Opportunity Cost

Fork in the Road

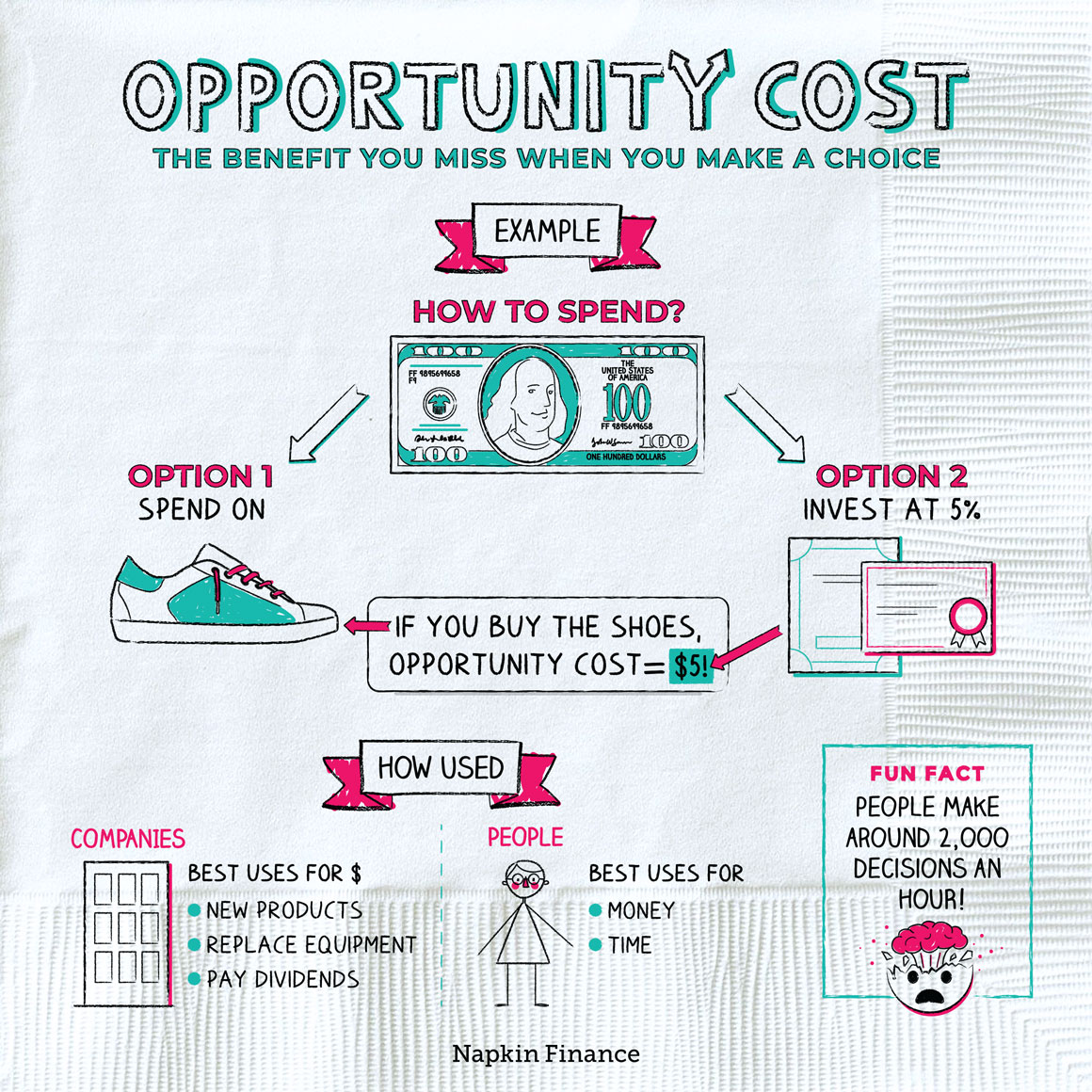

Opportunity cost is the return or benefit you miss out on by choosing one option over the next best alternative.

Every choice you make in life involves an opportunity cost because it requires you to pick one thing instead of something else. You might also think of this as a trade-off.

For example, by spending your bonus on a vacation, you might give up the chance to use it to pay off debt.

Opportunity cost is directly related to the economic principle of “scarcity”—that is, limited resources force us all (e.g., individuals, companies, governments) to make choices about how to use our resources.

Although most people don’t actually go through life making decisions this way, economists and finance types argue that opportunity costs represent real costs that we should take into consideration.

For example, suppose that the bonus you received was for $5,000. You might think that if you spend it on a vacation then your vacation costs $5,000. But suppose that instead you could have used it to pay off $5,000 in credit card debt that’s racking up interest at a 15% rate.

Opportunity costs are important because they can help you see the total price tab of your decisions.

Corporations often use opportunity costs in deciding the best use for their money, such as whether to:

- Invest in developing a new product

- Invest in new technology to boost production

- Invest in replacing old equipment

- Use cash to issue dividends or buy back stock

But people can consider opportunity costs, too, and it doesn’t always have to be a hard calculation. Experts recommend that you think about opportunity cost from both a short- and long-term perspective. When making a decision, ask yourself:

- How important is this to me?

- Is there a better way I could be using this money?

- What will I miss out on in the future based on my decision today?

Without considering the opportunity cost, a better choice might go unnoticed.

When using opportunity costs to weigh your options, there are a few important things to keep in mind:

- Opportunity costs don’t always involve money. For example, you might choose whether to spend two hours watching TV or cleaning your house.

- Opportunity cost is best considered in situations when you’re comparing apples to apples, that is, dollars to dollars or time to time.

- It’s impossible to always know the exact value of every option (investments, for example, can go up or down), so it’s ok to use some guesswork.

And it’s ok to think about nonfinancial rewards too. Maybe that vacation is to go visit your grandma for her 100th birthday, and it means a lot to you to go. In that case, skipping the trip could come with a big emotional opportunity cost.

Using opportunity costs doesn’t mean you have to choose the option that makes the most financial sense. It just means you have more information about the choice.

An opportunity cost is the future benefit or return that you give up by choosing one option over another. Every choice has an opportunity cost—whether you’re deciding how to spend your money or what to do with your free time. Considering opportunity costs can help you make the best choice when you’re facing multiple options.

- The average person makes around 2,000 decisions per hour. Some of those are automatic, while others require more thought.

- “Decision fatigue” describes how our ability to make good decisions starts to wear down as we face more and more choices. (It also might explain why you always feel cranky at the end of an Ikea trip.)

- Judges grant parole more often to prisoners whose cases are heard in the morning than in the afternoon, likely due to decision fatigue.

- Opportunity cost is the return or benefit that you lose by picking one option over another.

- Adding the opportunity cost to the total cost of the option you’re considering can give you a more complete picture of its true total cost.

- Corporations regularly use opportunity costs in deciding how to use their money—such as by investing in new products versus upgrading old equipment.

- You can use opportunity costs to consider the full costs of your decisions whether you’re deciding how to spend your money or how to spend your time.

- Opportunity costs don’t always involve money, but the calculation is best used when comparing uses for the same resource (such as money or time).