Filing for Unemployment

Pink Slip

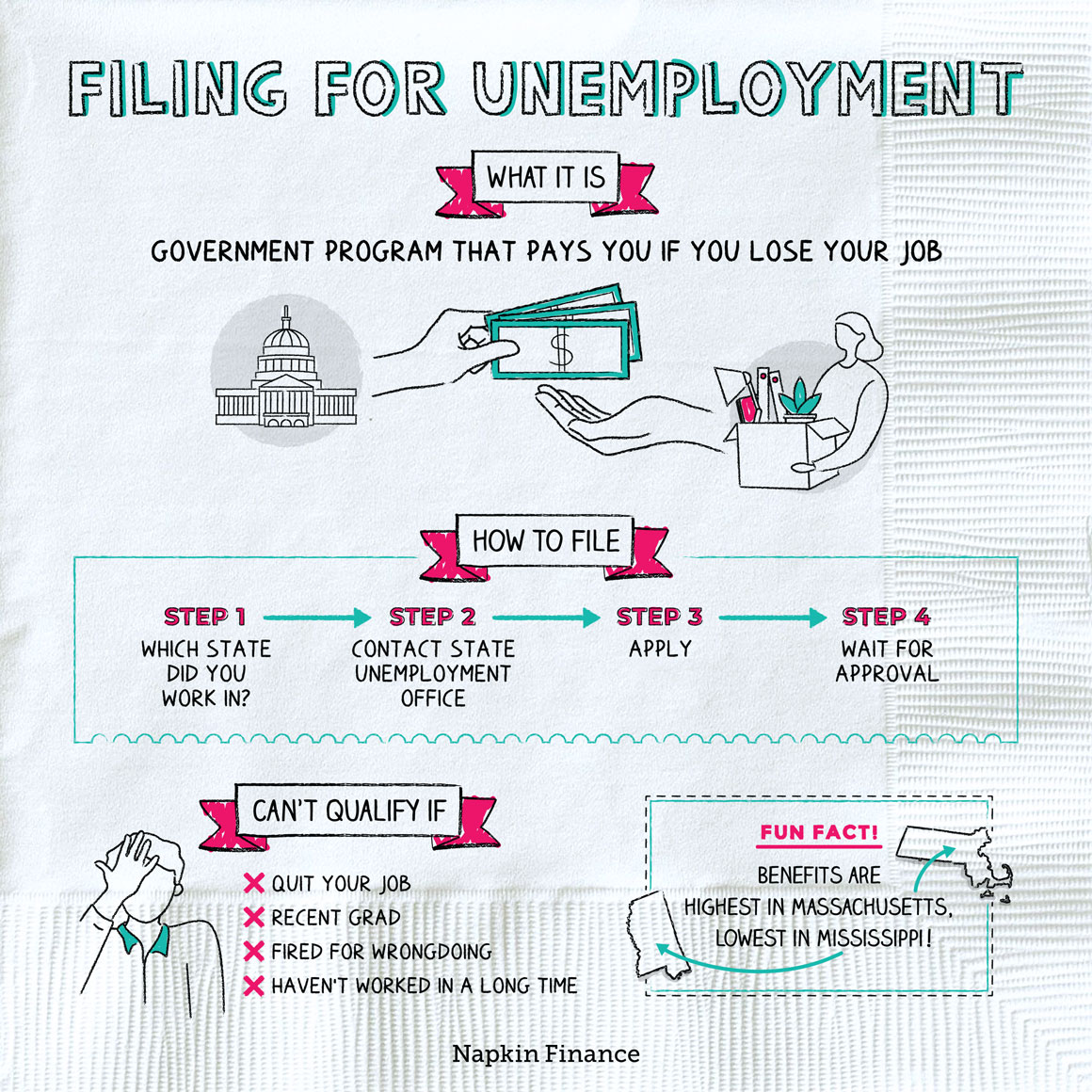

Unemployment insurance is a government program that gives you money if you lose your job.

Sometimes, life doesn’t go your way. Luckily, unemployment insurance benefits are available to help get you back on your feet. But in order to collect the benefits, you need to figure out whether you qualify and then apply.

You have to be unemployed to receive unemployment benefits. But you also typically have to meet a number of other criteria.

Each state gets to decide its own specific requirements, but usually the program is only for people laid off through no fault of their own, who are available and looking for work, and who meet wage and time worked requirements.

The program is generally not for people who are:

- Unemployed because they quit their last job

- Fired for misconduct

- Searching for their first job (sorry, recent grads)

- Reentering the workforce after voluntarily leaving (like after having a baby)

- Self-employed (although there have been temporary exceptions to this rule, like during the coronavirus pandemic)

- Too picky about the job they’ll take (like if you’ve been offered an acceptable job but turned it down)

You also typically must have some minimum length of recent work history or minimum level of earnings to qualify.

If you lose your job, get the ball rolling on unemployment benefits right away. Reach out to the unemployment office in the state where you worked (not necessarily where you live), and:

Fill out an application online,

over the phone, or in person

↓

Provide personal information and work details

(including job addresses and dates of your employment)

↓

Wait patiently for the state to review and approve your claim

↓

Get your first benefit payment in the mail or via direct deposit

↓

Follow the rules to stay qualified

If you’re approved, you typically receive your first payment about two to three weeks after applying.

Approval isn’t the last hurdle. You have to follow your state’s rules to stay eligible until you find a job or your benefits run out, whichever comes first. This often means:

- Regularly looking for work

- Continuing to file regular unemployment claims (often weekly)

- Reporting any money you do earn (some states let you make a certain amount while still getting benefits)

- Telling the state about any job offers you receive (including any you turn down)

- Registering with the state employment assistance center

Exactly how long your benefits can last varies by state, but most states have a maximum of around 26 weeks (i.e., half a year).

Here’s what else you need to know as you’re navigating the world of unemployment:

- What you receive is meant to cover about half your working salary (up to a certain limit) but varies a lot based on what you used to make and whether you have dependents.

- Unemployment benefits are taxable. You can choose to have taxes withheld from each benefit check you receive so that you don’t face a big tax bill at the end of the year.

- Part-time workers qualify for benefits in some, but not all, states.

Unemployment insurance is a government benefit that provides cash payments if you lose your job. You can file for unemployment by applying through the unemployment office in the state where you worked and providing information about your last job. The state gets to decide whether you qualify and for how much, but you can often receive around half of your salary for up to 26 weeks.

- Almost seven million people filed for unemployment in a single week in March 2020, as quarantine orders forced the U.S. economy to shut down. That all-time high shattered all the previous records for unemployment claims.

- Where’s the best state to be unemployed? Payouts are generally highest in Massachusetts and lowest in Mississippi.

- In normal economic times, about half of all unemployed workers fail to qualify for unemployment assistance, though in some states less than 10% qualify.

- Unemployment insurance provides cash benefits to people who lose their job through no fault of their own.

- You can apply for benefits in person, online, or over the phone through the unemployment office of the state where you worked.

- If you qualify, it usually takes about two to three weeks to get your first check, and benefits can then last for a maximum of around 26 weeks.

- After qualifying, you have to maintain eligibility by looking for work, filing additional unemployment claims, and letting the state know if you’re offered a job.

- Unemployment benefits are taxable. Consider having taxes withheld from your unemployment checks so that you don’t face a cash crunch when it’s time to do your taxes.