Estate Planning

Bite the Dust

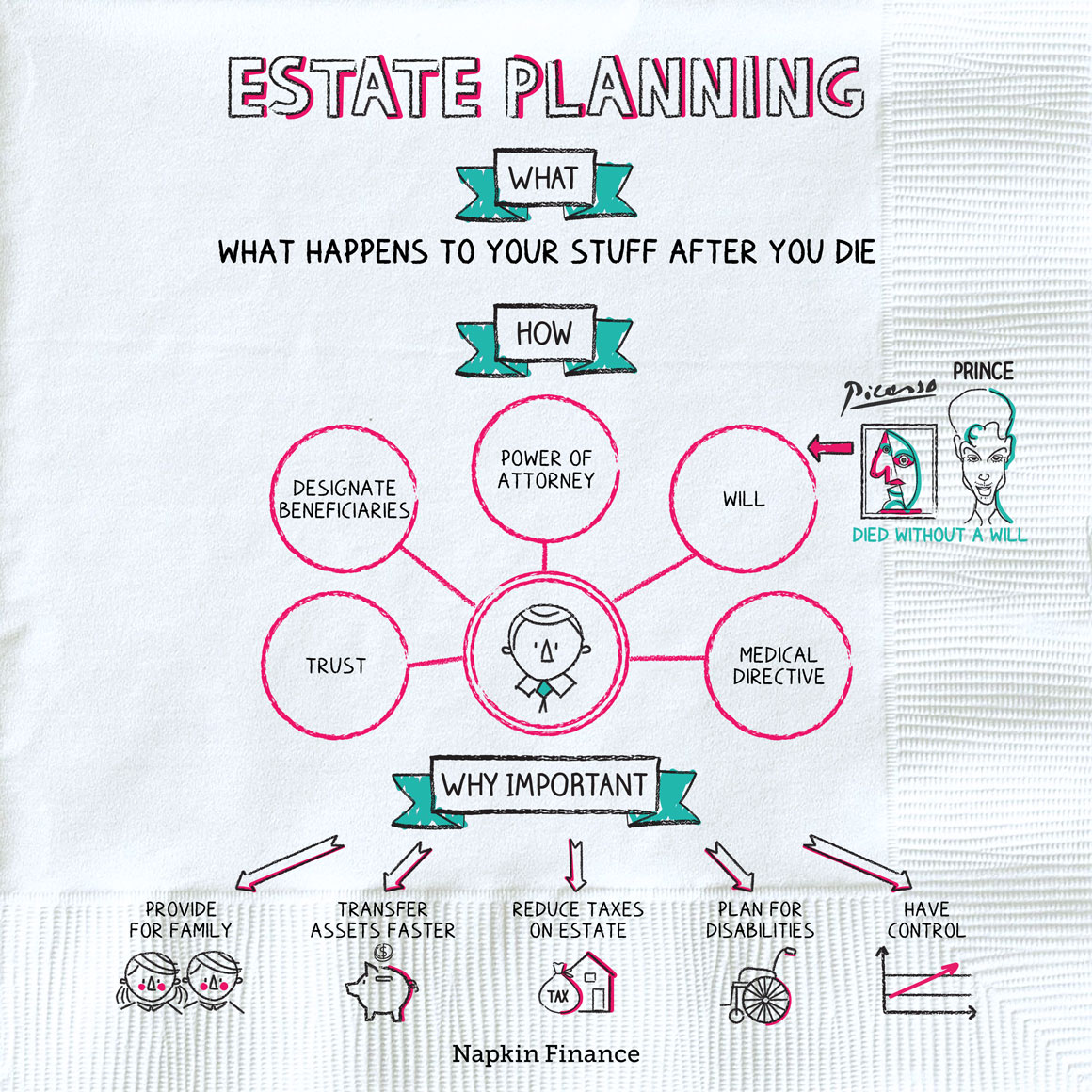

Estate planning is the process of figuring out what will happen to your stuff after you die. It’s coming up with a plan for your assets and then writing your plan down in a way that’s legally valid (and that a court would recognize as enforceable).

Having an estate plan can be an important way to:

- Provide for your family if something should happen to you.

- Transfer assets to your survivors faster—by hopefully skipping a trip through the court system.

- Reduce taxes. If you’re wealthy, there may be legal strategies you can use to lower taxes on your assets after you die.

- Plan for disabilities. An estate plan typically also includes documents that specify your wishes if you become unable to make decisions on your own behalf.

- Have control. Maybe you want to make sure that your best friend inherits some prized possession, or maybe you want to make sure that your ex-spouse doesn’t. Either way, with an estate plan, you get to decide.

“I made my money the old-fashioned way. I was very nice to a wealthy relative right before he died.“

—Malcolm Forbes

An estate plan is basically a collection of documents and might include the following:

- Will—your will can specify who gets which of your stuff and who should take care of your kids (or pet turtle).

- Healthcare directive or power of attorney—these may dictate who is authorized to make decisions for you if you can’t make them for yourself.

- Trust—if you’re wealthy or have a more complicated financial situation, a trust might make sense for some of your assets.

- Beneficiary designations—some financial accounts let you specify in your paperwork who should receive the account if you pass away. (These designations are important because they can trump what you say in your will.)

Estate planning isn’t just for the rich. If you have kids and you don’t have a will, it could be up to the courts to decide who takes care of them if you die. If you’re in a relationship but not married, your partner could get left out in the cold if something happened to you.

Estate planning might not be the most pleasant thing to think about, but it can help save your family and friends a lot of stress if something happens to you. To start:

- Define your goals: What do you own and how do you want it distributed? Are you wealthy enough that you have to worry about estate taxes?

- Check your designations: Review your beneficiary selections for any savings accounts, investment accounts, retirement accounts, and life insurance policies. Update as needed.

- Analyze your options: Talk about possible strategies with a professional advisor or an estate planner.

- Put your plan into place: Draw up your own documents or ask for the help of a lawyer or estate planner. Keep your documents in a safe place.

- Tell your loved ones: Let your loved ones know what your plan is and where to find those documents.

- Review and update as needed: When your life changes, make sure your estate plans still represent reality. Your best friend from college might have been a good choice to inherit your possessions 10 years ago, but your new wife might not agree.

“Death is not the end. There remains the litigation over the estate.“

—Ambrose Bierce

Estate planning is the process of deciding and putting in writing what happens to your assets after you die. An estate plan gives you the control to provide for your family if something happens to you and can help your assets reach your loved ones faster (and potentially with less in taxes skimmed off the top). A professional estate planner or an attorney can help you consider options and develop a legally enforceable plan.

- Prince and Pablo Picasso both died without wills.

- Abraham Lincoln also died without a will even though he was a lawyer (and president).

- Although Jimi Hendrix died in 1970, legal battles within his family over his estate have continued until recent years because he didn’t leave a will.

- Estate planning is the process of deciding on and documenting a plan for what will happen to your things after you die.

- Having an estate plan is extremely important if you have dependents, but it can be useful for anyone to make sure their wishes are followed after they pass away.

- Your estate plan may encompass a range of documents and legal arrangements, including a will, trust, power of attorney, and beneficiary designations.