Social Security

Safety Net

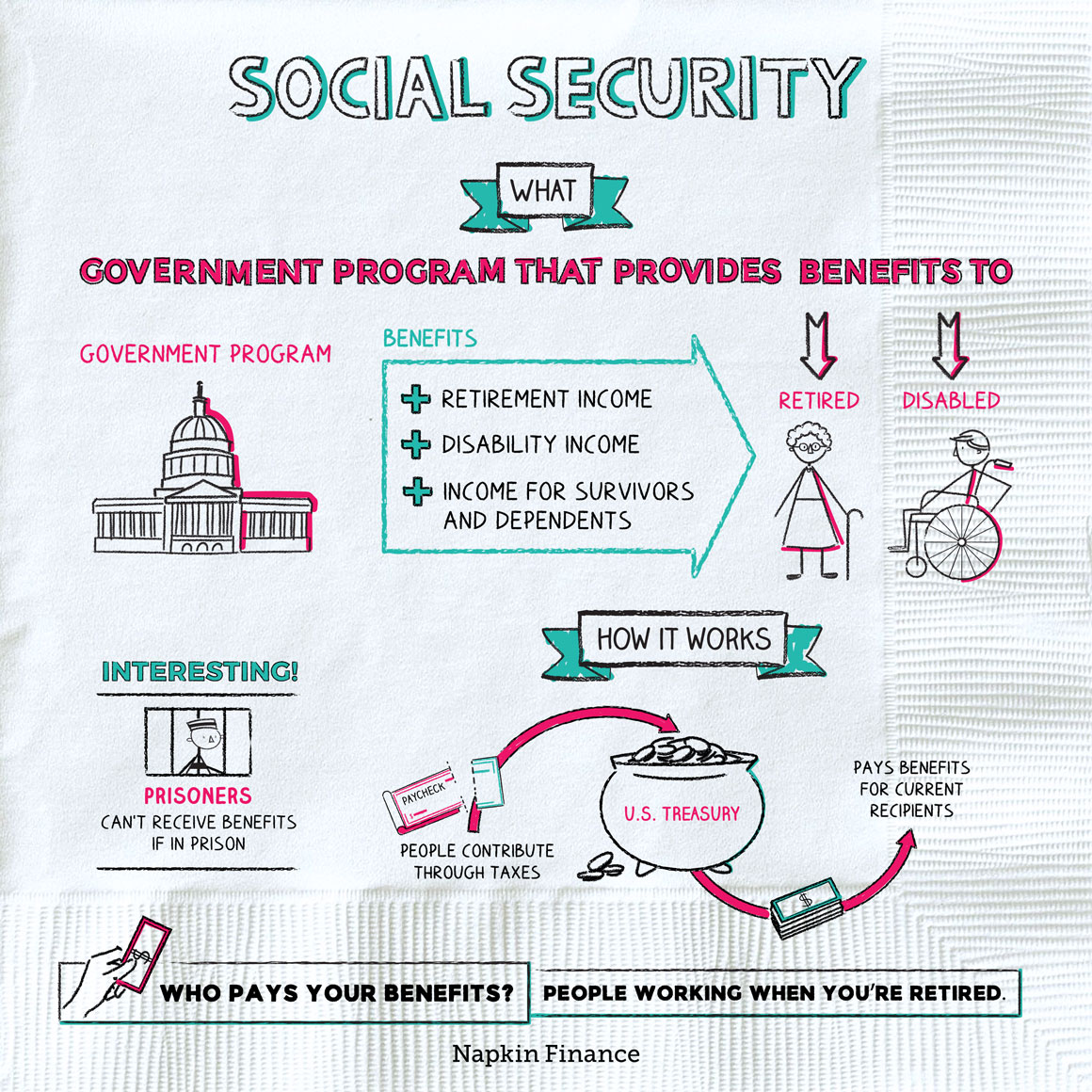

Social Security is a government program that takes in taxpayer dollars and pays out benefits to older Americans, the disabled, and in some cases survivors and dependents.

It’s essentially a national retirement-savings plan and economic safety net.

Typically, only those who have paid into the Social Security system—through taxes paid on income from work—are eligible to receive income from the system.

Once eligible, people may receive benefits if they:

- Reach age 62—the youngest age at which you can claim retirement benefits

- You generally must have paid into the system for at least ten years (or more specifically, 40 quarters) to be eligible for these benefits.

- Become disabled

- You have to meet Social Security’s definition of disabled to qualify.

- You must have paid into the system for a certain length of time. Exactly how long depends on how old you are when you become disabled.

- Are the dependent, spouse, or ex-spouse of someone who’s receiving benefits or a worker who died.

Lots of money flows through the Social Security system. Here’s where it goes:

Working people pay into the system

through FICA taxes and the self-employment tax.

↓

That money goes to pay today’s benefits to retirees

and others who are currently receiving benefits.

↓

Any money that’s left over goes into the Social Security trust fund,

which helps pay for future benefits.

What doesn’t happen is that your money goes into an account with your name on it, sitting there until you’re ready to claim your benefits and withdraw it. Everyone’s contributions go into the same pot, and what you pay in today typically goes back out of the system today. (That means the workforce of the next generation will have to pay for your benefits.)

- Your contributions may show up on your pay stub as deductions for FICA, which stands for the Federal Insurance Contributions Act (the law that authorizes payroll taxes for Social Security and Medicare).

- If you’re an employee, you pay 6.2% of your salary to Social Security.

- If you’re a contractor, you pay 12.4%.

- Your future benefits are based on your income during your working years. So a nice big raise today should also mean (slightly) better Social Security benefits for you in the future.

- Although you may first become eligible for those retirement benefits at 62, experts often recommend that you wait until age 70 because your benefits increase for every month you delay claiming during that period.

- You can check on your projected benefits at the Social Security website. Experts recommend that you do so periodically to make sure the government’s tally of your earnings history is correct. (One reason your Social Security number is so important is that it’s how your earnings get tracked.)

Think of Social Security as something that will be nice to have but not as something that’s going to single-handedly bankroll your extravagant golden years, since the average monthly benefit for retirees is only about $1,500.

Plus, the program is politically controversial and has perennial funding problems, so it’s not 100% guaranteed that it will be there when you retire.

Social Security is a program sponsored by the federal government that pays regular income to older Americans and the disabled. People pay into the Social Security system through payroll taxes, also known as FICA. Although Social Security can provide a nice supplement to your retirement income, you probably shouldn’t count on it to be your only source of income.

- Social Security was signed into law by President Franklin D. Roosevelt in 1935 as part of the New Deal—a package of programs that was designed to help pull the U.S. out of the Great Depression and to create a better system of economic safety nets for the country.

- About one out of every six U.S. residents currently receives Social Security.

- Legal immigrants may be eligible to receive Social Security if they’ve paid into the system and meet all its requirements. But you can’t receive Social Security in prison, even if you meet all the requirements.

- Social Security is a taxpayer-funded program that pays monthly benefits to the elderly, the disabled, and some survivors and dependents.

- To be eligible for Social Security, you generally must have paid into the system through work (or you must be the dependent or survivor of someone who paid into the system).

- What you pay into Social Security doesn’t go into an account just for you. Instead, it goes to pay current benefits to people who are eligible today.

- Although you may first become eligible for retirement benefits at age 62, it can make sense to wait until age 70 since your monthly benefit will increase if you do.

- Social Security may be one important piece of your income in retirement, but it probably won’t pay enough to be your sole source of income.