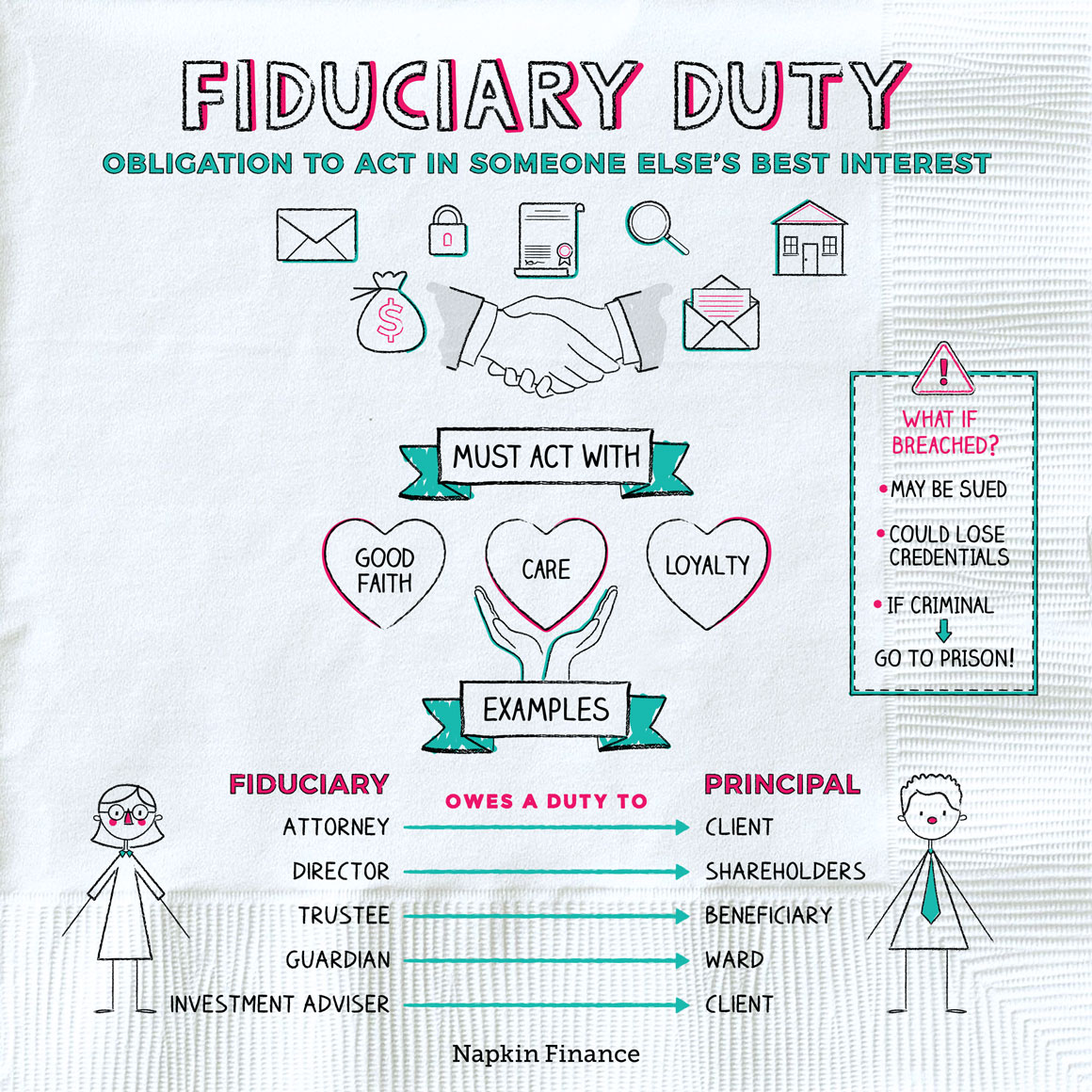

Fiduciary Duty

Your Best Interest

A fiduciary duty is a legal obligation to act in another person’s best interest.

A fiduciary relationship involves:

- A fiduciary—i.e., the person who owes the duty

- A principal—i.e., the person whose best interest the fiduciary is supposed to protect

In this type of relationship, a principal entrusts a fiduciary with taking care of their money, property, or other assets.

Trust is the key element of a fiduciary relationship. To maintain this trust, a fiduciary is expected to fulfill three specific obligations:

- Duty of loyalty: A fiduciary has to make decisions that are in the principal’s best interests (even if those decisions go against the fiduciary’s financial interests).

- Duty of care: A fiduciary should thoroughly research and evaluate all options and scenarios before making a decision or recommendation to the principal.

- Duty of good faith: A fiduciary must use good judgment and act carefully.

Most fiduciary relationships involve financial matters, but others focus on providing advice or general caretaking. Here are some examples:

| Who’s involved | Fiduciary | What they have to do |

| Lawyer and client | Lawyer | Provide the client with enough information to make legal decisions and protect the client’s privacy |

| Guardian and ward | Guardian | Ensure the ward has a place to live, receives the healthcare and education they need, and keeps their finances in order |

| Board directors and shareholders | Board directors | Use company assets in ways that maximize benefits for shareholders |

| Trustee and beneficiary | Trustee | Manage assets in the trust and distribute them to the beneficiary |

Sometimes, a fiduciary does not meet their legal obligations. This is considered a breach of fiduciary duty. This might occur when a fiduciary:

- Doesn’t disclose conflicts of interest

- Acts carelessly

- Does something that gives them a financial gain at the expense of the principal’s interests

- Neglects certain responsibilities

Although a fiduciary duty is a legal responsibility, simply breaching it doesn’t mean the fiduciary goes to prison (though they could if they did something criminal). However, the principal could sue for damages, or the fiduciary could lose their professional credentials (like if a lawyer gets disbarred).

Fiduciary duty is a hot topic (and source of confusion) when it comes to financial advisors because they aren’t all fiduciaries despite what many people think.

| Examples | Requirements | |

| Fiduciaries | Registered investment advisors | Must follow the (more strict) fiduciary duty |

| Not fiduciaries | Broker-dealers and insurance agents | Must follow the (less strict) suitability standard, which requires making recommendations suitable to a client’s personal situation (but not necessarily in their best interest) |

In practice, this can mean that non-fiduciary advisors may be more likely to recommend investment options that pay them commissions and could face less strict requirements when it comes to disclosing certain conflicts of interest.

The fiduciary duty is a legal relationship in which one party is required to act in another’s best interest. The duty can arise in lawyer-client, director-shareholder, trustee-beneficiary relationships, and more.

- The word “fiduciary” comes from the Latin term fidere, which means “to trust.”

- The concept of a fiduciary was first defined in Roman law, but some historians trace the origins of fiduciary duties back to Hammurabi’s Code.

- A fiduciary relationship may be spelled out in a contract or other legal document, but it can also be implied and occur informally through one party’s dealings with another.

- A fiduciary duty requires one party to act in the best interest of another party.

- Fiduciary relationships often involve the handling of one party’s money or property.

- A breach of fiduciary duty occurs when a fiduciary fails to fulfill their obligations, such as by putting their own interests ahead of the principal’s.

- Some financial advisors, like registered investment advisors, are fiduciaries, but others, like broker-dealers, may not be.