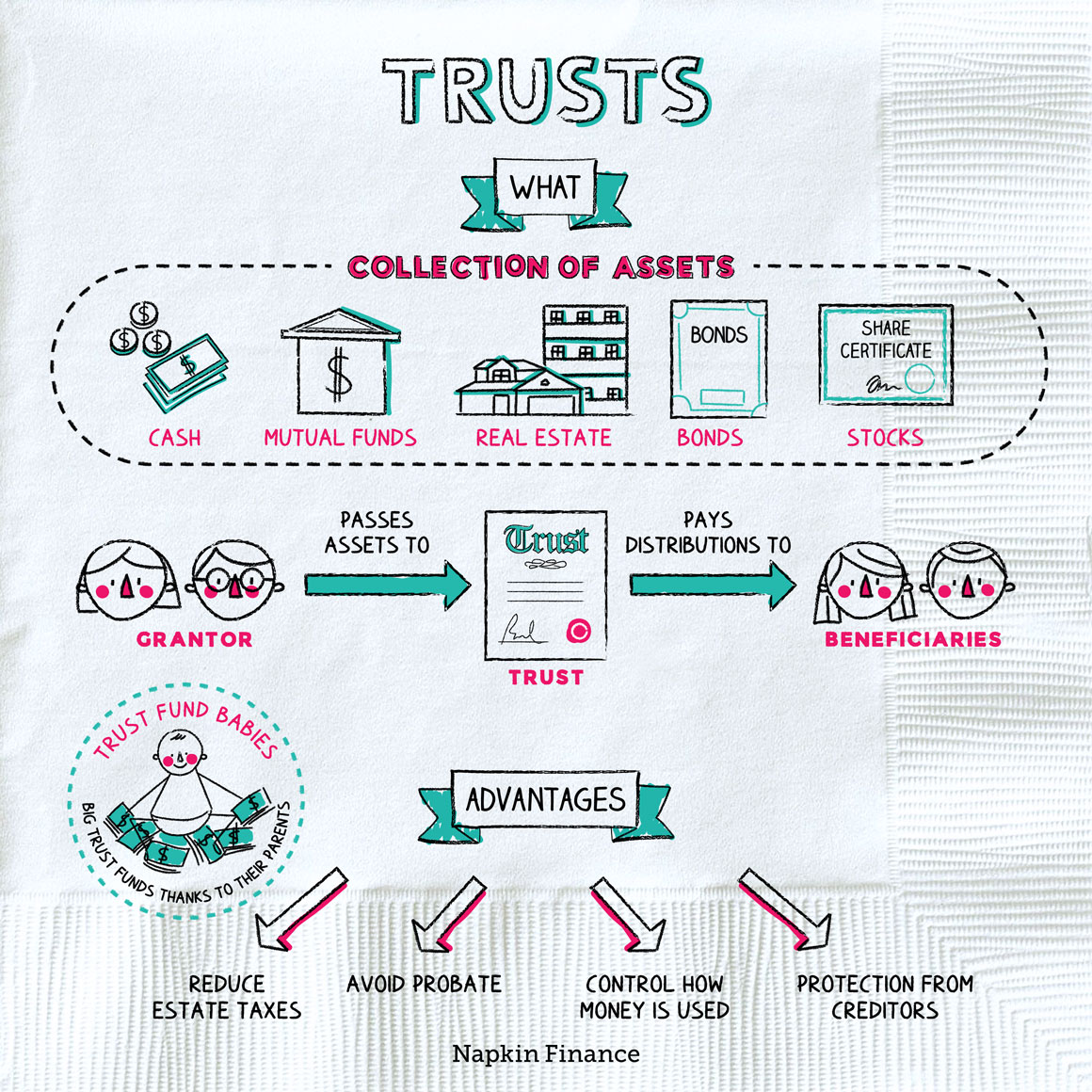

Trusts

Pennies From Heaven

A trust is a legal document that allows a person (the trustee) to hold the assets of someone else (the grantor) and eventually give that property to a beneficiary at some point in the future.

Many people view trusts as only for the uber wealthy who want to leave their riches to their kids. However, there are many reasons anyone might want to create a trust, including:

- Providing for family and friends in the future

- Paying education expenses for children or grandchildren

- Establishing a charitable fund

- Controlling how beneficiaries care for certain property and how it’s distributed

- Managing assets in case of disability or incapacitation

- Maintaining privacy after death

- Protecting assets from creditors

- Avoiding a lengthy probate process

There are usually fees involved in setting up a trust. And, while you can go it alone with an online template, experts recommend meeting with an estate planner or attorney to make sure it’s exactly what you want.

The process tends to look something like this:

Choose what you’re putting in the trust (real estate, stocks, money, life insurance, etc.)

↓

Pick out the beneficiary or beneficiaries

↓

Set rules for asset distribution (e.g., after a child turns 18 or graduates college)

↓

Choose a trustee (family, friends, or even a professional) and talk through your plans

↓

Meet with an attorney to discuss your plan, review any tax issues, and draft the trust document

↓

Sign the trust document, preferably with witnesses, and get it notarized (if required or preferred)

Trusts come in many varieties, but generally fall into one or more of these categories:

- Living vs. testamentary

- Living: You use the assets held in the trust during your lifetime, then a trustee passes them to beneficiaries after you die

- Testamentary: Created after the probate process wraps up following your death

- Revocable vs. irrevocable

- Revocable: You continue to control the assets and can make changes until your death

- Irrevocable: You lose control of your assets and changes are extremely difficult without the involvement of a court

- Funded vs. unfunded

- Funded: Assets added during your lifetime

- Unfunded: Assets only added after your death

Both a trust and a will let you transfer assets to someone else. However, there are important differences between these two estate planning tools.

| Trust | Will |

| Can take effect immediately | Only takes effect after you die |

| Includes only the assets in the trust | Includes most assets in your name |

| Usually avoids probate | Usually goes through probate |

| Can be kept private | Becomes part of the public record |

| Cannot name caretakers for minor children | Can designate caretakers for minor children |

| More expensive and time consuming to set up | Cheaper and easier to create |

A trust is a way to transfer assets to someone else after you die. The person who creates the trust, the grantor, chooses a trustee to hold the items in the trust for a beneficiary who will receive the assets at a set point in time. People use trusts for many reasons, including to provide for their families, manage assets in case of disability, give money to charity, and avoid certain taxes. There are many types of trusts available, including those that the grantor can use while living and those that lock up assets that only transfer to a beneficiary after death. A trust differs from a will, which is also an estate planning tool, in various ways including cost, permissible uses, and whether probate is a factor.

- A “beach bum” provision links a beneficiary’s payout to their income, basically as a way to prevent someone from living solely off the trust.

- While some celebrities set up trust funds for their kids at a young age, others, including Sting, George Lucas, Ashton Kutcher, and Gene Simmons, refuse to leave all their riches to their offspring, instead saying they’ll have to work hard for what they want.

- A trust is a legal document that lets you transfer assets to someone else, via a third party trustee.

- People use trusts to provide for family members, create charitable funds, avoid certain taxes, and dictate how the trust transfers assets.

- There are many types of trusts that break down into basic categories based on how they’re funded, the level of control you have in life, and when they go into effect.

- You can use either a trust or will to transfer assets, and while a trust is more expensive to set up it usually helps your family avoid probate.