Credit

Permanent Record

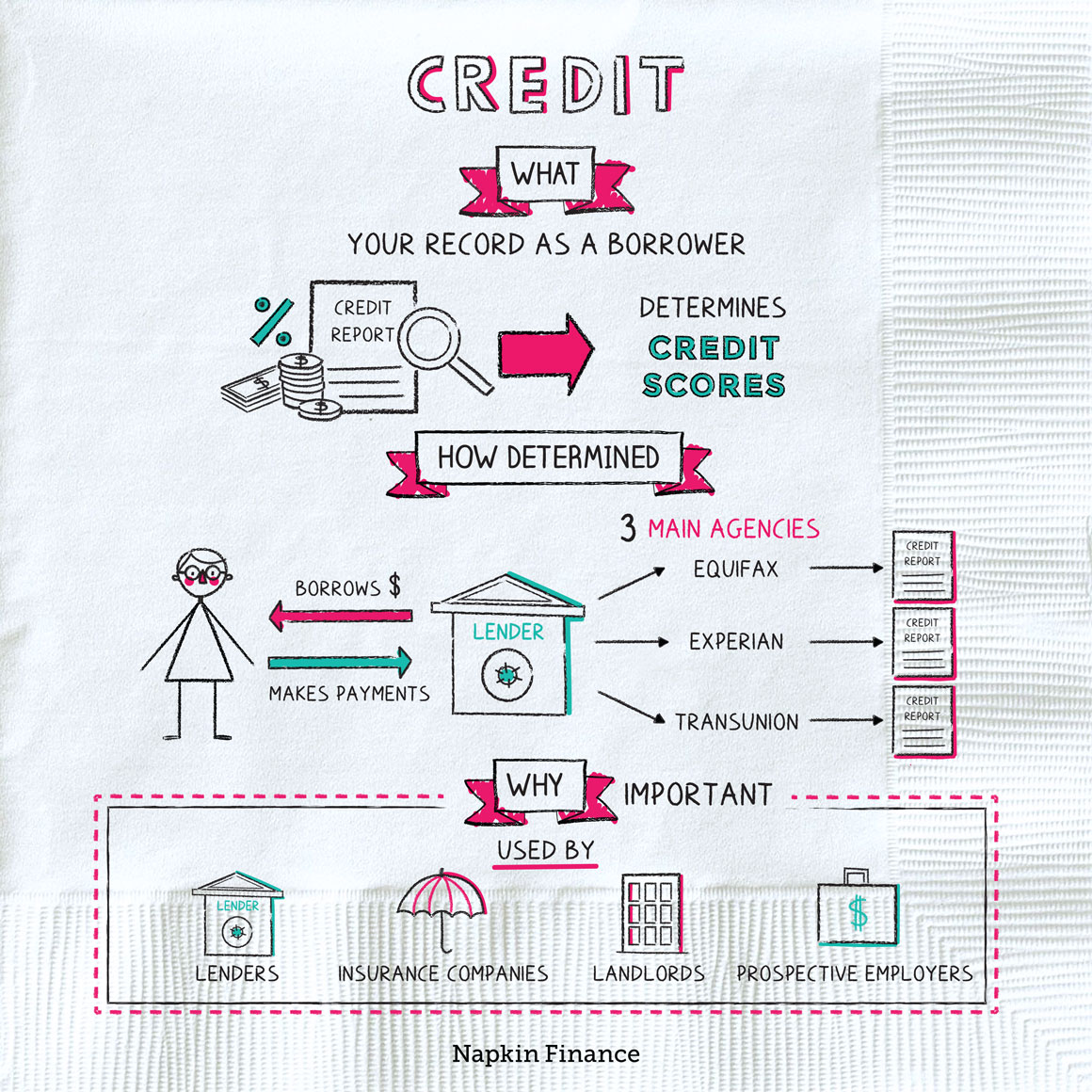

Credit is, simply put, your financial reputation. Your credit history describes your record as a borrower, including whether you’ve generally paid bills on time or not.

Your credit history can be used for many reasons, including by:

- Lenders, in deciding whether to loan you money

- Lenders, in deciding what interest rate to charge you

- Insurance companies, in setting what rate to charge you

- Landlords, in deciding whether to rent to you

- Prospective employers, in deciding whether to hire you

You generally build credit any time you borrow money. Repaying money as promised helps you build good credit. Missing payments builds a poor credit history. Actions that affect your credit score can include:

- Spending on your credit card and paying your monthly bill

- Making or missing your student loan payments

- Making or missing payments on any other type of debt, including a car loan or mortgage

- Unresolved overdrafts on your bank account

- Unpaid utility bills or doctor bills

- Any time a bill goes to collections

Private companies called “credit bureaus” keep track of your credit history. If you miss a credit card payment, your card issuer will probably report the missed payment to the bureaus. (Sometimes, it’s possible to persuade a lender not to report a missed payment.) The three main credit bureaus are:

- Equifax

- Experian

- TransUnion

The credit bureaus will keep track of everything that’s reported to them for seven to 10 years (after that, negative marks generally get erased). That information is called your “credit report,” and it’s used to calculate your credit scores.

Your credit report includes four buckets of information.

| Category | What it includes |

| Personal | Your name, Social Security number, birthdate, phone numbers, addresses, and employers |

| Account | Credit account details, including credit limits, balances, payment history, and lender information |

| Inquiries | Any recent (the past year or two) applications for new credit |

| Public records and collections | Bankruptcy filings, tax liens, certain court judgments, foreclosures, and accounts in collections |

The information in your credit report mostly comes from your lenders. Every time you make (or miss) a payment, that information is sent from your lender to the credit bureau, and then the credit bureau updates your report. There are a few important points to know about this:

- It takes some activities up to 30 days to appear on your report. So if you just paid off a credit card in anticipation of applying for a loan, you might want to hold off on that application until the payment shows up on your report.

- Not all lenders share information with all three credit bureaus (and the bureaus don’t always share information with each other), so your report might look different from one bureau to the next.

- The credit bureaus can take information from public records and add it to your report.

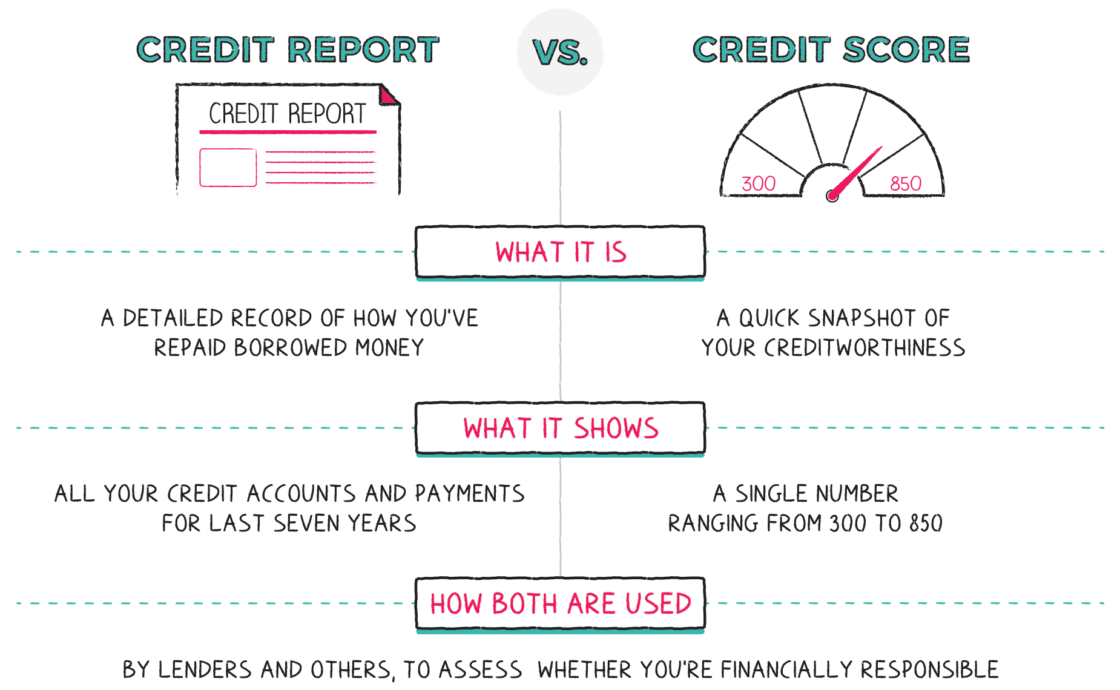

Your credit score and credit report are related, but they aren’t the same thing. Think of your credit score as the Cliff notes version of the far more detailed credit report.

A credit bureau or lender condenses all the information in your credit report into a three-digit score ranging from 300 to 850. If your credit report shows that you pay your bills on time and don’t carry a huge amount of debt, your number will be higher. If you miss payments, max out your credit cards, or have bills in collections, your score will be lower.

You can have many different scores, and some lenders even calculate a special score based on what type of credit you’re looking for (for example, an auto loan).

Your credit is a record of your borrowing and repayment activity. Lenders report this information to the credit bureaus, which maintain your credit report. This report—and the associated credit score—help lenders, landlords, employers, and others decide whether to do business with you.

- Both Equifax and Experian started as groups of business owners who decided to share notes on which of their customers weren’t paying their debts.

- Equifax allegedly used to collect information on consumers’ marriages, political activities, and even “bedroom activities” (wink wink).

- Your credit and credit history describe your record as a borrower.

- Credit is important because it can affect your ability to obtain loans or even get hired for a job.

- Lenders report information about how much you borrow and whether you repay debts on time to credit bureaus, which compile this information into your credit reports.

- Your credit report is used to calculate your credit score, a three-digit number ranging from 300 to 850. The higher your number, the better!