Charitable Remainder Trusts

Big Love

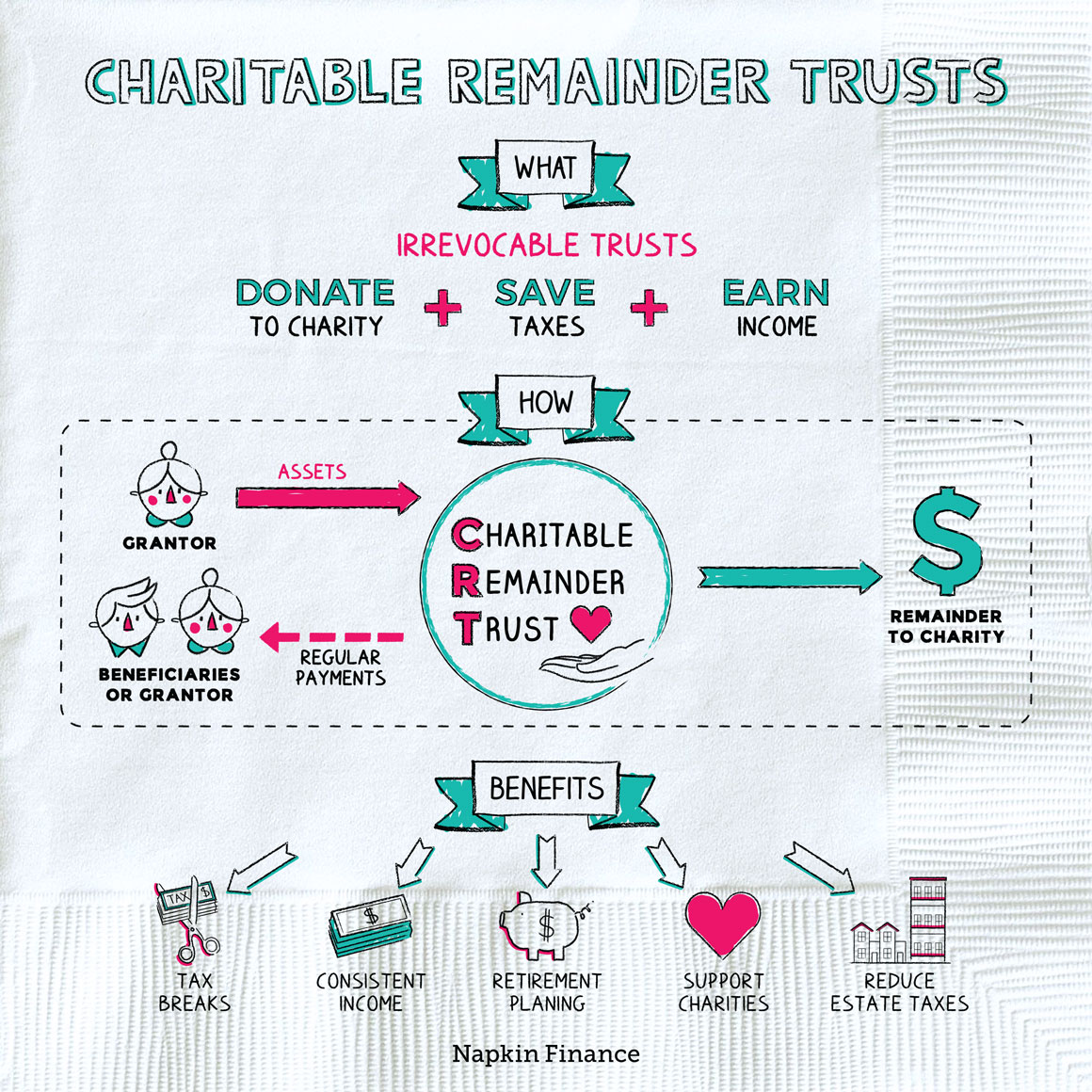

A charitable remainder trust is a financial tool that can provide a steady source of income while also benefiting a charity of your choosing.

They can be a good option for people who want flexibility in their estate plan, want to save money on taxes, or are preparing for retirement.

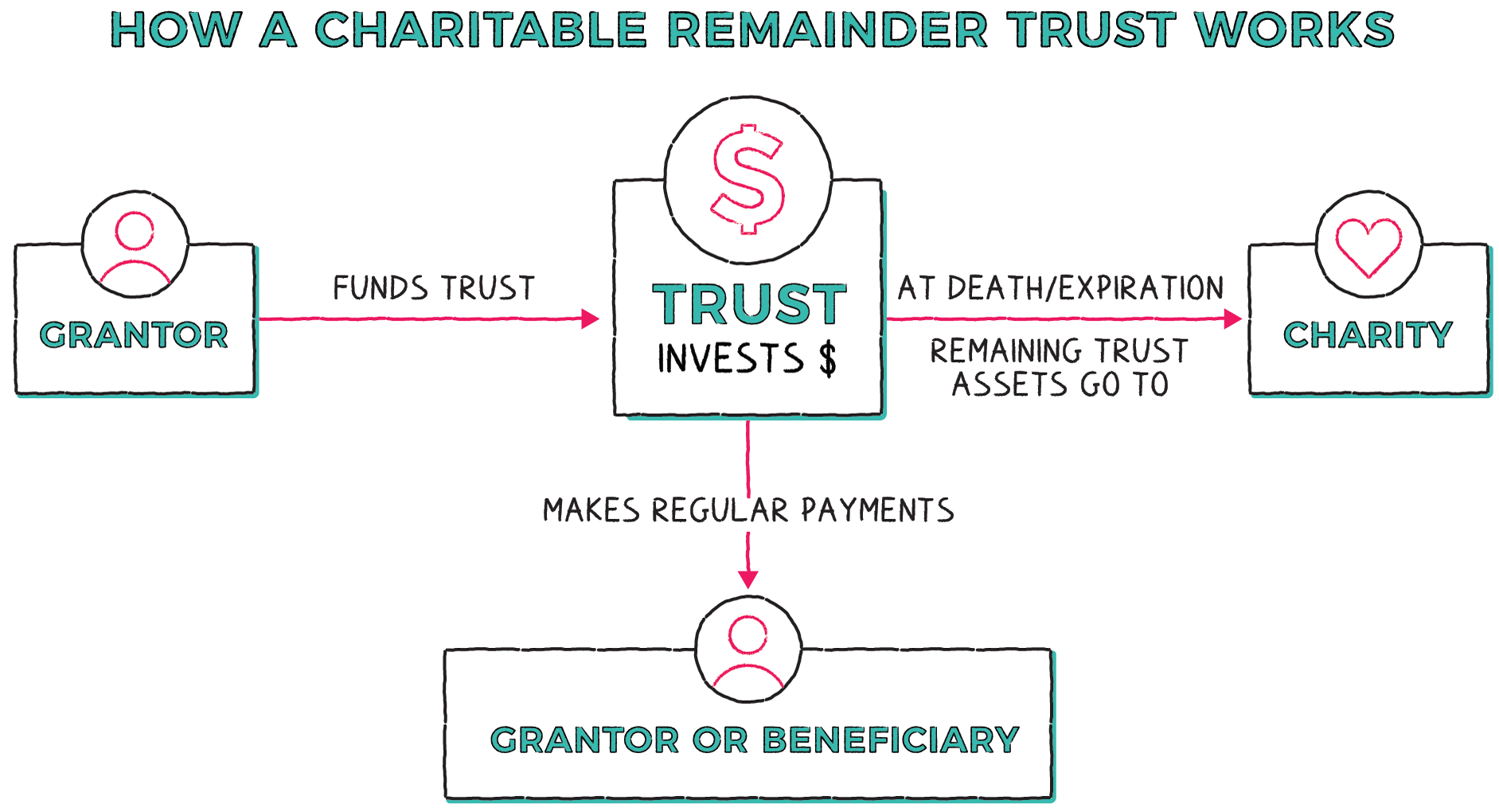

Here’s what a typical lifecycle of a charitable remainder trust looks like:

Step 1: A person known as the “grantor” creates a charitable remainder trust.

Step 2: The grantor deposits assets—such as cash, collectibles, real estate, or securities—into the trust.

Step 3: The trust sells the assets.

Step 4: The trust reinvests the proceeds into income-producing investments, like mutual funds, stocks, and bonds.

Step 5: The trust pays out periodic income—either to the grantor or another person they’ve chosen (called a “beneficiary”).

Step 6: When the grantor or beneficiary dies or the trust term expires, any assets left in the trust are donated to a designated charity.

A trust is a type of legal agreement, so most people work with a lawyer to set one up. Accountants, financial planners, or investment advisors may also be able to help.

In the course of setup, you’ll also need to make some important decisions, including:

- What charity or charities should the trust benefit?

- Who will receive income from the trust—you or a beneficiary?

- Will the trust distribute income for the rest of your or your beneficiary’s lifetime? Or will it make payouts for a set period of time (up to 20 years)?

- Should the trust’s periodic payments be set at a specific dollar amount or at a percentage of its value?

Answering this last question will help you decide which type of charitable remainder trust is best for you—a charitable remainder unitrust or a charitable remainder annuity trust.

Here are some of the key differences:

| Charitable remainder unitrust (CRUT) | Charitable remainder annuity trust (CRAT) | |

| Type of payment | Pays a set percentage of its value | Pays a set dollar amount |

| Main benefits | Payments could increase over time if the investments perform well | A fixed dollar-value payment is more reliable and makes retirement planning simpler |

| Main risks | Payments could decrease if the investments do poorly; changing payment amounts makes retirement planning harder | Trust assets could be depleted if investments do poorly; in that case the trust may be voided |

| Can you make additional contributions? | Yes | No |

Note: All charitable remainder trusts are irrevocable, so you can’t cancel or change them in any way after creation.

Charitable remainder trusts can provide significant tax savings. For example, you can:

- Claim a partial charitable tax deduction (up to a limit) when you deposit assets into the trust

- Contribute appreciated assets—like a stock that you bought for $5 but is now worth $5,000—to the trust and avoid paying a hefty capital gains tax bill

- Remove large assets from your taxable estate to reduce the amount of estate or gift tax that might be due down the line

However, distributions you or your beneficiary receive from the trust may be taxable.

A charitable remainder trust can provide a consistent source of income, particularly in retirement, all while benefiting your favorite charity. There are two primary types: unitrusts and annuity trusts. Working with a qualified professional can help you pick the right kind and avoid legal and tax pitfalls.

- Trust and estate lawyers really love acronyms. In addition to CRUTs and CRATs, there are GRATs, SLATs, NINGs, and QTIPs (to name a few).

- Charitable remainder trusts are also known as “split interest trusts” because the interests in the trust are split between the grantor or initial beneficiary and the grantor’s chosen charity.

- Charitable remainder trusts were created as part of the Tax Reform Act of 1969.

- A charitable remainder trust pays you or a beneficiary a set amount of money every year for a certain period of time.

- When the trust term expires or you or your beneficiary die, all assets still in the trust are given to your chosen charity.

- There are two main types of charitable remainder trusts—charitable remainder unitrusts and charitable remainder annuity trusts—each of which has different risks and benefits.

- Creating a charitable remainder trust can reduce your tax burden, but you may still have to pay taxes on distributions. You also have to be careful not to deplete the trust before its term ends.