Paying Down Debt

Get Low

Paying down debt can make you more financially secure and give you more flexibility when deciding what to do with your money. But if you have a large debt load, it can be hard to feel like you’re making a real dent in your balances.

Unfortunately, there’s no magic way to make your debts shrink overnight. But there are strategies that can help you ensure you’re making consistent progress.

Debt isn’t always a bad thing. Having a little can help you build your credit history. Plus, it’s often necessary to live your dreams (it’s not easy to buy a house or pay for college in cash).

But debt can turn bad when it starts controlling your life—like if you’re paying more in interest on something than it cost in the first place.

Reducing your debt load can help you:

- Reduce stress

- Improve your financial flexibility

- Increase your credit score

- Give you extra money for the things you want to do

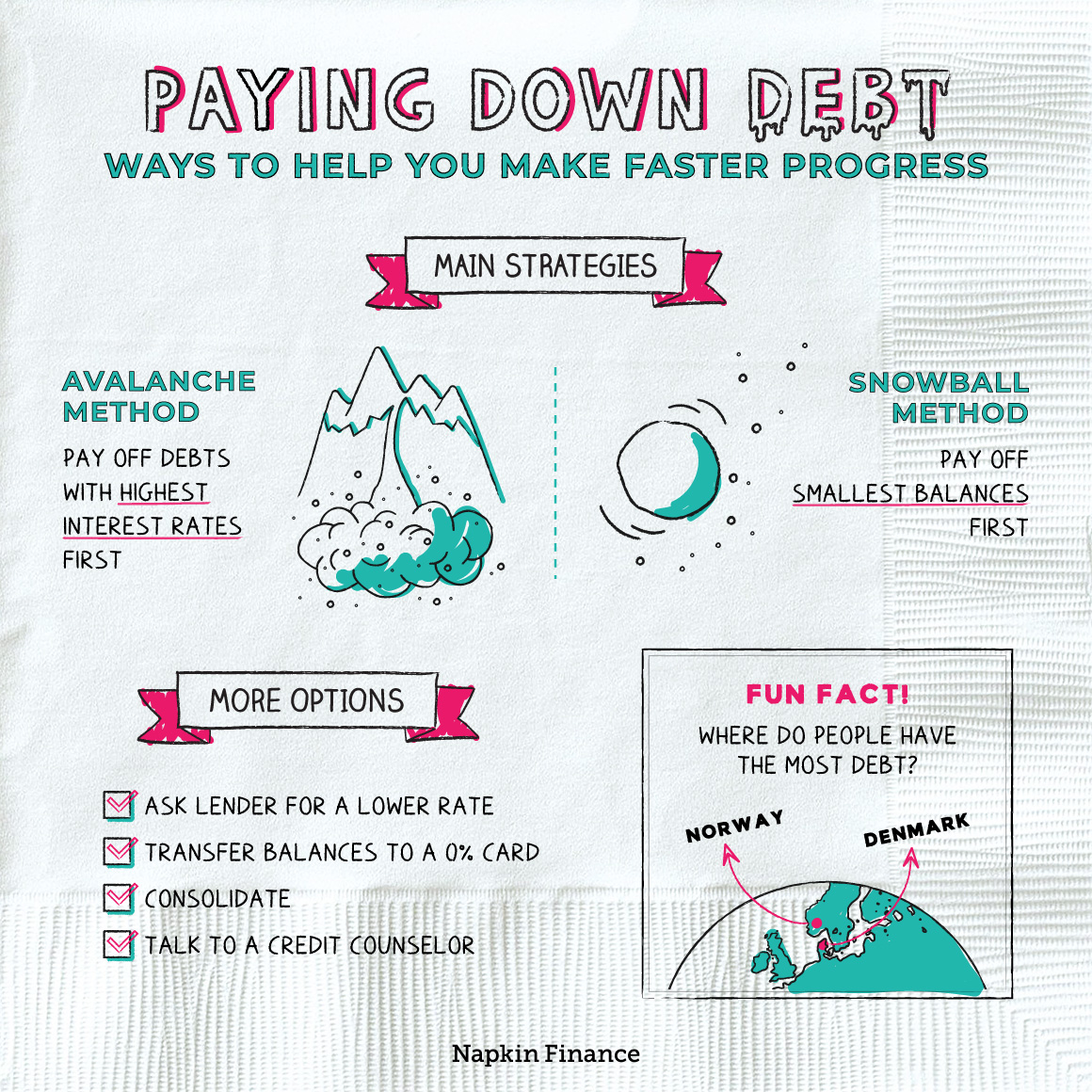

There are two main strategies for paying down debt:

| Avalanche method | Snowball method | |

| What it is | Pay off your debt with the highest interest rate first and then the next highest, etc. | Pay off your debt with the smallest balance first and then the next smallest, and so on |

| Pros |

|

|

| Con |

|

|

Both strategies still take hard work, but they can give you a plan and help you stay organized while you’re digging out.

While the avalanche and snowball methods are the main ways of whittling down your balances, there are some other steps you may want to take in addition to help you reduce your debts even faster:

- Ask your lender for a lower interest rate—if you’ve been making timely payments, they might give you a break.

- Consider a balance transfer—if you can qualify and can pay off your tab before the grace period ends, it could make sense to transfer your credit card balances to a 0% card.

- Talk to a credit counselor—they may be able to help you explore other options for your unique situation.

- Consider consolidating—if you simply have too many debts, combining everything into one loan could make your finances simpler.

No matter what you choose, be sure that you keep making at least the minimum monthly payment on all of your loans, credit cards, and other debts.

Your biggest challenges while you’re paying down debt are to find extra cash to put toward your balances and to avoid taking on new debt. Here are some tips to help you tackle them:

- Leave your credit cards at home—you can’t spend money you don’t have (be sure to delete credit card info online too).

- Toss any extra money toward your debt—commit to using your tax refund, bonus, and any other windfalls to pay back what you owe.

- Sell things you don’t use—Marie Kondo your space and use that extra money toward your bills.

Paying down debt can be an important part of securing your financial future. However, depending on your current situation, it might not be the right immediate decision for you.

Experts recommend that if you’re struggling financially—because you’ve lost your job or because of another emergency—you prioritize making sure you can cover necessary expenses, like keeping food on the table and a roof over your head.

Paying down debt can help you reduce stress and free up cash to put toward your financial goals. There are many ways to reduce what you owe, including paying off your highest interest debt first or focusing on the smallest balance and working your way up. Other strategies include securing a lower interest rate, doing a balance transfer, or talking to a credit counselor.

- Although the U.S. gets a bad rap for how much debt we use, when compared to other countries, we’re actually pretty average—with only slightly more debt (as a percentage of income) than Germany.

- Households in Denmark, Norway, and the Netherlands carry the highest debt loads, while those in Russia and Latvia carry the lowest.

- About 70% of students graduate college with student loans. They have an average balance of $30,000.

- Paying off debt or reducing what you owe on your loans and credit cards is a way to make yourself more financially stable.

- Not all debt is bad, but getting out of debt can give you more financial flexibility, reduce stress, and possibly even help you improve your credit score.

- The avalanche method for paying off debt entails targeting your debt with the highest interest rate first. It can help you save money by paying off your most expensive debts fastest.

- The snowball method involves closing out your smallest balances first. It can help you build momentum so that you stick with your debt repayment plan.

- Other strategies to reduce what you owe include asking for a lower interest rate, transferring balances to a 0% card, or consolidating debts.

- If you’re in a financial crisis, paying off debt might not be your immediate priority.