Paying for College

Higher Education, Higher Costs

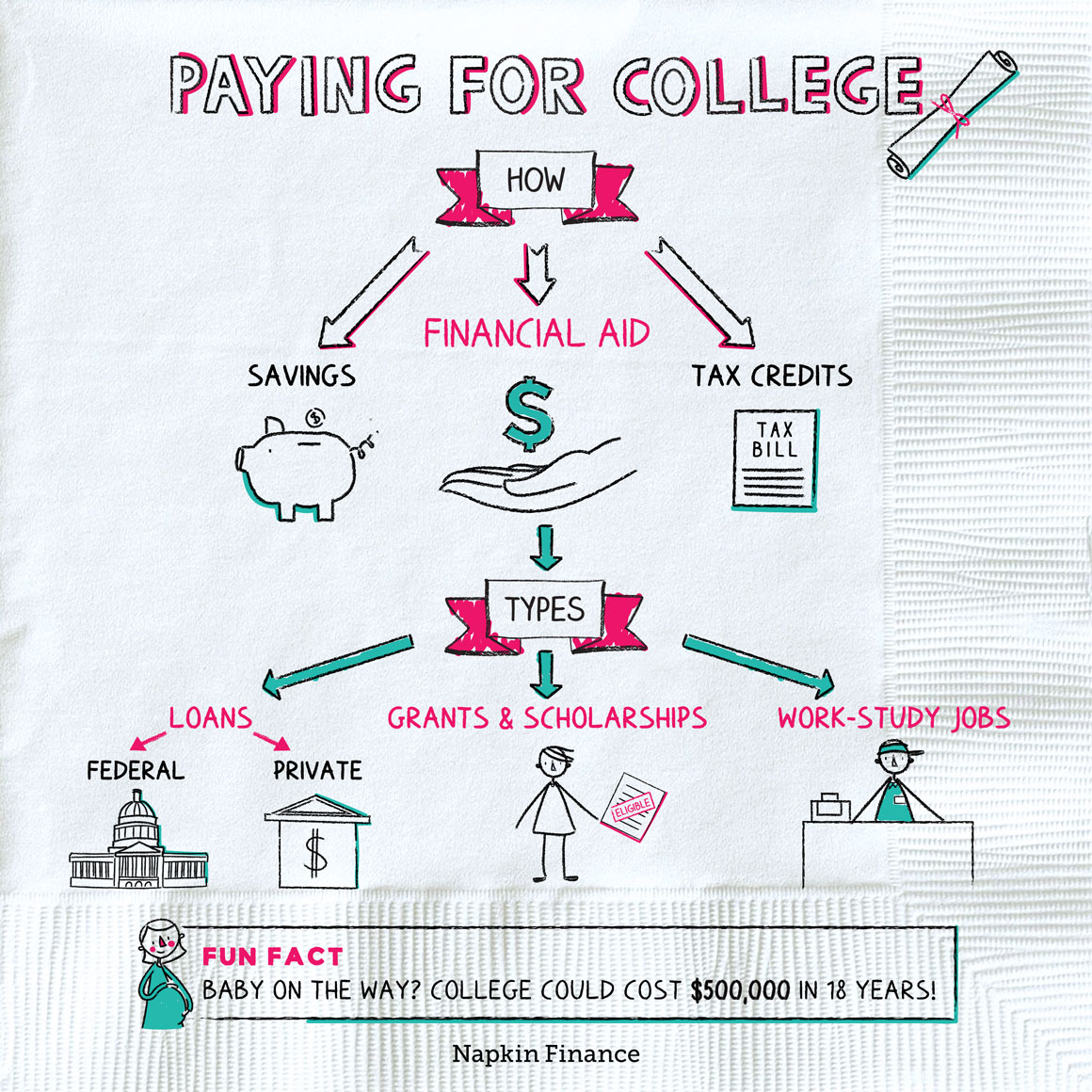

Going to college can lead to better jobs and bigger paychecks. But it comes at a high cost, with tuition alone often costing tens of thousands of dollars a year. To help pay those bills, you have three main resources:

- Savings

- Financial aid

- Tax breaks

For many people, it makes sense to start saving as soon as possible. That could mean starting the college fund now—even if your kid’s still in diapers. The sooner you start saving, the more time your money has to grow.

Where you save matters too. There are several options that offer unique advantages:

| Account type | What it is | Good to know |

| 529 savings plan |

|

|

| 529 prepaid tuition plan |

|

|

| Coverdell Education Savings Account (ESA) |

|

|

| UGMA/UTMA Custodial Accounts |

|

|

Even if you start saving while your kid is still a zygote, you may not have enough cash in the bank to pay out of pocket. Financial aid can help cover the difference. There are three main types:

- Scholarships and grants—aka free money!

- Scholarships are typically awarded on merit—such as for academics, athletics, or even playing Pokemon (seriously).

- Grants are typically awarded on financial need.

- Both can be offered by colleges themselves, private organizations, and/or various levels of government.

- Work-study jobs

- Provide part-time jobs for students with financial need.

- Unlike other jobs, income from work-study doesn’t typically hurt your ability to qualify for financial aid.

- Loans—federal and private.

- Federal loans typically offer a better deal, with lower interest rates and more flexible repayment options.

- Private loans can have higher rates and don’t offer as much wiggle room on payments.

The most important step you can take to access financial aid is to file the FAFSA. Here’s what you need to know about it:

What: The Free Application for Federal Student Aid, or FAFSA.

Why: Filling it out is an automatic application for not just federal aid, but also school-specific aid, state-level aid, and other sources.

Where: Studentaid.ed.gov/sa/fafsa

When:

- Application period starts October 1 of the year before the school year you’re applying for and lasts 21 months.

- Submitting your application asap can give you a better shot at aid.

How: To file, you’ll need:

- Social Security numbers

- Most recent tax return

- W-2s

- Records for any other income

- Records for bank and investment accounts

Although filing FAFSA is an important step, it’s not the only one, as some schools or aid providers may use a different application process. Talk to your school’s financial aid office for ideas on what else you should do to cover your bases.

Tax breaks alone won’t cover the bill for a $60,000 per year fancy private college. But they can help you make it over the finish line. There are two main ones to consider, and you can typically only use one at a time:

| American Opportunity Tax Credit | Lifetime Learning Tax Credit | |

| What it does |

|

|

| Good to know |

|

|

“An investment in knowledge pays the best interest.“

—Benjamin Franklin

College is unbelievably expensive. But somehow people manage to pay for it, typically with a combination of savings, financial aid, and tax breaks. Starting to save early for a kid’s education, saving in the right types of accounts, and applying for aid as soon as possible can all help you pay the tab. (Want to really save on your kids’ college degrees? Don’t have kids.)

- Germany, France, Norway, Finland, Sweden, and Slovenia are among the countries that provide free college.

- About two-thirds of recent graduating seniors were leaving college with student loan debt, with an average balance of about $30,000.

- Having a baby soon? A college education could cost $500,000 in 18 years. (Congratulations.)

- The main ways of paying for college include savings, financial aid, and tax breaks.

- Saving in the right account types and starting as soon as possible can help you save more.

- Financial aid can include free money, loans, and work-study. The most important step you can take to qualify for aid is to fill out the FAFSA.

- Tax breaks don’t provide big bucks toward the cost of college. But every dollar helps, so make sure you claim any breaks you qualify for.