Credit Cards

Swipe Right

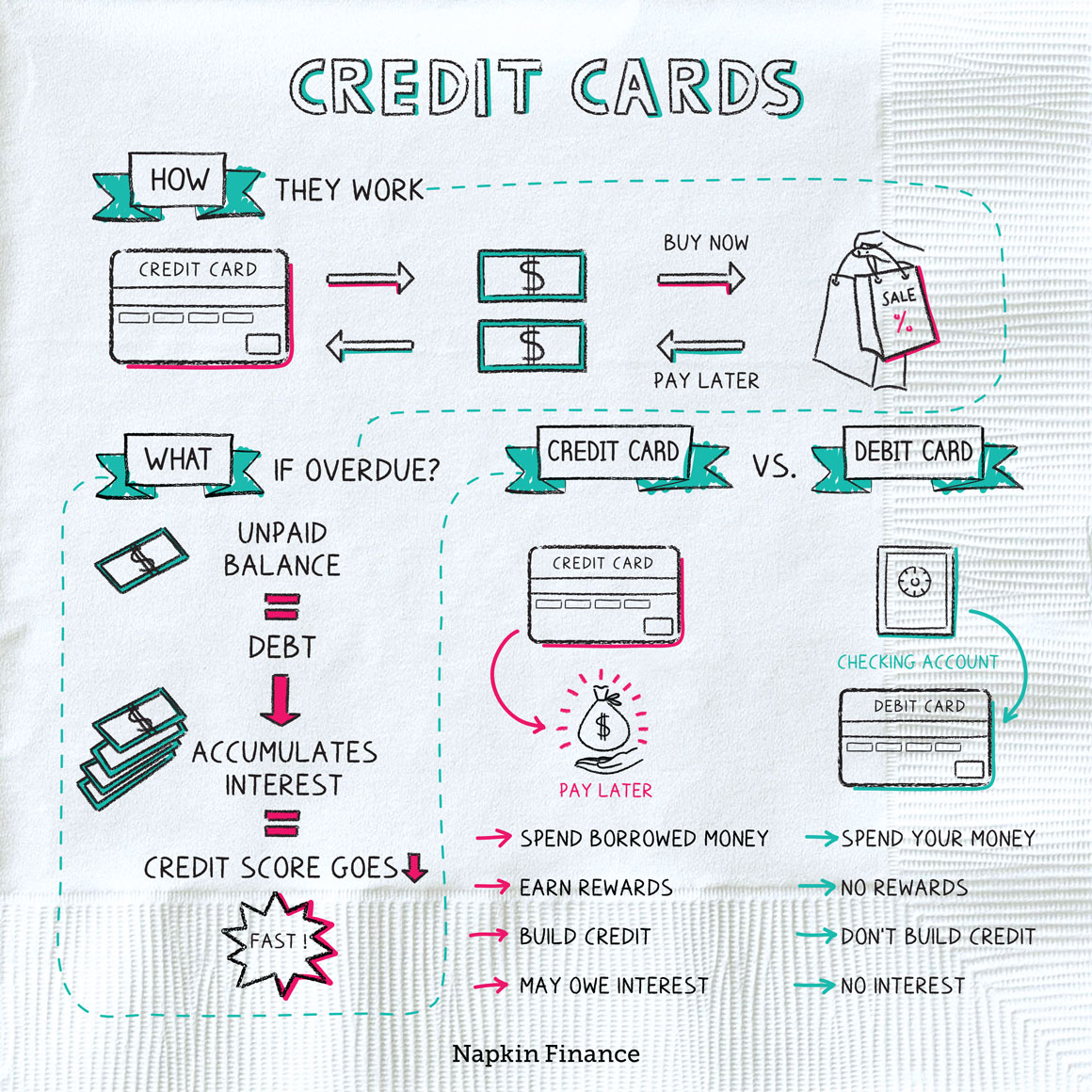

A credit card lets you buy now and pay later, all without the hassle of counting out bills or change. When you spend on a credit card, you are borrowing from the issuer (such as the bank that issued your card). At any given point in time, your card balance is the total amount you currently owe.

Credit cards generally come with a set limit—the maximum balance you can carry—such as $5,000. If you try to spend beyond your limit, your card will probably be declined.

While there are hundreds of different credit cards to choose from, they come in two primary forms:

- Unsecured: The more traditional and common type, these don’t require an up-front deposit and often come with better rewards and lower interest rates than secured cards.

- Secured: Used mostly by those building (or rebuilding) credit, these require an up-front cash deposit to the card issuer, which then lets you borrow up to that amount.

No matter the type, each card will have a minimum payment due each month. That amount can fluctuate based on your balance.

Nothing in life comes free, and that extends to credit cards. When choosing one, there are several costs to consider. These include:

- Annual percentage rate (APR): Your card’s interest rate. It’s usually a variable rate, meaning it can change over time. You might qualify for a lower APR if you have a good credit score (and vice versa), though you can avoid paying any interest if you pay your balance in full each month. You might also have different rates for different transactions—whether buying something, transferring a balance, or taking a cash advance.

- Fees: Not all cards charge fees (and not all have the same fees), but among the most common are:

- Annual fee

- Late-payment fee

- Cash-advance or balance-transfer fee

- Foreign-transaction fee

- Over-limit fee

Because fees and interest rates can vary from card to card, if you’re in the market for a new credit card, it’s a good idea to shop around to see where you can get the best deal.

As with any other type of debt, you need to make your credit card payments on time. Interest will start to accrue on any balance that you carry from one month to the next. And if you don’t at least make your minimum payment, your account will probably also start to accrue fees. Missing credit card payments is a surefire way of tanking your credit score, fast.

If you’re careful with your plastic, credit cards can offer the following advantages:

- Easy to use online

- Offer solid protections if your card is lost or stolen

- Can help you build your credit history

- May let you earn rewards when you spend on the card

Depending on the card you choose, you could earn rewards, such as cash back, airline miles, or points you can put toward a range of different uses. You typically need to already have rock-solid credit in order to qualify for the best rewards deals.

Although you can generally use credit and debit cards the same way—whether swiping at the store or placing an order online—they have some important differences.

| Credit cards | Debit cards | |

| What? | Spend borrowed money that you have to repay later | Spend directly from your bank account |

| Owe interest? | Pay interest on any balance you carry month to month | Pay no interest |

| Earn rewards? | Yes, with a rewards card | Typically, no |

| Impact on your credit history? | Build good credit if you pay on time or bad credit if you don’t | No impact |

| Difficult to obtain? | Have to pass a credit check to get one | Generally, qualify automatically when you open a bank account |

A credit card lets you borrow money when you need it and pay it back later. Secured credit cards require an up-front deposit before you spend any money, while unsecured cards don’t. Banks, credit unions, and stores offer credit cards, and the fees, APRs, and rewards they come with can vary. Credit cards can help you build good credit if you use them responsibly or bad credit if you don’t.

- There are almost 400 million open credit cards in the U.S.—a little more than one for every person.

- Until 1974, women needed their husbands to cosign to get a credit card. The Equal Credit Opportunity Act then banned discrimination in issuing credit. (Women are still charged higher interest rates, on average.)

- When you spend with a credit card, you are taking out a loan.

- There are two primary types: secured cards, which require an up-front deposit, and unsecured cards, which are the more common type and don’t require a deposit.

- As with any other type of borrowed money, you need to pay your credit card bills on time or else interest and fees may accrue.

- Credit cards and debit cards may look almost identical but have important differences in terms of interest charges, effects on your credit history, and the potential to earn rewards.