Remittance

Check’s in the Mail

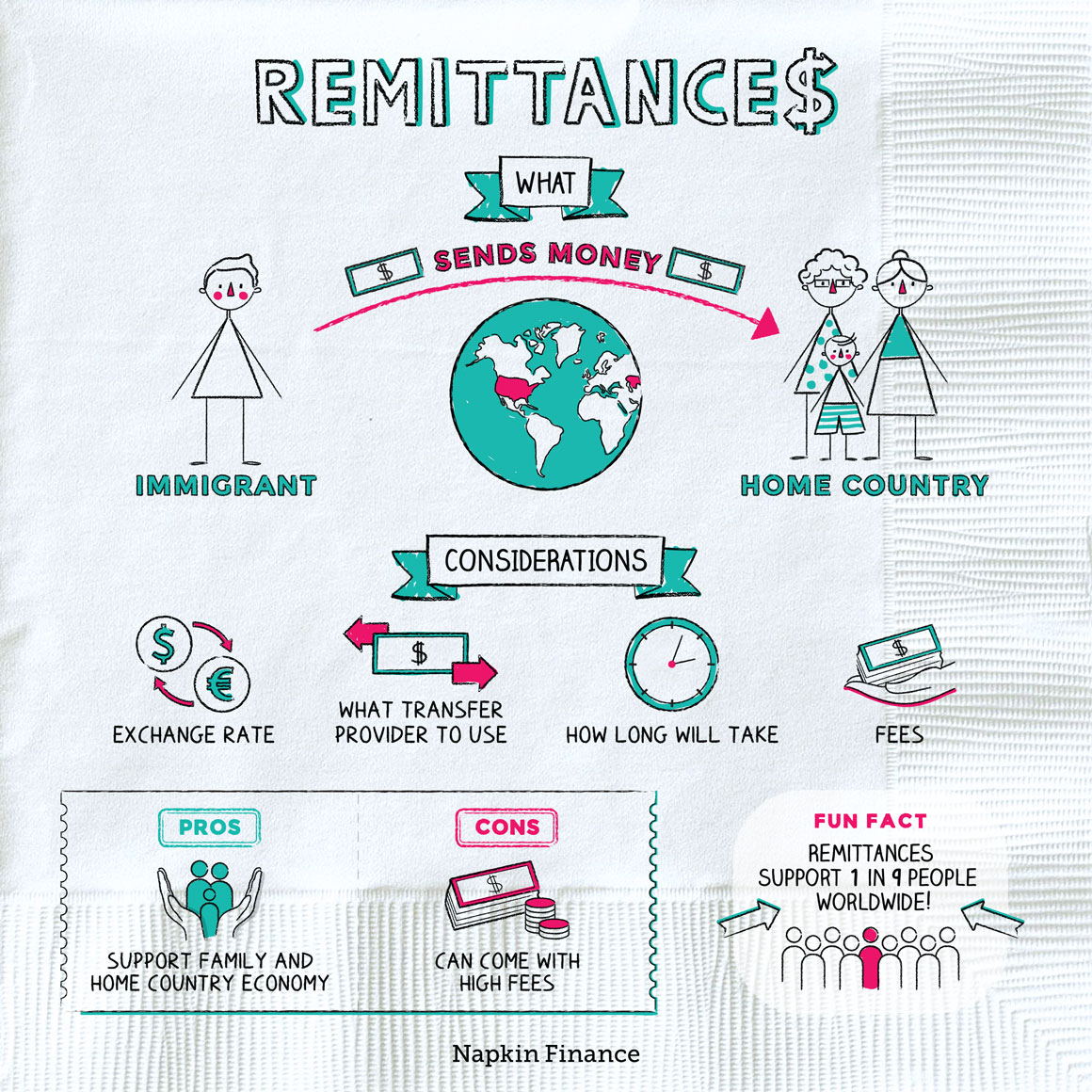

Remittances, also known as remittance transfers or international wires, are when someone in one country sends money electronically to someone in another country.

Immigrants often use remittances to send money back to loved ones in their home country.

Many people emigrate to move from a less wealthy country to a more wealthy country but may still have family back home in their original country. If they’re able to secure a higher paying job in their new country, they may choose to send part of their new paychecks back home.

These remittances can provide an important economic boost to both the family as well as the immigrant’s home country. In fact, some developing nations offer tax incentives to encourage remittances.

Someone who wants to send money overseas often uses a remittance transfer provider. These include banks, post offices, and companies, such as Western Union, and specialty transfer websites.

For a fee, these companies can facilitate moving the money and exchanging it into a different currency (if needed) for a fee. Here’s how the process usually works:

Complete the required forms, which provide information on you,

the recipient, and the amount

↓

Review and agree to the taxes, interest rate,

and fees charged for the transfer

↓

Submit your remittance request

↓

Funds travel from your local bank

to the remittance transfer provider

↓

The remittance transfer provider sends your funds

to the recipient’s bank overseas

After that, it can take anywhere from a few minutes to a few weeks for the recipient to receive the money.

Remittances can be expensive to send—often costing as much as 7% of the amount you’re sending in fees and other charges.

Those costs can vary depending on:

- How much you’re sending (the more you send, the cheaper it usually is)

- The exchange rate

- What countries the money is moving between

- How the receiver will access the funds

- How quickly the transfer will happen

In the U.S., laws and regulations provide some protections for remittance senders, including:

- Required disclosures—Companies have to provide information on all fees, the exchange rate, and when the receiver should expect the money.

- Handling complaints—Companies are required to investigate and fix any reported errors in transfers.

- Canceled transactions—You generally have around 30 minutes to cancel your transaction for free (unless the recipient has already received the money).

Remittances describe money that immigrants send back to their home countries—usually to help support loved ones. You can conduct these transactions through remittance transfer providers, such as banks, post offices, and other outlets, like Western Union. Remittances can provide valuable financial support, but they’re typically very expensive to send.

- Globally, remittances support about one in nine people.

- India and China are the largest recipients of remittance transfers at well over $100 billion combined each year.

- In some countries, remittances received exceed the amount of disaster relief funds, direct investment, and development assistance received.

- A remittance transfer is when one person sends money to someone in another country.

- Sometimes referred to as an “international wire,” immigrants often use these transfers to send money back to family and friends in their home countries.

- Remittance transfer providers handle the transaction in exchange for a fee and are required to provide specific information on costs and transfer times.

- Depending on the provider used, where the money is going, and how much is sent, a remittance transfer can cost 7% or more of the total amount sent.