Featured Napkin

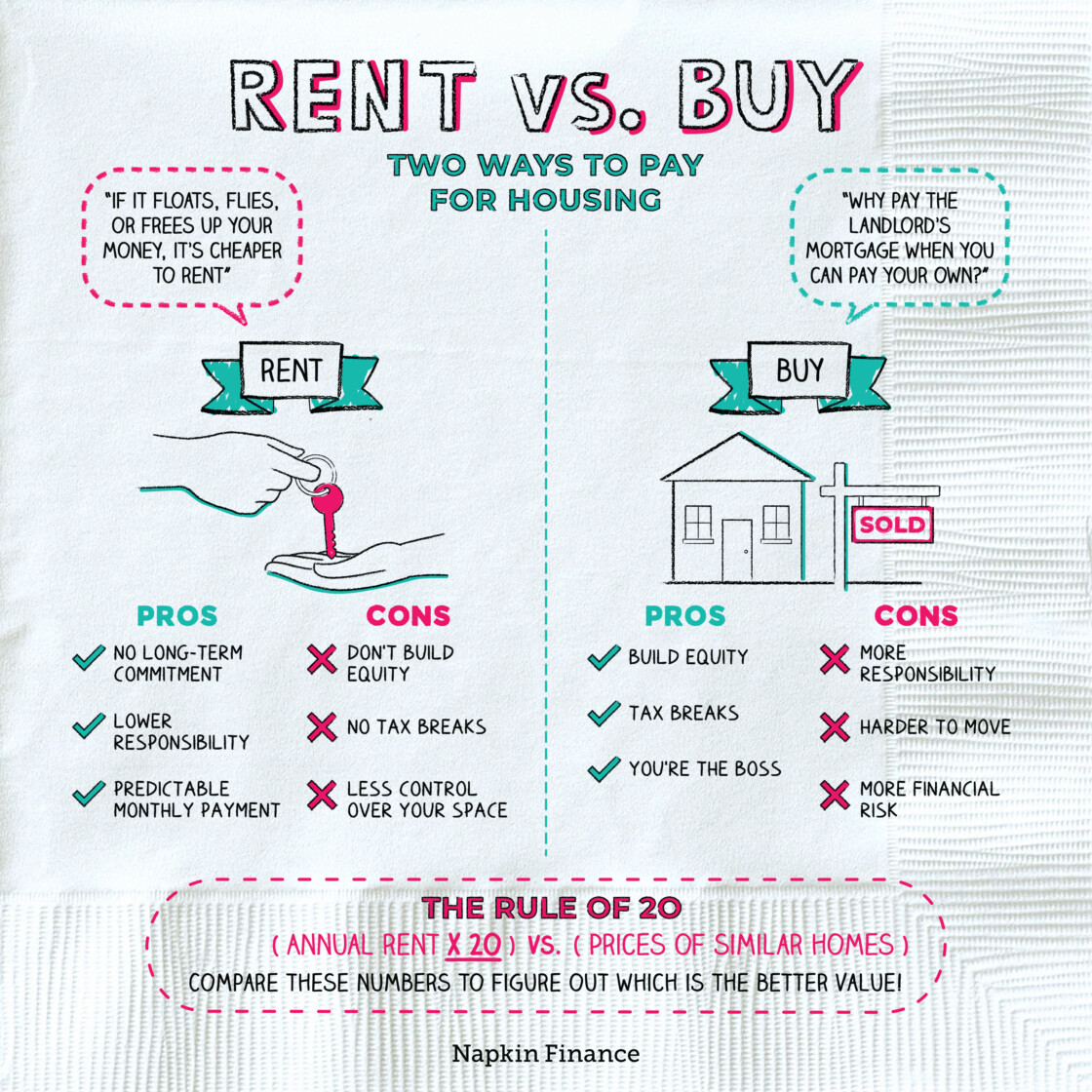

Rent vs. Buy

Where the Heart Is

The choice between renting or buying a home may be one of the biggest decisions you make in your life. Each option comes with financial trade-offs—plus nonfinancial, personal considerations, which can be equally important.

Learn moreMore starting a family Napkins...

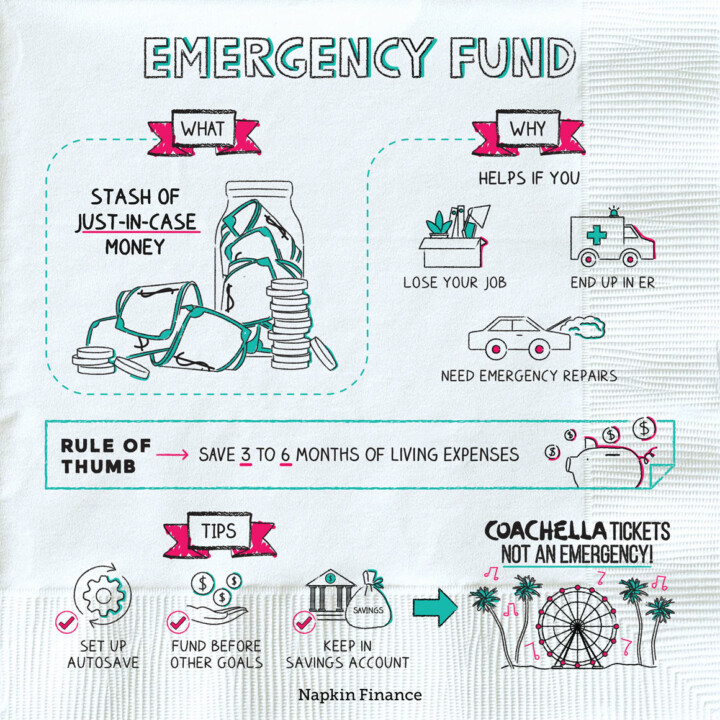

Emergency Fund

Cash Cushion

An emergency fund is your stash of just-in-case money. Along with your insurance coverage, it’s a vital...

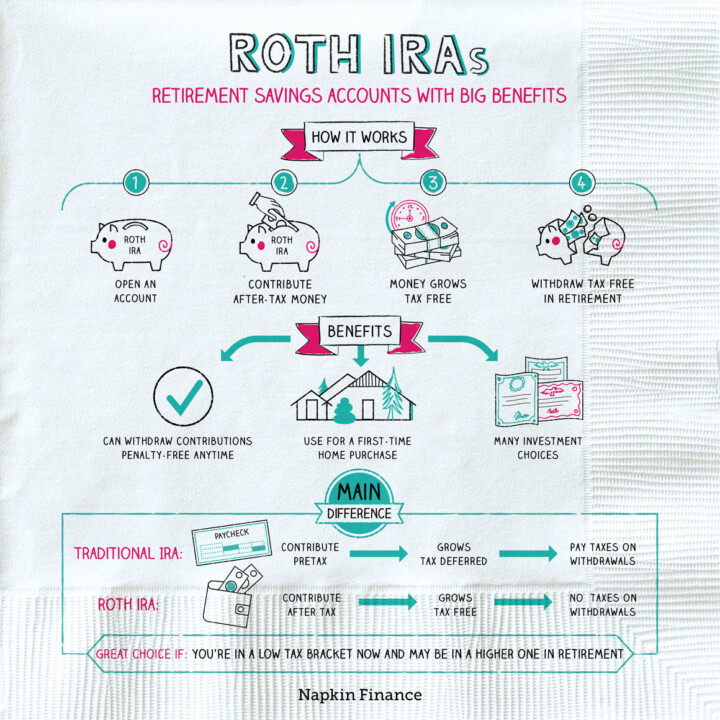

Learn moreRoth IRAs

Road to Retirement

A Roth IRA, or Individual Retirement Account, is one of the most common types of retirement savings...

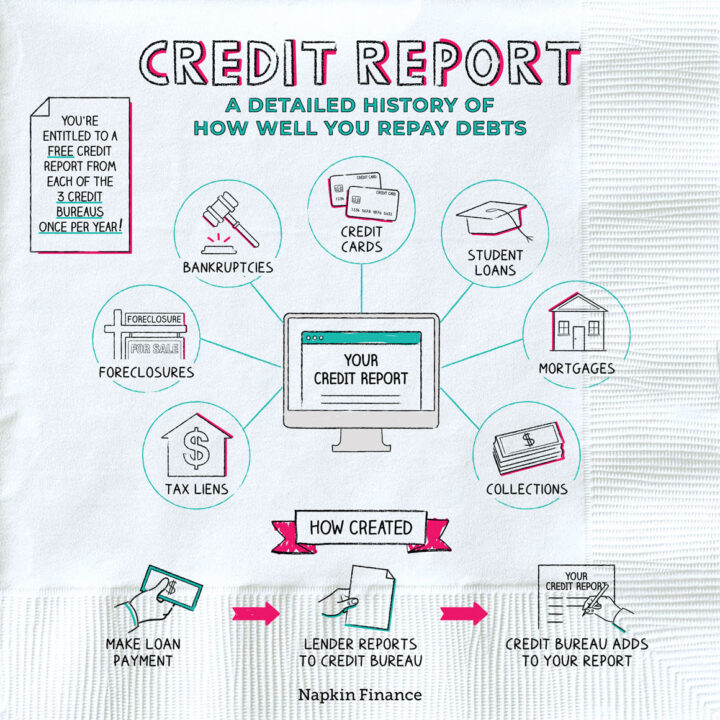

Learn moreCredit Report

Good Marks

Your credit report is a detailed history of your past use of credit. It’s a bit like...

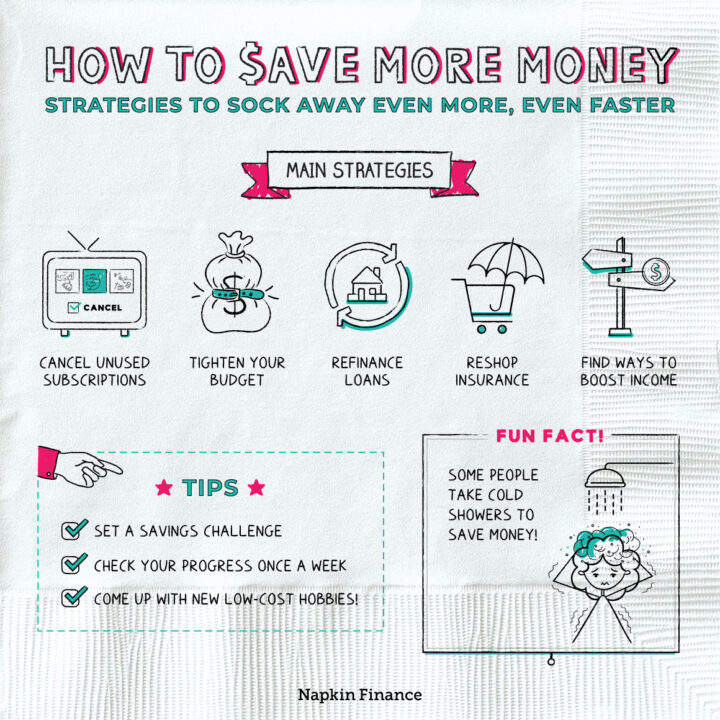

Learn moreHow to Save More Money

Keep the Change

Like many good habits, saving more money is easier said than done. Once you’ve gotten into a...

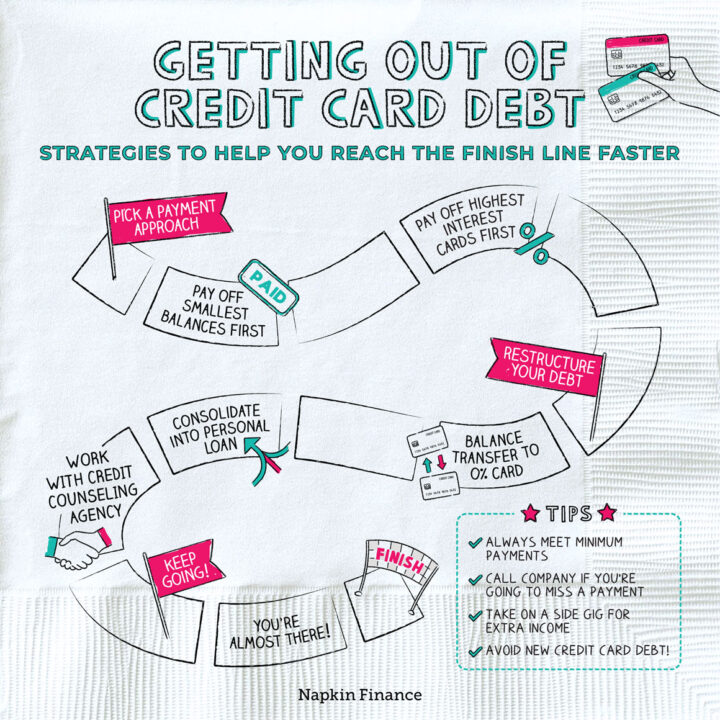

Learn moreGetting Out of Credit Card Debt

Pay the Piper

Credit card debt can be overwhelming. As interest accrues, your balances may keep increasing even if you’re...

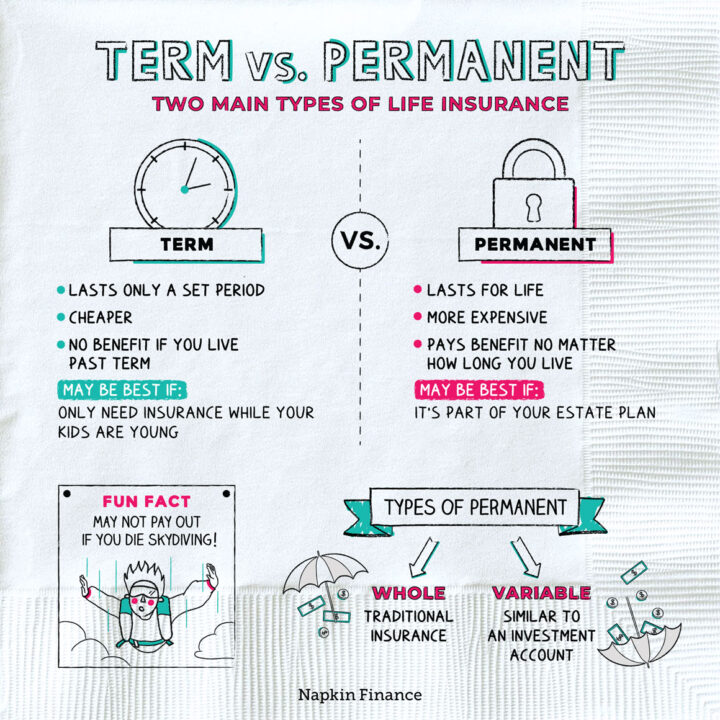

Learn moreTerm vs. Permanent Life Insurance

Life Sentence

Term and permanent policies are the two main types of life insurance. With both types of policies,...

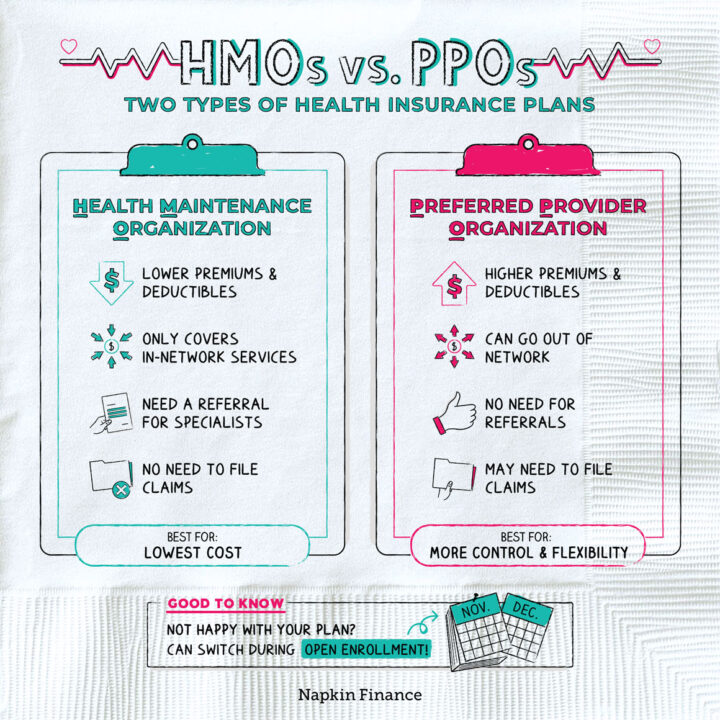

Learn moreHMO vs. PPO

Bill of Health

HMOs and PPOs are two different types of health insurance plans. HMO (or Health Maintenance Organization) plans...

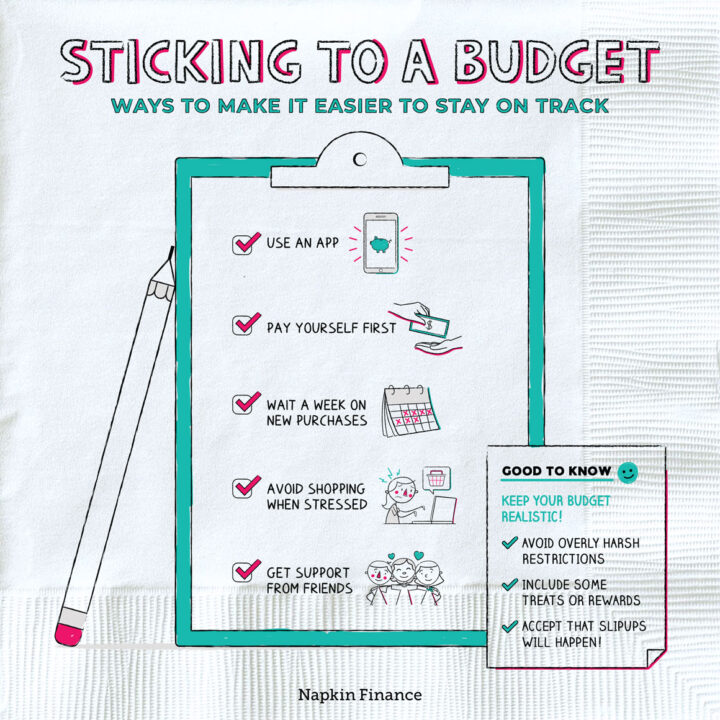

Learn moreSticking to a Budget

In It to Win It

Budgeting can be a lot like dieting. You start out with big hopes for dramatic changes in...

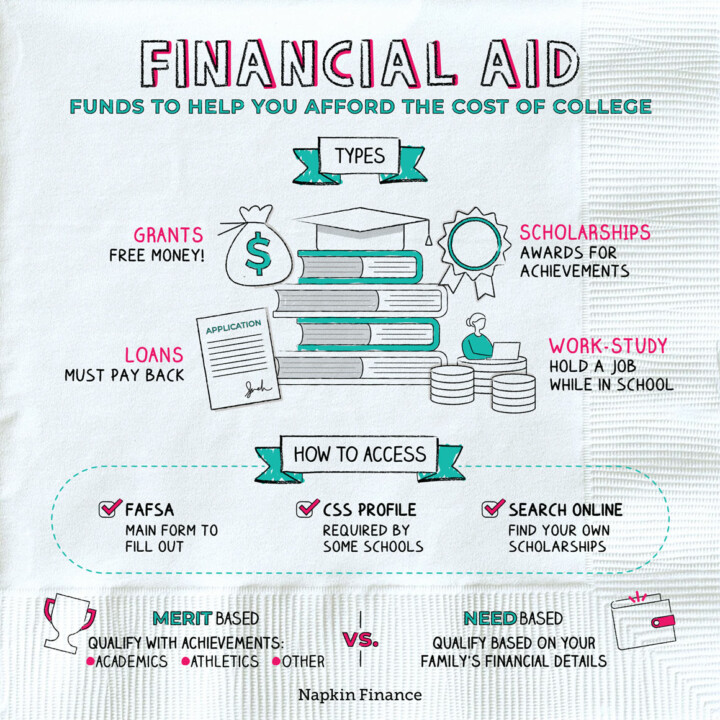

Learn moreFinancial Aid

Lean on Me

Financial aid can refer to any of a number of types of assistance that help students afford...

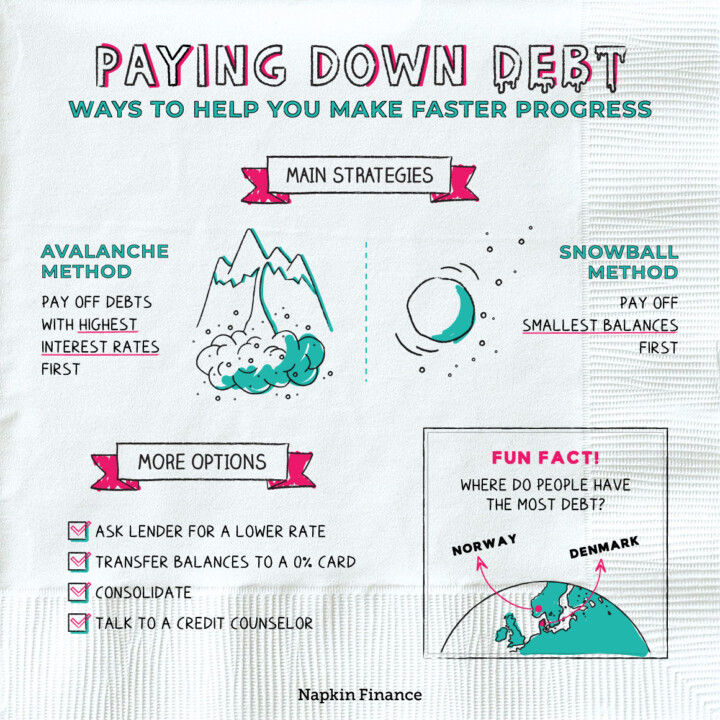

Learn morePaying Down Debt

Get Low

Paying down debt can make you more financially secure and give you more flexibility when deciding what...

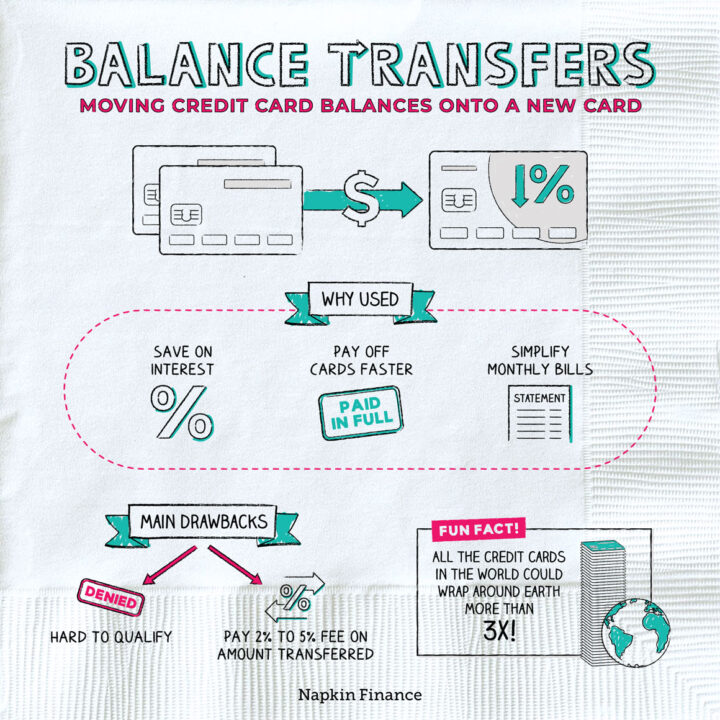

Learn moreBalance Transfers

Shell Game

Balance transfers are a way to move what you owe on one (or more) credit cards and...

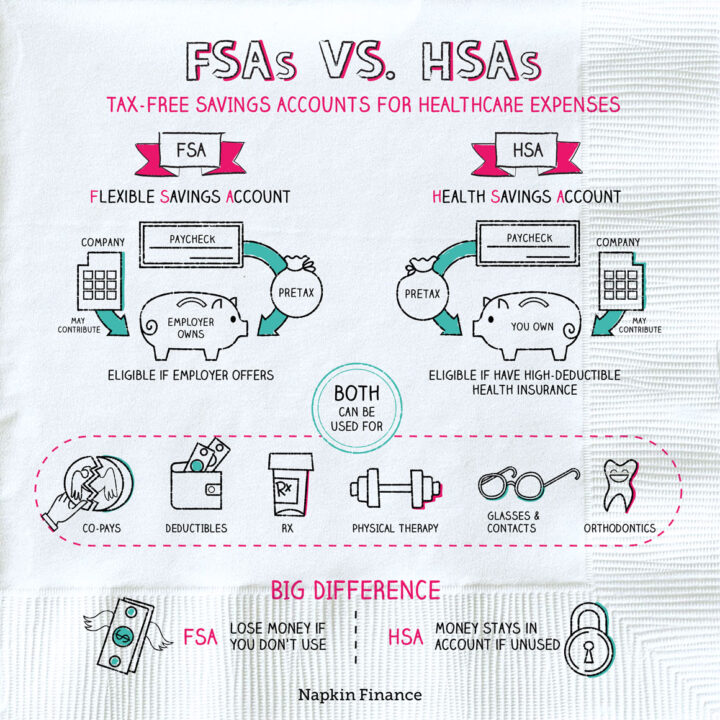

Learn moreFSAs vs. HSAs

Health is Wealth

Health care FSAs and HSAs let you save money for out-of-pocket medical expenses (basically the things your...

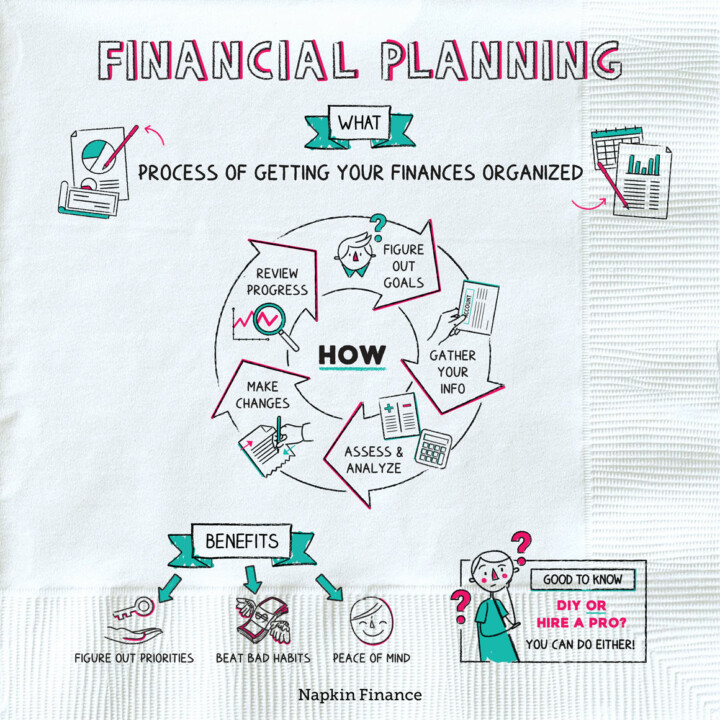

Learn moreFinancial Planning

Ducks in a Row

Financial planning describes the process of mastering your money. It means figuring out where you actually are...

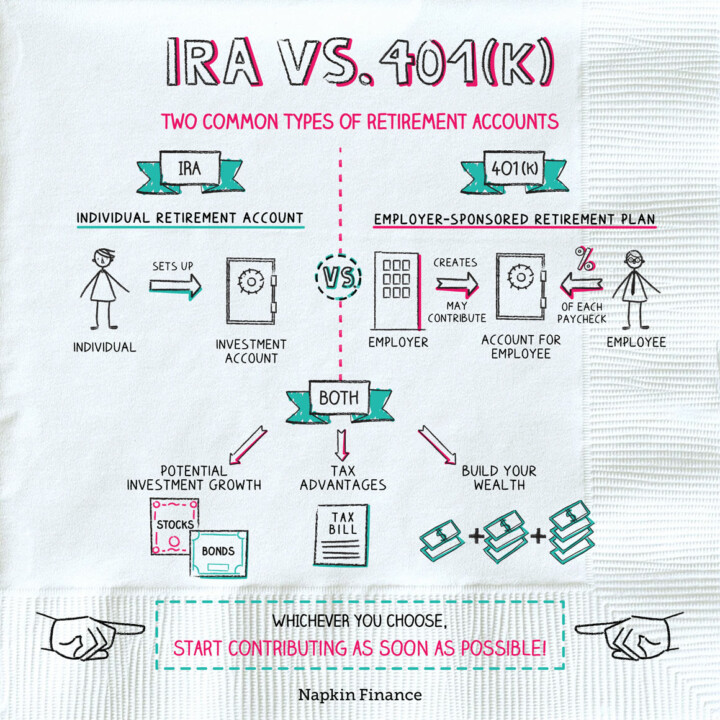

Learn moreIRA vs. 401(k)

Nest Eggs

IRAs and 401(k)s are two popular types of retirement savings accounts. Most people who work in the...

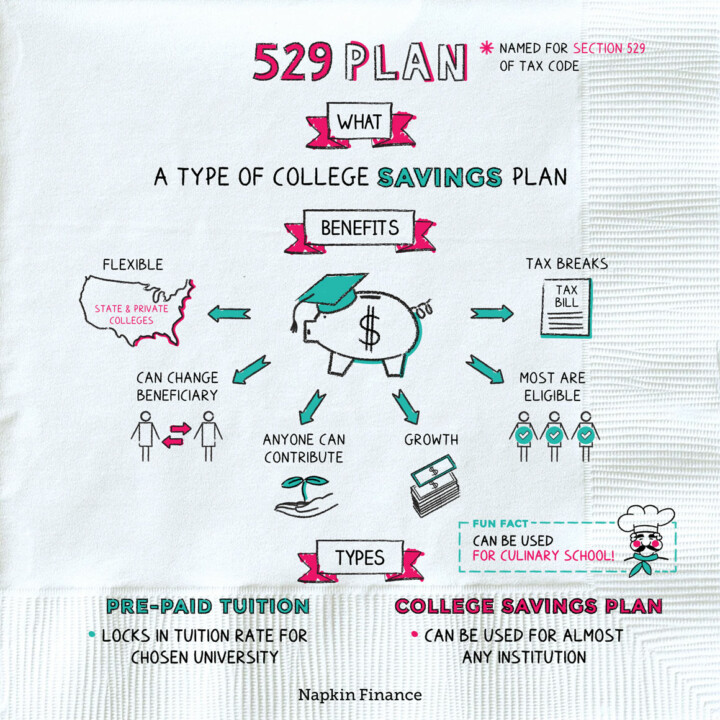

Learn more529 Plan

Higher Ed, Higher Returns

A 529 plan is a tax-advantaged college savings account sponsored by a state government or education institution....

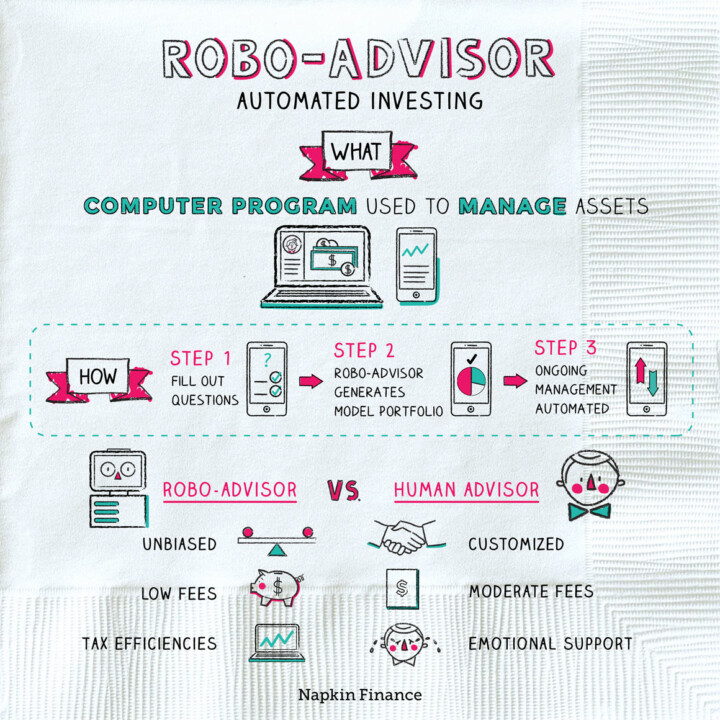

Learn moreRobo-Advisor

Autopilot

A robo-advisor is an investment management company that uses a computer program instead of a live human...

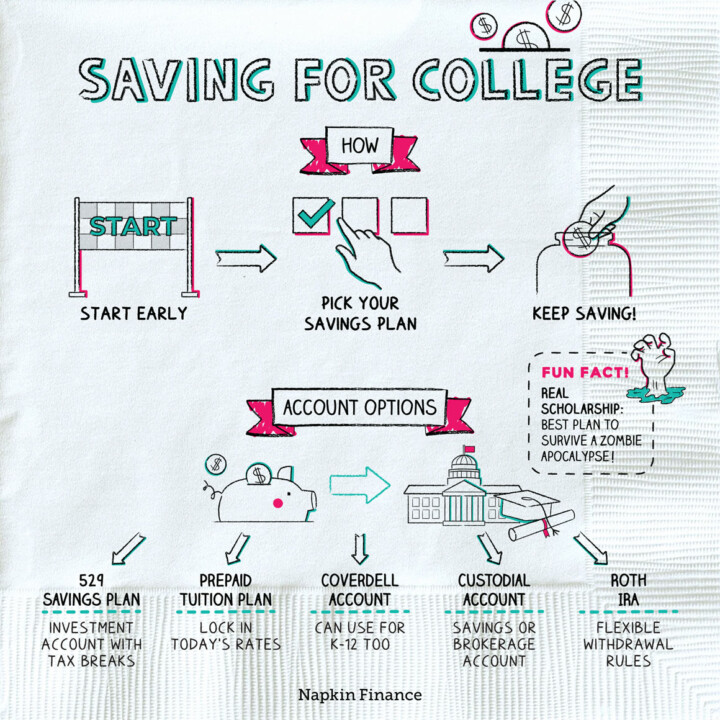

Learn moreSaving for College

Pay Your Dues

Saving for college means setting aside funds for education expenses. It means making a dedicated investment in...

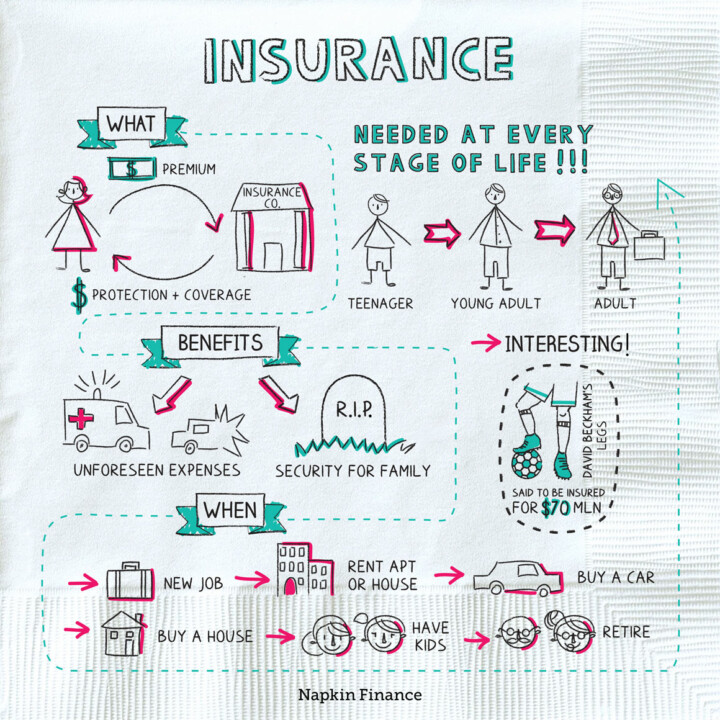

Learn moreInsurance

Cover Your Assets

Insurance is financial protection. Along with your emergency fund, insurance makes up your safety net so that...

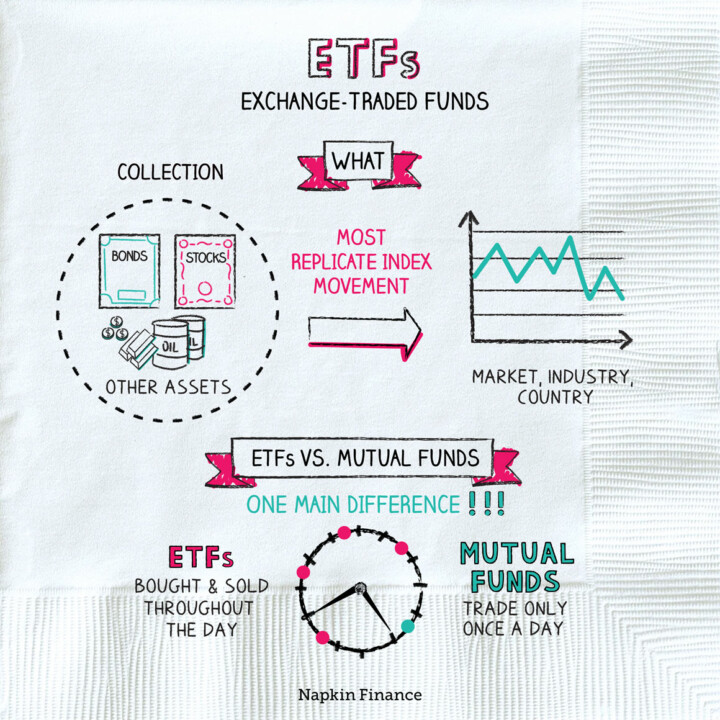

Learn moreETFs

Jack-of-All-Trades

Exchange-traded funds (ETFs) are investment vehicles similar to mutual funds. Like mutual funds, ETFs are professionally managed...

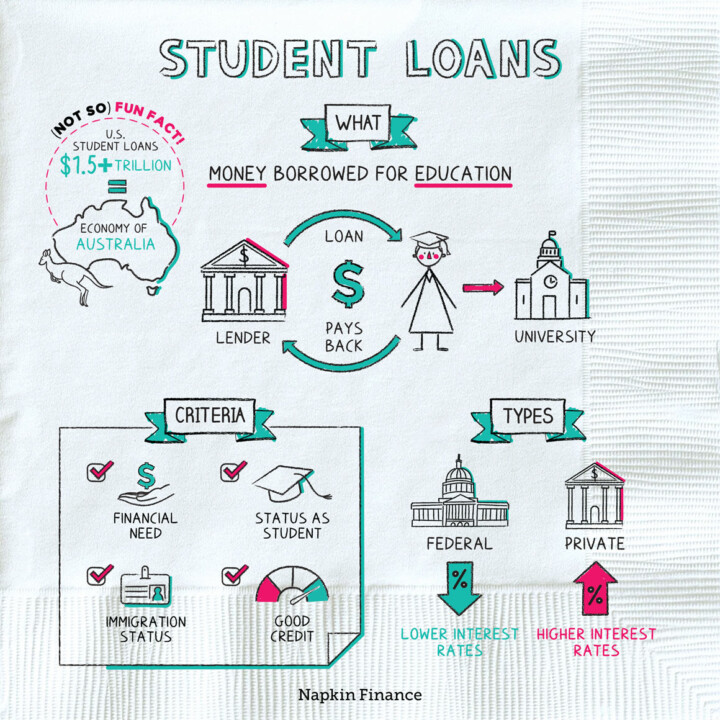

Learn moreStudent Loans

Old College Try

A student loan can be any kind of borrowed money that’s used to pay for education. Although...

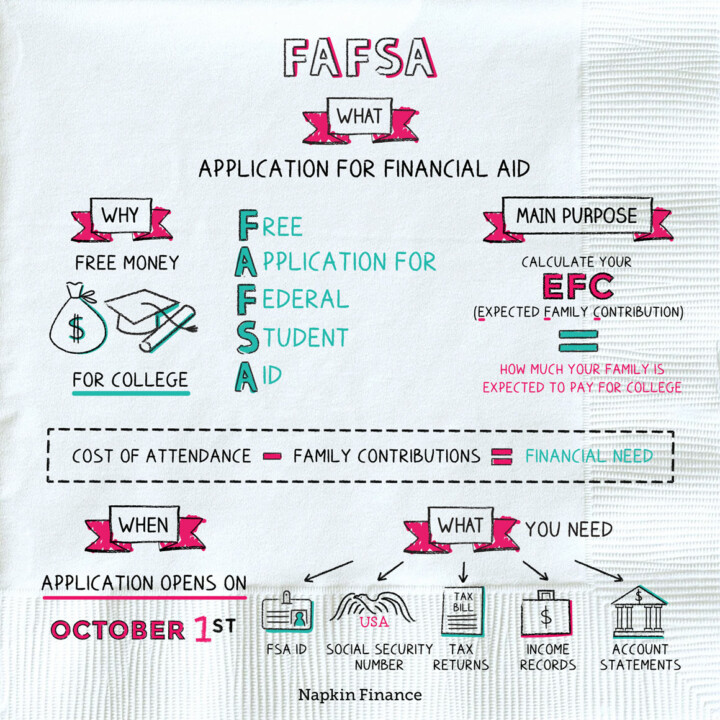

Learn moreFAFSA

Aid and Abet

The Free Application for Federal Student Aid, or FAFSA, is a form that college and grad students...

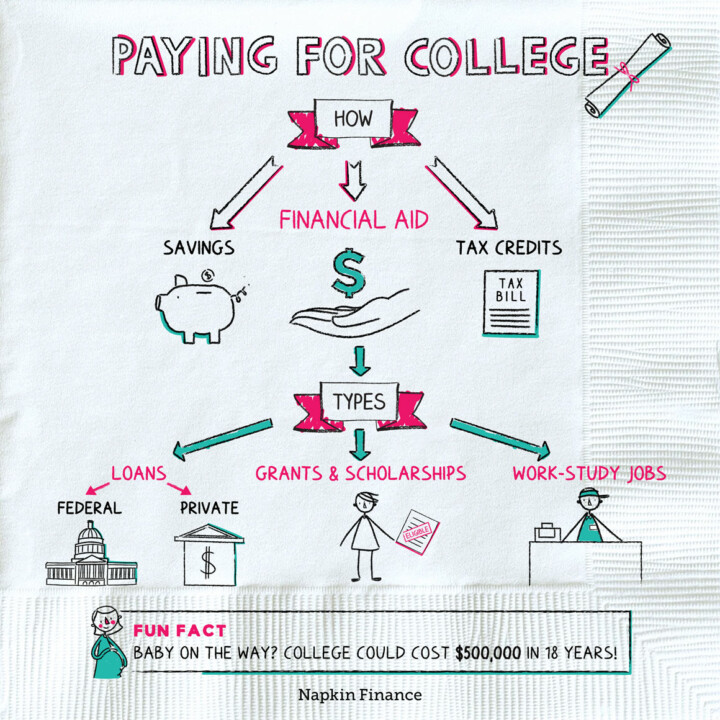

Learn morePaying for College

Higher Education, Higher Costs

Going to college can lead to better jobs and bigger paychecks. But it comes at a high...

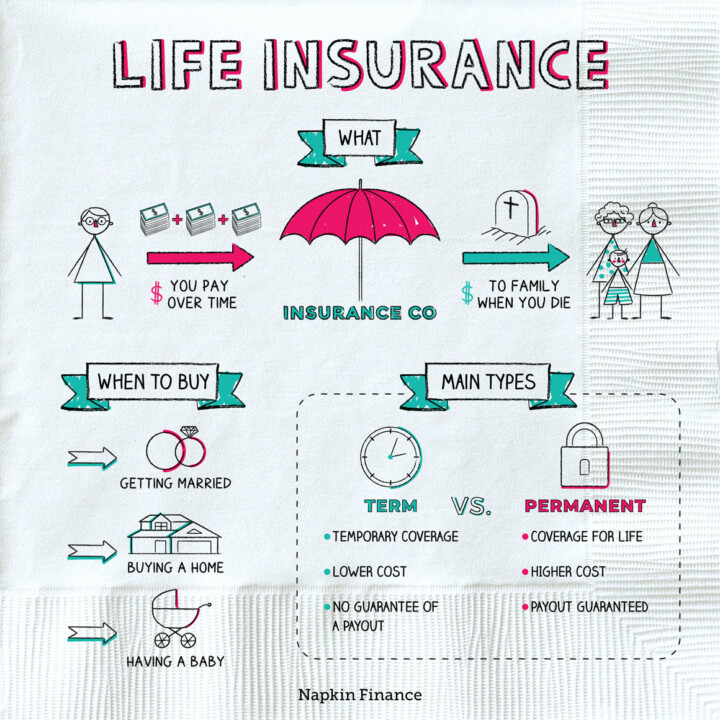

Learn moreLife Insurance

Beyond the Veil

Life insurance is a contract with an insurance company. In exchange for periodic payments, the insurance company...

Learn more