Invisible Hand

Helping Hand

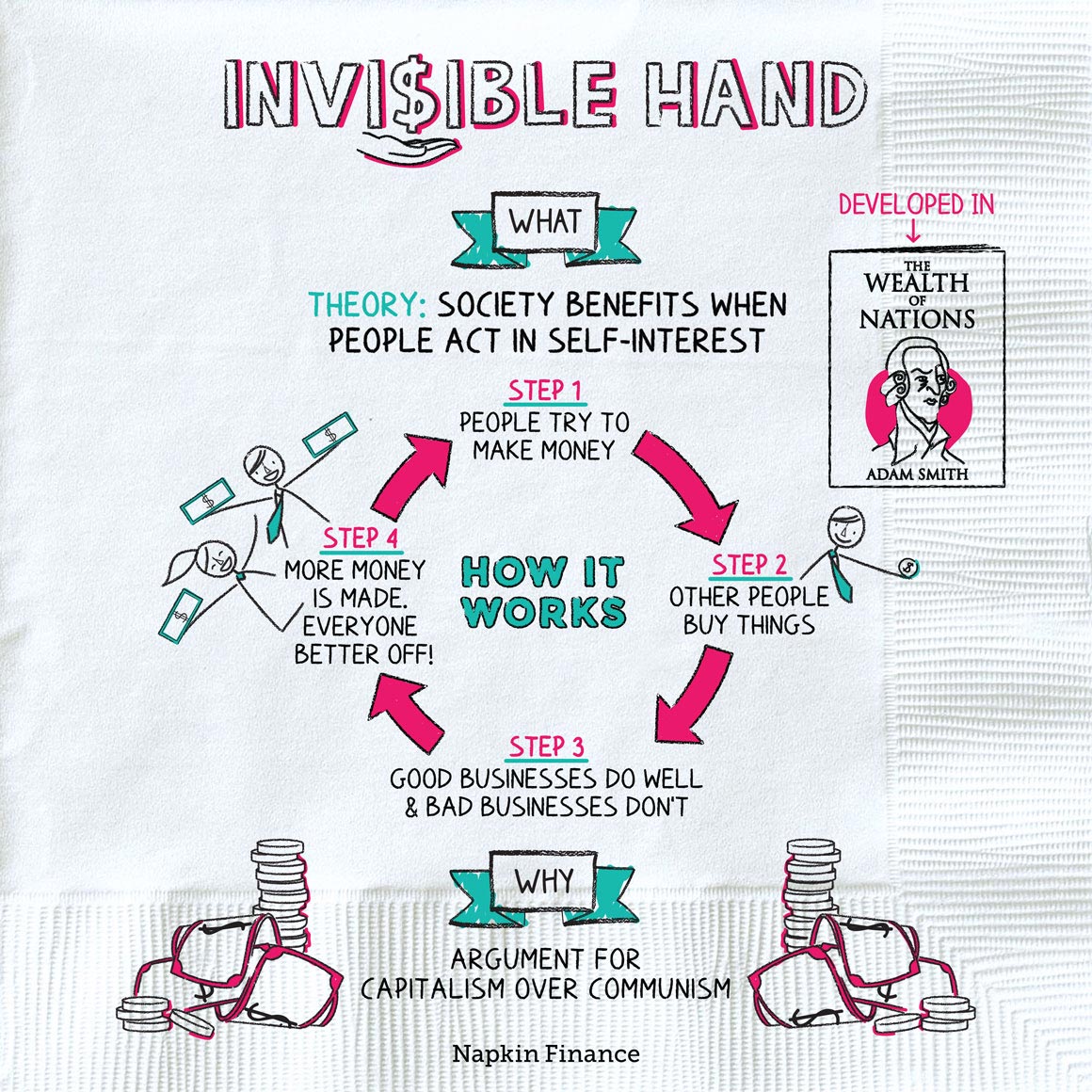

The “invisible hand” is an economic theory developed by Adam Smith. It proposes that when people act in their self-interest it unintentionally benefits society at large.

In a capitalist economy, an invisible hand guides everyone’s actions toward the one that will benefit society the most (or so the theory goes).

The invisible hand theory argues that capitalism creates a virtuous circle:

- Step 1: People try to make money. They start companies that sell goods and services.

- Step 2: Other people decide for themselves how much to buy of certain things. If they buy more of something, companies produce more of that thing. If they buy less of something, companies produce less of that thing.

- Step 3: Good businesses do well, and bad businesses don’t.

- Step 4: More money is made, more money is spent, and more people have jobs. Everyone is better off.

“It is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from

their regard to their own interest.“—Adam Smith

According to the theory, the invisible hand balances out the forces of supply and demand and even has an impact on employment. Here’s just one way it plays out:

People want to buy more laptops

than there are available

↓

Prices of laptops rise because there

aren’t enough to meet current demand

↓

Company A sees these higher prices as a profit opportunity

and decides to start making more laptops

↓

Company A hires more workers to keep up with production

↓

If workers are scarce,

Company A raises wages to attract employees

Based on the invisible hand theory (and traditional economic theory), as Company A makes more laptops, the price of laptops will start to fall.

Eventually, the forces of supply (i.e., how many laptops Company A is willing to make given the current selling price of laptops) and demand (i.e., how many laptops consumers want to buy at that price) will come into balance. That’s called “equilibrium.”

Smith’s point was that it’s kind of amazing that the market can reach this equilibrium all on its own—as though an invisible force guides Company A and consumers to the best outcome.

The invisible hand theory is generally used to argue in favor of capitalism—in which people are free to decide what job to have and how to spend their money—over communism—in which the government decides these things.

| Capitalism | Planned economy (aka communism) |

|

| What job do you have? | You’re free to pick (and change your mind). | The government tells you what job to do. |

| What stuff can you buy? | Whatever you want as long as you can afford it. | The government may ration goods or distribute them on a predetermined basis. |

| Who decides what gets made? | Companies or other producers decide. | The government tells, say, shoemakers how many shoes to make in a given year. |

| Who bears the risk? | Individuals bear the risk. If you can’t make money, you’re poor. If you do well, you get rich. | Society bears the risk. No one gets rich or poor (in theory). |

But it can also be used to argue against greater government regulation or intervention in the economy.

The invisible hand is an economic theory that argues that when people act in their own self-interest they benefit both themselves and society as a whole. It is often used in support of capitalism, in which people and businesses decide what to make or how to spend money, over communism, in which the government decides these things.

- It wasn’t just the self-interest of the butcher and the baker that put Adam Smith’s dinner on the table—his mother cooked his dinners until she died (when Smith was in his sixties).

- To paraphrase Jeff Goldblum: Capitalism will find a way. Cigarettes, gold, and U.S. dollars have all served as alternate currencies in restricted economies, such as communist nations and prisons. (Ramen noodles have overtaken cigarettes as the currency of choice in U.S. prisons.)

- The invisible hand theory argues that society and the economy are better off when people are allowed to decide for themselves how to make money and what to buy.

- Under this theory, companies will increase production and hire more workers as consumer demand (and selling prices for goods) increase.

- As companies increase production, selling prices start to fall until supply and demand forces come into balance. That balance is called equilibrium.

- The theory is generally used as an argument in favor of capitalism over communism, in which the government plans and decides what is produced and what jobs people have.