Financial Planning

Ducks in a Row

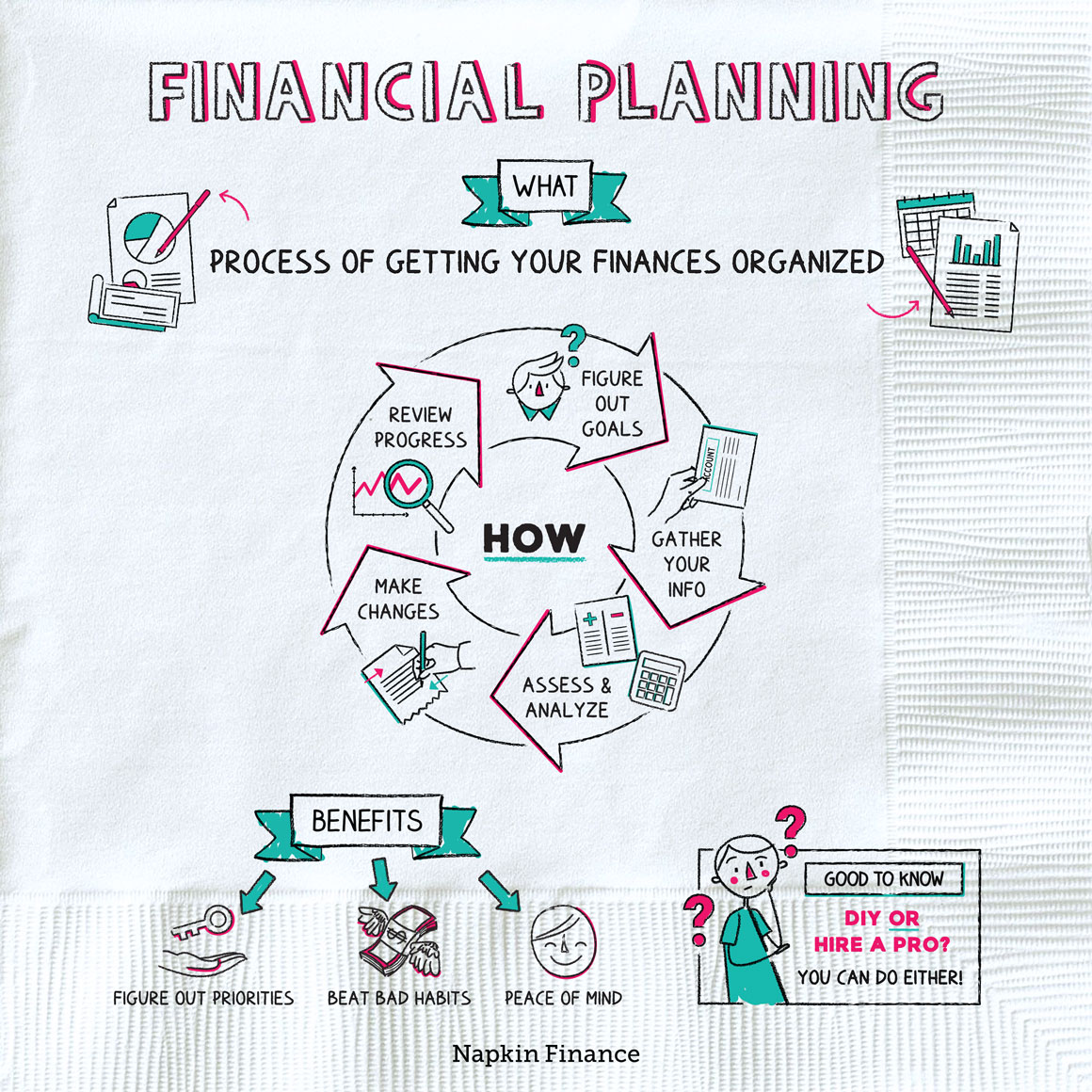

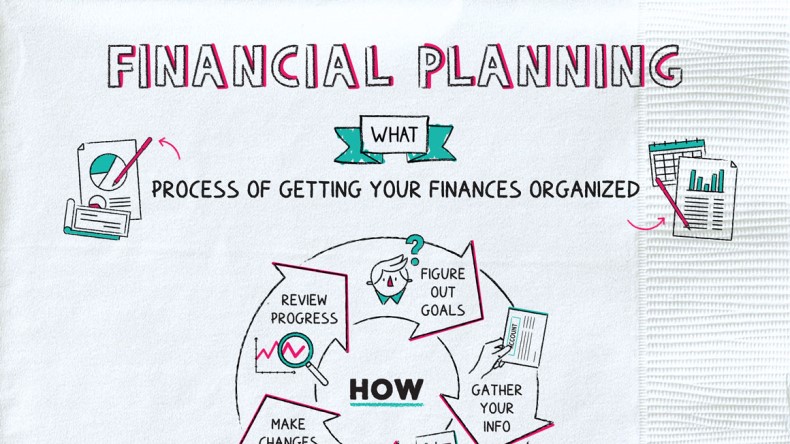

Financial planning describes the process of mastering your money. It means figuring out where you actually are and how you’re going to get your finances to where you want them to be.

It can entail:

- Getting your finances organized

- Figuring out the direction they’re currently heading in, and

- If you need to tweak that direction (because you aren’t saving enough money or you’re digging into debt, for example), figuring out what changes you should make to do so

Financial planning can look different depending on the situation.

If you’re aiming to get your whole life in order, it could be a major undertaking—entailing finding a professional planner, gathering all your account statements and information, having a series of meetings with your planner, and slowly making major changes over time.

But it can also be something that you do on your own or you do only to tackle one specific problem area. If you spend a half hour filling out a budgeting worksheet or setting up an app to track your spending, you’re doing financial planning. And you can often hire a planner to help you with just one particular area of concern—such as coming up with a plan for paying off your debt or optimizing your investment mix.

Different planners may have different areas of expertise. And some won’t be able to help with everything. (Many planners are limited in how much advice they can give you on taxes, for example.) But some of the topic areas planning may cover include:

- Budgeting

- Saving

- Retirement

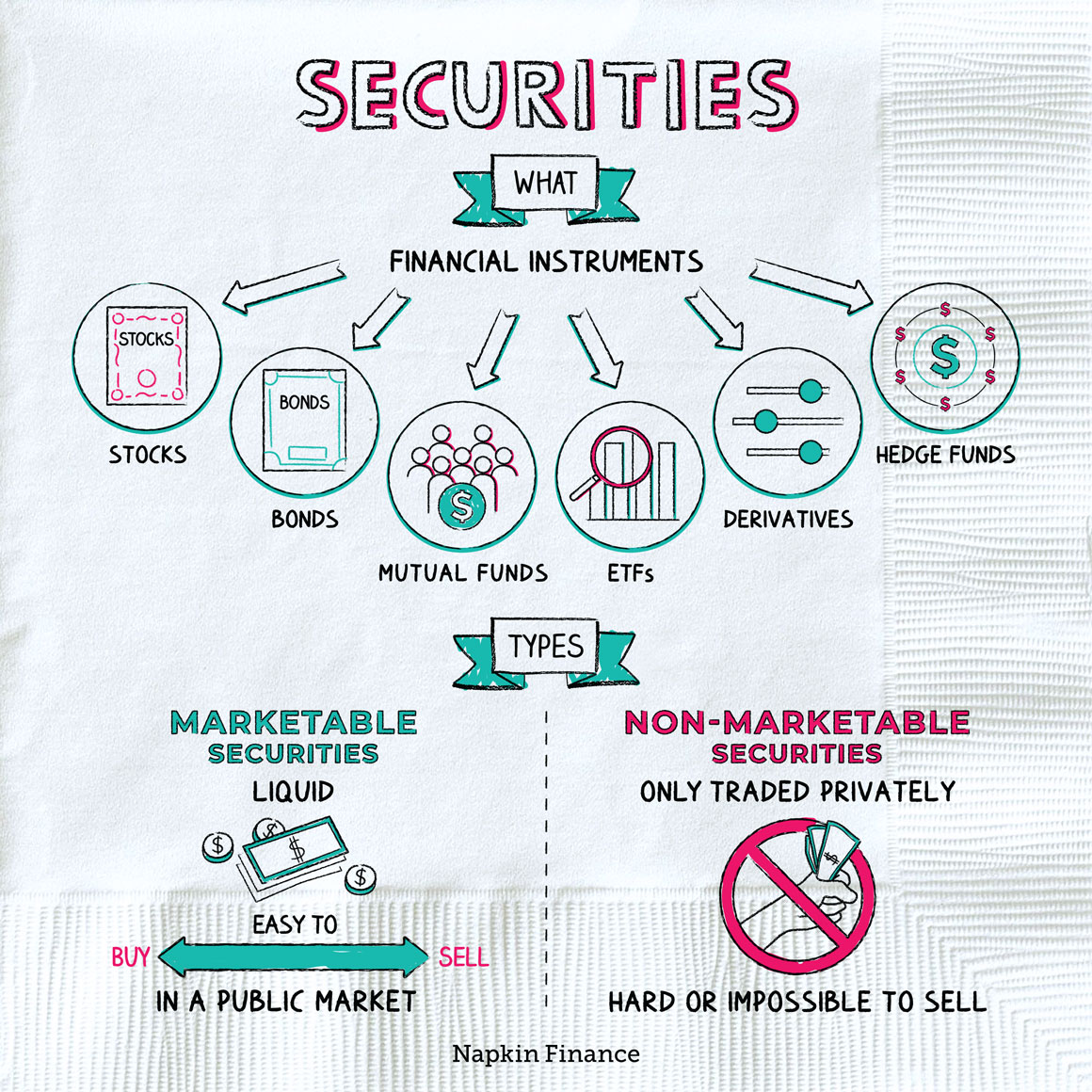

- Investing

- Taxes

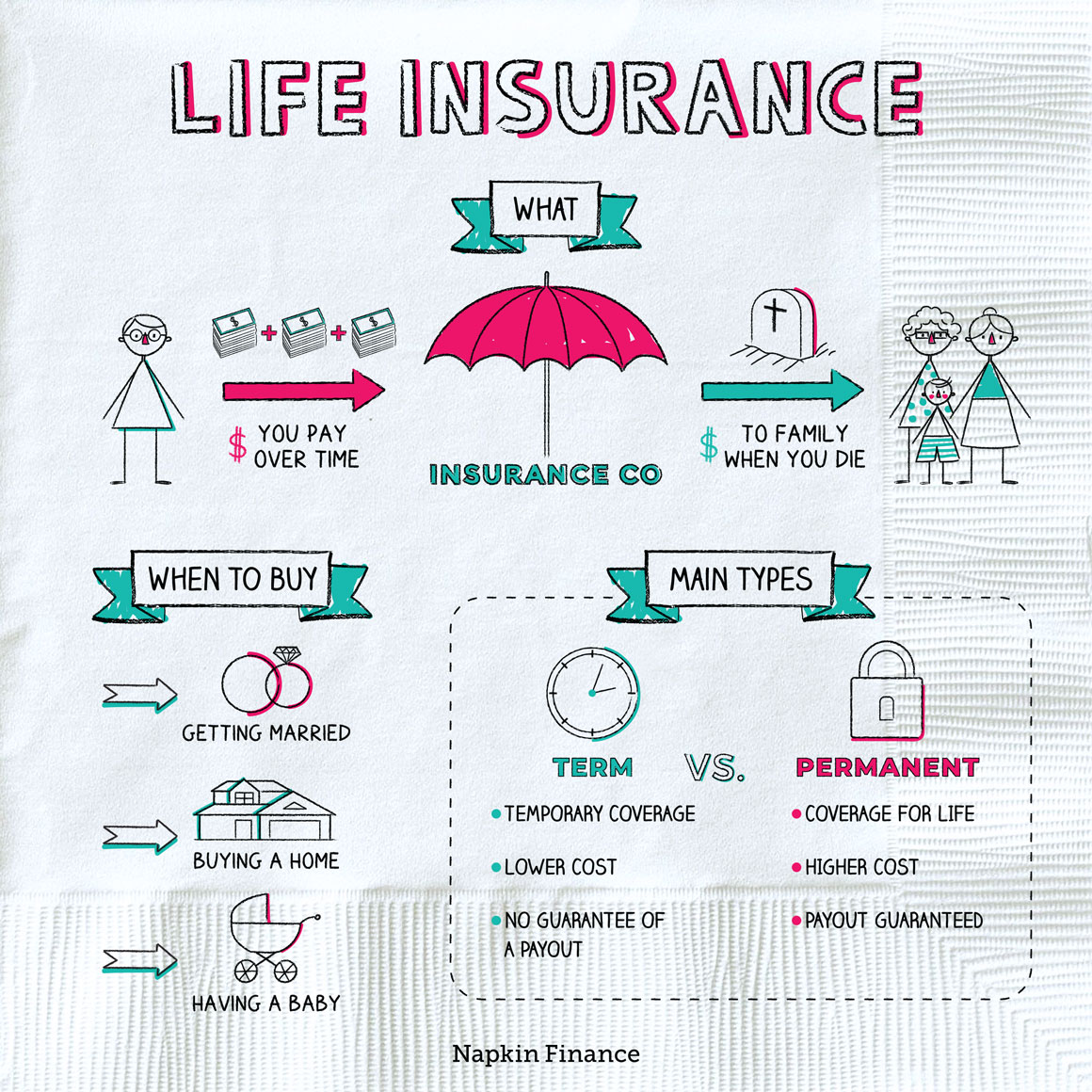

- Insurance

- College savings

- Employee benefits

- Estate planning

If you’re doing planning on your own, then you drive the process. If you decide to work with a professional, the process may look like this:

Step 1: Find a planner, do some due diligence, and make sure he or she is a good fit in terms of expertise and personality.

Step 2: Decide together what your aim is. Are you only going to tackle one or two specific issues or everything? Are you going to work together indefinitely or only for a set period of time?

Step 3: Figure out what your goals are for your money. You probably want to retire in comfort one day. Maybe you also want to eventually buy a vacation home or help your kids get through college.

Step 4: Gather all the relevant information on your finances.

Step 5: Hand that information over to your planner, who will do some numbers crunching and analysis.

Step 6: Listen to your planner’s conclusions and recommendations. Maybe you need to tweak your investment mix or save more in your Roth IRA. He or she could also have some reality checks for you—such as if getting that vacation home isn’t going to happen.

Step 7: Put those recommendations into action. Maintain any changes you’re making, and check back in on your situation periodically. Rinse and repeat.

Whether done on your own or with a pro, planning is one of the best things you can do for your finances. Some of the benefits are:

- Getting organized

- Finally understanding your situation

- Making sure you’re saving and investing enough

- Catching any mistakes you’re making

- Helping you figure out your priorities

- Beating any bad habits—whether that’s overspending, using the wrong mix of retirement accounts, or not investing enough money in stocks

- Peace of mind that you’re making the right decisions

Financial planning is the process of finally getting organized, really looking at your money, and figuring out what you need to be doing differently. You can do financial planning on your own or with a professional. In either case, it’s a great way to help your finances be all that they can be. Future you will thank you.

- Hiring a pro? Hope you like alphabet soup. CFP, CFA, RIA, PFS, CPA, ChFC, and CMFC are just a few of the designations you may run into when you’re researching planners.

- Professional planners don’t necessarily have to be licensed or to have passed any particular exams. (But there are licensing or other regulatory requirements for specific focus areas—such as giving advice on taxes or investments or for selling insurance.)

- Similarly, some planners (but not all) are fiduciaries, which means they have a legal obligation to put your financial interest ahead of their own. The best way to find out if a planner has a fiduciary duty to you is to ask.

- Financial planning is the process of getting your finances organized and figuring out what, if anything, you need to be doing differently.

- Financial planning can mean scrutinizing and overhauling every aspect of your money. Or it could mean simply spending an evening learning about investing and adjusting your 401(k)’s investment mix.

- You can do financial planning on your own or with a professional planner.

- If you work with a pro, you’ll need to spend some time finding the right person and making sure that you’re on the same page when it comes to what aspects of your finances you’re looking at and how long the relationship will last.

- Financial planning is a great gift you can give to your future self, since it can help you get organized, fix any bad money habits, and even grow your money faster.