Medicare

Free for All

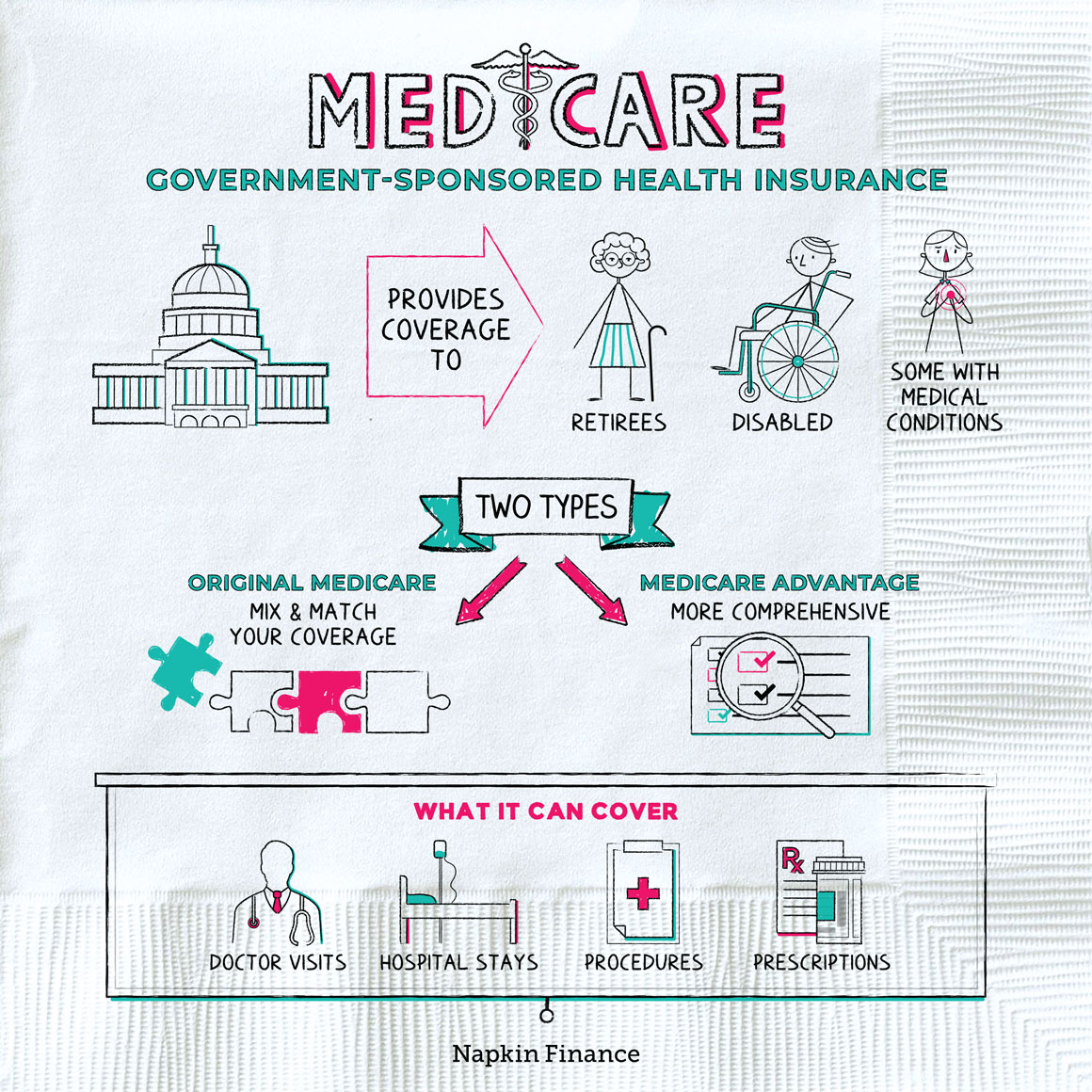

Medicare is a health insurance program for retirees that is sponsored by the federal government. It is available to Americans who are 65 or older along with some younger people with disabilities or specific medical conditions.

Medicare, like Social Security and Medicaid, is part of the government-provided economic safety net. It helps ensure retirees and others can have at least a basic standard of living.

Although Medicare may make you think of retirees, the program is not just for the boomer crowd. Medicare is generally available to:

- People who are 65 or older

- Younger people with disabilities

- Younger people who have either of these specific conditions: end-stage renal disease or ALS (aka Lou Gehrig’s disease)

However, to qualify, you may need to meet a few more specific requirements. For example, you generally must have received disability benefits for at least 24 months before you can qualify based on a disability.

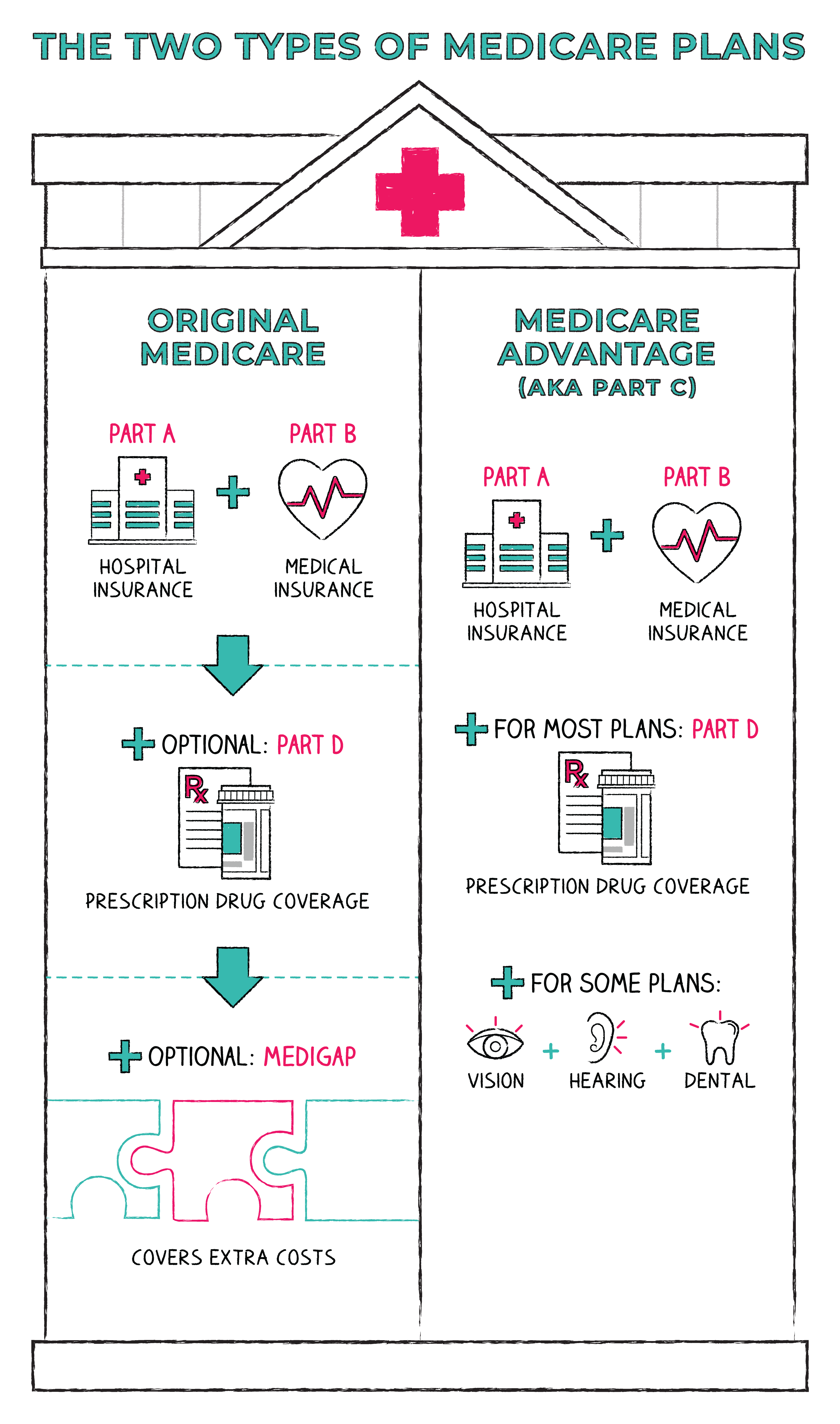

Medicare isn’t actually just one plan. Instead, it’s made up of four different “parts”—each of which provides coverage for different aspects of healthcare services:

- Part A: Hospital insurance, like hospital stays or care in a nursing facility

- Part B: Medical insurance, including routine care, like checkups and outpatient care

- Part C: All-in-one coverage known as Medicare Advantage (more on that below)

- Part D: Prescription drug coverage

If that isn’t confusing enough, it gets more complicated. When people sign up for Medicare, they’re generally choosing between two main plans: Original Medicare and Medicare Advantage.

Those two plans essentially combine Parts A through D in certain ways.

Here are some other ways the two plans compare:

| Original Medicare | Medicare Advantage | |

| Prescription drug coverage? | No, not usually | Yes, included in most plans |

| Choose your doctor? | Yes, in most cases | Only go in network (or have a referral) |

| Annual healthcare expenses? | No limit on annual out-of-pocket costs | Out-of-pocket costs vary but are capped at a predetermined amount |

| Need for a supplemental policy? | Yes, if desired | No |

There’s an element of “choose your own adventure” with Medicare. For starters, you need to choose whether you’re going with an Original or Advantage plan. If you choose an Original plan, you may also need to decide:

- Whether or not to add a plan to cover prescriptions (aka Part D)

- Whether or not to buy additional private insurance to cover any costs that your Medicare plan won’t (these policies are called “Medigap” plans)

Here are some other details to keep in mind about the program:

- Medicare isn’t free. You’re typically still on the hook for paying some expenses, such as deductibles and coinsurance.

- You may even still have a monthly premium. Many Advantage plans have premiums, and you could even face a premium with an Original plan if you didn’t pay into the system for at least ten years through work.

- You’ll still receive insurance through a private company. When people enroll in Medicare, they actually receive the insurance through a private company that contracts with the government to provide benefits.

- The minimum age is different from Social Security. Social Security can begin at 62, but you only become eligible for Medicare at 65

Medicare often gets lumped in with Medicaid because both programs are overseen by the same department. The difference? Medicaid offers health insurance to low-income Americans—no matter how old they are or whether they have any disabilities.

Medicare is a government-sponsored health insurance program for Americans over the age of 65 or who have a disability or specific disease. It’s a safety net program for retirees, though there are some holes in that net. Many people end up supplementing Medicare with other health insurance, and you’ll generally still be facing at least some out-of-pocket costs.

- Almost one in five Americans are covered by Medicare.

- The federal government already spends more than $600 billion per year on Medicare, but that’s projected to reach nearly $1.3 trillion by 2029.

- Better hope you don’t need dentures or hearing aids when you’re older—because Medicare doesn’t cover them.

- Medicare is a federal government program that provides health insurance to people over the age of 65 and younger people who have a disability or certain specific diseases.

- Medicare isn’t actually just one health insurance plan. It’s made up of four “parts,” each of which provides coverage for different types of services.

- Navigating the various parts of Medicare can be confusing, but there are two basic paths: Original Medicare and Medicare Advantage.

- Original Medicare can let you mix and match what types of coverage you want, while Medicare Advantage is generally more comprehensive.

- As with other government-sponsored programs, there are some strict restrictions regarding eligibility for Medicare and what types of benefits the different plans provide.