Featured Napkin

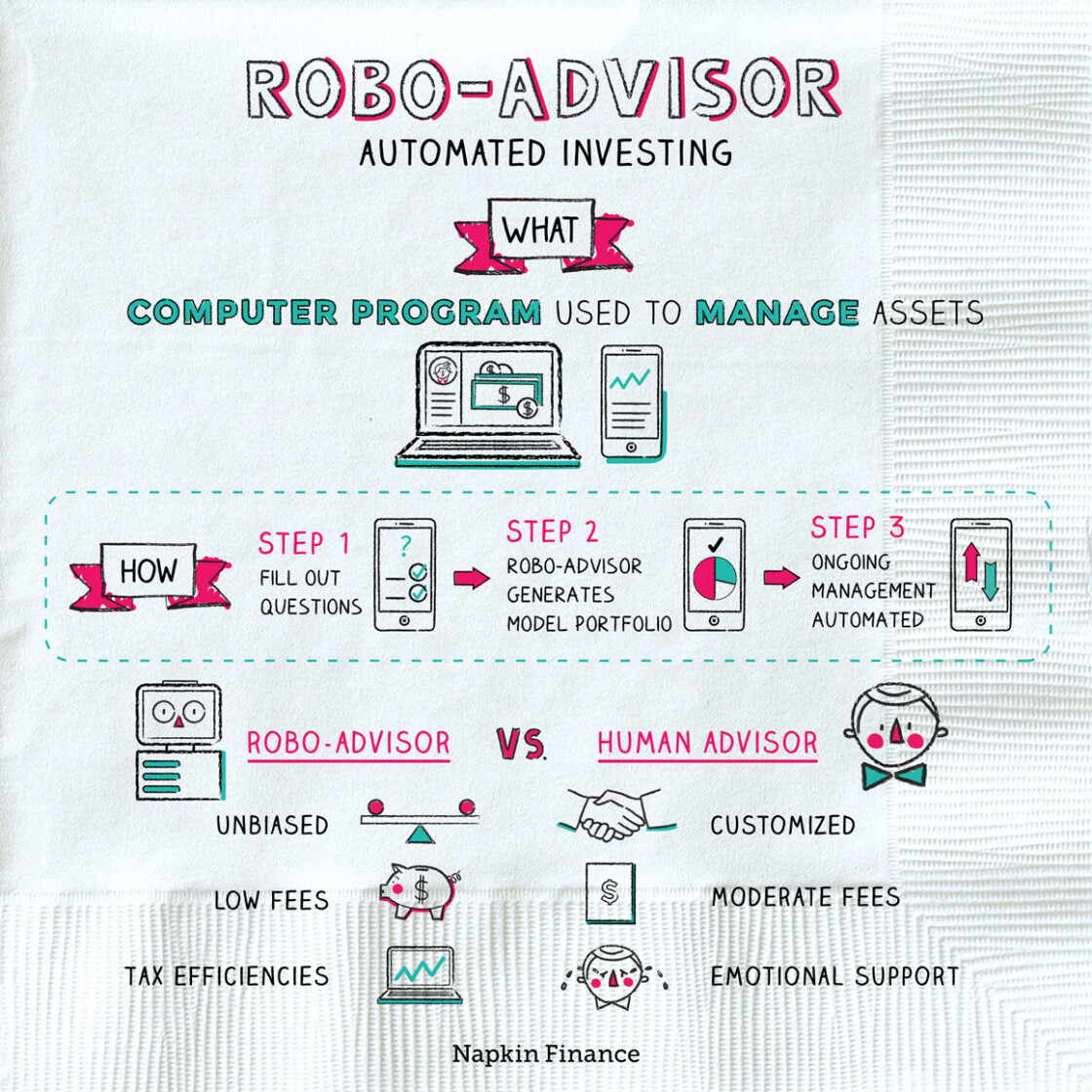

Robo-Advisor

Autopilot

A robo-advisor is an investment management company that uses a computer program instead of a live human to manage assets. Startups, such as Betterment and Wealthfront, invented the concept of robo-advising. But it’s been so successful that now financial giants, such as Charles Schwab, Fidelity, and Vanguard, have gotten in...

Learn moreMore getting married Napkins...

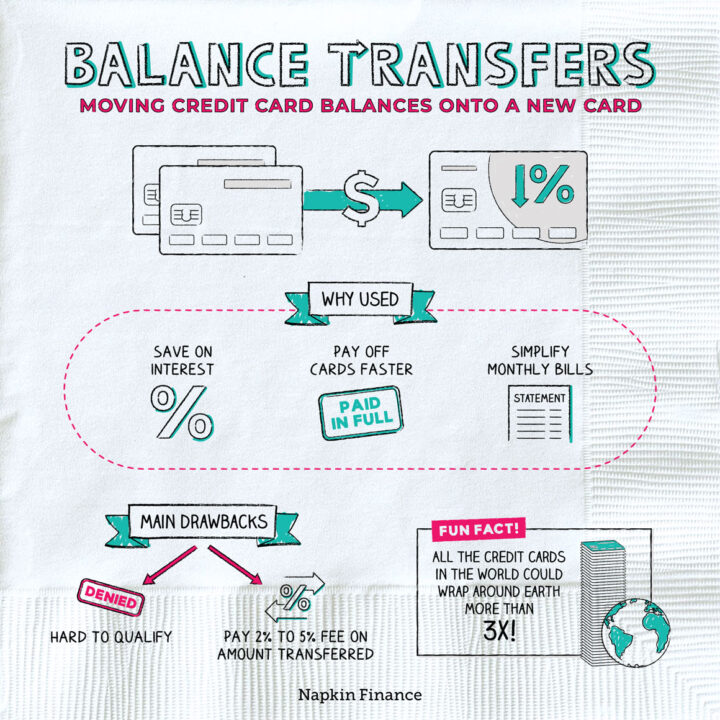

Balance Transfers

Shell Game

Balance transfers are a way to move what you owe on one (or more) credit cards and...

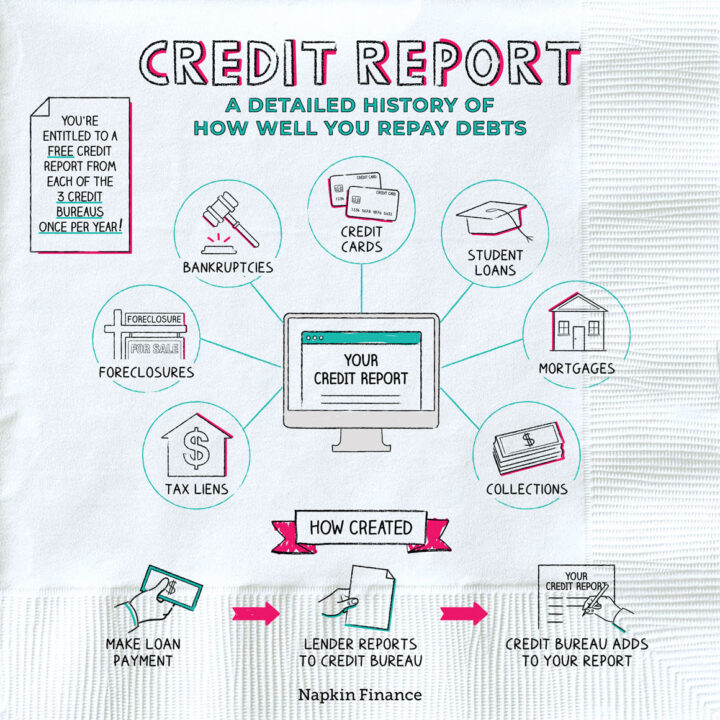

Learn moreCredit Report

Good Marks

Your credit report is a detailed history of your past use of credit. It’s a bit like...

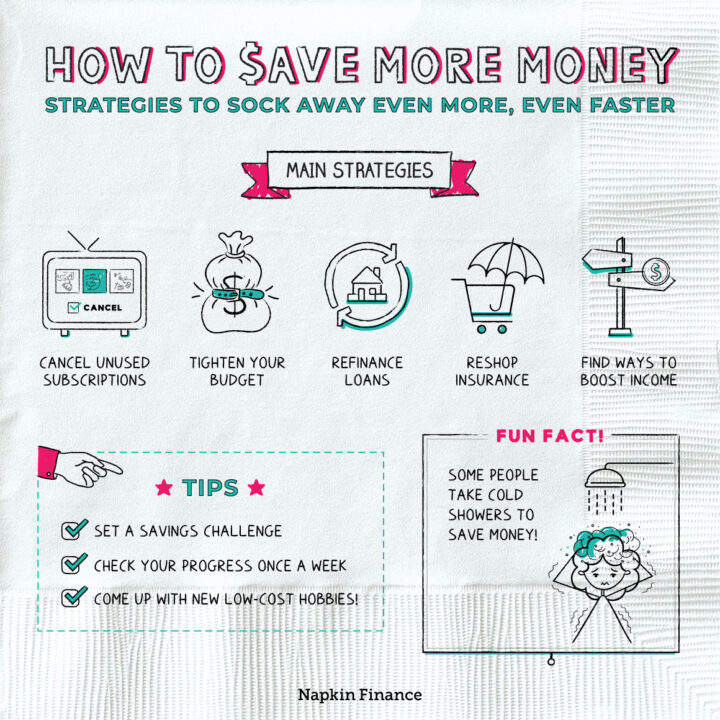

Learn moreHow to Save More Money

Keep the Change

Like many good habits, saving more money is easier said than done. Once you’ve gotten into a...

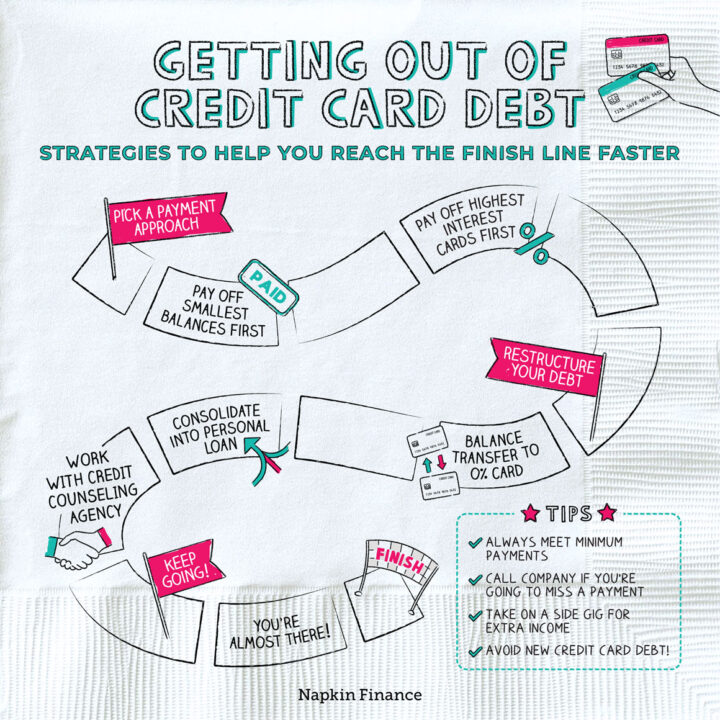

Learn moreGetting Out of Credit Card Debt

Pay the Piper

Credit card debt can be overwhelming. As interest accrues, your balances may keep increasing even if you’re...

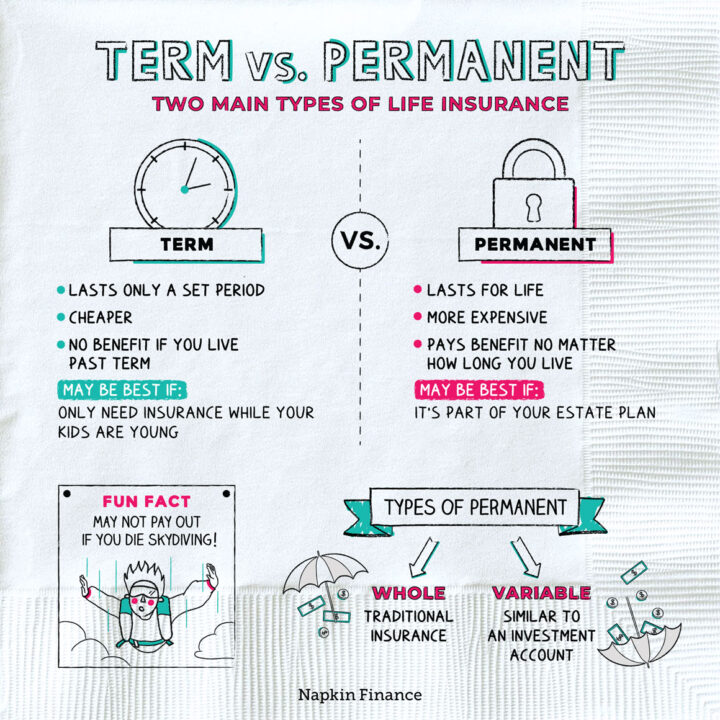

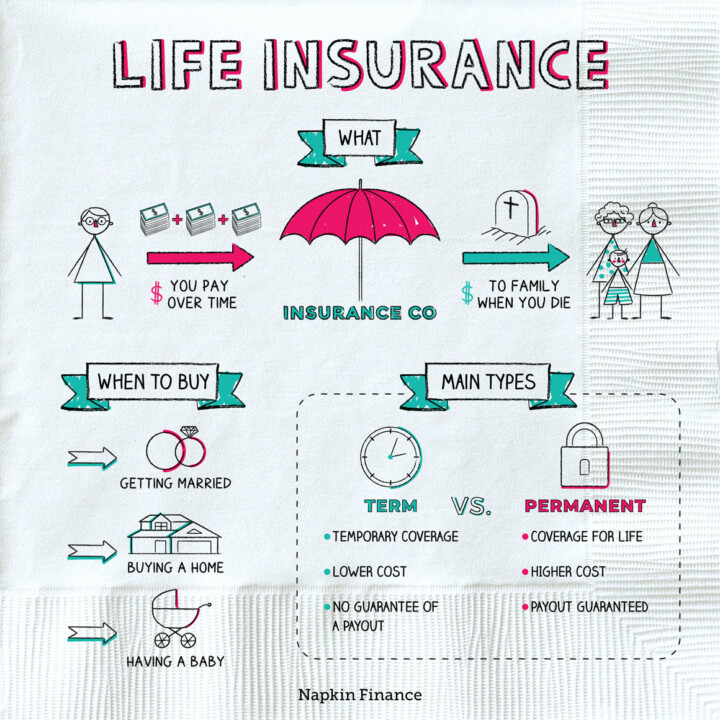

Learn moreTerm vs. Permanent Life Insurance

Life Sentence

Term and permanent policies are the two main types of life insurance. With both types of policies,...

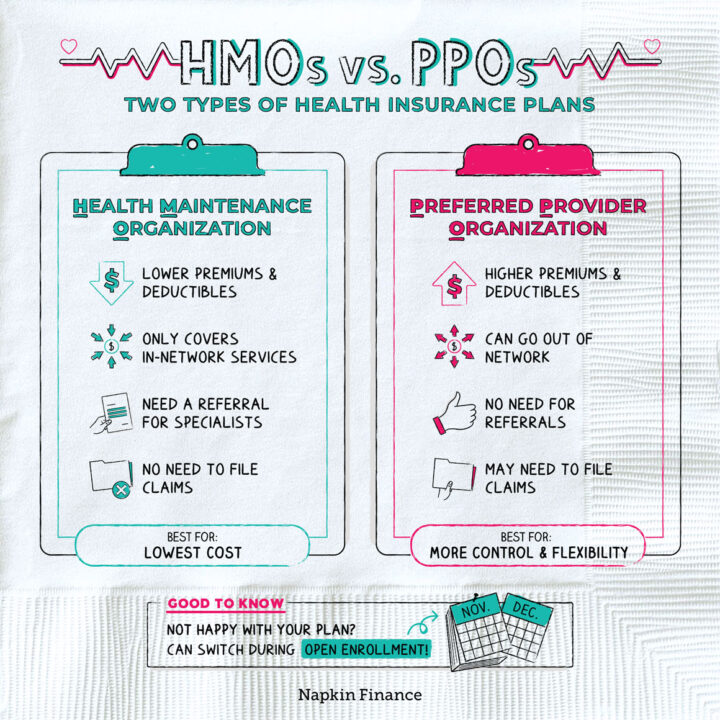

Learn moreHMO vs. PPO

Bill of Health

HMOs and PPOs are two different types of health insurance plans. HMO (or Health Maintenance Organization) plans...

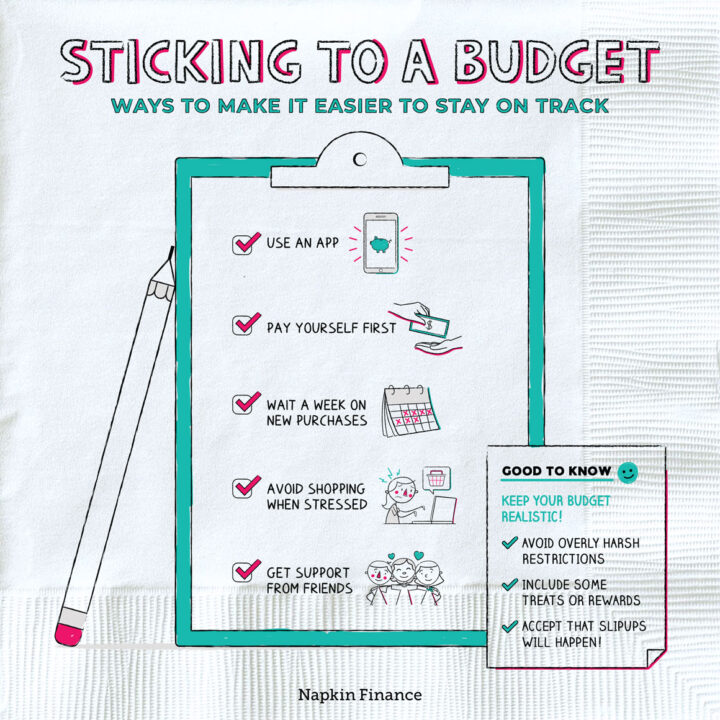

Learn moreSticking to a Budget

In It to Win It

Budgeting can be a lot like dieting. You start out with big hopes for dramatic changes in...

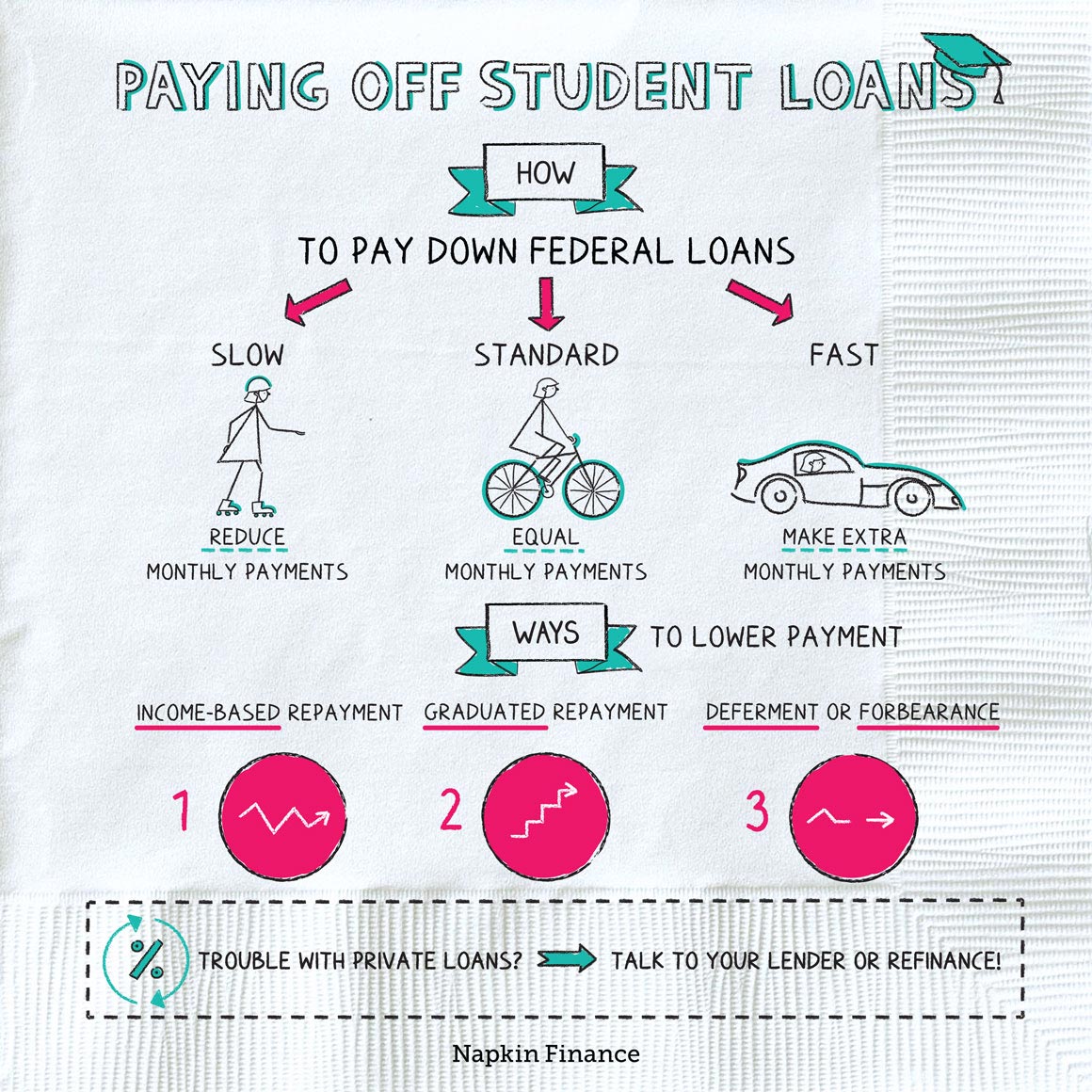

Learn morePaying Off Student Loans

Take a Load Off

It might seem like there’s only one way to pay down your student loans (namely: slowly, painfully,...

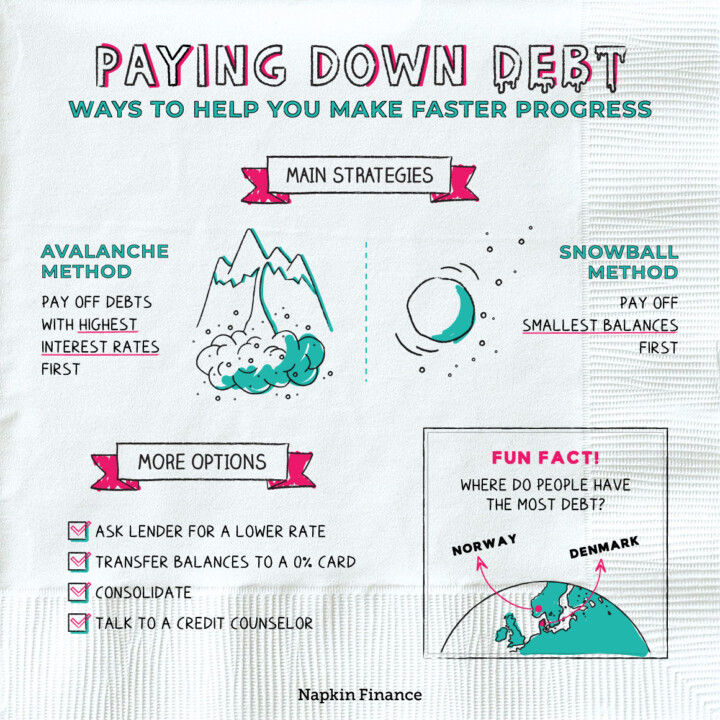

Learn morePaying Down Debt

Get Low

Paying down debt can make you more financially secure and give you more flexibility when deciding what...

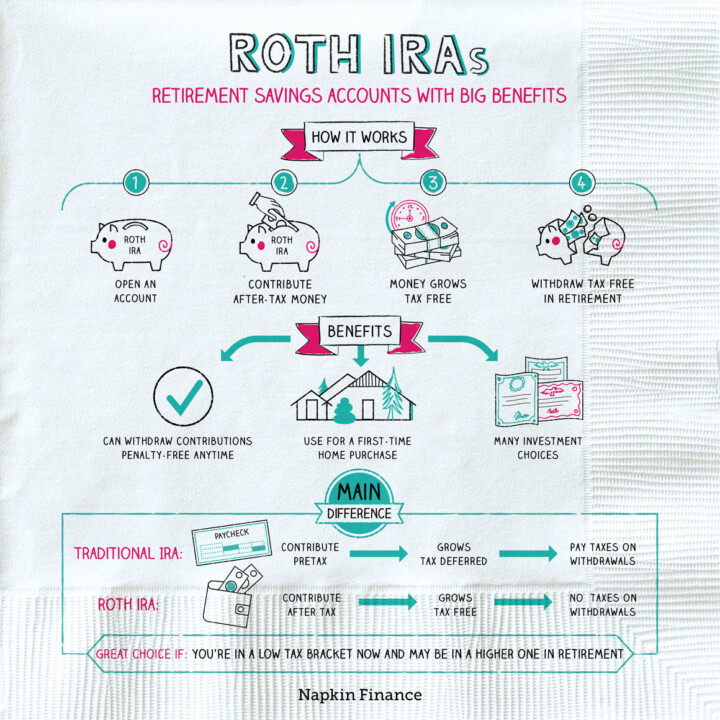

Learn moreRoth IRAs

Road to Retirement

A Roth IRA, or Individual Retirement Account, is one of the most common types of retirement savings...

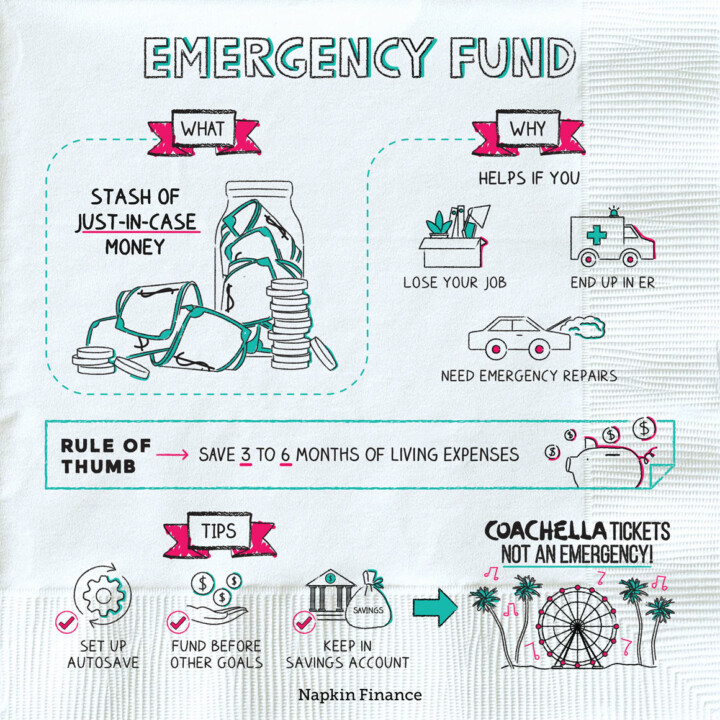

Learn moreEmergency Fund

Cash Cushion

An emergency fund is your stash of just-in-case money. Along with your insurance coverage, it’s a vital...

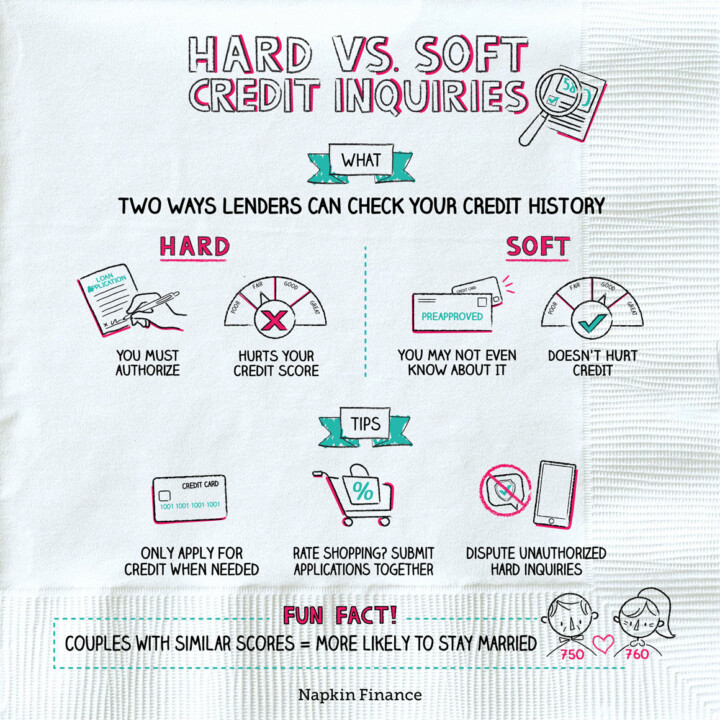

Learn moreHard vs. Soft Credit Inquiries

Extra Credit

Banks, lenders, and others use your credit report and scores to determine your creditworthiness. In other words,...

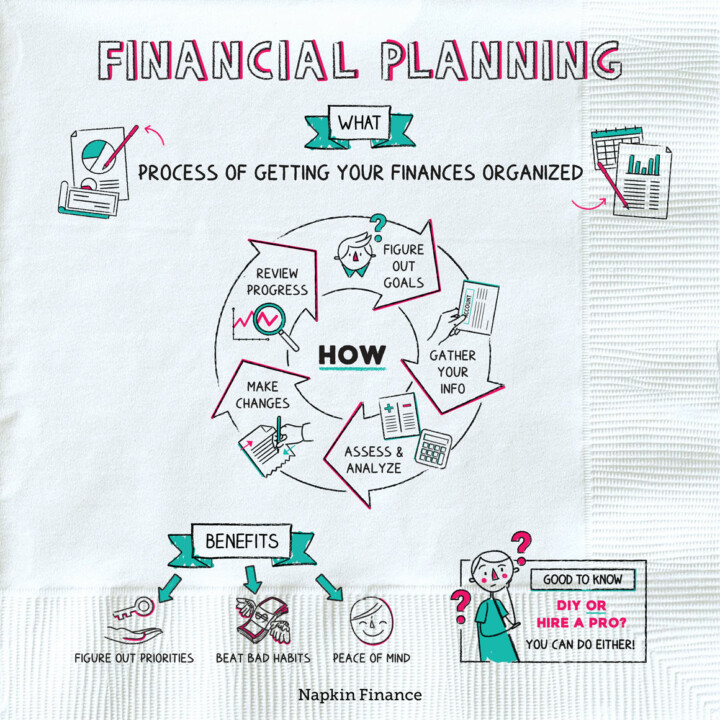

Learn moreFinancial Planning

Ducks in a Row

Financial planning describes the process of mastering your money. It means figuring out where you actually are...

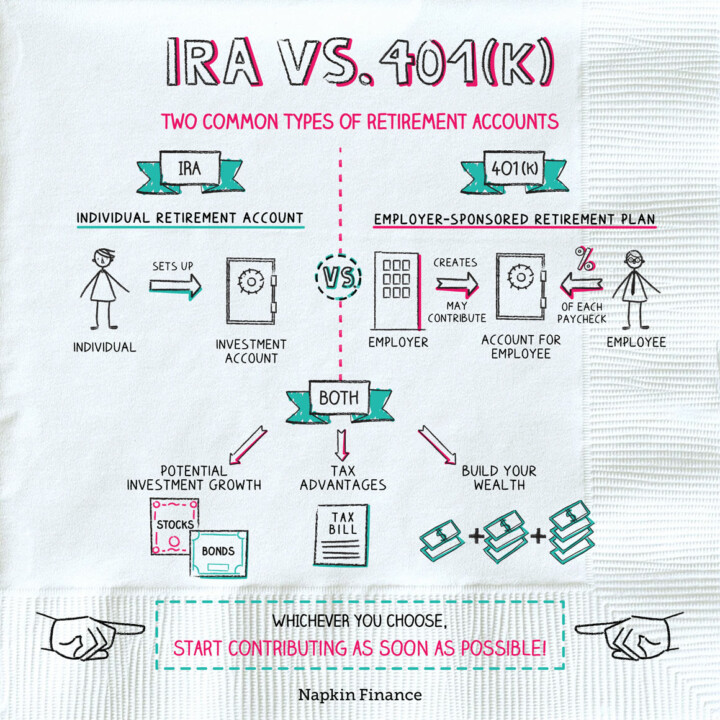

Learn moreIRA vs. 401(k)

Nest Eggs

IRAs and 401(k)s are two popular types of retirement savings accounts. Most people who work in the...

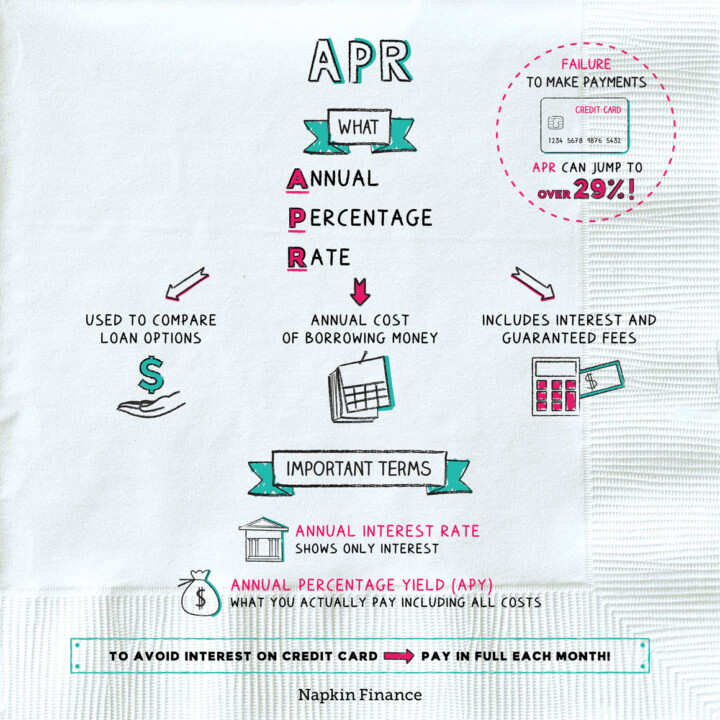

Learn moreAPR

Another Day, Another Dollar

An annual percentage rate (APR) represents the annual cost of borrowing money, including fees. Because the APR...

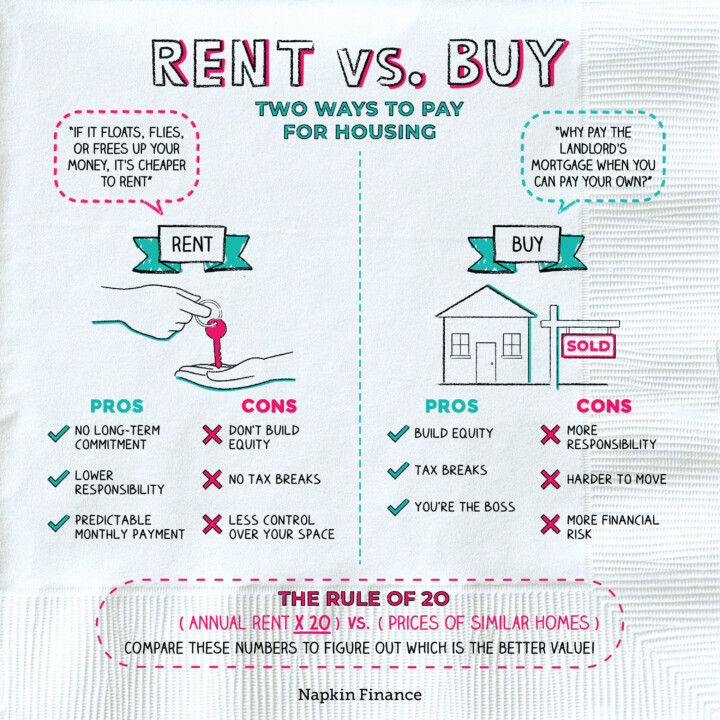

Learn moreRent vs. Buy

Where the Heart Is

The choice between renting or buying a home may be one of the biggest decisions you make...

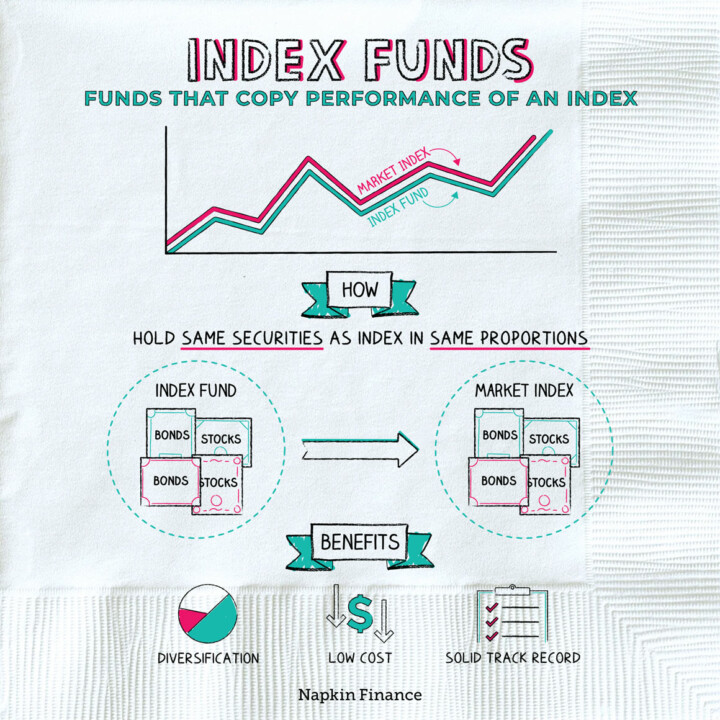

Learn moreIndex Funds

Copy That

An index fund is a professionally managed collection of stocks, bonds, or other investments that tries to...

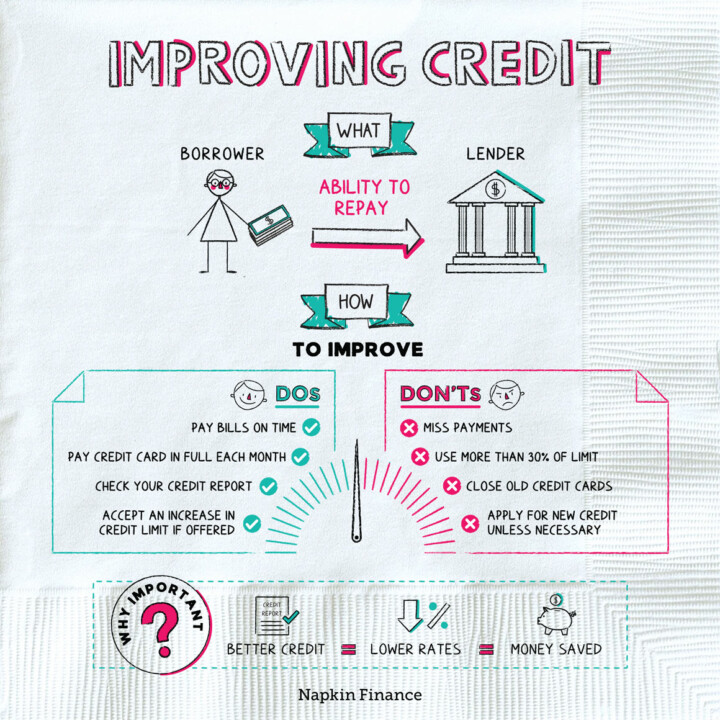

Learn moreImproving Credit

Extra Credit

Your credit report and credit scores describe whether you have a good track record of repaying borrowed...

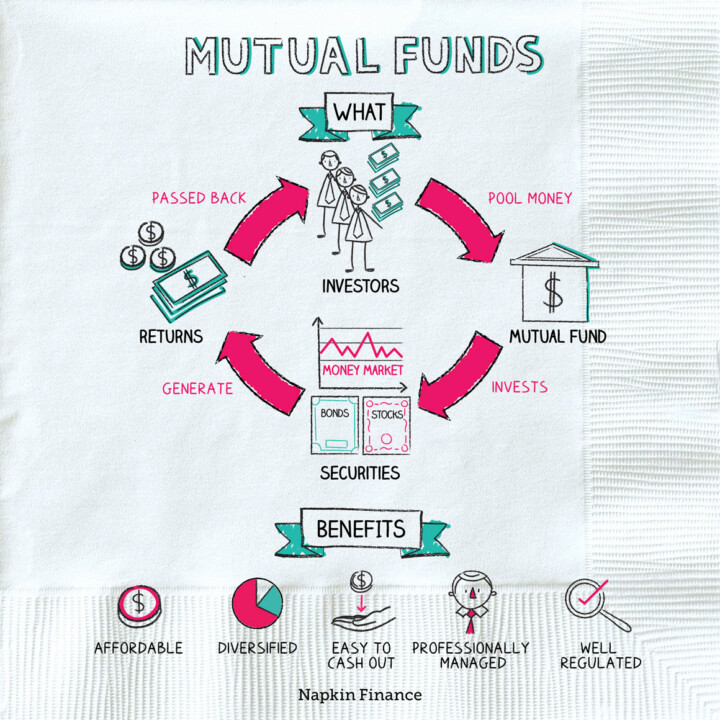

Learn moreMutual Funds

Join Forces

A mutual fund is a professionally managed fund that pools lots of investors’ money in order to...

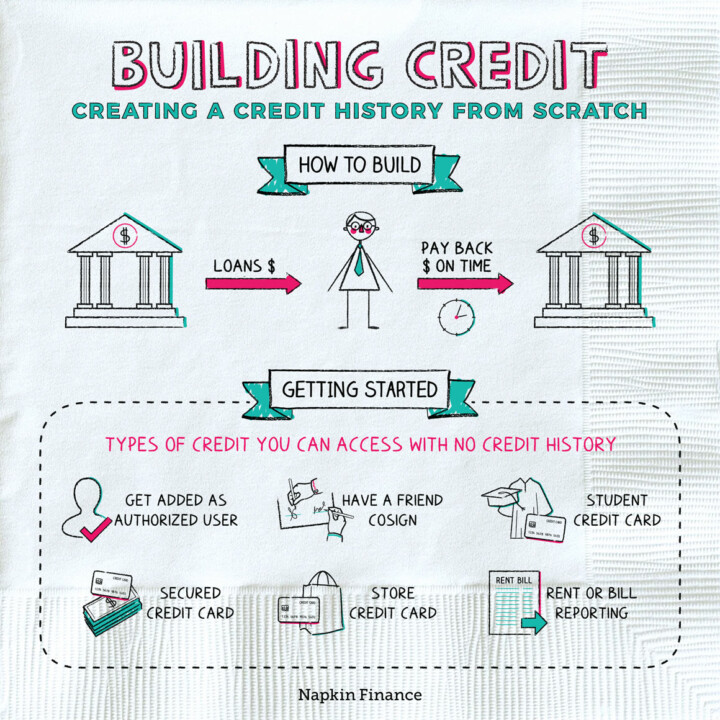

Learn moreBuilding Credit

Bit by Bit

Credit is money that’s available to you to borrow whether through a credit card, mortgage, car loan,...

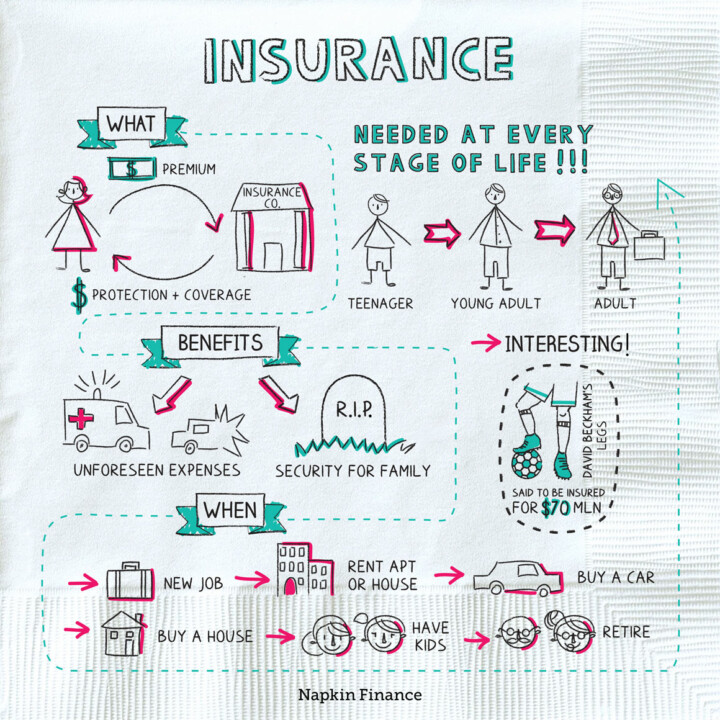

Learn moreInsurance

Cover Your Assets

Insurance is financial protection. Along with your emergency fund, insurance makes up your safety net so that...

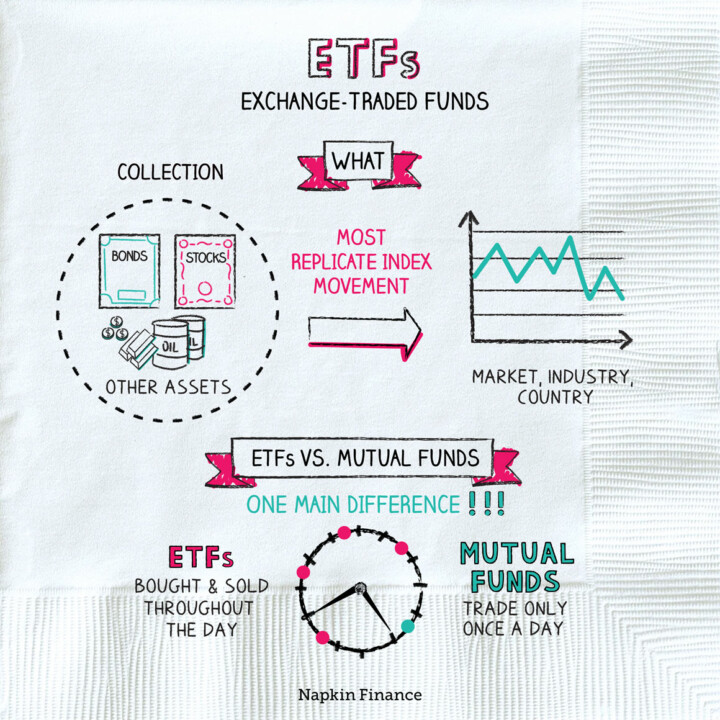

Learn moreETFs

Jack-of-All-Trades

Exchange-traded funds (ETFs) are investment vehicles similar to mutual funds. Like mutual funds, ETFs are professionally managed...

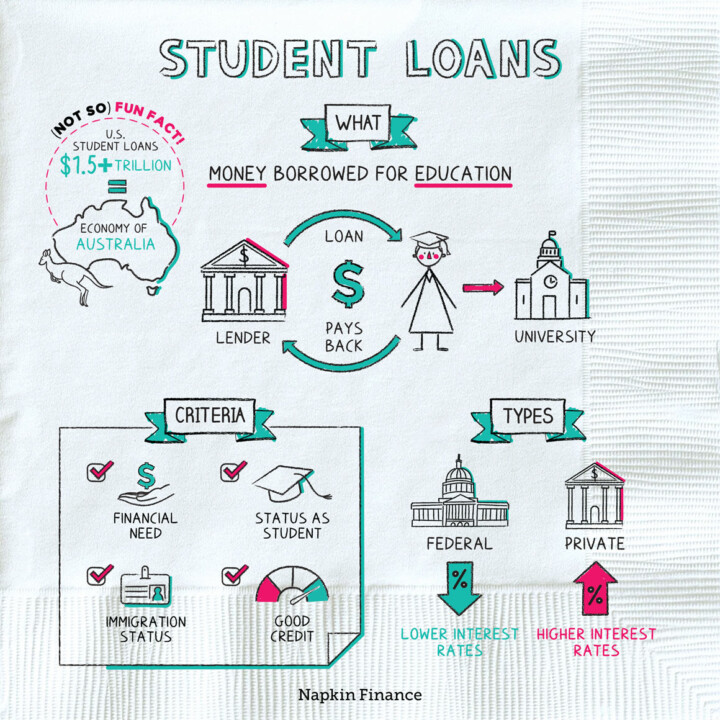

Learn moreStudent Loans

Old College Try

A student loan can be any kind of borrowed money that’s used to pay for education. Although...

Learn moreLife Insurance

Beyond the Veil

Life insurance is a contract with an insurance company. In exchange for periodic payments, the insurance company...

Learn more