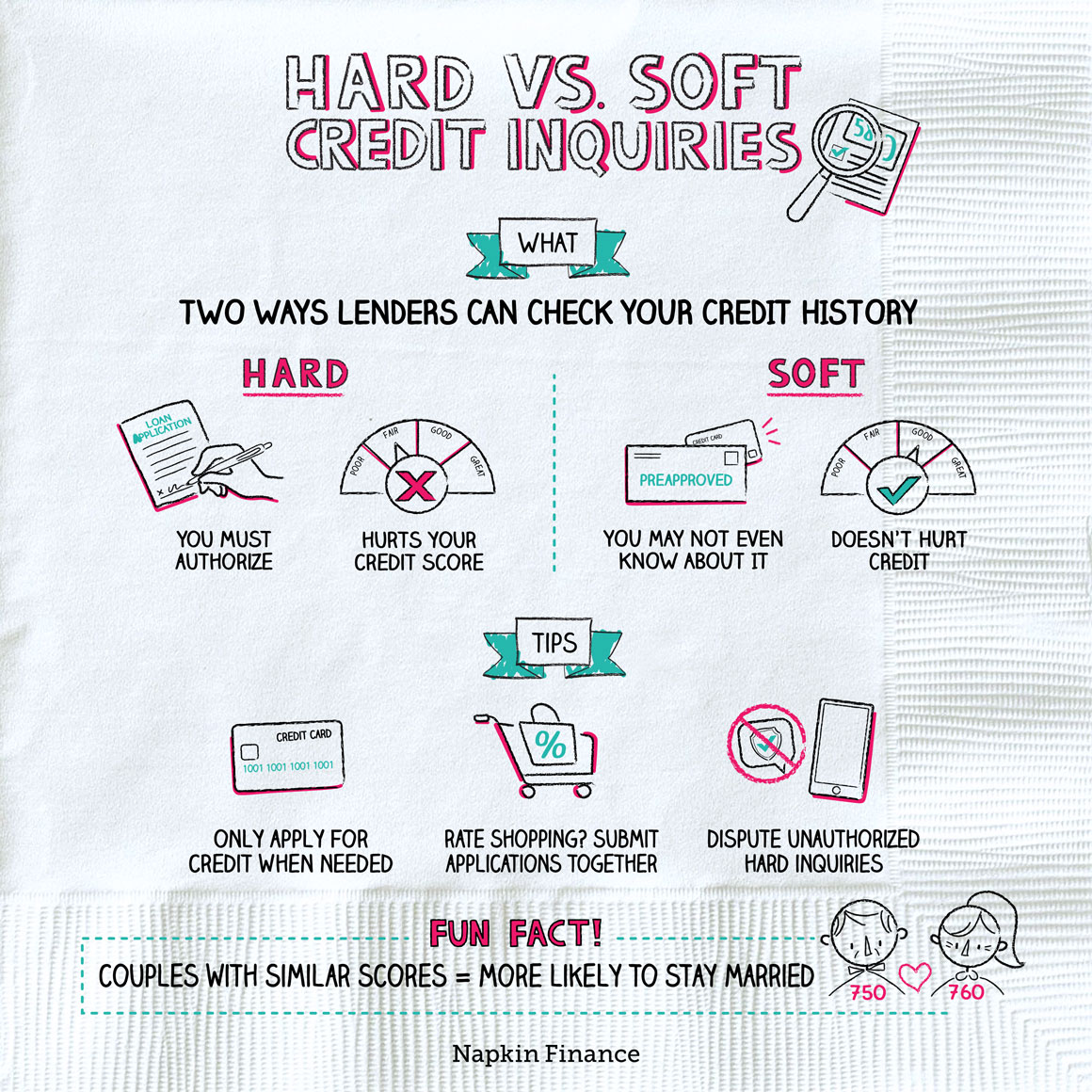

Hard vs. Soft Credit Inquiries

Extra Credit

Banks, lenders, and others use your credit report and scores to determine your creditworthiness. In other words, your credit history can help lenders and others decide whether or not to loan you money, rent you an apartment, or do business with you.

Lenders view your credit history in one of two ways—a hard inquiry or a soft inquiry (also known as a hard pull or soft pull).

| Hard inquiry | Soft inquiry | |

| Who uses | Lenders | Lenders and borrowers |

| When used | When you apply for a loan | Lenders use it to make preapproval offers; borrowers use to check credit |

| What it shows | Credit score, payment history, delinquencies | Same |

| Appears on credit report? | Yes, for up to two years | No |

| Hurts credit score? | Yes, lowers the score temporarily | No |

| Examples |

|

|

Lenders run a hard inquiry when you apply for a loan, such as a mortgage or a car loan, or a credit card. They run soft inquiries when they market their products, such as credit cards or personal loans, to you through preapproval offers. Any time you check your own credit score, that’s considered a soft pull as well.

The biggest difference between a hard and soft inquiry is that the hard pull temporarily lowers your credit score and appears on your credit report. Why? Because if you’re applying for a loan, it means you need money, which tells other creditors you might have a higher risk of defaulting on your loans.

The best shorthand for knowing when it’s a hard or soft credit inquiry is whether you’ve applied for a loan or otherwise agreed to let a company check your credit (such as if you’ve applied to rent an apartment or set up a new account with your local energy provider). If you get a preapproval offer in the mail that you didn’t request, that’s a soft inquiry. But if you submitted an application for a specific loan, that’s a hard inquiry.

Sometimes, phone, Internet, utility, or other service providers may run a hard inquiry when you first apply for service. If you’re ever in doubt, just ask if the company is going to do a hard pull.

Soft inquiries don’t affect your credit score and can even help you monitor your credit, so they don’t really have a downside.

But even hard inquiries aren’t always bad since they’re a necessary part of the loan approval process. The key is to avoid unnecessary hard inquiries so that you’re not dinging your credit without good reason.

To steer clear of unnecessary hard inquiries, try to:

- Only apply for loans when you’re ready to borrow

- Borrow only when you really need to

- Make sure you know about any hard inquiries into your credit

You can also minimize the effects of hard inquiries when rate-shopping for a loan by submitting all of your loan applications within a short period of time—such as within two weeks when shopping for a mortgage. Credit-scoring companies may treat multiple loan applications more favorably when it’s clear you were shopping for the best rate on a single loan.

If you see an unauthorized hard inquiry on your credit report, you have the right to dispute it. Unauthorized inquiries appear when:

- A credit bureau mistakenly adds them to your report

- A fraudster attempts to open accounts in your name

- A lender requests a hard pull without your permission

If you spot one, you can file a dispute with the credit bureau, which will investigate the claim. If an inquiry looks like ID theft, you may also want to request new cards and change your account passwords.

The key difference between hard and soft inquiries is that hard inquiries lower your credit score, and soft inquiries don’t. Although taking a hit to your credit score isn’t great, hard inquiries are a necessary part of the loan application process. But you want to minimize the number of hard pulls on your credit history and watch out for any hard inquiries you didn’t OK.

- Credit scores are a relatively new phenomenon. They came into vogue in the 1950s with the creation of the Fair Isaac Corporation (FICO) and FICO score system.

- Your credit score may serve as a crystal ball into your romantic future: Couples with similar scores at the start of their marriages have a better chance of staying hitched. And the higher your credit score, the longer your relationship is likely to last according to research by the Fed.

- If your FICO number is less than perfect—meaning anything under 850―you’re not alone. Only 1.2% of Americans hold that elusive high score.

- A hard credit inquiry stays on your credit record for two years and can lower your credit score.

- A soft inquiry does not affect your credit score and only you can see the inquiry on your credit report.

- Hard inquiries are part of the loan approval process, so it’s smart to apply for loans and credit cards only when you really need them.

- Keep an eye on your credit score and dispute any hard pulls you didn’t authorize.