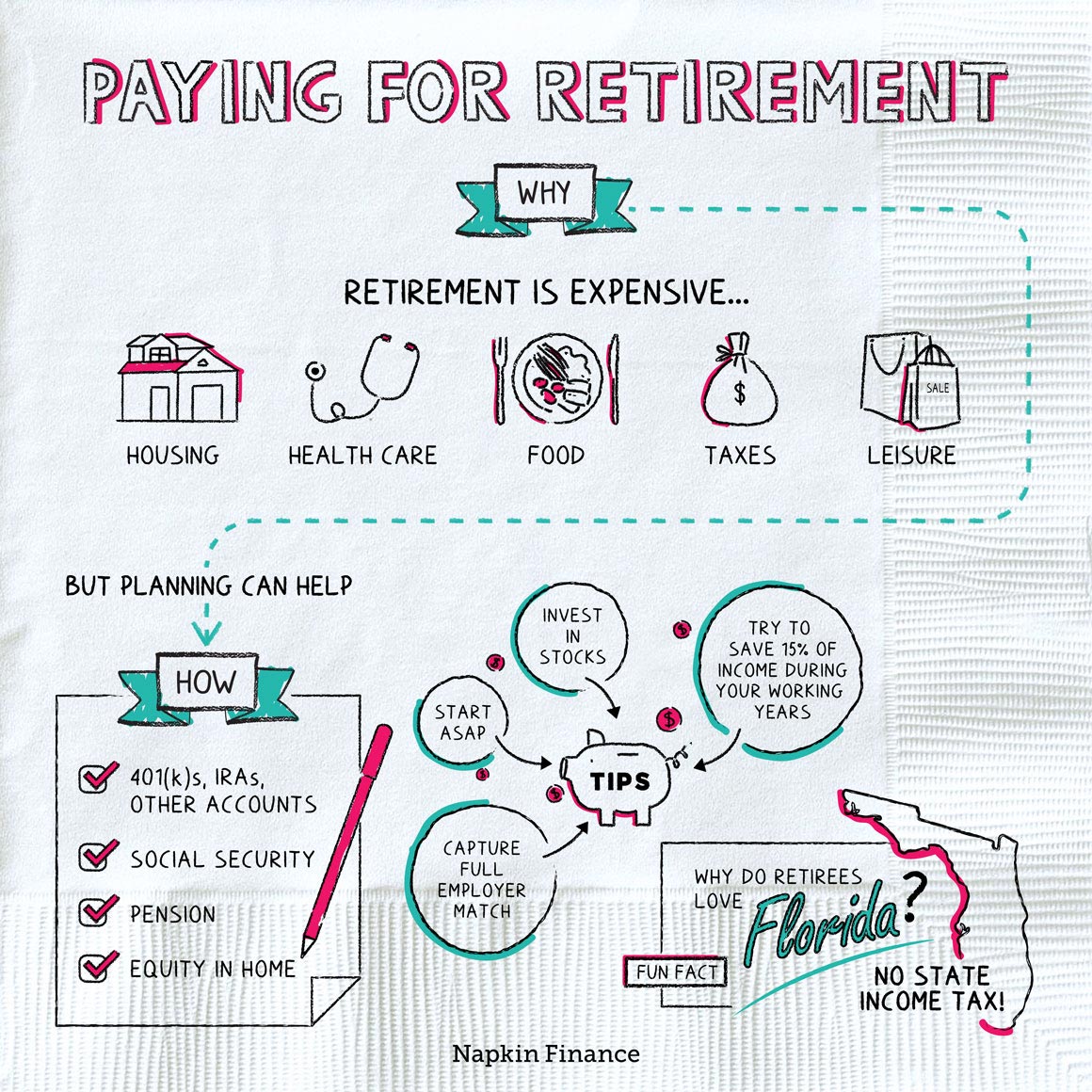

Paying For Retirement

Into the Sunset

Retirement may seem like an abstract, far-off goal (unless you’re already independently wealthy or a 401(k) ninja, in which case—respect). But you’ll never drink Mai Tais on the beach in your 70s unless you start saving money now.

Retirement is expensive. Your costs in retirement will probably include:

- Housing

- Healthcare

- Food

- Taxes

- Travel and entertainment

Experts estimate that you’ll need upwards of 80% of your pre-retirement salary during your golden years. But exactly how much you’ll need may depend on:

- When and where you’ll retire

- Your health

- Whether you’ll keep receiving employer-sponsored health insurance

- Whether you’re a two-income household

- If you’ll keep working part-time

What plans or hobbies you’ll pursue and your overall lifestyle matter too. If you’re a homebody who finds a weekly trip to the library is plenty enough excitement, your retirement budget can be a bit leaner than someone who’s hoping to travel full-time.

Your income and assets in retirement may include:

- Investment and savings accounts—including what you’ve saved in retirement accounts.

- Social Security—which is paid by the government.

- Traditional pension—if you worked for an employer that provides one.

- Your house—if you own a home.

Paying into Social Security generally happens automatically when you work. Unfortunately, you probably don’t have any control over whether your employer offers a traditional pension.

The main thing you can do to plan for your retirement is to save—particularly in a tax-advantaged retirement account where your money can grow. The main types of accounts include:

- 401(k)s—tax-deferred accounts offered by many employers. (Employees of nonprofits and public school systems may have 403(b)s instead.)

- Individual Retirement Accounts (IRAs)—tax-deferred accounts you can open on your own with a financial institution.

- Roth 401(k)s or Roth IRAs—accounts similar to their non-Roth counterparts but which let you contribute after-tax dollars and take withdrawals tax free in retirement.

“Retirement is like a long vacation in Las Vegas. The goal is to enjoy it to the fullest, but not so fully that you run out of money.“

—Jonathan Clements

Saving for retirement is like an ultra-marathon: you have to pace yourself. Here’s how to focus your strategy at different life stages:

| Age | Plan |

| 20s to 30s |

|

| 40s to 50s |

|

| 60s and beyond |

|

Paying for retirement usually involves a combination of Social Security and pension checks plus any individual or employer-sponsored retirement and savings accounts. Saving on your own, whether in a traditional or Roth 401(k) or IRA, is key to making sure you can maintain the lifestyle you want. Experts recommend that you start saving for retirement as soon as you can, invest heavily in stocks while you’re young, and try to save at least 15% of your income.

- Why do retirees love Florida so much? It’s not just the sunshine and beaches—it’s also one of the handful of states with no personal income tax.

- The country with the youngest retirement age is the United Arab Emirates, where citizens become eligible for pensions and retirement benefits at 49 (expats have to wait until they’re 65).

- Retirement is expensive, so you need to start saving for it while you’re young.

- Tax-advantaged retirement accounts, such as 401(k)s and IRAs, are the best retirement savings options for many people.

- Start saving in your 20s and continue until retirement. How much you save will likely change over time as will your investment strategy.

- Saving 15% of your income and investing heavily in stocks while you’re young can help you get there.

- Exactly how much you’ll need may depend on your health, where you end up retiring, and the kind of lifestyle you want to lead.