Layaway

Bill Me

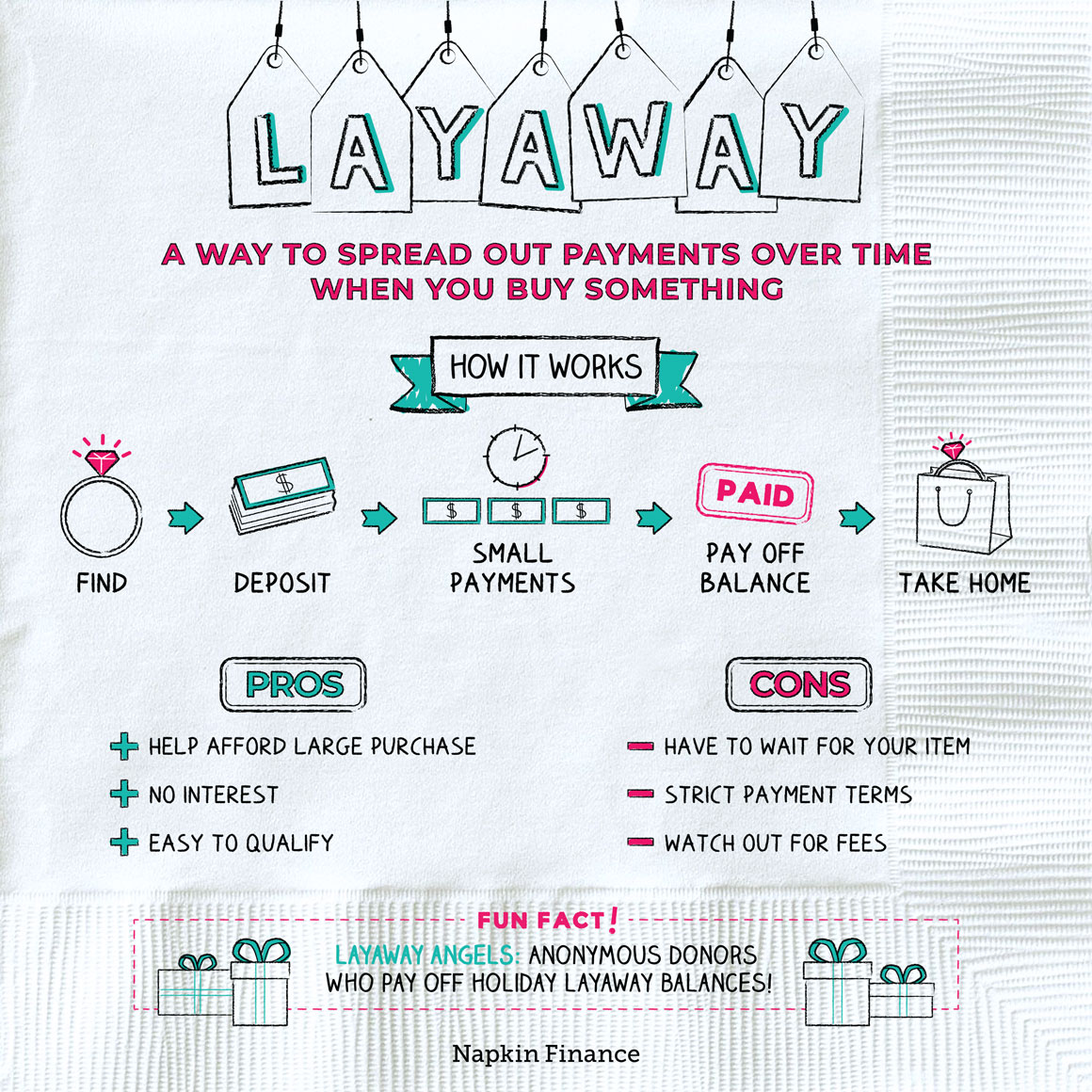

Layaway lets you spread out payments over time when you buy something. Buyers often use it for big-ticket items instead of credit cards or in-store financing, which charge interest.

When you use layaway, a store will put the item on hold until you pay off the balance. Here’s how it works:

Find an item you want.

↓

Take it to customer service, a register, or another

appointed place at the store (sometimes, you can do this online).

↓

Pay a deposit to hold the item.

↓

Choose your payment term.

↓

Make small payments over time.

↓

Pick up the item once you’ve paid it off.

Unlike buying something with a credit card, which lets you take your item home now and pay for it later, buying something on layaway means you pay for it now and take it home later.

Layaway is not always the best option, but it can be a more manageable option for people with limited income or who don’t qualify for a credit card.

| Benefits | Drawbacks |

| Lets you spread out large costs over time | Might require a service fee |

| Can make large purchases accessible if you have low income | Deposits (usually a flat fee or percentage of the item’s cost) can be high |

| Lets you avoid paying interest | Strict repayment terms; failing to meet them or cancelling your purchase could trigger extra fees |

| Easy to qualify | Not available at all stores or for all products or times of the year |

If you have a credit card, you might be wondering whether it makes sense to opt for layaway instead. Here’s what you should know:

| Layaway | Credit card | |

| Pay interest? | No | Yes, if you carry a balance |

| Requires a credit check? | No | Yes |

| Does it affect your credit score? | No | Yes |

| When do I get the item? | Once you pay off the balance | Take it home the same day |

| Are there fees involved? | There’s often a layaway fee plus additional fees if you change your mind or miss payments | Only if you miss a payment |

| Is a down payment required? | Usually | No |

| How do you make payments? | Generally at the store in person (though sometimes online or by phone) | Online, by mail, or through an app (from home in your pjs if you want) |

Layaway could be the cheaper option depending on the fees charged by the store and your credit card interest rate. Crunch the numbers before you decide.

If you’re considering layaway, be sure to:

- Get a copy of (and read) the store’s layaway policy.

- Know when payments are due and how long you have to finish paying for the item.

- Understand the deposit, fees, and any penalties you could face.

- Figure out what happens if you change your mind or need to return the item.

Layaway lets you buy something at a store in installments and take the product home once the last payment is made. Not every store offers layaway, and it usually requires at least an up-front fee and a down payment. Layaway can be helpful for those with limited income or who don’t have a credit card, but it can also come with high fees and means you have to wait to take your purchase home.

- Every year “Secret Santas” around the country visit stores, such as Walmart, to pay off layaway purchases for hundreds of strangers.

- Pay Away the Layaway is a nonprofit group that pays off layaway debts at different retail locations every year. It’s funded through donations and covers thousands of dollars worth of gifts each year.

- Layaway can let you pay for a big-ticket item over time.

- It can be useful for those with little disposable income but isn’t always the cheapest option due to fees.

- Like a credit card, layaway lets you spread out payments. Unlike a credit card, it doesn’t result in interest charges or impact your credit score.

- Before using a layaway program, it’s important to understand a store’s policies and all the potential fees involved.