Judgments

By the Book

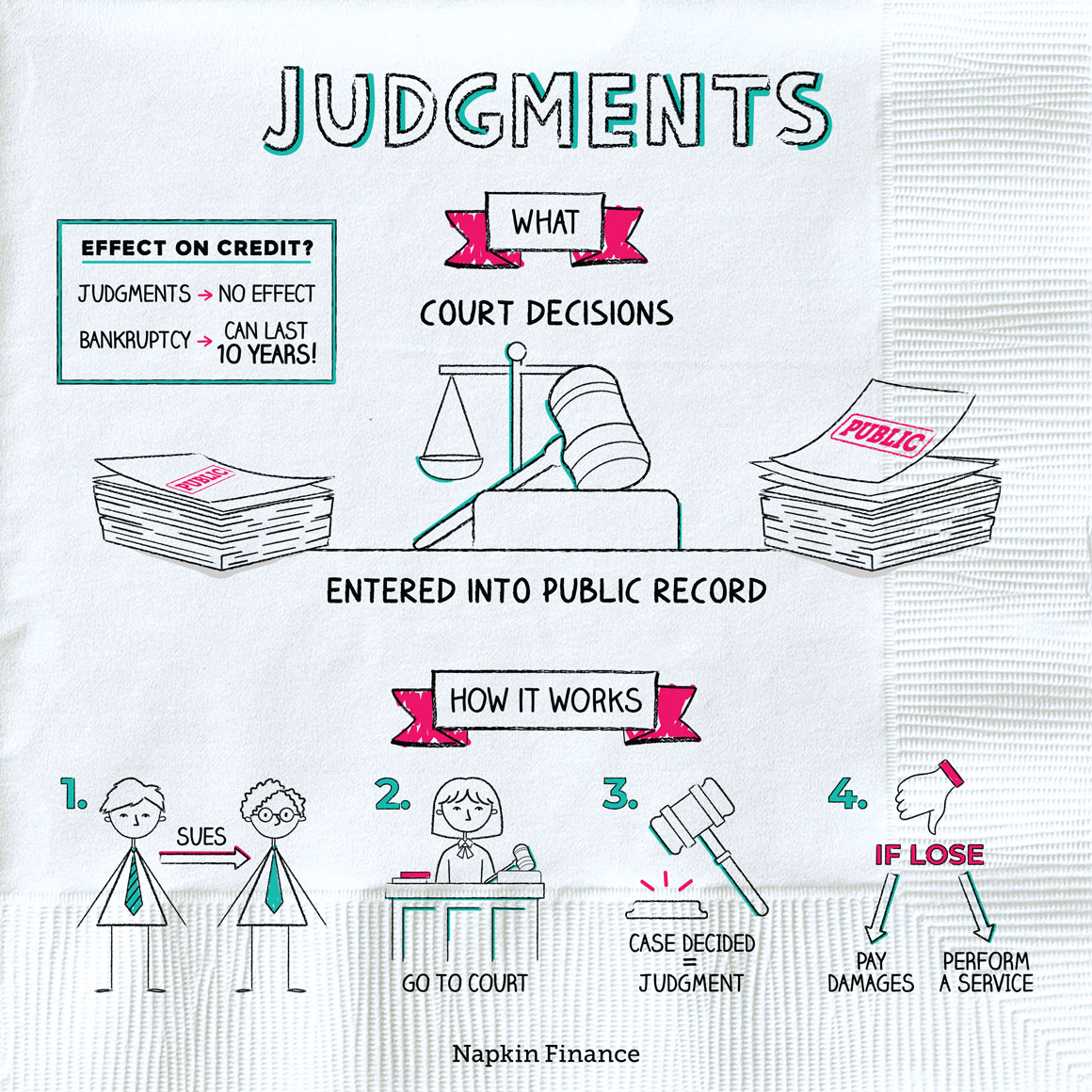

A judgment is a decision made by a court that’s been entered into the public record (i.e., you can see it on court records available to the public). Judgments are the result of a legal action or lawsuit.

Judgments start with a lawsuit and generally end with someone owing someone else something.

Someone files a lawsuit.

↓

The party being sued has a chance to respond.

↓

The parties may exchange documents or

try to negotiate.

↓

If they can’t reach a settlement,

the dispute goes to trial.

↓

A judge or jury makes a decision in the case.

↓

The court enters a judgment in the public record.

The judgment could require the losing party to pay the winner—either with money or a service. For example, a judge might order a building contractor to complete a project rather than paying the homeowner.

If a judgment has been entered against you, it can give debt collectors extra tools to try to force you to pay. These might include:

- Wage or bank account garnishment—the debt collector takes money directly from your paycheck or accounts.

- Payment plans—you work with the company you owe to establish a way to pay your debt.

- Property liens—the debt collector may be able to make a claim against something you own (like your house), which then serves as collateral for your outstanding debt.

- Seizure—the debt collector comes to your house and takes stuff you own to recoup the debt owed.

States have their own laws governing how much of your money a debt collector can take or which property it can seize. This is meant to ensure you can maintain at least a basic standard of living.

Judgments related to debt repayment can’t be added to your credit report (they used to get added, but recent policy changes have changed this).

But bankruptcy, which is one way people resolve judgments, will show up on your credit report (and stick around for as long as ten years) as will unpaid account balances (which typically disappear after seven years). Both can lower your credit score.

Your best bet is always to pay the debts you owe. However, if you’re facing a judgment, keep in mind that:

- Depending on where you live, if you don’t pay up after a judgment, the creditor might be able to try collecting for more than 20 years.

- It’s possible to be “judgment proof”—which means you have too little in assets to pay the debt. However, creditors might still keep trying to collect for years just in case you do end up with property or money.

- It’s possible to make an agreement with your creditor to settle the judgment by paying only a portion of what you owe.

- A court can enter a judgment against you even if you don’t show up to court.

A judgment is a decision made by a court in response to a lawsuit. A judgment might require you to pay another person or complete a service. Judgments are legally enforceable and give debt collectors tools—including property liens and wage garnishment—to make sure you pay the debt.

- Good news: Debt collectors aren’t allowed to call you too many times a day, call you at work, use abusive language, or call really early or really late.

- The Federal Trade Commission gets more complaints about debt collectors than any other industry.

- If you’re looking to date only those who pay their debts on time, check out CreditScoreDating.com, whose motto is: “Where good credit is sexy.”

- A judgment is a decision made by a court that gets entered into the public record.

- Judgments can require the losing party to pay money or provide a service.

- If you choose not to pay a judgment, a debt collector might garnish your wages, take money from your bank account, or seize your assets.

- Credit bureaus can’t include judgments on your credit report, but they can include delinquent accounts and bankruptcies.