E-Filing

Signed, Sealed, Delivered

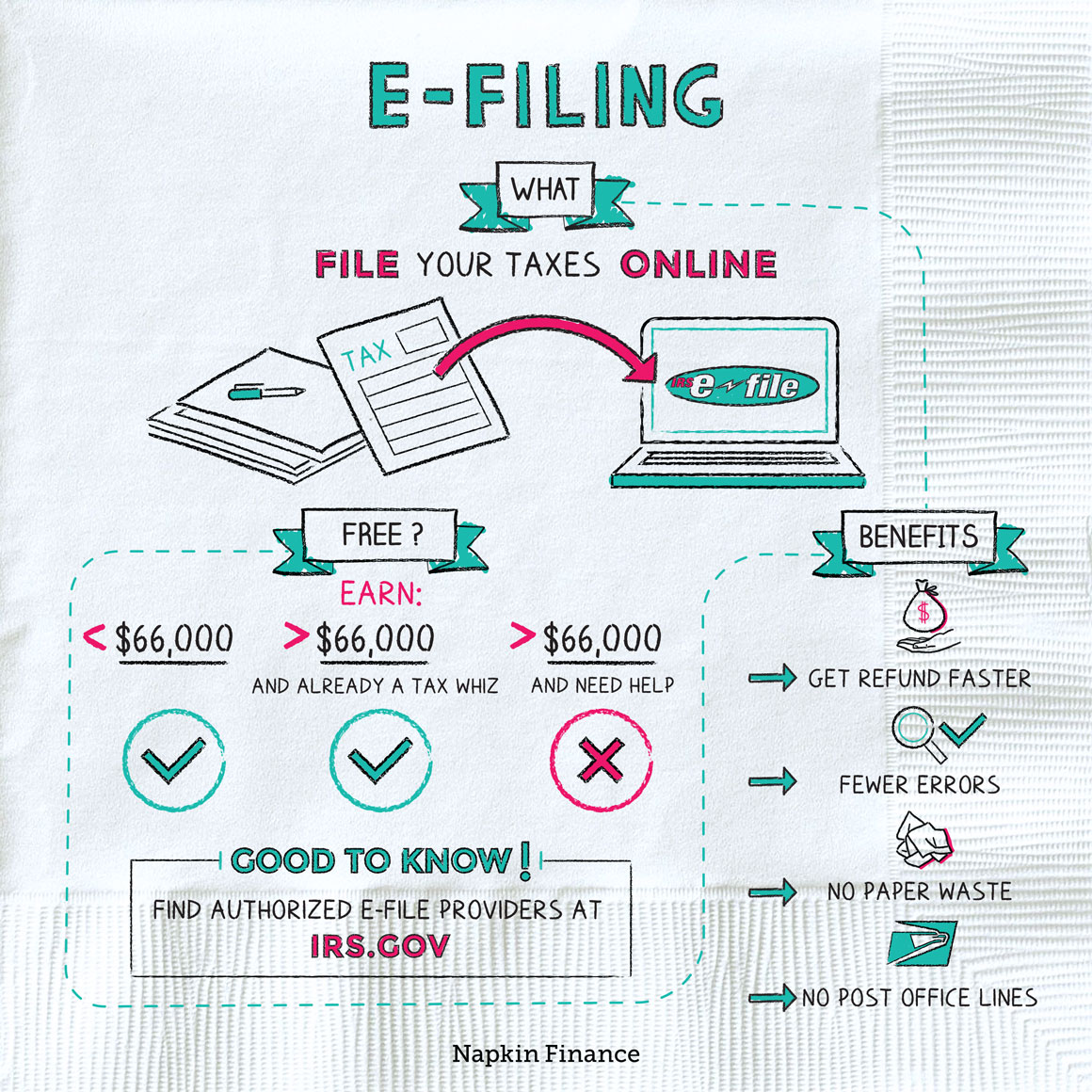

E-filing means filing your taxes online. You’ll still need all the same documents you’d use to file a paper return, but you won’t have to worry about messy handwriting or missing pages.

You can e-file through a software program that walks you through the process step-by-step and calculates everything for you, or you can fill out your forms yourself and submit them to the IRS electronically. The option that’s best for you depends on your income and math skills.

The main benefit of e-filing is that it can take the guesswork out of doing your taxes.

Automated e-filing software is built to ask you questions and then use your answers to calculate your taxes for you. So, instead of filling out those long forms and schedules and trying to follow complicated instructions, you can just answer the program’s questions and let it do all the work.

E-filing can also mean:

- Faster processing times (meaning your refund should arrive faster)

- Reduced chance of errors

- No paper waste

- No post office lines

If you opt to have your tax refund deposited directly into your bank account, the process can be 100% paperless from start to finish.

Several different websites allow you to e-file your taxes, including some you’ve probably heard of, such as H&R Block and TurboTax.

An Internet search for e-filing will bring up plenty of results, but make sure you use a website that’s authorized by the IRS, which provides a list of bona fide services here:

Whether or not you qualify for free e-filing may depend on how much you earn per year and if you’re comfortable crunching the numbers yourself.

| Your situation | Is it free? | You can e-file by . . . |

| Earn less than $66,000 | Yes! | Filing through one of the IRS-authorized software providers. |

| Earn more than $66,000 and are already a tax whiz | Yes! | Using Free File Fillable Forms—basically a 1040 that you fill out and submit online but doesn’t hold your hand or offer advice through the process. |

| Earn more than $66,000 and need help | Nope. | Pay for a premium tax filing service through one of the sites authorized by the IRS,

or hire an accountant who can e-file. |

Whether you fill out your tax forms yourself or use software, you’ll need:

- A W-2 from each employer

- A 1099 from each client if you’re a freelancer or contractor

- Tax forms, such as 1099s, for any investment accounts or other income you received

- Records for any business expenses or other deductions you’re eligible for

- Last year’s tax return

- Your taxes are due April 15 unless you file for an extension.

- You can use this handy IRS look-up tool to figure out which free filing sites you qualify for.

- The IRS website can help you understand any deductions, credits, or forms you need help with. Just use the search bar at the top of the page.

- Self-employed or freelance workers generally need to pay the self-employment tax in addition to income taxes—but may also qualify for more deductions—so your taxes might be a bit more complicated.

Tax season may not be anyone’s favorite time of year, but using an authorized e-filing program can help you hold onto your sanity and get your refund faster.

- You might not have to file at all if you’re under 65 and had income of less than $12,000 during the year. (However, you might be missing out on a refund if you skip it.)

- You pay more in taxes than Amazon.com. The trillion-dollar behemoth paid no federal income taxes in 2018 despite earning profits of more than $11 billion.

- The rate of fatal car accidents tends to go up on tax day. All the more reason to e-file.

- E-filing means submitting your tax return to the IRS electronically.

- You can e-file using automated tax-filing software or online fillable forms that are submitted directly to the IRS.

- Automated software takes care of the math, while fillable forms make you do the heavy lifting.

- If you earn less than $66,000 per year, you may qualify for free e-filing through an IRS-authorized software provider.

- You’ll need all your tax documents handy (such as a W-2 from your employer) to e-file your taxes.