FICO vs. VantageScore

Settle the Score

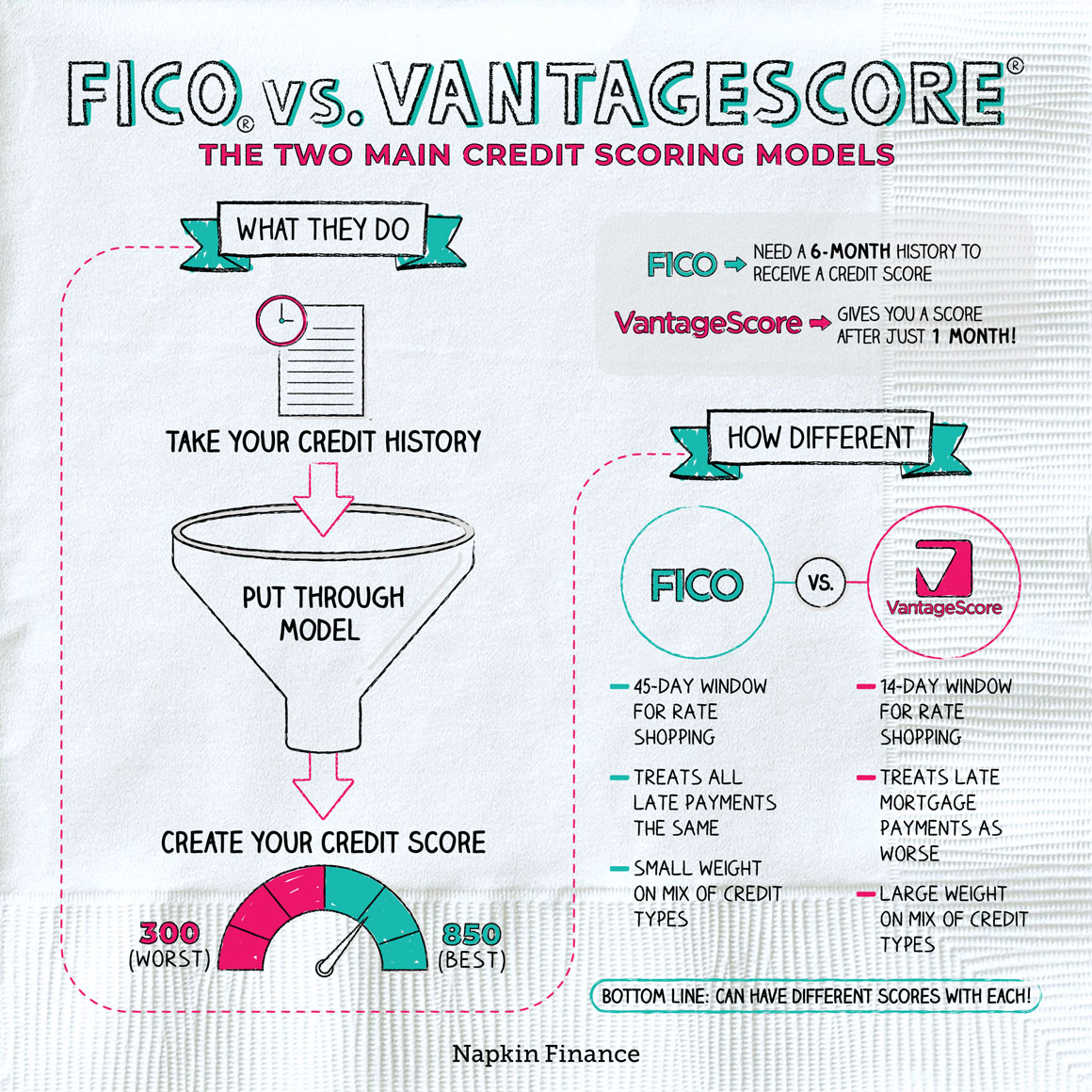

FICO and VantageScore are two of the most common credit scoring models.

Contrary to popular belief, you don’t actually have just one credit score—you can have a number of different scores. One thing that can drive differences in your scores is which company’s model is used, FICO or VantageScore.

In fact, you might have a higher score from one and a lower score from the other.

Both FICO scores and VantageScores are used to rate your creditworthiness or to predict how likely you are to pay back borrowed money.

Both models give you a credit score that ranges from 300 to 850. The higher your score under either model, the more likely you are to make timely payments.

There’s a lot of overlap in what each model considers. For example, they both consider:

- Your payment history—i.e., whether you have a good track record of meeting due dates on your bills

- The length of your credit history—in either model, a longer credit history should give you a higher score since it means you have more experience with credit

- Any recent new accounts you’ve opened—opening many new accounts is bad for your credit

- Your credit utilization ratio—i.e., your outstanding balances compared with your total credit limits

- The mix of credit types you’ve used—a more varied mix is usually better

However, the two models differ widely in how they treat some more detailed aspects of your credit history. Here are some key items they treat differently:

| FICO | VantageScore | |

| Credit inquiries | Gives you a 45-day window for rate shopping (i.e., only dings your credit score once even if you’ve submitted many applications) | Gives you a 14-day window for rate shopping (i.e., only dings your credit score once even if you’ve submitted many applications) |

| Late payments | Treats all late payments the same | Treats late mortgage payments as worse than other late payments |

| Accounts in collections | Ignores collections with an original balance below $100 | Ignores collections once you’ve paid them off |

| Mix of credit types | Gives this minor influence on your score | Gives this major influence on your score |

Those differences mean that if you put your VantageScore and FICO credit scores side by side you’ll probably be looking at two different numbers.

Although FICO scores are still more widely used than VantageScores, VantageScore is gaining ground.

One other major difference between the two is when you can first qualify for a score. FICO won’t produce a score unless you have at least a six-month credit history, but VantageScore will give you a score after just one month.

Here are some other points to keep in mind about the two models and credit scores in general:

- The FICO and VantageScore models are constantly revised. So your score can vary depending on which model is used but also with which version of each model.

- If you’re denied credit or get crummy terms based on your score, the lender has to tell you your score and explain their decision.

- Many companies let you check your credit scores for free, which experts recommend as good practice before you apply for credit just to see where you stand.

FICO and VantageScore are both credit scoring models. Each uses information from your credit report to create your credit score, which tells lenders how likely you are to pay back the money you owe. Both models rate you on a scale from 300 to 850.The higher your score, the less risky you are to lenders and the easier it should be to qualify for credit on good terms.

- Around 1.2% of people have a perfect 850 FICO score. Surprisingly, these credit score unicorns have more credit cards than the national average (but they carry less credit card debt in total).

- Hawaii has the highest percentage of people with perfect FICO scores, while Minnesota residents have the highest average credit score.

- FICO and VantageScore are the two main models used to create credit scores.

- Both use a range from 300 to 850, with lower scores for worse credit histories and higher scores for better histories.

- The two models weigh certain aspects of your credit history differently, so you might have a higher score with one model and a lower score with the other.

- That said, both weigh the major aspects of your credit history in similar ways. So actions you take to improve one score generally ought to improve the other as well.

- If you’re new to credit, you may be able to qualify for a VantageScore sooner than you can for a FICO score because it doesn’t require as long of a borrowing history.