Recession Shapes

Give Me a V

A recession is an economic downturn that lasts for at least several months and ripples throughout the economy. Typically, some people lose their jobs, while others see their hours cut or pay reduced. People become nervous about the economy and start cutting back on spending. Corporate profits fall, stocks fall, and the country’s overall economic output—measured by gross domestic product (GDP)—falls as well.

While recessions can cause serious financial distress, they don’t last forever. Recessions in the U.S. have always eventually ended—but they can have lasting impacts on the economy even after they’re officially over.

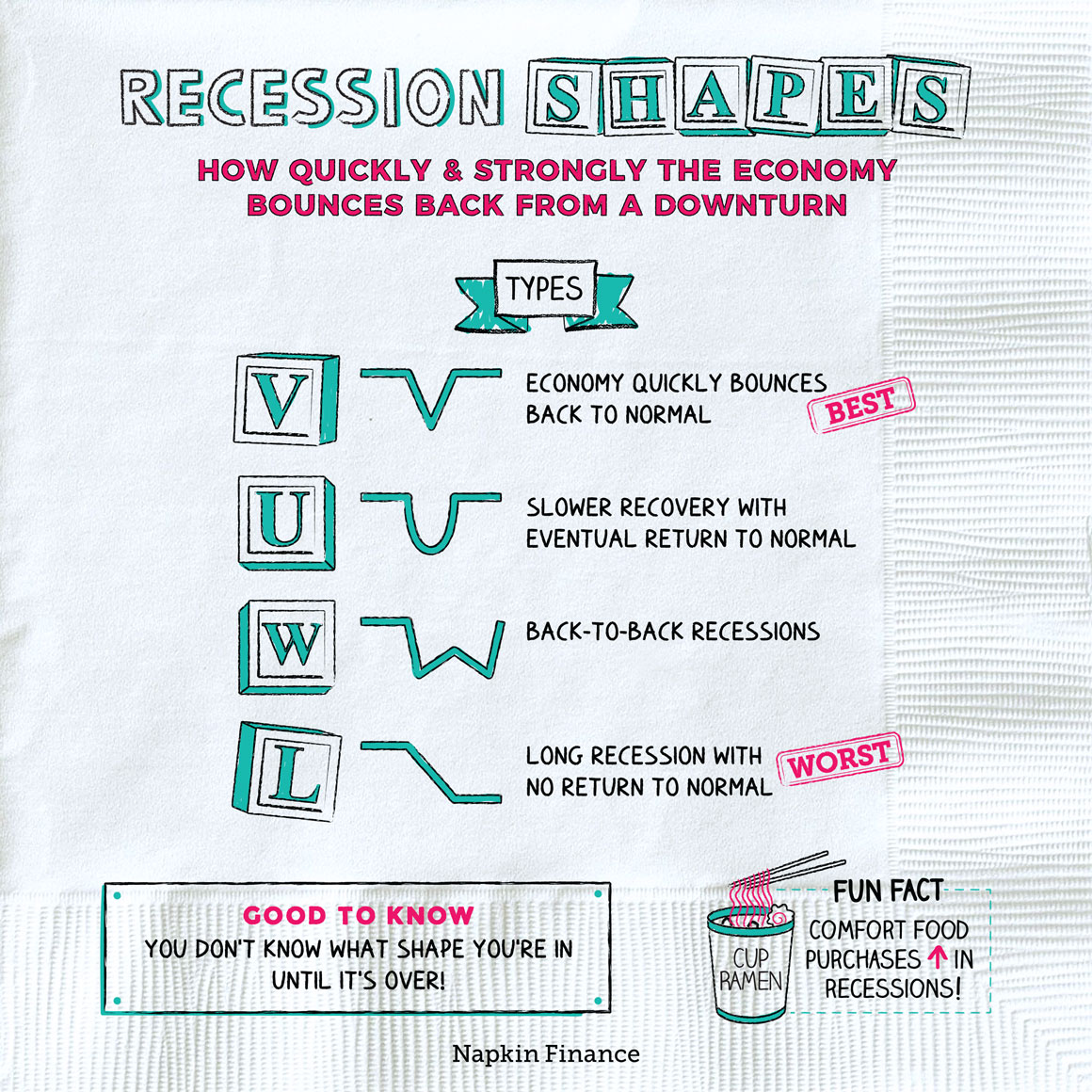

The long-term impact of a recession depends both on how long it takes for the economy to bounce back and on how strong that bounce is once it happens. You can think of those two forces as driving the shape of a recession’s recovery.

Here’s what recessions and their recoveries can look like:

| Shape | What it means |

| V | Economy declines steeply and recovers quickly |

| U | Recession is prolonged; economy recovers slowly |

| W | Economy rebounds quickly but falls into recession again soon after |

| L | Recession goes on for an extended period of time without relief |

The shape a recovery takes depends largely on how long it lasts, which is influenced by a range of factors.

Economists generally see recessions as normal (if painful) parts of the economic cycle, but they can be caused by any number of factors, including:

- Stock market crashes

- Changes in monetary policy

- Commodity prices

- Falling consumer confidence

- Inflation

- A bubble bursting (like the housing bubble in 2007)

Sometimes, forces that have nothing to do with financial markets can drive the shape of a recession. In the COVID-19 pandemic downturn, many economists believed that public health would play a significant role in the U.S.’s recovery trajectory.

If you have to have a recession, a V shape is the best you can hope for. After a relatively brief downturn, the economy recovers rapidly, and life returns to normal.

The worst case scenario is an L-shaped recession, which symbolizes a stark decline with little relief for a long time. Typically, L-shaped recessions see stagnant growth and long stretches of high unemployment.

Let’s put a shape to famous downturns from the last century:

| Shape | Examples |

| V | 1953 post-Korean War Recession, which was driven by changes in government spending and monetary policy and lasted ten months |

| U | Nixon Recession of 1973-1975, which was caused by inflation and lasted just under a year |

| W | Europe from 2008 to 2012, when countries felt a one-two punch of the Great Recession followed by a sovereign debt crisis |

| L | The Great Depression; The Great Recession |

Recessions have occurred periodically throughout U.S. history, but it’s the most painful ones that stay on the history books. That’s why the Great Depression still looms so large—it was the most catastrophic financial period in the country’s history.

The timeline of a recovery depends on several factors. Some clues that indicate the economy is starting to recover include:

- A return to precrisis GDP

- Improving unemployment rates

- Corporate profits bouncing back

Stocks also typically rise when the end of a recession starts to come into sight. However, sometimes stocks will rise in the middle of a recession only to then fall even further, so they can be a difficult clue to read.

Recessions and depressions both refer to declines in economic activity. The main differences are how long they last and how bad they get.

Recessions often end in less than a year (or within a couple of years at most), whereas depressions can drag on for years. Recessions cause financial hardship, though for most people life goes on pretty much as usual (while a few specific industries may be harder hit). Depressions, on the other hand, can cause crippling financial distress that touches almost everyone.

The recovery periods for each can also look very different. It can take an economy years to return to prerecession levels of employment and productivity. The recovery timeline for a depression can last a decade or more.

As challenging as recessions are, in the U.S., they have always eventually ended. How long it takes them to end and for the economy to start growing again determines the shape they take.

- What do IBM, Instagram, and Disney all have in common? They were all founded during recessions and continue to thrive today.

- The Federal Reserve, the central bank of the U.S., was created because of the Panic of 1907 (aka the “Knickerbocker Crisis”), a yearlong recession that was set into motion by a run on New York City banks.

- Comfort food is king during recessions. In 2009, consumers bought up cheap staples, like Kraft mac-n-cheese and Hormel chili, over pricier, trendy foods.

- Recessions are declines in economic activity and are generally seen as normal parts of the economic cycle.

- A recession’s shape is determined by how long it takes the economy to recover, how strong the recovery is, and whether the economy manages to avoid falling into a second recession shortly thereafter.

- A best-case scenario is a V-shaped recession, while a worst case is an L-shape.

- Trends in GDP, unemployment, and corporate profits can give clues as to whether the economy is starting to get back on track again.