Long Term Care Insurance

Senior Moment

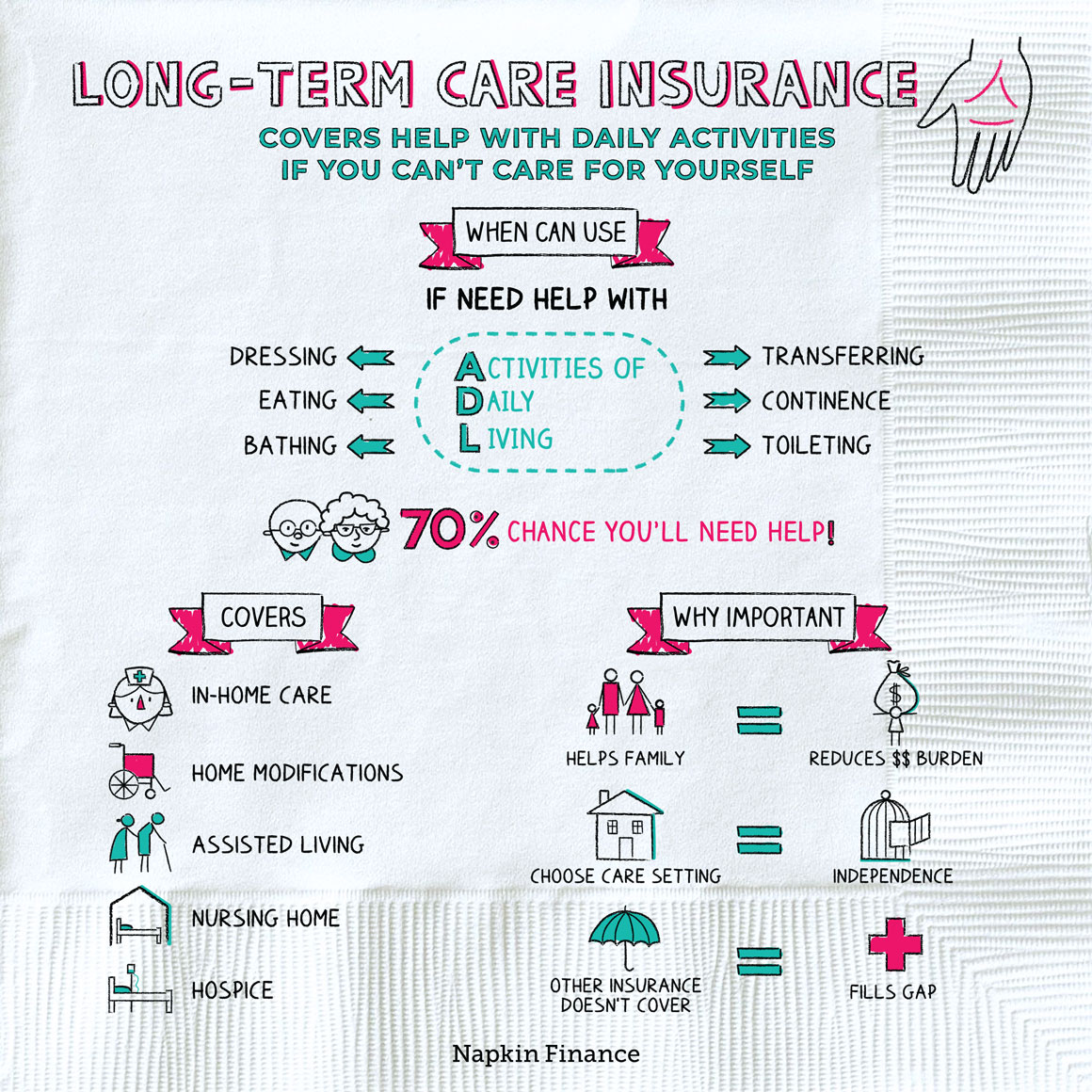

Long-term care insurance is a policy that helps cover the cost of assistance with daily activities if you’re unable to care for yourself.

The insurance typically assists those aged 65 and older or who have chronic illnesses or disabilities.

Long-term care for the elderly or disabled can be incredibly expensive—often costing hundreds of dollars per day. Long-term care insurance policies can give you peace of mind that if you ever need that kind of care you’ll be able to afford it.

Similar to other types of insurance, you pay a premium (monthly, quarterly, or annually) to an insurance company for coverage in the event you need long-term care. The insurance company bases your premium on issues such as your age and health plus what kind of a policy and benefits you’re buying. Plans typically cost a few thousand dollars per year.

Depending on the policy, you might be able to use your coverage for:

- Nursing home care: typically a 24-hour live-in facility with full-service care

- Assisted living: a 24-hour live-in facility for those who need some assistance but not full nursing care

- Adult day care: Daily program outside the home

- In-home care: Nurses or other care providers come to your home to help with daily tasks

- Home modifications: Adding a ramp to stairs or grab bar to your shower to make your home more accessible and safe

- Hospice or palliative care: Care for end-of-life needs

Not all policies are created equal, so be sure to check the specific terms of any policy you consider to ensure it provides the type of coverage you’re looking for.

You can’t use long-term care insurance whenever you want. Instead, you must meet two criteria:

| Criteria | What it means |

| Benefit trigger | Your health or abilities have declined to the point that you need care:

|

| Elimination period | The time between the benefit trigger and when coverage begins:

|

Long-term care insurance policies aren’t cheap, but neither is long-term care. Here are some things you might want to know if you’re considering a policy:

- You’ll usually get lower premiums if you buy a policy in your 40s or 50s. The trade-off is you’ll probably be paying premiums for a longer period of time.

- You may not qualify for the insurance if you have a preexisting condition.

- There’s often a daily or lifetime limit on how much your policy will cover.

- If you stop paying your premiums, the insurance company can cancel your coverage, and you might lose anything you’ve paid up to that point.

- Some companies offer shared coverage to couples, who can then split the benefits.

There are some types of insurance that everyone needs, such as auto insurance if you own a car, life insurance if you have dependents, or health insurance. Because of the cost, long-term care insurance isn’t as easy a call.

When in doubt, a professional advisor, like a financial planner, may be able to help you work through the trade-offs.

Long-term care insurance is a policy that can help cover the cost of nursing and other services for those who are elderly or become disabled. In exchange for a regular premium payment, you might be eligible to receive nursing home care, home modifications, adult day care, or other assistance.

- Around 25% of the population will spend $50,000 or more out of pocket on long-term care expenses in their lifetime.

- The cost of nursing home care varies widely with where you live, from around $54,000 per year in Texas to more than $150,000 in Connecticut.

- An estimated 70% of those aged 65 and older will need some type of long-term care.

- Long-term care insurance can help cover certain care costs for those who are elderly or disabled in exchange for regular premium payments.

- Covered care might include services in a nursing home, assisted living facility, or even in your own home.

- Before coverage begins, you must meet the benefit trigger (which is a way of testing whether you need care) and the elimination period (a type of waiting period before your policy starts paying).