Tariffs

Barriers to Entry

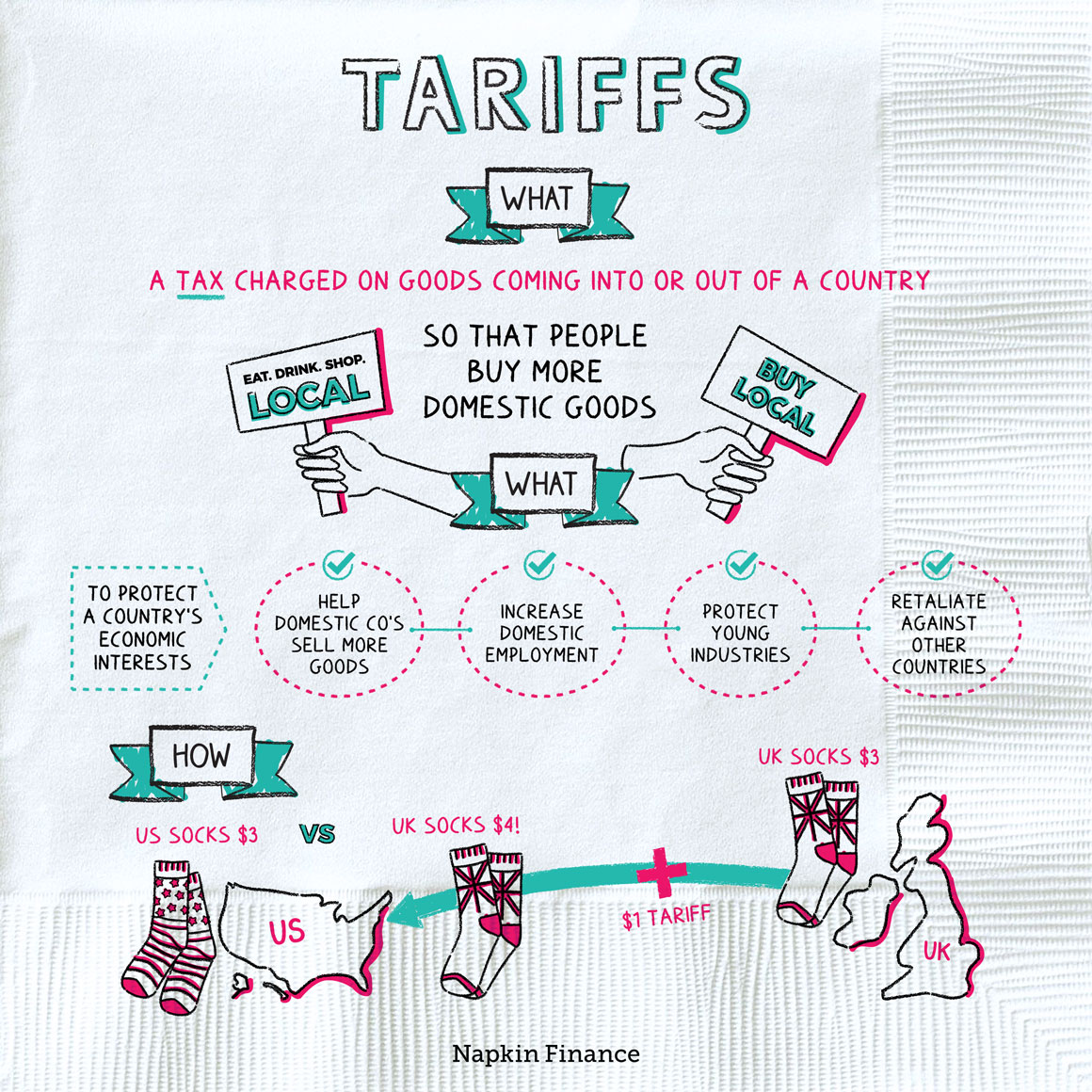

A tariff is a tax charged on goods coming into or out of a country. When a tariff is charged on a good, it makes that good more expensive.

Tariffs on imports (the most common type) raise the price of imports so that people buy more domestically made goods. Although tariffs on exports are less common, they can be used to limit the amount of goods leaving a country. (For example, if there were a global shortage of antibiotics, an export tariff on antibiotics might help a country protect its own supply.)

Tariffs are generally used to protect a country’s economic interests. By raising the cost of certain imported goods, tariffs can:

- Help domestic companies sell more goods

- Increase domestic employment

- Protect young industries from international competition

- Retaliate against countries with unfair trading practices

Suppose the US decides to impose a 10% tariff on all imported cars.

Before the tariff, importing a car from South Korea might look like this:

Car produced in South Korea

↓

Imported to US

↓

Car sold for $25,000

After the tariff is imposed, importing the car might look like this:

Car produced in South Korea

↓

Imported to US

↓

Importer pays 10%, or $2,500

to US Customs and Border Protection

↓

Car sold for $27,500

(i.e., $25,000 + $2,500)

After the tariff is imposed, US cars become more competitive because instead of competing against a $25,000 foreign car, they’re now competing against a $27,500 foreign car. That should boost sales of US-made cars.

“Tariffs that save jobs in the steel industry mean higher steel prices, which in turn means fewer sales of American steel products around the world and losses of far more jobs than are saved.“

—Thomas Sowell, economist

Tariffs can have wide-ranging effects, which can include:

- Higher sales for domestic producers

- As we saw above, the aim with tariffs is generally to give a boost to domestic industries.

- Fewer imports

- If imported cars cost 10% more, Americans won’t buy as many foreign cars, so fewer will be imported in the first place.

- That means lower sales for South Korean carmakers.

- Higher costs for consumers

- Fewer imports means less competition among car sellers. US carmakers will probably raise prices, meaning Americans pay more no matter where their car is made.

- Higher costs on other goods

- When a tariff is placed on a raw material, such as steel, US companies that make things with steel have to pay more for their raw materials. That can lead to higher prices on a range of goods.

- Retaliation

- In the above example, South Korea could respond by imposing a tariff on imported US cars. If the US then responded with additional tariffs on South Korean goods, the situation could escalate into a trade war.

- In the real world, the US is currently engaged in a trade war with China.

- Economic slowdown

- If US companies have to pay substantial tariffs on exports, it could hurt their sales enough to cause a recession.

“Trade wars are good and easy to win.“

—President Donald Trump

Mainstream economists are generally opposed to tariffs. That’s because free trade—in which goods and services can flow across national borders, with as few restrictions as possible—generally boosts the world’s economy by fostering greater competition, lowering prices, and ensuring resources are used in the most efficient way possible.

At the same time, although free trade is typically good for the planet as a whole, it can hurt individuals—such as US auto workers who have lost jobs as more cars are imported. A tariff might protect a specific industry or a company and its workers but at a cost to the broader economy.

Tariffs can also be used for non-economic reasons, such as to protect the domestic defense industry. In that case, the aim is to protect national security rather than boost the domestic economy.

There are two basic types of tariffs:

- Specific: Levied as a fixed charge per unit, such as $2,000 per car imported.

- Ad valorem: Levied as a fixed percentage of the value of the commodity imported, such as 10% on imported cocoa.

A product that has both a specific and an ad valorem tariff is called a two-part tariff. It’s not as common, but it can happen.

Tariffs are taxes levied on certain imported goods. They are used to protect domestic companies from foreign competition by making foreign products more expensive. Tariffs can have wide-ranging consequences, including higher prices for consumers and even slowed economic growth. Although mainstream economists are generally opposed to tariffs, they can also be used for non-economic reasons, such as to protect national security interests.

- The word “tariff” may have come from the Spanish port Tarifa, which invented the practice of charging ships for using its docks.

- First tariff: The Tariff Act of 1789 was the first piece of major legislation enacted by the first Congress and imposed tariffs of up to 50% on imported steel, tobacco, indigo, and cloth.

- In 2015, the US collected $34 billion in tariffs, most of which came from China. (That works out to about $100 per US citizen.)

- In response to the 40% tariff imposed on US vehicles sold in China, Tesla raised prices of the Model S and Model X vehicles sold there by about 20%.

- Tariffs are taxes charged on goods coming into or leaving a country.

- Governments use tariffs to protect domestic economic interests, such as to shelter an industry from foreign competition.

- Tariffs generally lead to higher prices for consumers and fewer imports.

- Mainstream economists generally oppose tariffs because they hinder free trade.

- Tariffs can be charged as a flat fee per item or as a percentage of a good’s value.