Revocable vs. Irrevocable Trusts

In Good Hands

A trust is a legal agreement allowing one person to transfer their assets to someone else via a third party.

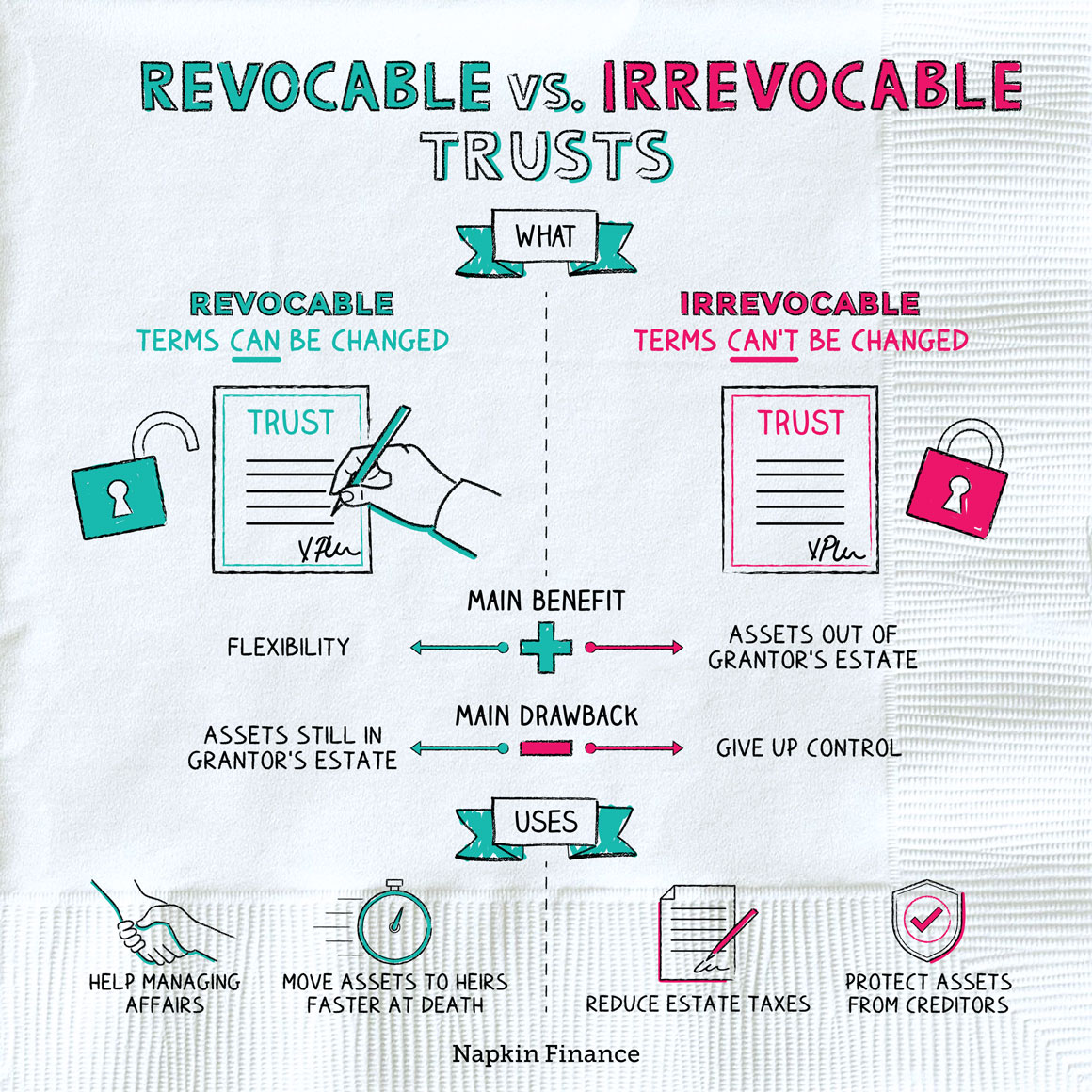

A revocable trust is one that you can change after you’ve set it up (including by terminating the trust). An irrevocable trust is one that’s all but set in stone after it’s created.

Any trust—whether revocable or irrevocable—involves three key players:

- Grantor: The person who creates the trust and deposits assets into the trust.

- Beneficiary: The person (or people) who receive income or assets from the trust.

- Trustee: The person chosen by the grantor to administer the trust.

Depending on the type of trust, the same person may have multiple roles. For example, often the grantor is also one of the beneficiaries of a trust they create.

Revocable trusts, also known as “living trusts,” are incredibly flexible. The grantor can write, rewrite, and even cancel the trust as many times as he or she likes. Specifically, they can:

- Change any of the trust terms

- Choose a new beneficiary or trustee

- Change the assets in the trust

Once an irrevocable trust is created, the grantor generally can’t make changes (except by going through a long, arduous, expensive court process). Specifically, they can’t:

- Take assets back from the trust

- Dissolve the trust

- Change the terms, beneficiaries, or trustee

The differences between revocable and irrevocable trusts matter for tax and estate planning reasons.

The reason people choose irrevocable trusts—even though they have to give up all that control—is because the grantor doesn’t legally own any assets they put into an irrevocable trust. That means if the grantor dies their estate will be smaller (and will hopefully pay less in estate taxes).

Here’s how those differences play out:

| Revocable trust | Irrevocable trust | |

| Who owns the assets? | The grantor | The trust |

| Who pays taxes on the assets? | The grantor | The trust |

| Are assets part of the grantor’s estate? | Yes | No |

| What if the grantor gets sued? | Creditors can make a claim on trust assets | Creditors can’t touch trust assets |

People can have different reasons for picking one type of trust over the other, but common reasons can include:

- Revocable

- Choose if you need someone else to manage your affairs for you (such as if your health is declining)

- Choose so that once you die your assets can be transferred to your heirs faster (otherwise, your money has to take a trip through the court system, which can be slow)

- Irrevocable

- Choose as part of a strategy to reduce estate taxes (typically only relevant for the very wealthy)

- Choose if your job or life circumstances put you in a position where you’re likely to be sued

Experts recommend that before opting for a trust you consider other less-involved options that might do exactly what you’re hoping for (such as setting up a durable power of attorney).

Trusts can be either revocable or irrevocable. Revocable trusts can be changed (or revoked) after they’re created, while irrevocable ones generally can’t. Although no one likes giving up control and flexibility, irrevocable trusts can be valuable tools in estate planning because they let wealthy people move assets out of their estates.

- Trust your spouse? It’s not uncommon for one partner in a rocky marriage to set up a trust to hide assets ahead of a divorce.

- FDIC insurance protects the money you set aside in a trust, and, in fact, each named beneficiary in a revocable trust adds $250,000 in protection.

- Anytime someone decides to create a trust, they have to decide if they want to set up a revocable trust or an irrevocable trust.

- A revocable trust lets you make as many changes as you like during your lifetime.

- With an irrevocable trust, typically once it’s written, you cannot change it without jumping through many significant and costly hoops.

- Irrevocable trusts can help very wealthy families save money on taxes because assets placed in an irrevocable trust no longer belong to the person who placed them there.

- Revocable trusts are more commonly used to help manage the affairs of someone who isn’t able to manage them themselves or to transfer assets faster at death.