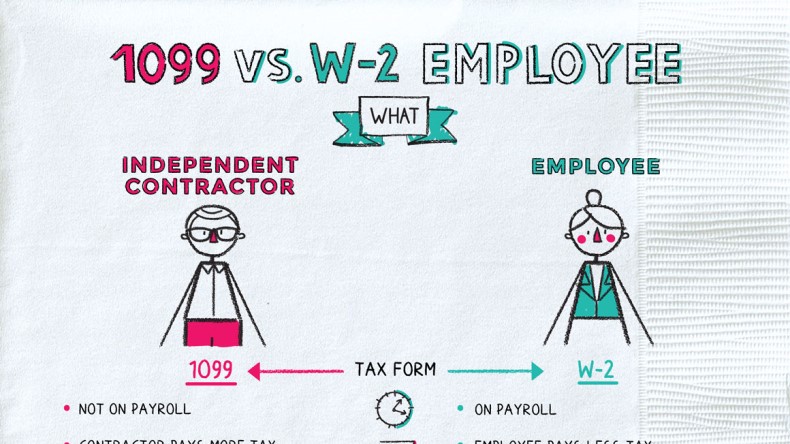

1099 vs. W-2 Employee

Bring Home the Bacon

1099s and W-2s are both types of tax forms. If you’re a contractor, you should receive one or more 1099s at the end of the year. If you’re an employee, you should receive a W-2.

Whether you are classified as a contractor or an employee affects both how much you pay in taxes and when you pay. It can also affect what benefits you’re eligible for:

| Contractor | Employee | |

| Tax form | 1099 | W-2 |

| When you pay taxes | Pay estimated taxes four times a year. | Taxes withheld from your paychecks. |

| You pay | More tax | Less tax |

| Your employer pays | Less tax | More tax |

| Benefits? | May not be eligible for unemployment if you lose your job.

Not eligible for health insurance, 401(k), or other company benefits. |

Generally eligible for unemployment if you lose your job.

Usually eligible for health insurance, 401(k), or other company benefits. |

Your classification dictates what form you get, but why does that matter? Each form includes different information:

- W-2s

- Show earnings over the past 12 months

- List how much your employer withheld in federal, state, and other taxes

- 1099s:

- Show the money you received from a single client

- Occasionally list withheld taxes but do not include the estimated payments you make

Heads up! Even if you’re a contractor, you might not get a 1099. Companies are only required to send 1099s to contractors who earned at least $600 during the previous calendar year. However, the IRS doesn’t care whether you got a 1099 or not. You still need to report your earnings when you file your taxes.

You can tell whether you’re treated as a contractor or an employee by what type of tax form you receive and how you’re paid. If you’re paid every two weeks (or at other regular intervals) through payroll and receive a W-2 at the end of the year, you’re an employee. If you submit invoices for your work and you receive a 1099 at the end of the year, you’re a contractor.

The factors that decide this distinction include:

- How much control you have over the work you do.

- You have more control → contractor

- You have less control → employee

- Whether you pay for your work-related expenses or your employer does.

- You pay for your expenses → contractor

- The company pays → employee

- Whether or not you’re free to seek out additional work in the same field on the side.

- You can have side gigs → contractor

- You can’t (unless you get special permission) → employee

- How integral your contribution is to the business.

- Less integral → contractor

- More integral → employee

- Whether your gig is essentially permanent or will only last for a specific project or period.

- Specific period → contractor

- Essentially permanent → employee

It’s not always straightforward how someone should be classified, and the decision can be controversial.

Gig-economy companies, such as Uber, Lyft, and TaskRabbit, generally classify their workers as contractors (because it’s cheaper for them). But there’s been ongoing legal drama over whether they should really be treated as employees.

- If you’re an employee and you hit someone while driving your car for work, then your employer is probably liable. If you’re a contractor and you hit someone while driving your car for work, then you’re probably liable.

- Even the government can’t always make up its mind on how people should be classified. Different federal government agencies (such as the IRS and the Department of Labor) can have different opinions as can different states or courts. You could have one status for your taxes but another status for another purpose (such as if you’re resolving a labor dispute or if you’re sued for that car accident).

Companies provide W-2 tax forms to their employees and 1099s to contractors. How you’re classified dictates how much and when you pay taxes. Understanding how you’re classified is essential to making sure you file correctly.

- Whether you receive a 1099 or W-2 tax form depends on whether you are a contractor or an employee.

- Your classification affects how much you pay in taxes, when you pay, and what benefits you’re eligible for.

- Both the 1099 and W-2 include your earnings. The W-2 will also list taxes already withheld, but a 1099 often does not.

- How you should be classified can be complicated and depends on several factors.