Prepaid Card

Top Off

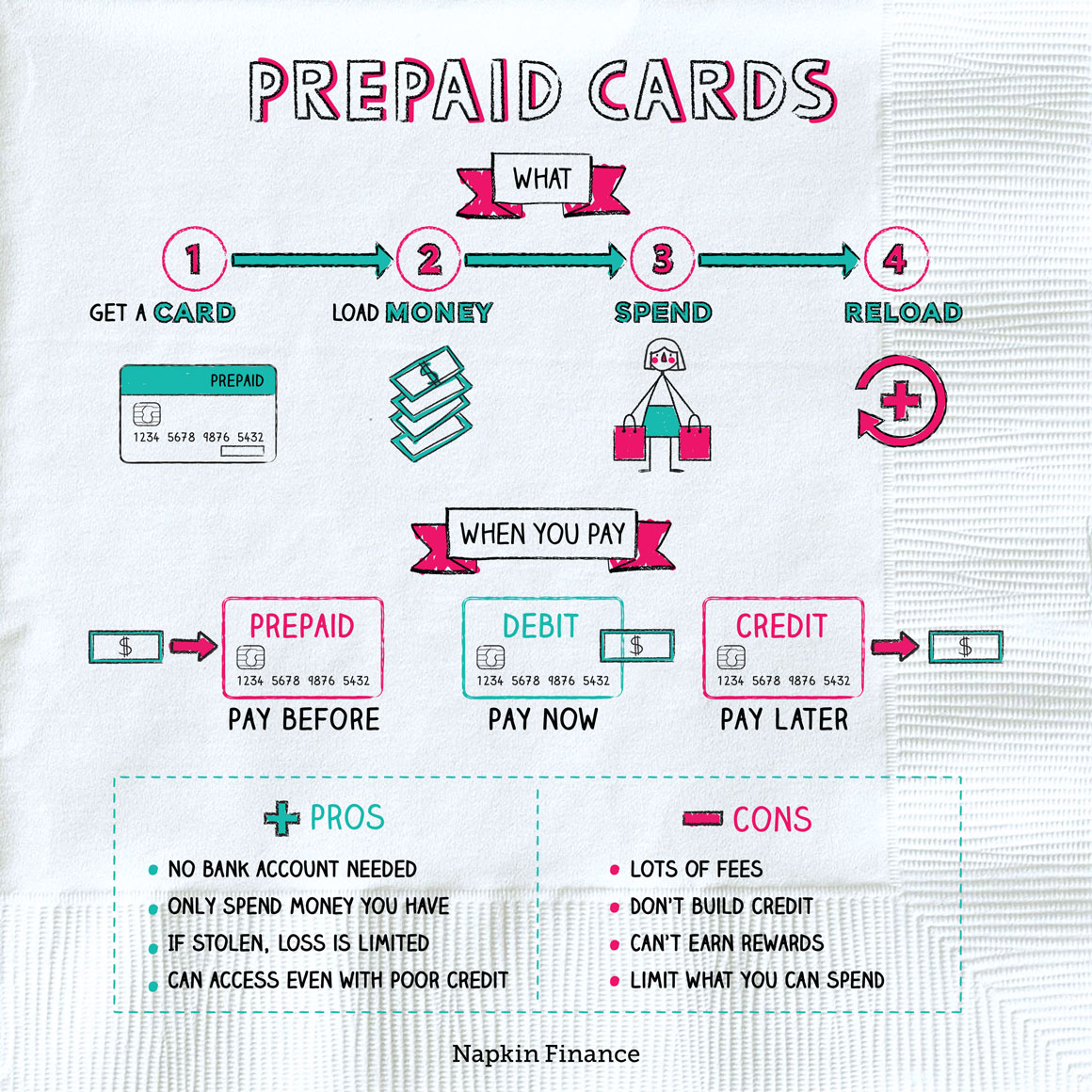

A prepaid card lets you spend money that you’ve already added to the card. It’s similar to a debit card but doesn’t require a bank account.

If you want to use a prepaid card, it requires a little more beforehand work on your part than a debit or credit card.

- Step 1: Buy a prepaid card at a store, over the phone, or online. The card you buy might have a certain amount already loaded onto it or you may need to add money before you can use it.

- Step 2: Use the card to buy stuff or withdraw cash up to the amount loaded onto the card.

- Step 3: Reload money onto the card once it’s empty. Depending on your card, you might be able to set up a regular deposit from your paycheck, transfer money from another account, buy a reload card, or add funds where you bought the card.

Prepaid cards typically carry a lot of fees, though they vary by card. Fees can include ones charged for:

- Card activation

- Loading money

- ATM use

- Balance inquiries

- Declined transactions

- Inactivity

- Card replacement

- Card cancellation

Needless to say, you should be crystal clear on any fees a given card is going to charge you before you take the plunge with a prepaid card.

Prepaid cards can be helpful for people who for one reason or another can’t or don’t want to use traditional debit or credit cards. While anyone can get one, people often use them if they:

Like any financial product, consider the trade-offs before sinking your money into a prepaid card:

| Pros | Cons |

| Don’t need a bank account | Many fees; high fees |

| If lost or stolen, you can’t lose more than what’s on the card | You can’t borrow or charge more than what’s loaded |

| Limits your risk of identity theft | Doesn’t help build or repair credit |

| Use them at many places | Won’t pay you points or rewards for spending |

If you’re trying to choose which piece of plastic to add to your wallet, it’s helpful to know the differences between prepaid, debit, and credit cards.

| Prepaid cards | Debit cards | Credit cards | |

| When do you pay? | Before you spend | When you spend | After you spend |

| How much can you spend? | Only what you load onto the card | Only what’s in your bank account (or you’ll face overdraft fees) | Up to your credit limit |

| Charge many fees? | Yes, many! | Typically no (unless you overdraw your account) | Some charge annual fees; interest charges if you carry a balance and late fees if you miss payments |

Before you purchase a prepaid card, you should know:

- It’s good practice to register your prepaid card so that you’ll have more protection if the card is lost or stolen. Registration might also give your money FDIC insurance (in case the issuer goes out of business).

- Not all cards can be used everywhere. So-called “closed-loop” cards will limit your spending to specific stores.

- When your card expires, the issuer might charge you for a replacement card with a new expiration date. You might also face a fee if you opt to cash out your money that’s left on the card.

A prepaid card lets you make purchases up to the amount you’ve loaded onto the card. It’s similar to a debit card but doesn’t require a bank account. Anyone can use prepaid cards, but they typically come with many fees and won’t help you build or repair your credit the way a credit card can.

- About 12 million Americans use a prepaid card at least once a month. That same number of Americans have confessed to keeping a source of income secret from their partners.

- Some people use prepaid cards to limit their spending. That may be a good thing when you consider that about two in five Americans carry a balance on their credit card, and the average balance is more than $6,000.

- A prepaid card is a form of payment that requires you to load money onto the card before you can make a purchase.

- People who don’t have a bank account, have bad credit, or need to limit spending often use prepaid cards.

- Prepaid cards typically carry many fees, including those for activation, purchases, and ATM use.

- Prepaid cards differ from credit and debit cards, and while they can be helpful for limiting spending, they have many more fees and usually don’t help build your credit.