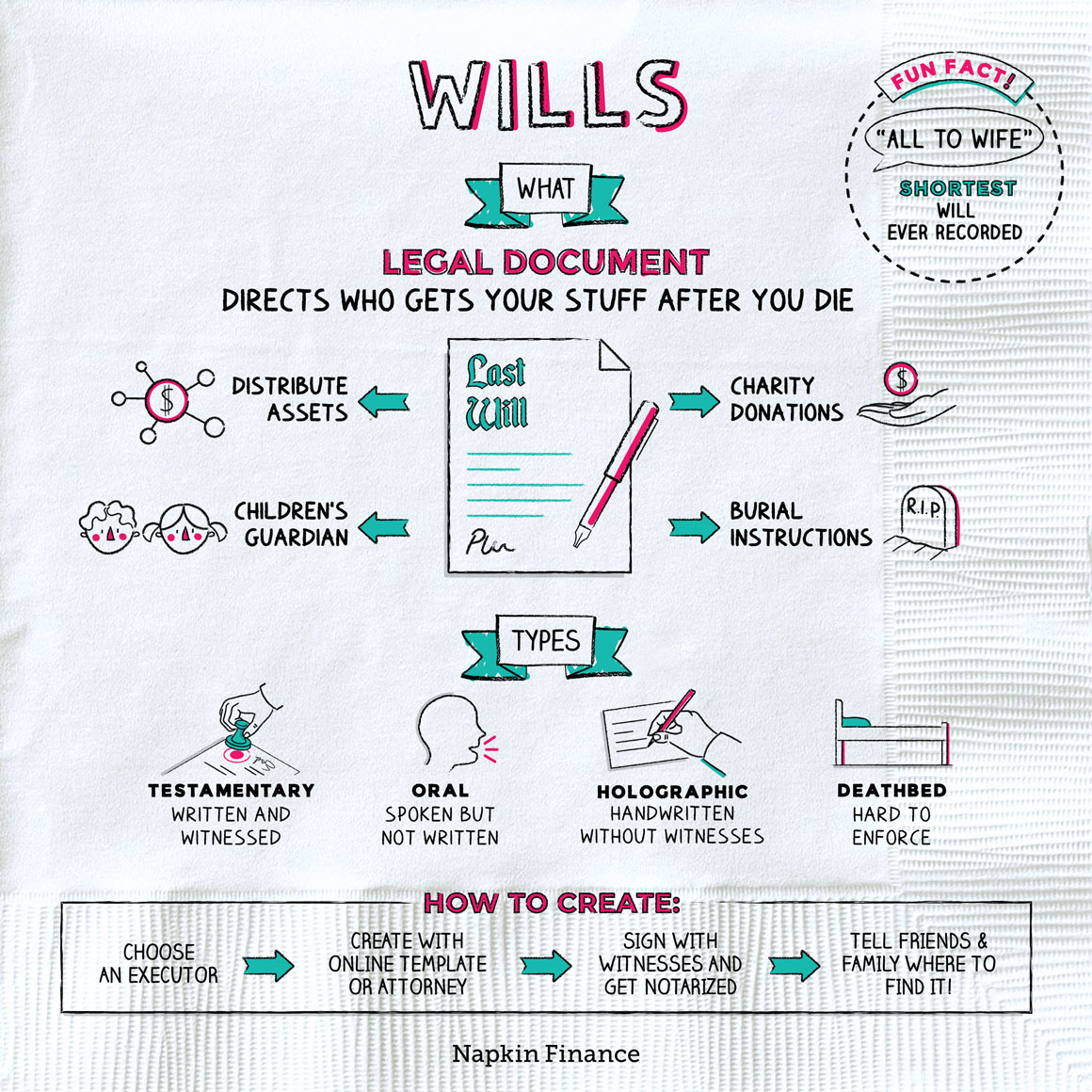

Wills

For Love or Money

A Last Will and Testament, or “will” for short, is a legal document that lets you transfer your assets after you die. If you have children under age 18, you can also use a will to choose someone to care for them after you pass.

Wills aren’t required, but it is generally recommended that everyone with something to leave behind, even small items, consider one.

Some common reasons people need wills are to:

- Ensure care of children goes to a loving guardian

- Correctly distribute property or financial assets

- Leave last messages for loved ones

- Give assets to charity

If you don’t have a will when you die, known as dying intestate, state law dictates the distribution of your assets.

There’s no single template for a will, but there are some standard elements, including:

- Your name and address

- Assets you want to allocate

- Names of the beneficiary for each asset (and alternates, should those people die before getting your assets)

- Guardian for your kids (plus an alternate)

- Name of your executor (the person who handles the process after you die)

- Your signature and the signatures of your witnesses

Putting your will together is pretty straightforward, and contrary to popular belief, you don’t have to involve a lawyer.

Decide what you have and who you want to give it to

↓

Pick an executor who will handle your wishes (probably a good idea to get their permission, too)

↓

Meet with an attorney or estate planner, use special software, or download a template online

↓

Write and review your will

↓

Sign your will in front of witnesses, and get it notarized if your state requires

↓

Store the document in a safe place and let someone (usually your executor) know where to get it

↓

Update as needed, either by writing a new will or adding an amendment

There are various types of wills and some are more likely to hold up in court than others.

| Type | How its created | What the courts think |

| Testamentary | Written and signed in the presence of witnesses | Typically these pass muster with the courts |

| Holographic | Handwritten and signed without witnesses | The high potential for fraud makes them difficult to defend |

| Oral (or nuncupative) | Spoken but not written down | They’re hard to uphold without a lot of witnesses or written proof of what happened |

| Deathbed | Written or spoken while you’re dying | These are hard to enforce for many reasons, including your mental state |

Bottom line: Written, signed, and witnessed is probably best, but check your state laws to verify the requirements.

- You can write people out of your will. Just keep in mind that in some states, certain people (such as spouses) still have legal claim to your assets no matter what you write.

- Unlike a trust, a will lets you keep control of your assets while you’re alive. Spend down your bank account, run your car into the ground, sell your house, it’s completely up to you.

- Experts overwhelmingly recommend you avoid joint wills, those shared with your spouse, because it’s unlikely that you’ll die at the exact same time and you might have unshared assets to allocate.

- Specificity is key when writing a will. If “Sam” is the name of both your ex-husband and daughter, simply a first name won’t ensure your assets go where you want.

A will is a document that lets you transfer your assets to people or organizations after you die. Experts usually recommend that anyone with assets or children have a will, listing specifically who will get which assets and who will manage the estate. You can type, handwrite, or speak a will, and witnesses may or may not be present. States generally have laws regulating the type of wills that courts can legally enforce. You can create a will on your own, or with the help of an attorney or estate planner, and you can update it until your death.

- More than 60% of Americans don’t have a will.

- Frederica Evelyn Stilwell Cook created the longest will in history, which clocked in at 1,066 pages.

- A will is a document used to distribute your assets after you die.

- It’s recommended if you have any assets to distribute, or children who need a guardian.

- Courts often have a hard time upholding handwritten, unwitnessed, and oral wills.

- You can write a will with an estate planner or attorney, or you can do it yourself using special software, an online template, or even a napkin (though the latter is not usually recommended).