Overhead

Keep the Lights On

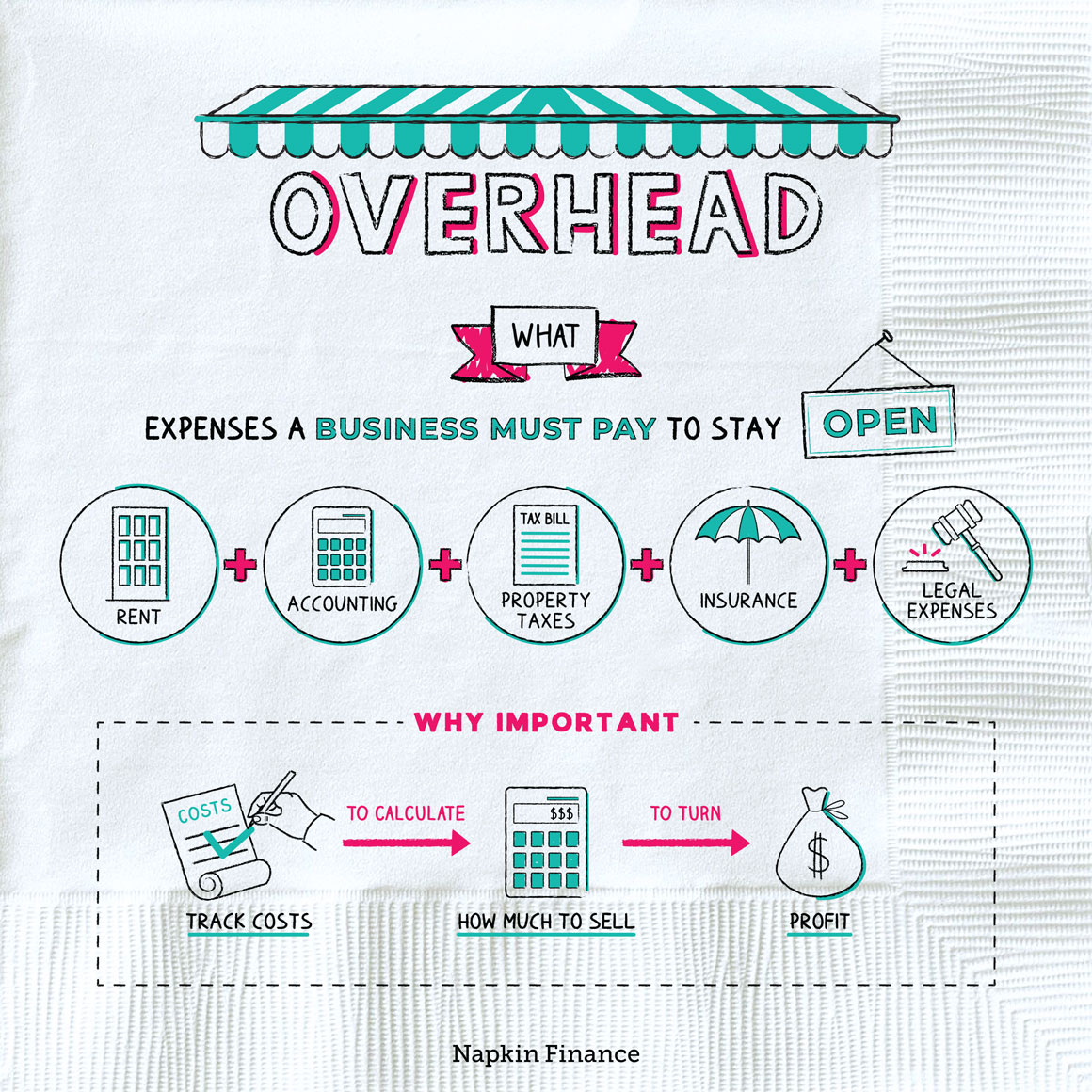

Overhead refers to the expenses a business must pay just to stay open. Also known as “indirect costs,” overhead generally covers expenses that support a company’s operations but that don’t go directly toward producing its products or services.

For a bakery, for example, overhead might include the cost of rent, utilities, and paying its manager and bookkeeper. But it wouldn’t include the cost of flour or sugar or paying its bakers.

Overhead typically includes costs such as:

- Rent

- Electricity, water, and other utilities

- Property taxes

- Insurance

- Wages for administrative staff

- Licensing fees

- Accounting and legal expenses

- Office supplies

Overhead costs are generally fixed costs, meaning they usually don’t change month to month.

Overhead does not include costs that go directly toward producing products or services. Those are known as “operating costs” or “direct costs” and generally include:

- Raw materials

- Worker salaries

- Machinery

An easy way to tell the difference between overhead and operating costs is whether an expense would disappear if a company stopped making its product. If it would, then it’s an operating cost.

For example, if a pizzeria stopped making pizzas tomorrow, the cost of pepperoni would disappear from its balance sheet. Rent, on the other hand, would not.

A business has to pay overhead costs even if it isn’t selling anything.

Many businesses watch these costs closely to keep tabs on:

- How much they have to sell to break even or turn a profit

- Which expenses are too high

- How expenses have changed over time

Generally, the lower a business’s overhead costs, the easier it is to both turn a profit and weather hard times. Businesses that can’t cover their overhead will eventually fail.

One way companies analyze their overhead is by comparing it to their sales. This percentage is known as the overhead rate:

Overhead rate = Overhead costs / Sales

For example, if a craft store has $10,000 in overhead costs per month and makes $40,000 in sales, its overhead rate is 25%. For every dollar the store makes, it spends 25 cents on overhead.

Overhead refers to the expenses a business must pay just to stay open no matter how much it produces or sells. Overhead typically includes rent, utilities, insurance, and administrative wages. Overhead does not include expenses that go directly into a business’s products or services, such as raw materials or worker salaries, which are known as operating costs or direct costs.

- Freelance and home-based businesses usually spend less of their revenue on overhead because they don’t have a physical location, while restaurants, factories, and retail stores devote more of their revenue to overhead.

- Many nonprofit organizations have surprisingly high overhead costs (often due to the high cost of fund-raising). The Walker Cancer Research Institute, for example, spends more than 96% of its funds on overhead.

- Overhead costs are those that don’t go directly into producing a business’s products or services.

- Examples of overhead costs typically include rent, taxes, utilities, and insurance.

- Overhead costs are different from operating costs, such as raw materials or worker wages, which are directly related to a company’s products and services.

- Businesses may track overhead and other expenses to determine their break-even points and identify ways to cut expenses.