Inflation

On the Up and Up

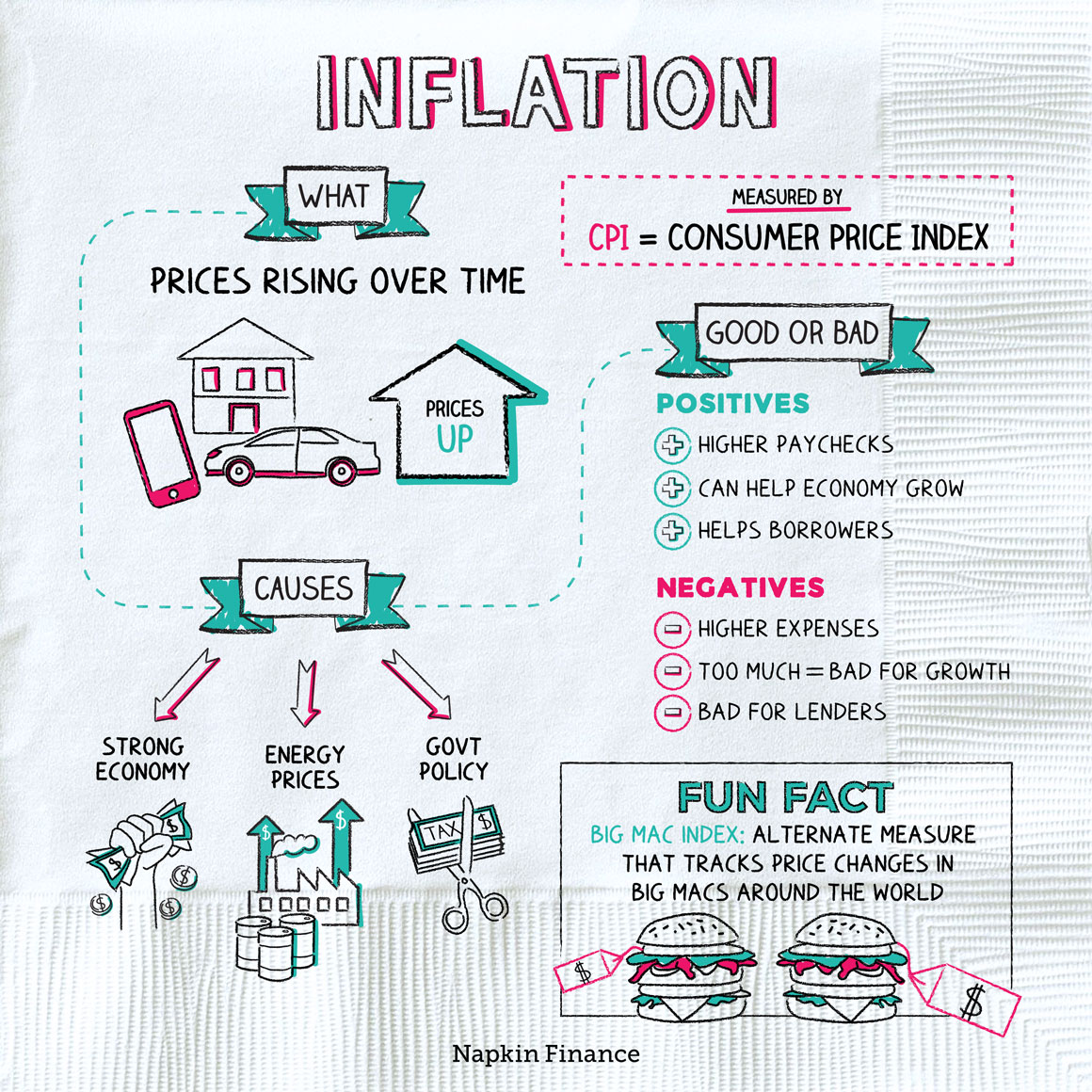

Inflation is when prices of things rise over time.

For example, in 1980 you could buy a movie ticket for less than $3, while these days a ticket costs about $9 on average. Although it can feel bad when things become more expensive, it’s pretty normal (healthy even) for an economy to experience a steady amount of low inflation.

Many different factors can contribute to inflation, including:

- A booming economy—Economic growth usually goes hand in hand with at least some inflation. If a company’s profits are good, it may give more raises to employees. If people are feeling secure in their jobs, they’re probably spending more money. The more they spend, the more prices tend to go up.

- Energy prices—The economy depends on oil and other energy sources in a variety of ways. When the cost of energy goes up, the cost of making goods, shipping goods, and keeping the lights on at stores goes up too. That means prices of goods and services tend to rise as well.

- Government policy—If the government cuts taxes, lowers interest rates, or prints money, both economic growth and inflation typically get a boost.

Inflation might seem like a wonky problem for economists and the government. However, it can impact your day-to-day life in both good and bad ways:

| The good | The bad |

| Encourages consumer spending (which is good for the economy) | Your money buys less than it did before |

| Wages go up | Interest rates go up, making borrowing more expensive |

| Some investments (like your house) usually go up in price along with inflation | Some investments (like CDs and cash) lose value |

That said, every instance of inflation doesn’t necessarily produce these results. For example, sometimes wages stay steady even when there’s strong inflation or investments that usually perform well tank instead.

“Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair.“

—Sam Ewing

It might sound great to be able to buy a movie ticket for $3 or a house for $100,000, like you could in the 1980s. And very high inflation can cause major problems throughout the economy.

But some inflation helps grease the wheels of the economy. Plus, a little inflation is better than risking deflation (when prices fall) because deflation can pull an economy into a full-blown depression.

Government policy influences inflation. Many governments aim for around a 2% annual inflation rate—that’s considered to be the sweet spot for slow but steady positive inflation.

The government tracks inflation with price indexes. Here’s how it works:

- Step 1: Economists put together a hypothetical basket of goods and services, which might represent what a typical family buys in a given period.

- Step 2: Changes in the price for this basket of goods and services are tracked over time.

- Step 3: The basket may be tweaked as people change what they buy, and its price may also be adjusted to account for improving quality (you don’t pay more for a smartphone than a flip phone only because of inflation; you pay more because it’s a more advanced product too).

In the U.S., the main measure of inflation is called the Consumer Price Index, or CPI.

Inflation is the increase in the prices of goods and services over time. A growing economy, rising energy prices, and changes in government policy can all result in inflation. While it tends to have a mixed impact, inflation is generally better than deflation, which can cause a depression.

- One alternate measure of price changes is the Big Mac index. You guessed it—it measures how the price of a Big Mac compares in different countries and changes over time.

- The CPI is incredibly controversial. Some experts argue that the way it’s calculated tends to lowball inflation—which could help the government keep its costs down because some government payments rise with the inflation rate (such as Social Security payments).

- Inflation describes when prices in an economy rise over time.

- For individuals, inflation can affect wages, the cost of buying goods and services, and investment returns.

- Although it may seem bad when things go up in price, a slow but steady rate of inflation is generally considered good for the economy.

- Economic growth, government policy, commodity prices, and other factors tend to influence the rate of inflation.