Improving Credit

Extra Credit

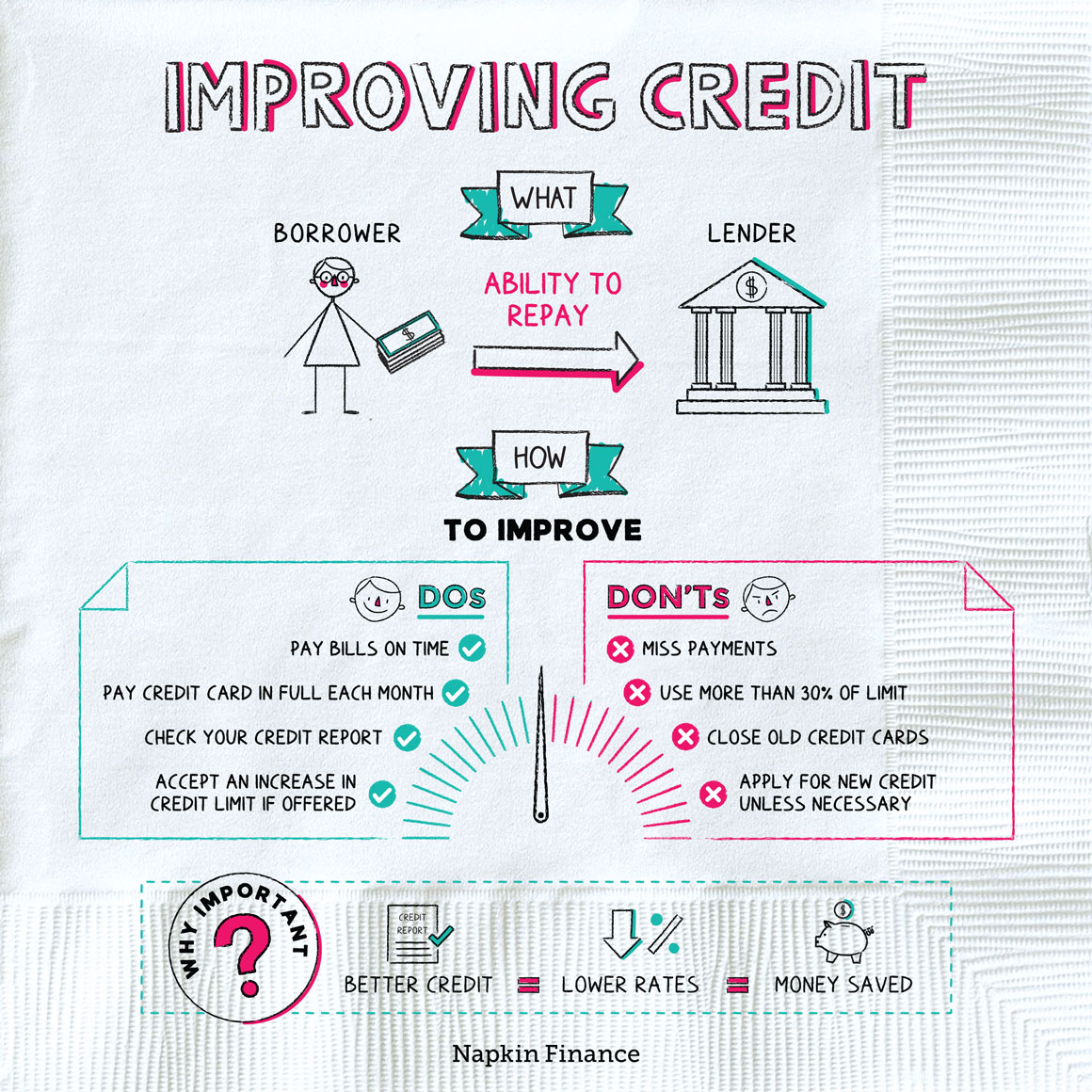

Your credit report and credit scores describe whether you have a good track record of repaying borrowed money.

Lenders and others may use your credit history to get a sense of whether you’re likely to fulfill your financial obligations. With a good credit history, it can be easier to open a credit card, get an apartment or a mortgage, or even get hired for a job.

Whether you already have a flawless credit history or you’re financially challenged, try taking these steps to boost your score:

- Pay all bills on time.

- Pay your credit card off in full each month.

- Check your credit report periodically for errors.

- Accept any increases in your credit limit that your issuer offers you.

To protect your history and score, you should also try not to:

- Miss payments (not just on your credit cards but on anything).

- Use more than 30% of your credit limit on any given card.

- Close old credit cards.

- Apply for new credit unless you’re sure it’s the right move.

Checking your credit report at least once a year is a big part of protecting your credit (you’re entitled to a free report from each of the three main credit bureaus once per year). You might spot mistakes, accounts you don’t recognize, or even accounts you forgot about.

Keep an eye out for these red flags:

- Incorrect personal information—like a misspelled name, wrong Social Security number, or unfamiliar address

- High outstanding balances—like if there’s an old account you forgot about or if an account balance is reported incorrectly

- Wrong account status—watch out for open cards reported as closed (and vice versa), account listed multiple times, or payments listed as late that you actually made on time

- Accounts in collections—whether an account you actually paid off that wrongly went to collections or an old account that you just forgot about

- Unfamiliar accounts—such as loans or credit cards that you’ve never opened

If you think there’s an error on your report, contact each of the three credit bureaus (Equifax, Experian, and TransUnion) ASAP to get it sorted out.

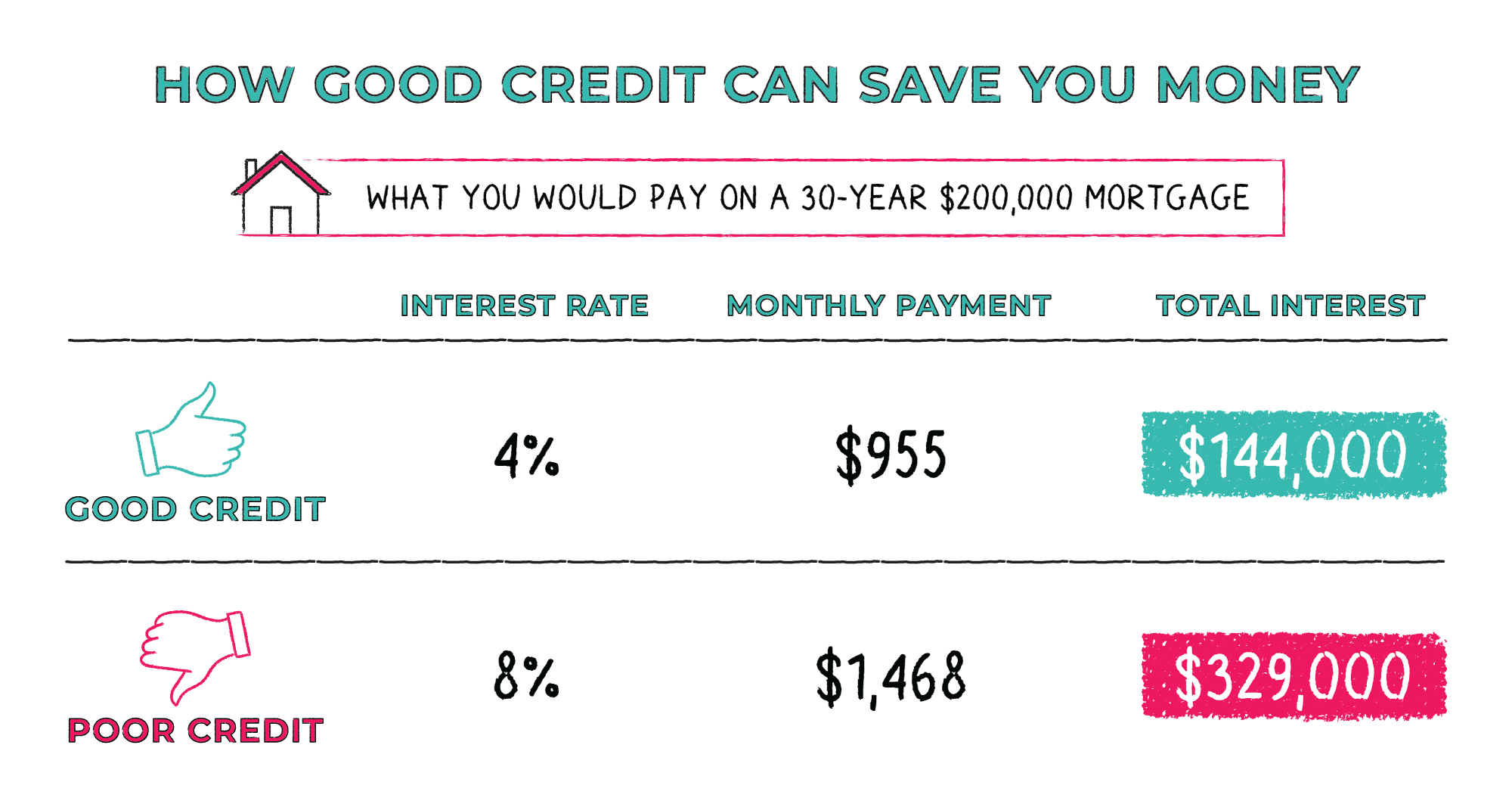

A good credit score can save you real money by qualifying you for better interest rates on loans.

Consider two mortgage borrowers—both looking to borrow $200,000 over 30 years. The borrower with the better credit score could save almost $200,000 in interest payments over the life of the loan.

Raising your credit score and protecting it over the long term takes patience and persistence. As you work at it over time, keep in mind that:

- There’s no quick fix.

- You can’t make your credit score jump from bad to good in a day, week, or month. Depending on how much work it needs, it could even take years.

- Lenders report your activity to the credit bureaus every 30 days or so.

- That means it can take some time for your hard work to actually show up on your report—like if you finally pay off a credit card balance.

- Bad stuff stays around for years.

- Late payments, bankruptcy, collections, and the like can stay on your credit report for seven to ten years (though they have less of an impact on your score over time).

- Don’t think it’s NBD to skip a payment or two.

- Creditors can be your best friends.

- Your creditors want you to pay your bills, so give them a call if you’re struggling and see what you can work out.

And remember that consistency is important. Keep paying your bills on time, apply for new credit sparingly, and don’t go on any credit card benders. Eventually, your credit will get and stay where you want it to be.

Good credit can help you access the resources you need, usually at better terms (such as lower rates and fees). You can improve your credit by paying your bills on time, keeping your account balances low, and avoiding opening too many accounts. Checking your credit report regularly to look for red flags—such as incorrect account balances or loans you never took out—can also help improve your credit.

- The word credit comes from the Latin word credere, which means “to trust.”

- Improving your credit could mean improving your romantic prospects if you use CreditScoreDating.com, a dating site for people who care a lot about prospective suitors’ financial histories.

- To improve your credit, make sure you pay all your bills on time and pay off your credit card balance in full each month.

- It can also help to avoid applying for new credit, closing old cards, and using more than 30% of your credit limit on a given card.

- Having good credit can make it easier to borrow money or rent an apartment, but it can also save you real money when it comes to taking on a mortgage or other large loan.

- Check your credit report at least once a year to look for red flags, and report any errors to the credit bureaus as soon as you find them.

- You can’t fix bad credit overnight, but following best practices consistently will help boost it over time.