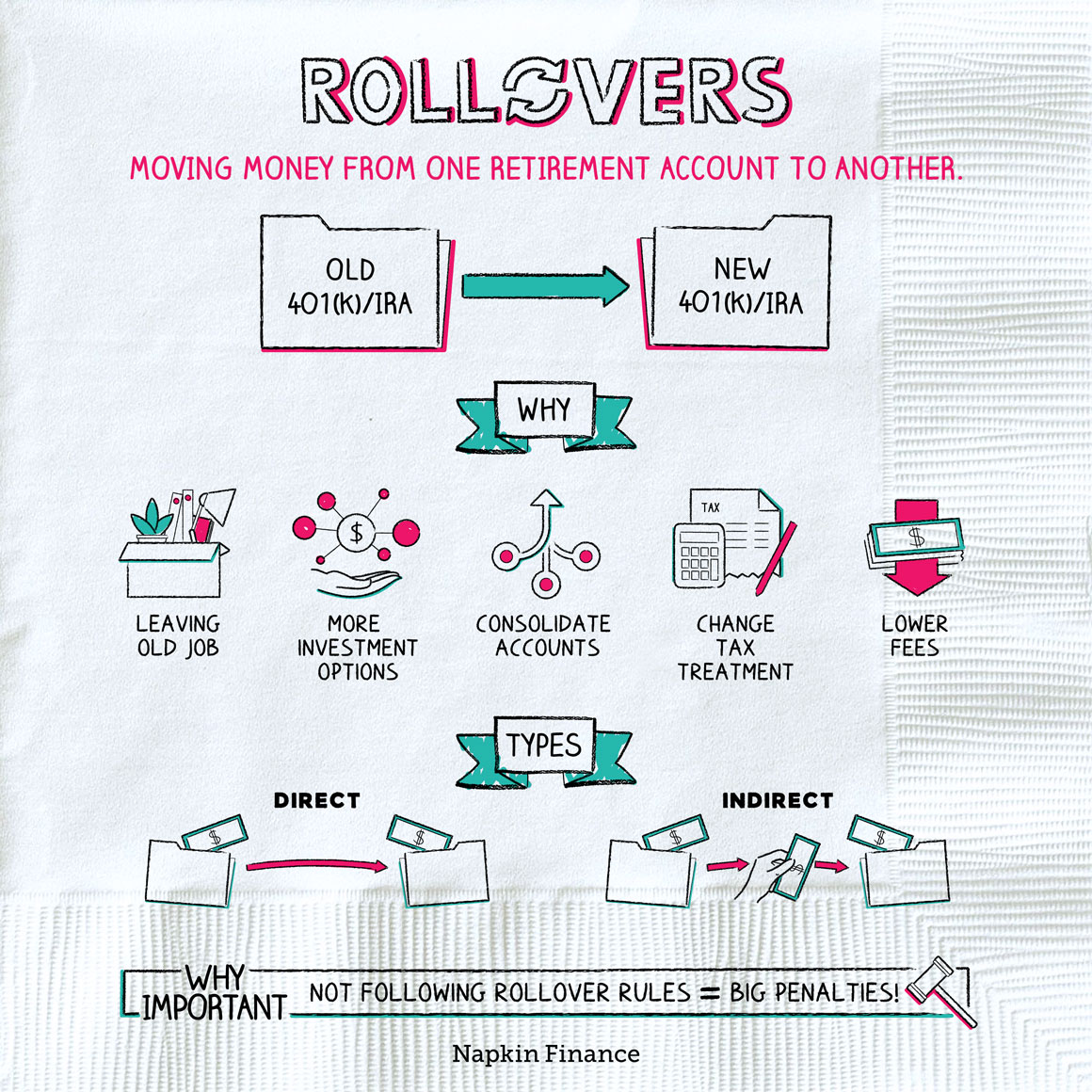

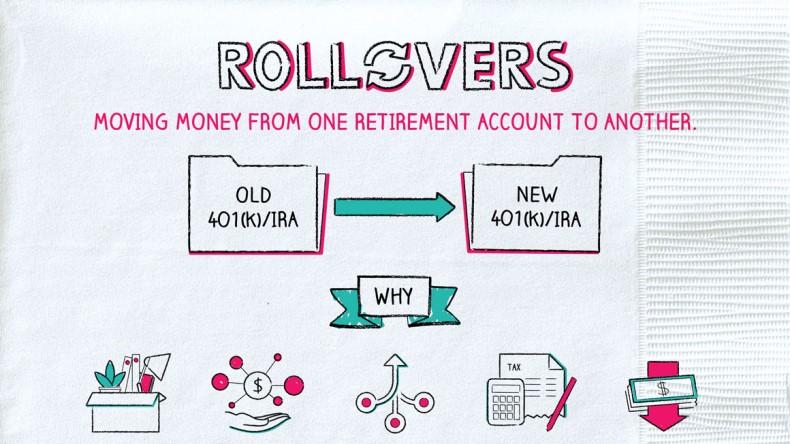

Rollovers

Roll With It

A rollover is when you move funds from one retirement account into another, such as from a former employer’s 401(k) into a new employer’s 401(k).

The government treats and taxes retirement accounts differently from savings or checking accounts. That means you can’t dip into or move around retirement savings without taking special precautions.

A rollover is a safe way to move funds between retirement accounts without causing tax problems.

You’d usually want to do a rollover when you leave a job (though some employers let you leave your money in the company retirement plan even after you quit). But there can be other reasons for doing a rollover, too, including:

- Employer-sponsored plans, such as 401(k)s and 403(b)s, may offer limited investment options. Rolling money into an Individual Retirement Account (IRA) may get you access to a wider menu.

- Consolidating accounts can make it easier to keep track of your savings.

- Sometimes, switching to a new account can save you money on fees.

You can generally roll over almost any type of retirement account into any other type. Here are a few of the possible permutations:

- Old 401(k) to new 401(k)

- If you roll money from an old 401(k) to a new one (or old 403(b) to a new one, etc.), you can keep your retirement savings all in one place.

- (Not all employers let you roll an old account into their plan.)

- 401(k) to traditional IRA

- You can also roll an old 401(k) into an IRA.

- That way, if you change jobs again, you don’t need to move that money again.

- Traditional IRA to Roth IRA

- This is a special type of rollover called a “Roth conversion.”

- Because traditional IRAs and Roth IRAs have different tax treatments, this type of rollover also has some special tax implications. (More specifically, it means you pay a big tax bill now but lower taxes in retirement.)

- 401(k) to Roth IRA

- You can also do a Roth conversion from a 401(k) or other employer-sponsored account.

There are also two different ways of handling the actual mechanics of the rollover:

- Direct rollover

- Your funds are transferred directly from your old account to your new account.

- Indirect rollover

- You receive a check from an old retirement account and deposit it into the new account.

- You generally have 60 days to do this, or you risk triggering a big tax bill.

Here are the steps to a typical rollover:

Step 1: Choose the type of account you want to roll your funds into, whether a new employer-sponsored plan or a traditional or Roth IRA.

Step 2: Call the financial institution that runs your current plan and request a direct or indirect rollover. (A direct rollover can reduce the risk of unplanned tax problems.)

Step 3: Wait while the administrative wheels turn. (A rollover typically takes two to three weeks to complete.)

Step 4: Choose a new set of investments for your funds, since the money will show up in your new account as cash.

There can be intended or unintended tax consequences to doing a rollover.

Roth conversions (i.e., rolling an IRA or 401(k) into a Roth IRA) always trigger tax bills, because you’re taking pretax money (an IRA or 401(k)) and turning it into after-tax money (a Roth IRA). Despite coming with a big tax IOU, these types of rollovers are popular because they can help you reduce your taxes in retirement. If you’re doing a Roth conversion, you should expect and plan for a big tax payment for that year.

But botching a rollover can also trigger a tax bill. That can happen if you request an indirect rollover but miss the 60-day mark for transferring funds. It can also happen if you simply withdraw funds (instead of formally requesting a rollover). In that case, you may owe not just income taxes but also big penalties on the money.

Whatever type of rollover you’re doing, make sure you’re crystal clear on any tax consequences and on what steps you need to take and when.

- Remember, you have 60 days (not two months) to transfer funds from one account to another with an indirect rollover. Missing the deadline by one day can trigger a giant tax bill.

- That said, not all botched rollovers are treated equally. If you missed the 60-day mark because you were in the hospital, the IRS may cut you some slack. If you missed the 60-day mark, bought a motorcycle with the money, but then changed your mind (as one taxpayer did), then you’re probably going to have to pay that tax bill.

- You can generally only do one rollover to or from an IRA per year (or else you’ll owe taxes and penalties).

The tax advantages of retirement plans can be incredibly valuable. But, with special treatment comes special responsibilities. If you want to move around your retirement account funds—whether to simplify your finances, to access better investments, or for another reason—make sure you’re not withdrawing money willy-nilly and that you’re following the formal rollover process.

- For the most part, people love their 401(k)s. Some 90% of people have positive opinions of 401(k)s (among those who have an opinion).

- About 64% of people participate in a retirement plan—either through their own employer or through a spouse. For people whose employer provides “automatic enrollment” (meaning you’re automatically signed up for your 401(k) unless you opt out), participation jumps to more than 90%.

- Americans hold more than $6 trillion in 401(k)s and other defined-contribution retirement plans.

- A rollover lets you move funds from one retirement savings account into another without triggering unintended taxes or fees.

- It can make sense to do a rollover if you’re changing jobs, if you want to consolidate accounts, or if a different account would offer better investment options or lower fees.

- The two main types of rollovers are direct and indirect rollovers.

- When considering a rollover, make sure you have your tax ducks in a row and that you know the rules of the type of rollover you’re doing, since mistakes can be expensive.