said to be insured for $70 million.

- Actress Shirley MacLaine reportedly owns a $25 million insurance policy protecting her fortune against alien abduction.

- When you buy an insurance policy, you agree to pay the insurer a small amount of money regularly. In exchange, the insurance company agrees to pay you a large amount of money if something horrible happens.

- Common types include health insurance, life insurance, disability insurance, homeowners or renters insurance, and car insurance.

- You may need new insurance any time you hit a major life milestone, such as having kids or buying a house.

- Insurance companies charge more for riskier policies.