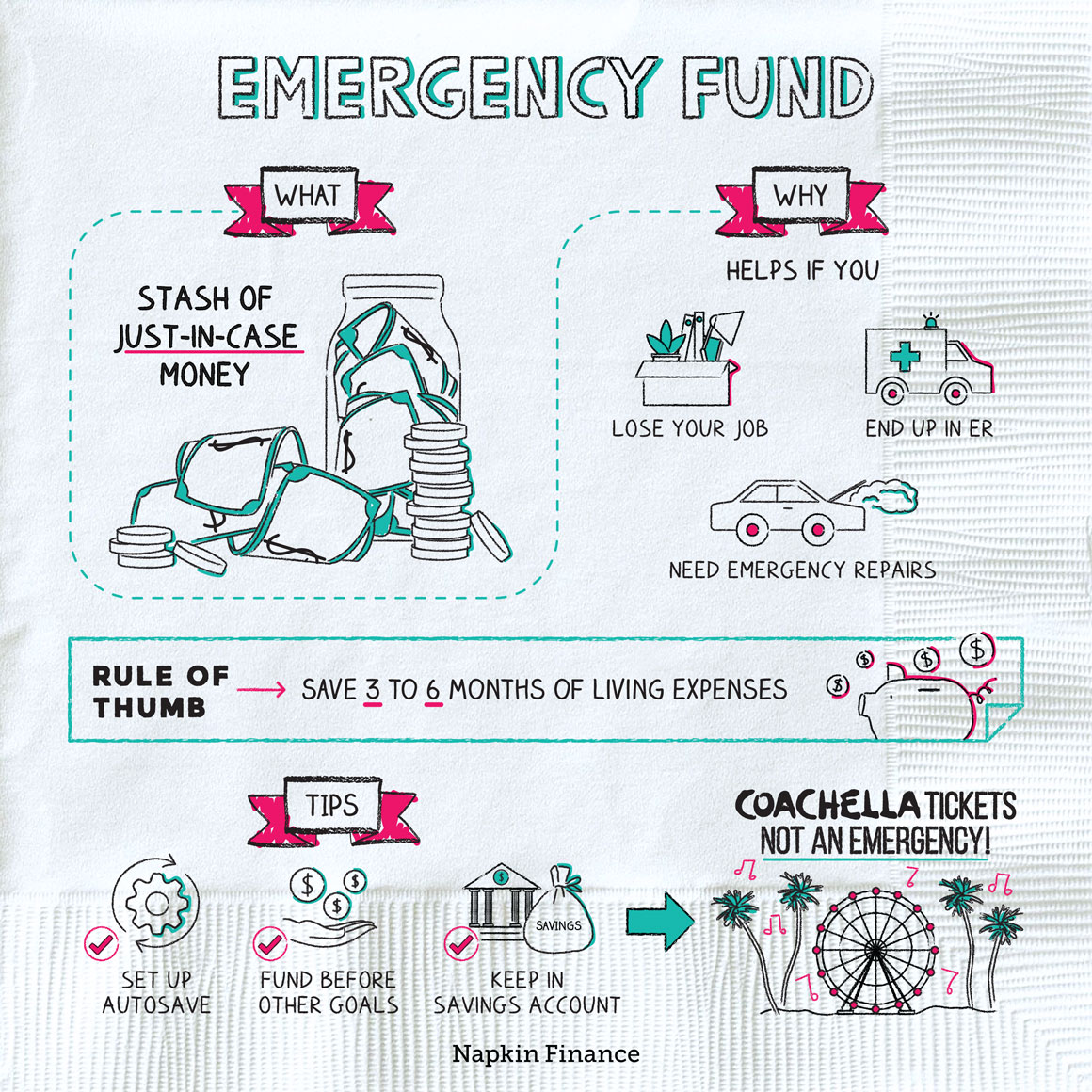

Emergency Fund

Cash Cushion

An emergency fund is your stash of just-in-case money. Along with your insurance coverage, it’s a vital piece of your financial safety net.

Your emergency fund is the money you would fall back on if:

- You lost your job

- Your car broke down

- You ended up in the ER

Having an emergency fund can help you roll with life’s unpredictable punches and makes it easier to recover from setbacks that could otherwise turn into financial disasters.

Experts typically recommend that you keep three to six months of living expenses in your emergency fund (an amount that’s probably less than three to six months of your income).

However, you can potentially adjust that number up or down depending on certain factors:

| Save less if: | Save more if: |

| You have stellar insurance coverage | You have bare-bones or no insurance |

| You could move back in with your parents in a heartbeat if you lost your job | You’d sooner die than move in with family or onto a friend’s couch |

| You fly solo in life | You have kids or other dependents |

| You have plenty of other assets | Your finances are already precarious |

Starting an emergency fund is a pretty painless process. But keeping it going (and protected!) is where willpower comes in. Here’s how:

Step 1

Figure out how much you should have in your fund

↓

Step 2

Open a separate savings or other type of account

↓

Step 3

Pick a weekly or monthly savings goal

↓

Step 4

Keep going! Slow and steady wins the race

↓

Step 5

Check in and reevaluate your emergency fund

anytime you have a major life change

(like a raise or an addition to your family)

If you ever need to dip into your emergency fund for a truly unexpected expense, reup your contributions once you’re financially able. Don’t be a one-and-done saver!

When you first figure out how much you need in your emergency fund, it can seem like an overwhelming amount. You don’t need to (and won’t) get there overnight, but there are some tried-and-true methods to chip away at your goal:

- Send your tax refund, bonus, or any other windfalls straight to your emergency fund

- Start using a budget

- Cut down on unnecessary expenses

- Reshop your insurance, and put the savings into your fund

- Cut back on subscriptions (stop paying for a gym you don’t go to or streaming you don’t use!)

Some other best practices for your emergency fund include:

- Making it a priority. Many experts recommend that you build up your emergency fund before you tackle other goals, such as saving for retirement.

- Setting up automatic transfers from your checking account to your emergency fund until it’s fully funded.

- Keeping it in a savings account, where it can earn some interest.

Whatever account you choose for your emergency fund, it should be somewhere safe and easy to access when you need it—but not so easy that you’ll be tempted to dip into it on a whim.

Last-minute Coachella tickets may feel like an emergency—but sorry, they don’t count. Don’t crack open your emergency piggy bank unless the bill you’re facing is truly an emergency.

You should also try not to use your emergency fund for predictable expenses. If you know your car’s going to call it quits soon, build up a separate new car fund so you don’t have to raid your emergency savings when the time comes.

Your emergency fund is a stash of money you can tap into if something unexpected happens, like a job loss, high medical bill, or car breakdown. Experts usually recommend having three to six months of living expenses set aside in this fund, though you can adjust that up or down depending on your bills, lifestyle, and other factors. Your emergency fund should be easy to access but not so easy that you’re tempted to spend it.

- About two in five adults don’t have the cash to cover a $400 unexpected bill.

- The most common reason people give for tapping their emergency fund is to pay for home repairs followed by car repairs.

- An emergency fund is just what it sounds like: a savings fund for emergency expenses.

- Try to save three to six months of living expenses in your emergency fund.

- Although hitting that savings goal can be a challenge, try to make your emergency fund a priority. Look for expenses to cut back on while you focus on getting it fully funded.

- Your emergency fund should be held somewhere easy to access, such as a savings account.